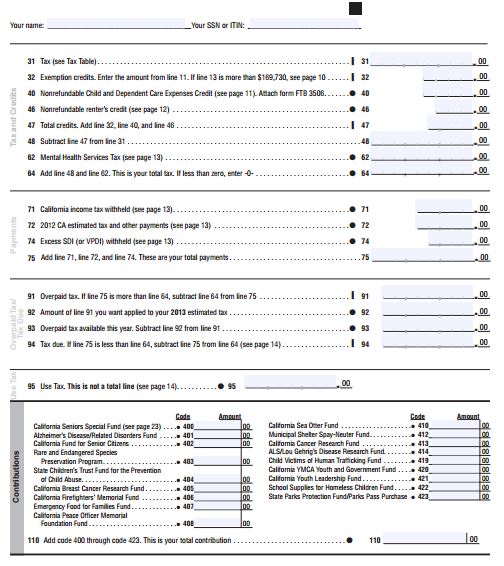

California Estimated Tax Payments Form

The undersigned certify that as of june 22 2019 the internet website of the franchise tax board is designed developed and maintained to be in compliance with california government code sections 7405 and 11135 and the web content accessibility guidelines 21 or a subsequent version june 22 2019 published by the web accessibility.

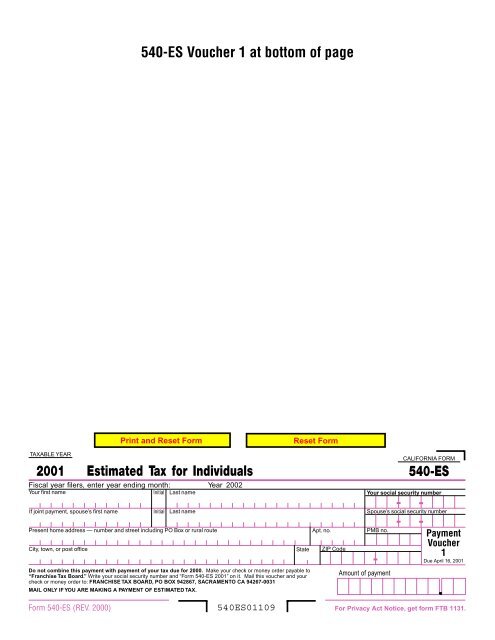

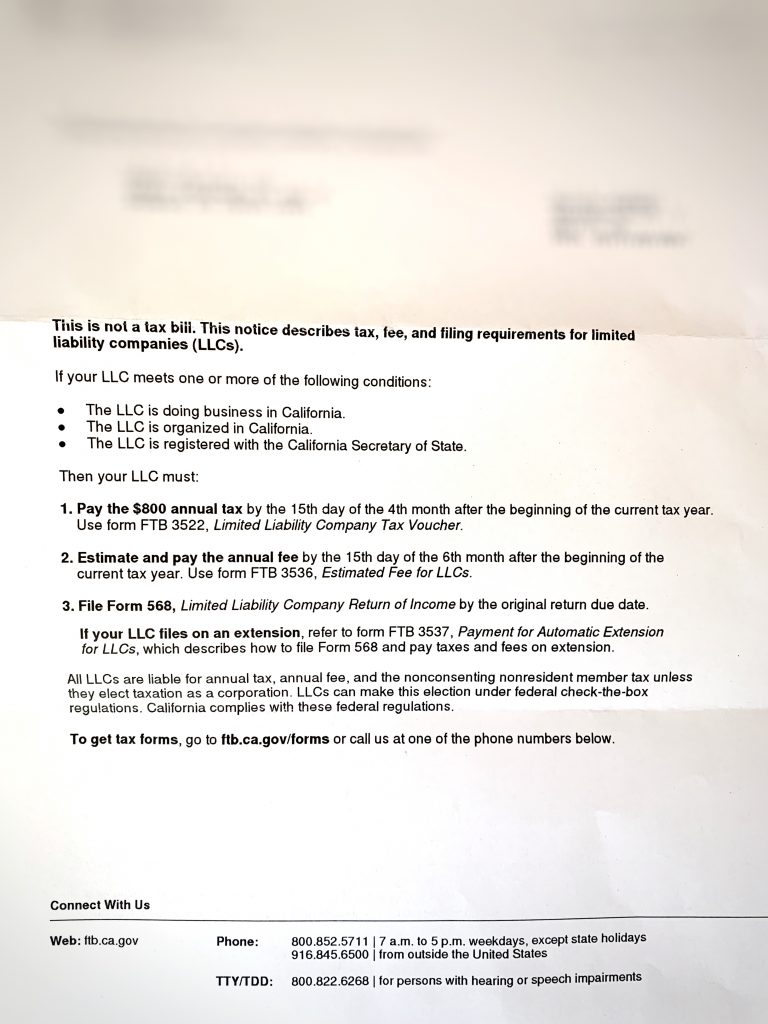

