California Employer Taxes

50 million in state funding for the small business disaster.

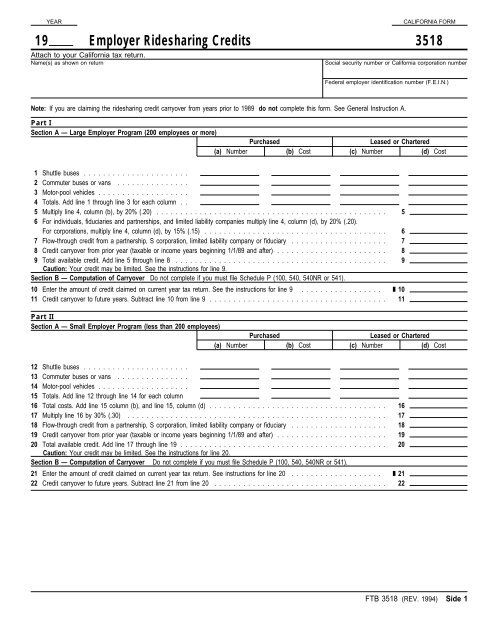

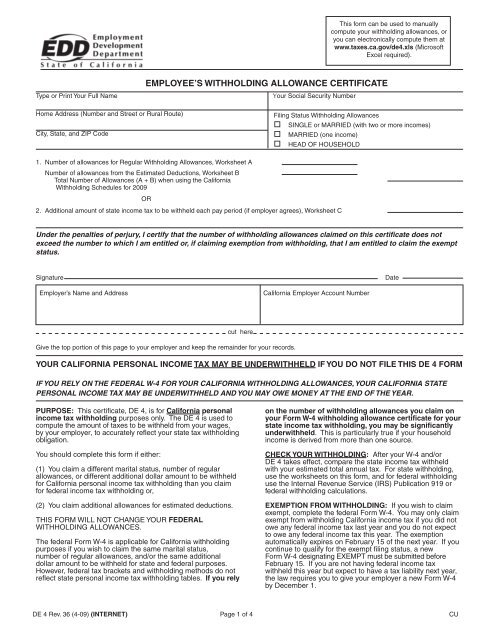

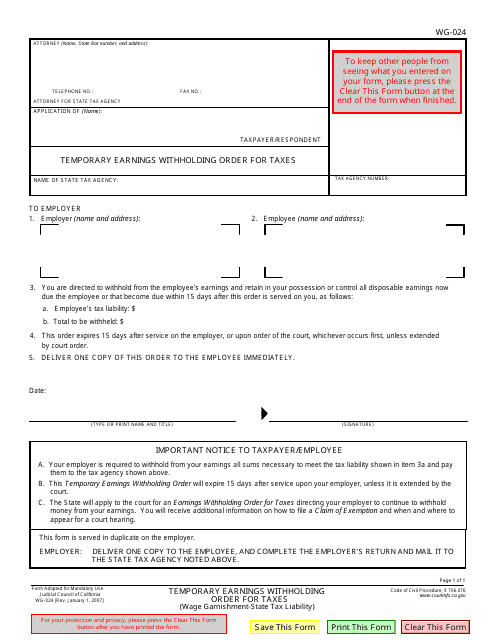

