California Capital Gains Tax Exemption

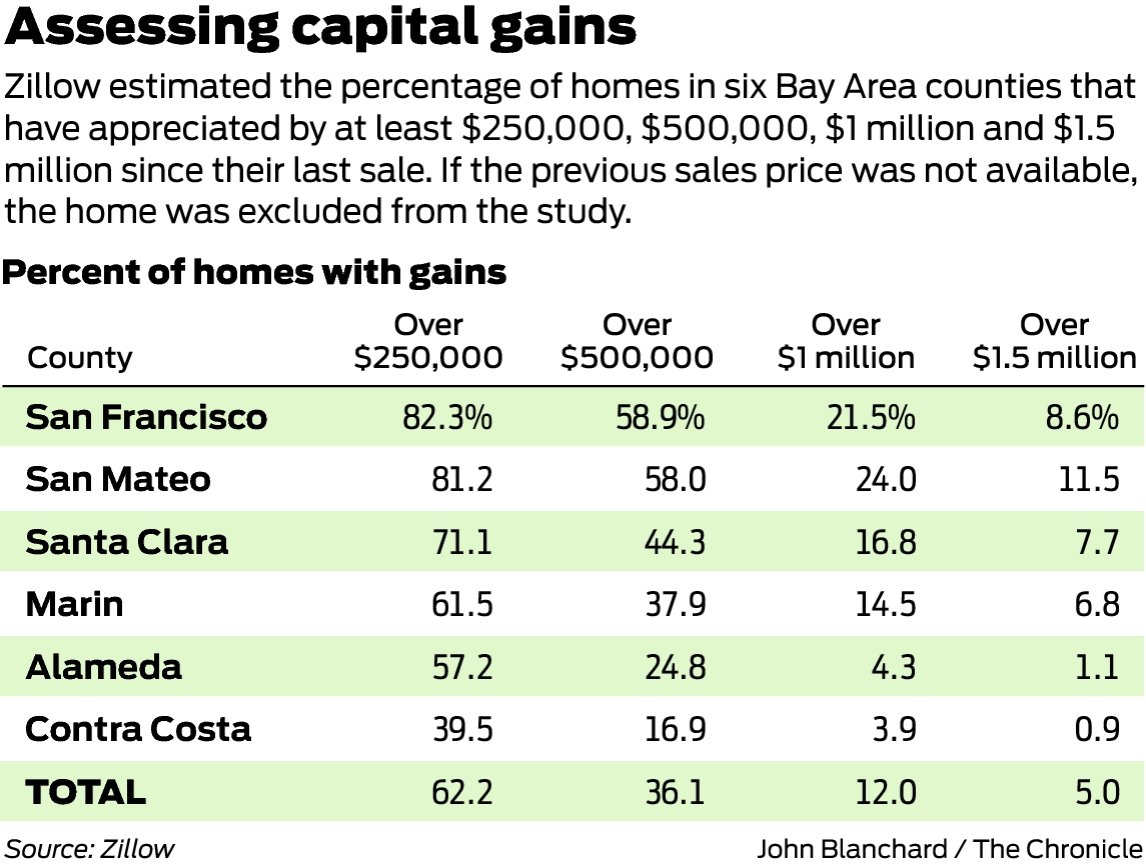

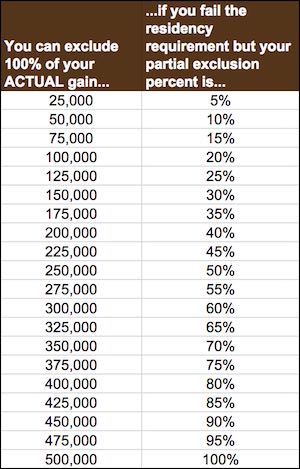

Marriedrdp couples can exclude up to 500000 if all of the following apply.