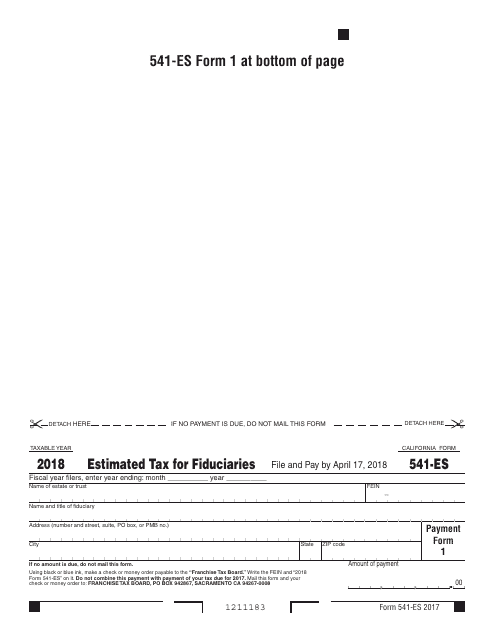

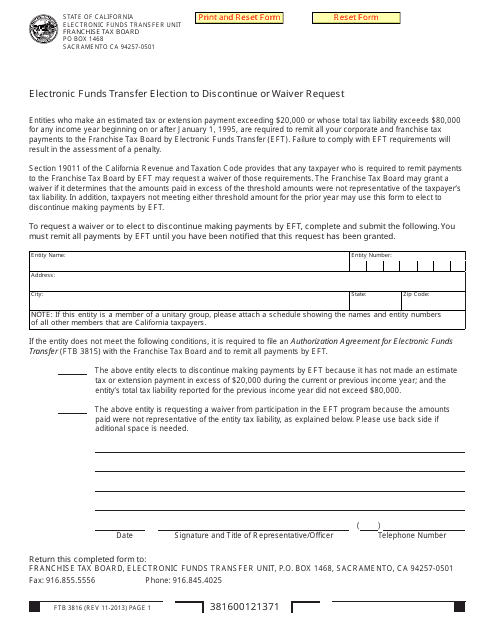

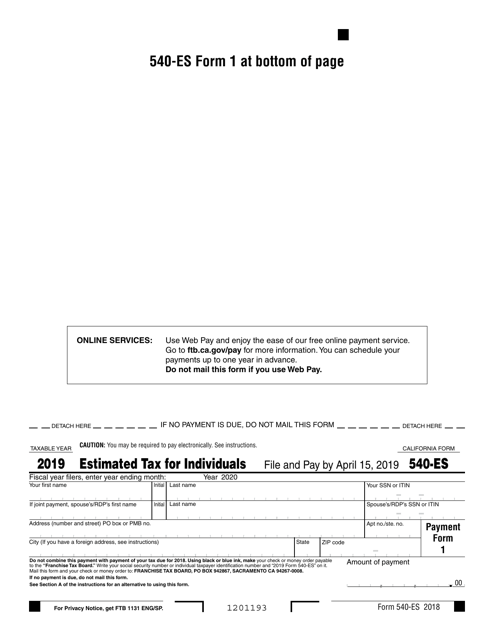

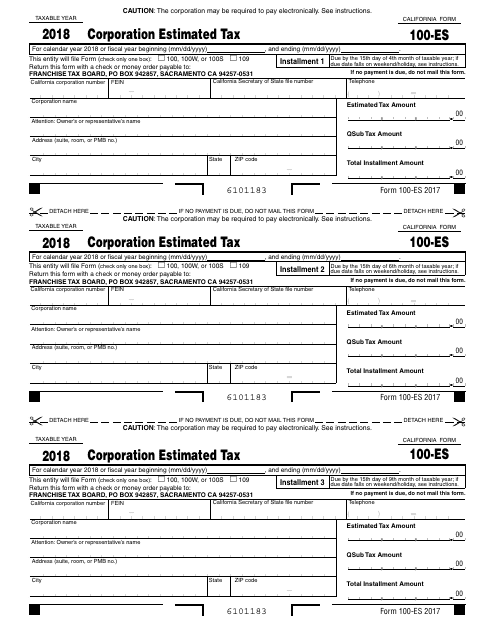

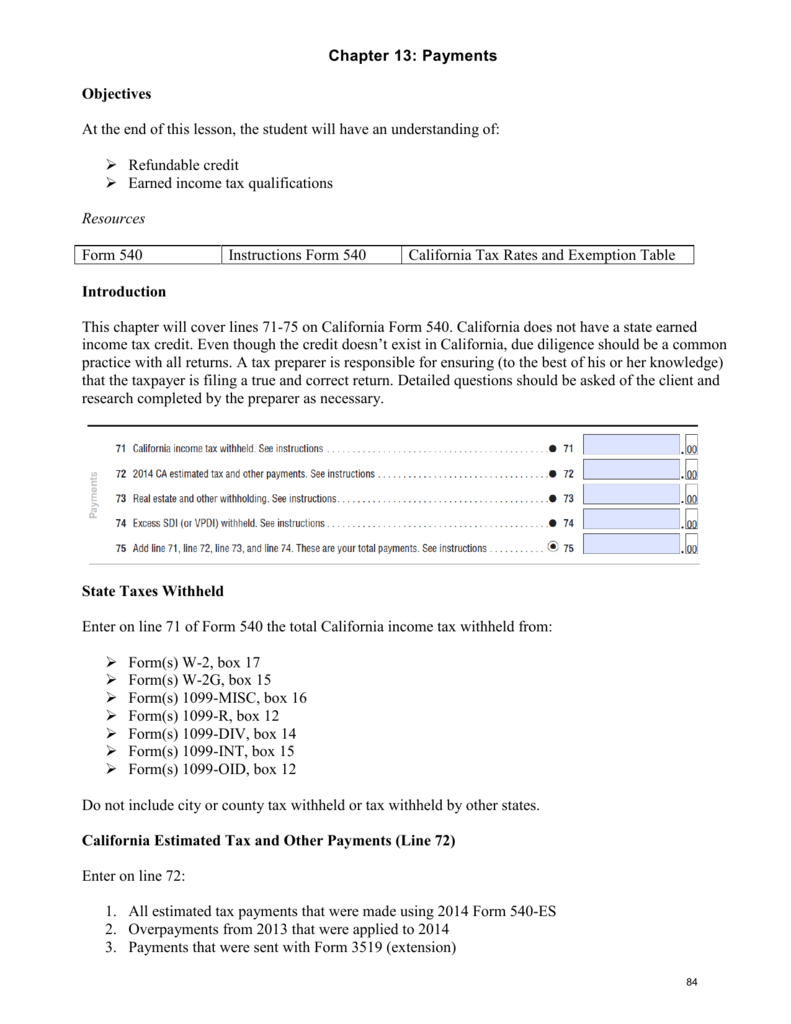

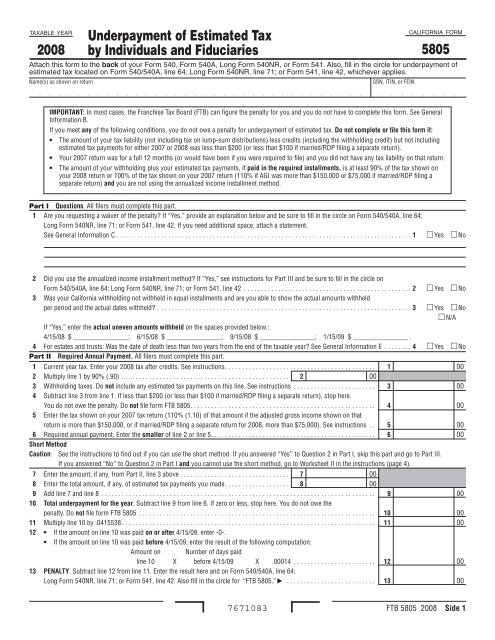

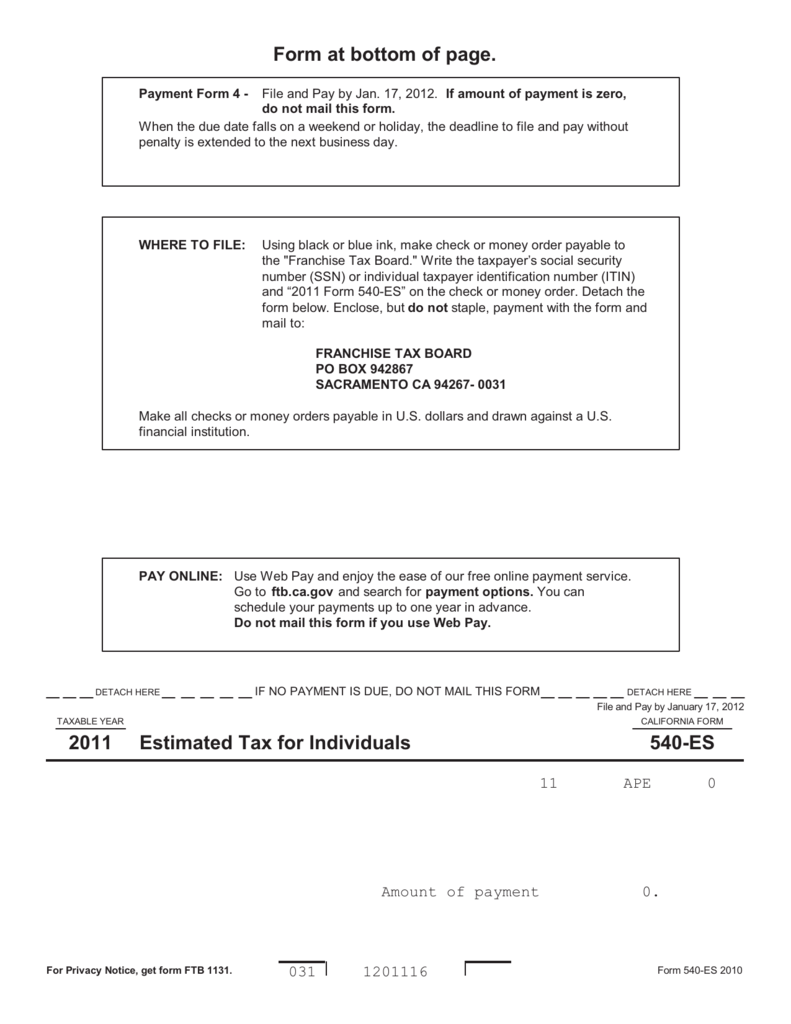