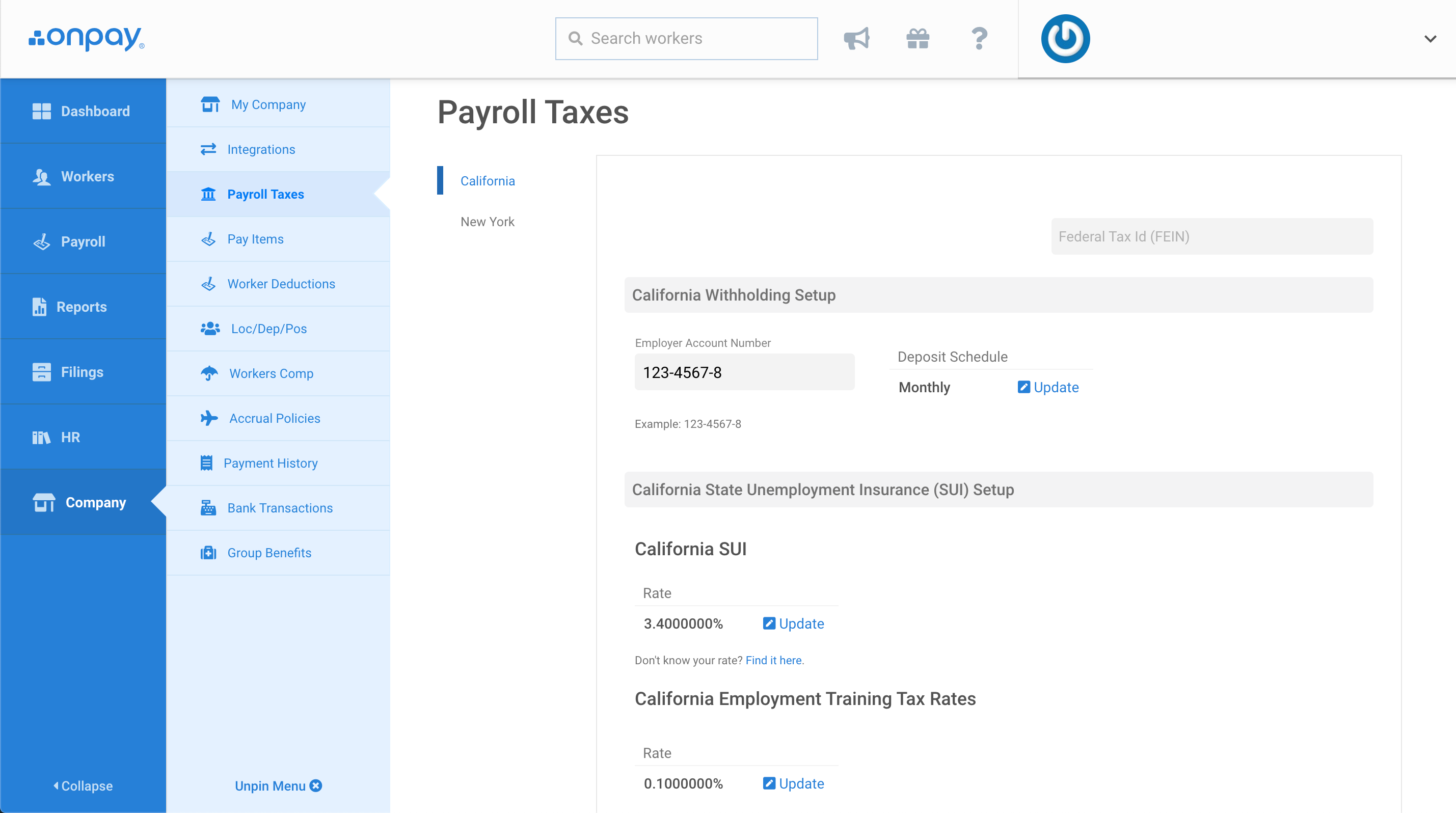

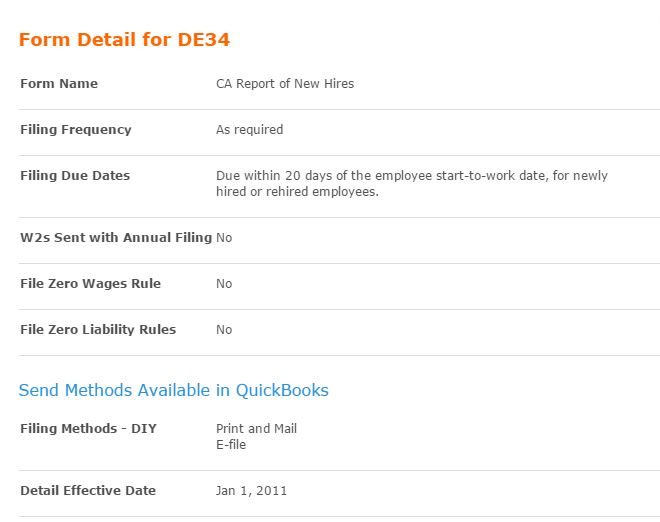

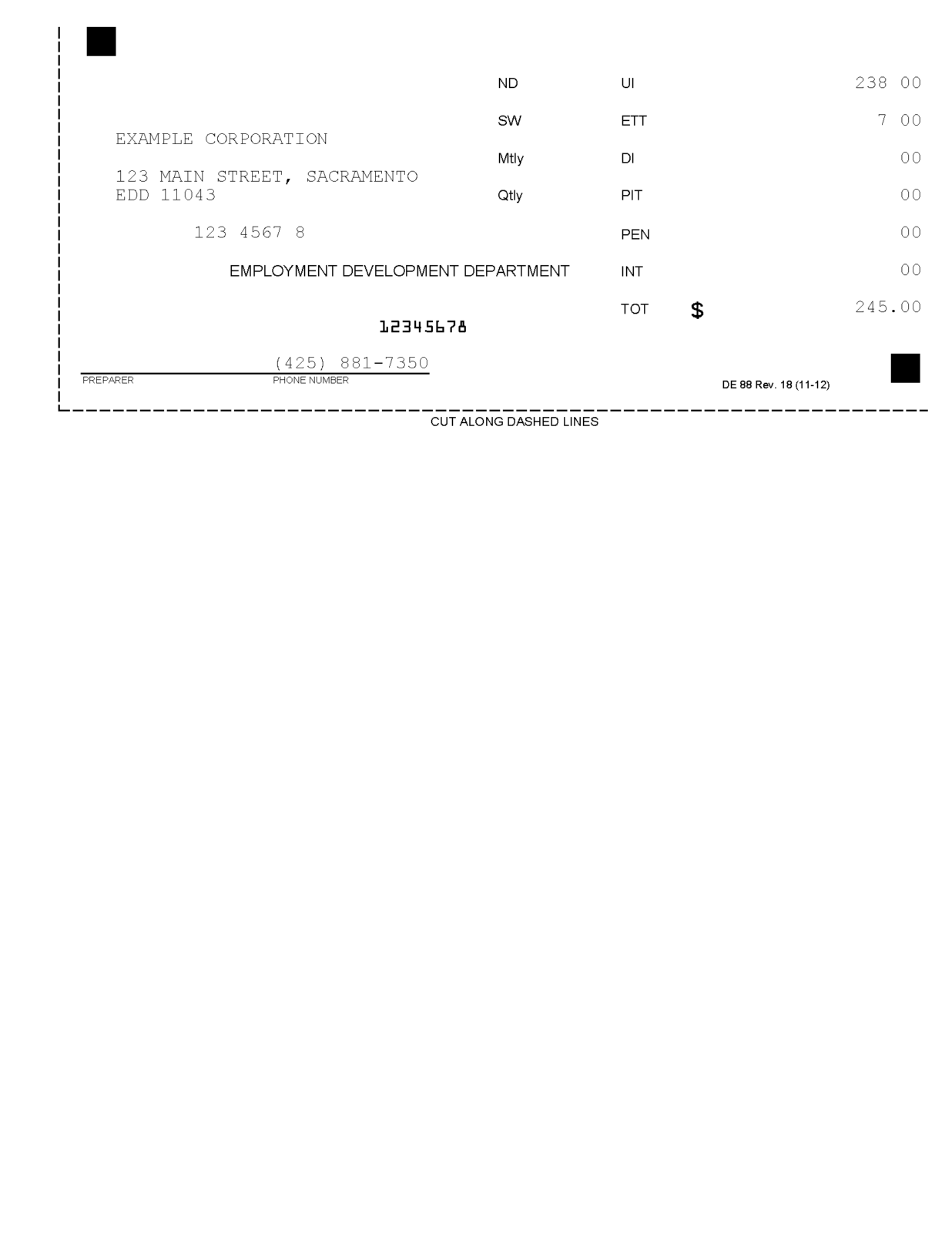

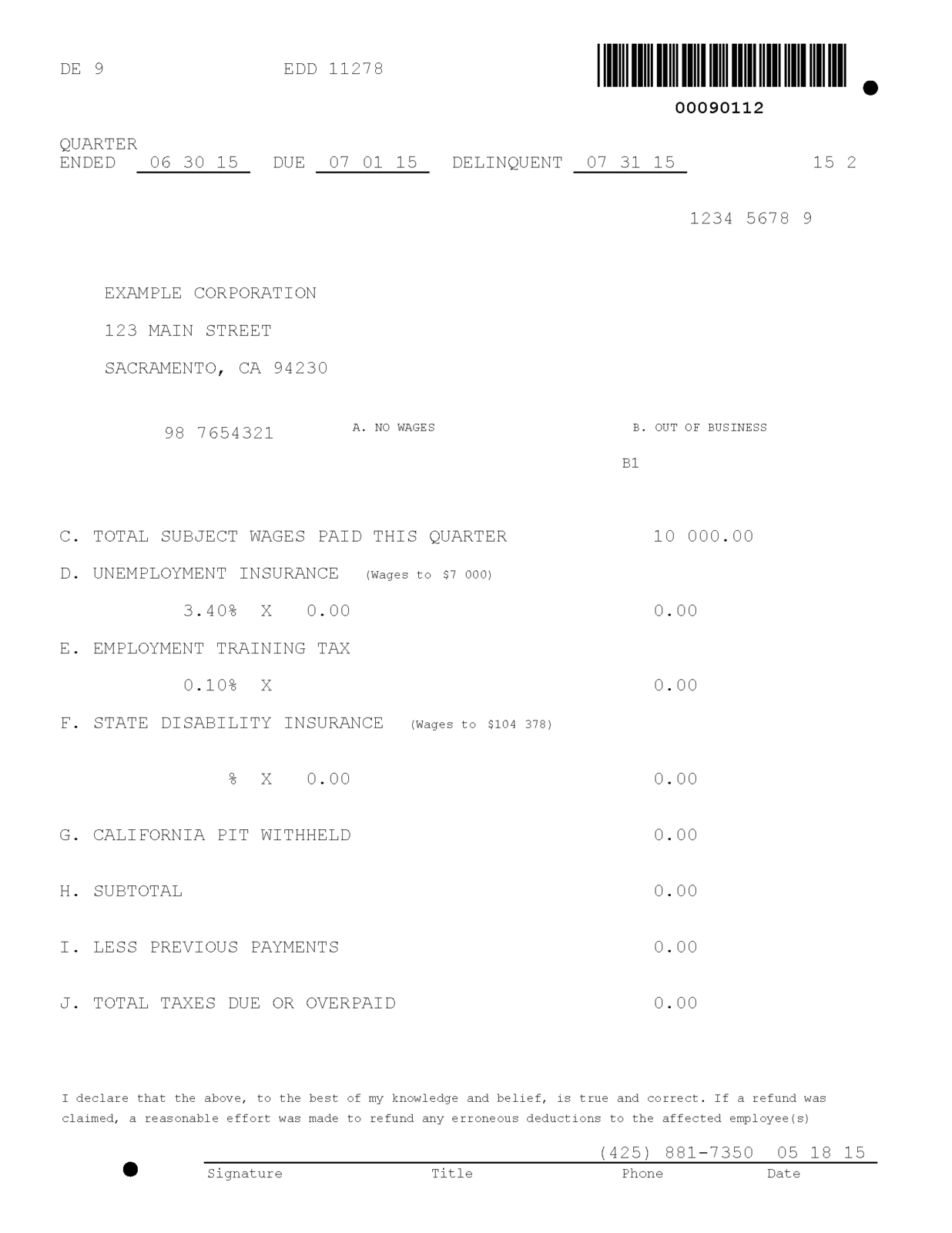