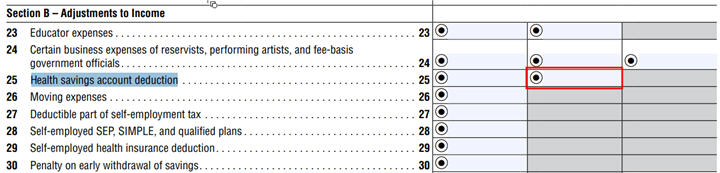

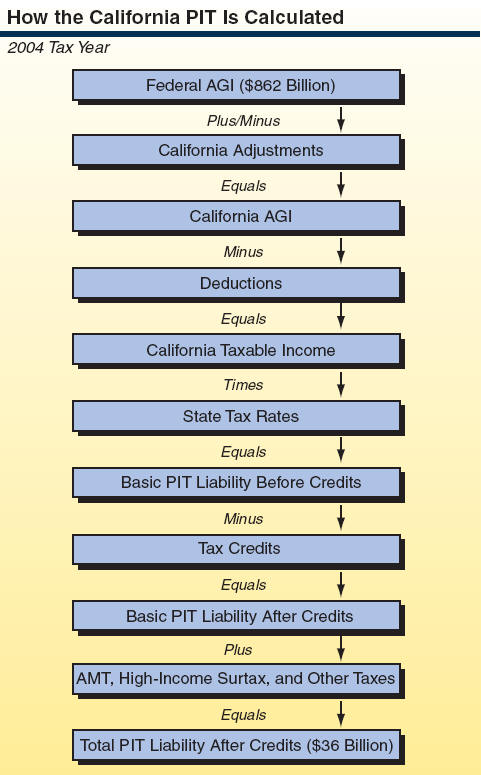

California capital gains tax exemption. Thats thanks to a taxpayer relief act of 1997. Your gain from the sale was less than 500000. Taxpayer on its franchise tax returns only shows that amount which is shown on the fiduciary return to be distributable to the beneficiary.

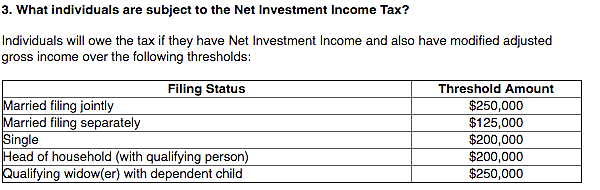

If youre married and file your tax return jointly the irs is even more generous letting you exclude typically up to 500000 in capital gains. California has strict rules for determining residency. Similarly what is the long term capital gains tax rate for 2019.

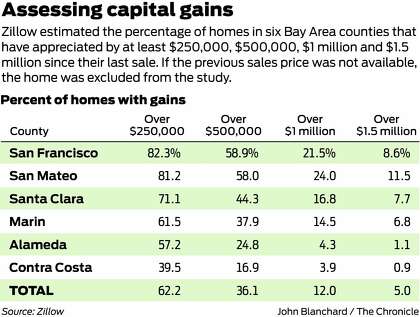

If you meet the conditions for a capital gains tax exemption you can exclude up to 250000 of gain on the sale of your main home. The answer is yesit is true in most cases. California does not tax long term capital gain at any lower rate so californians pay up to 133 too.

Fortunately there is also an exemption built into the various tax laws known as the capital gains real estate tax exemption. Even if you move out of the state of california depending when you leave and when the capital asset was sold you may still have capital gains tax california obligations. You filed a joint return for the year of sale or exchange.

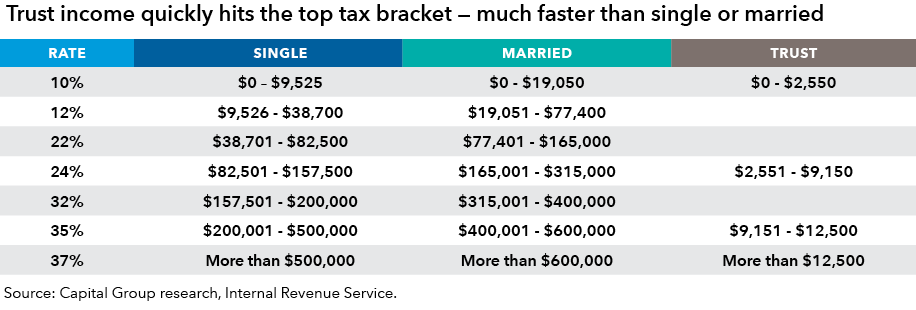

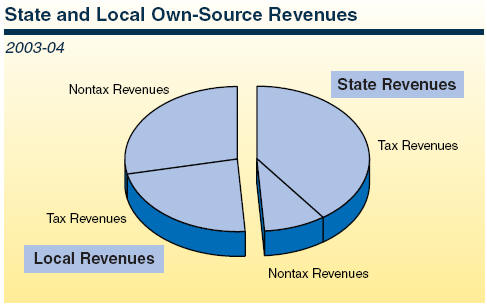

In computing the trust net income it excludes exempt interest of us. Capital gains tax in california is due to both federal the irs and state tax agencies the franchise tax board or ftb so its common to feel like one is being double taxed in the process of a home sale. For investors this can be a stock or a bond but if you make a profit on selling a car that is also a capital gain.