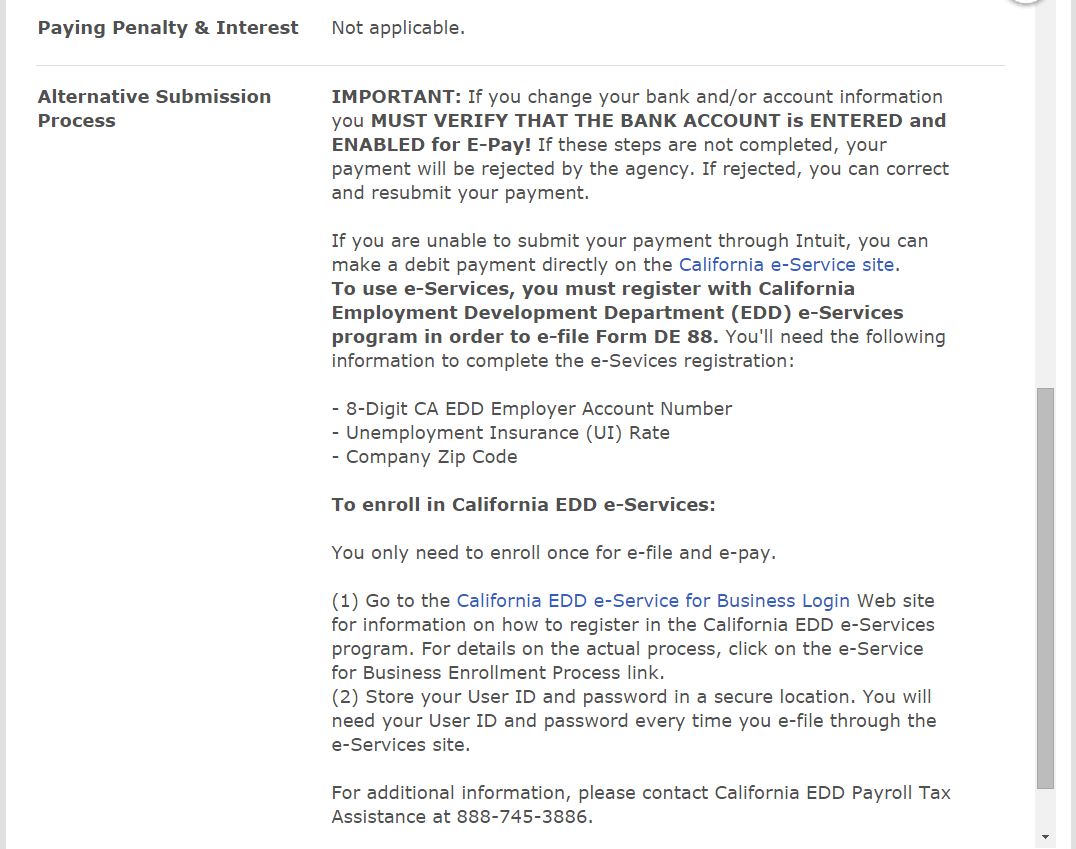

California employer taxes. 90 day extension for businesses filing a return for less than 1 million in taxes. The employment development department edd administers californias payroll taxes including unemployment insurance employment training tax state disability insurance including paid family leave and california personal income tax withholding. A california statute sets the tax rate at 01 of all ui taxable wages for employers with positive ui reserve account balances and subject to section 977c of the california unemployment insurance code cuic.

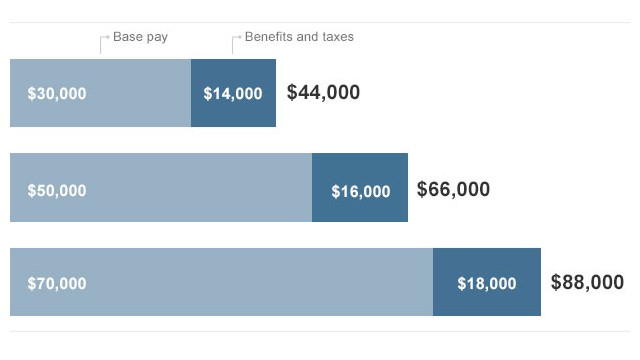

The main taxes employers have to pay in california. Income tax rates vary by state like a flat tax of 307 in pennsylvania or a tax that varies by income level reaching rates as high as 133 in california. Every employer in their first year of business is required to pay this california payroll tax but many with positive ui reserve accounts continue to pay it beyond the first year.

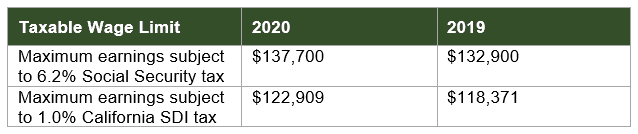

Nine states dont collect individual income tax at all although there may be alternate taxes your employees will need to account for. In contrast medicare has no ceiling at all. California and the federal government are providing broad assistance to small businesses and employers impacted by covid 19.