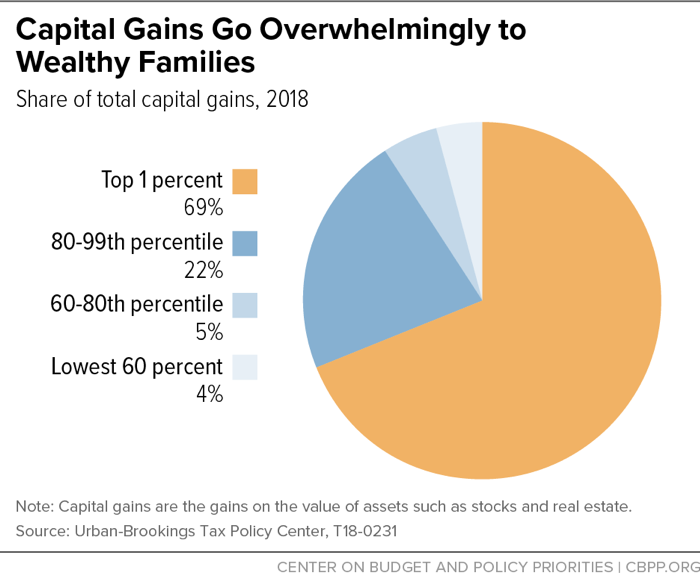

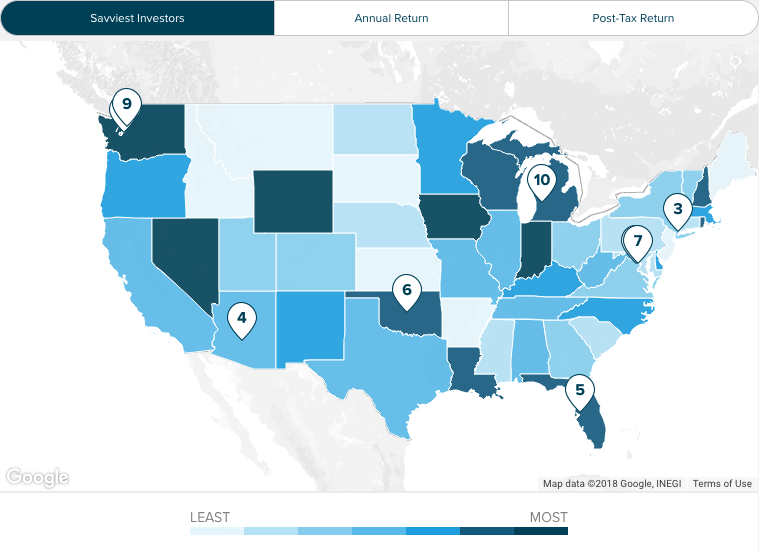

The usual high income tax suspects california new york oregon minnesota new jersey and vermont have high taxes on capital gains too. Long term capital gains taxes apply to profits from selling something youve held for a year or more. Certain joint returns can exclude up to 500000 of gain.

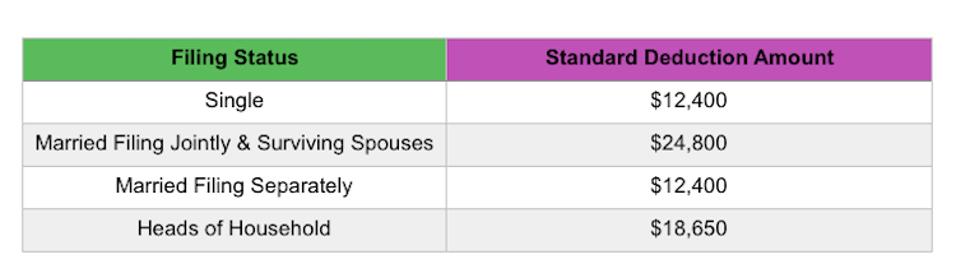

This clause in the tax law allows 250000 per taxpayer per tax year. Based on the taxpayer relief act of 1997 1 if you are. Both spousesrdps meet the 2 out of 5 year use requirement.

You must meet all these requirements to qualify for a capital gains tax exemption. For instance if you live in the state of california for more than nine months you are presumed to be a resident. Capital gains tax is the tax imposed by the irs on the sale of certain assets.

Bonds and includes capital gains and losses only to the extent of the percentages set up by section 18151.

2.png)

/california-state-taxes-amongst-the-highest-in-the-nation-3193244-finalv2-8a746a2ad14c4fba8d21382f812c7c76.png)

/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

/thinkstockphotos-97828574-5bfc346dc9e77c0026320939.jpg)

:max_bytes(150000):strip_icc()/TaxPolicy.Paul.4.2.1_-_figure_1-512c20575f6b4bc6bf23ef34dee0f9c4.png)

/TaxPolicy.Paul.4.2.1_-_figure_1-512c20575f6b4bc6bf23ef34dee0f9c4.png)

:max_bytes(150000):strip_icc()/will-i-pay-tax-on-my-home-sale-2389003-v4-5b4cb96046e0fb0037e65b73.png)

:max_bytes(150000):strip_icc()/GettyImages-656680302-b9ac142099da451e8fa31a60d9fa9a33.jpg)

:max_bytes(150000):strip_icc()/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81.png)