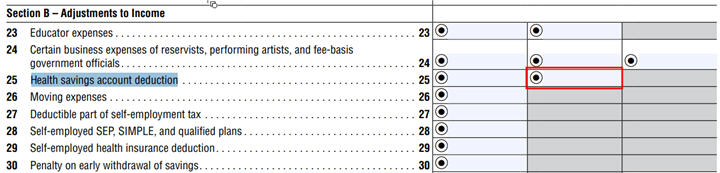

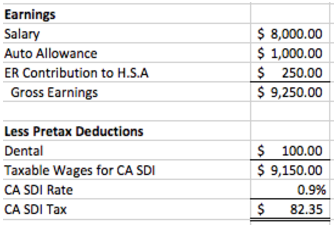

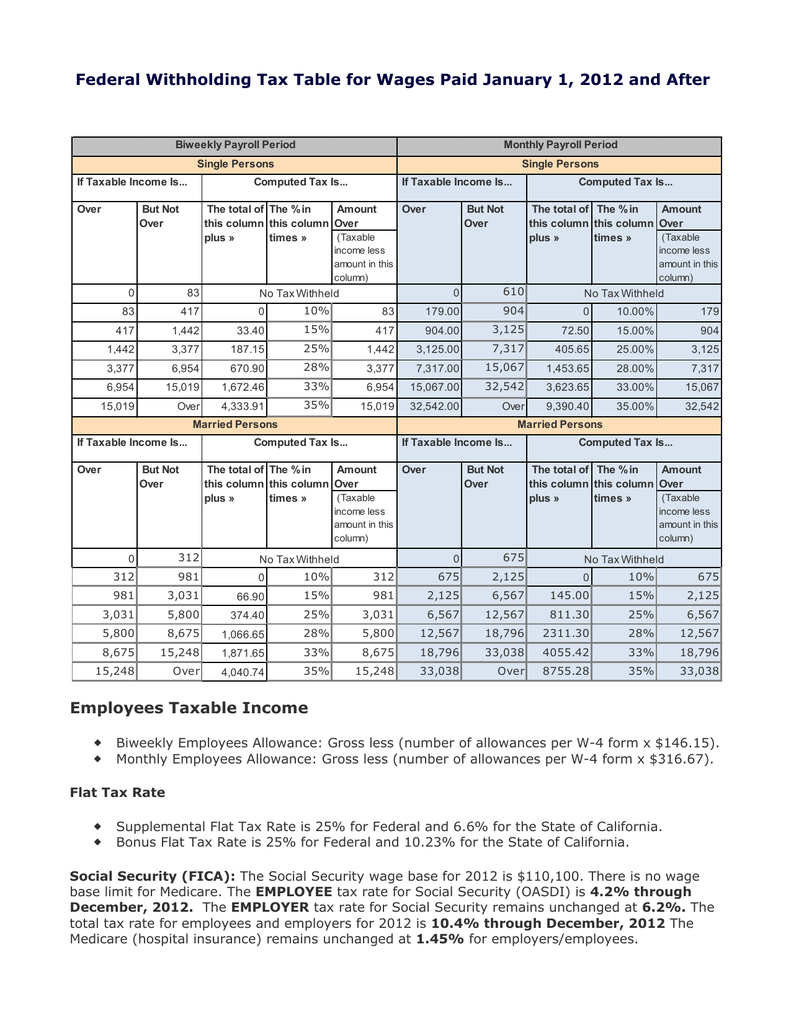

Interest free deferral of salesuse tax up to 50000 for businesses with less than 5 million in taxable sales. The social security and medicare taxes are far more significant. The program consists of unemployment insurance and employment training tax which are employer contributions and disability insurance and personal income tax which are withheld from employees wages.

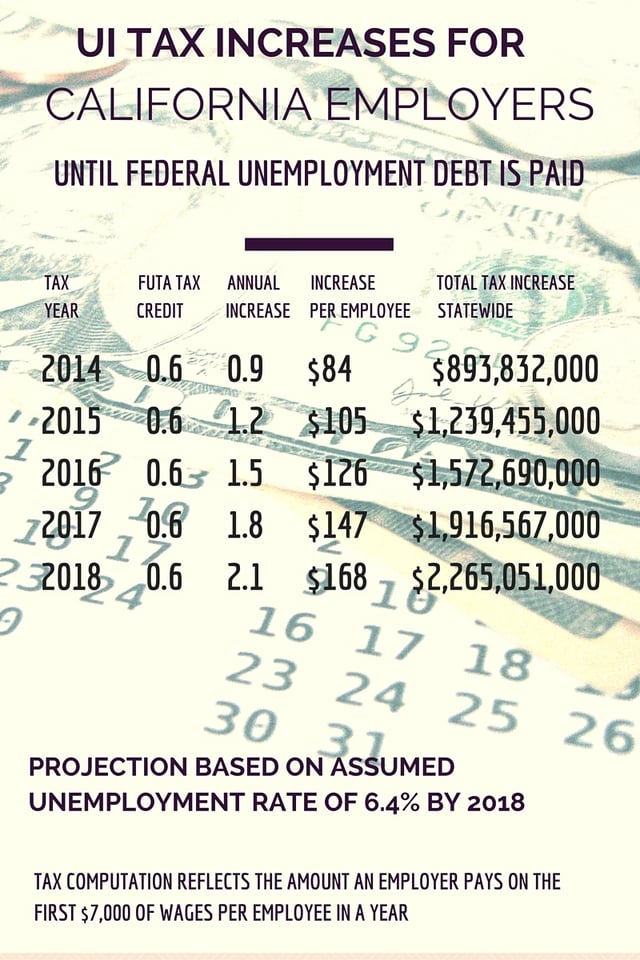

New employers in california pay 34 of the first 7000 in wages per employee for unemployment insurance ui tax and 01 also of the first 7000 in wages for employment training tax ett. Employers pay 145 percent on all of an employees wages. Employers are responsible for 62 percent on the first 132900 of an employees wages up to a maximum of 823980.

Log in to your myftb account. The tax rate is set at 01 percent 001 of ui taxable wages for the employers with positive ui reserve account balances and employers subject to section 977c of the california unemployment insurance code. Follow the links to popular topics online services.

While the ui rate for new employers doesnt change for the first three tax years the ett rate may be 0 zero for a new employer after his first year if his reserve account has a negative balance. California franchise tax board. File a return make a payment or check your refund.

/how-and-when-to-file-form-941-for-payroll-taxes-398365_FINAL-3e897153189040e99df9b89437493b7b.png)

/payroll-taxes-3193126-FINAL-ef94c8b30eda48fdbde6ab58d9a30d49.png)