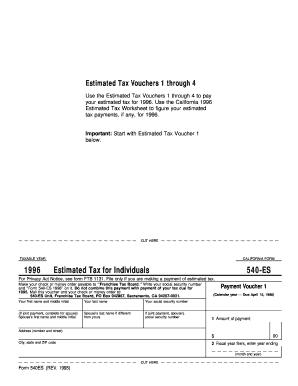

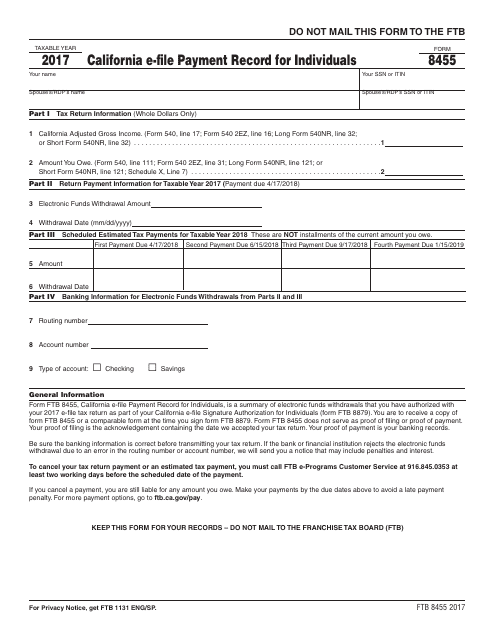

California estimated tax payments form. Use estimated tax for individuals form 540 es vouchers to pay your estimated tax by mail. Form 540es includes four estimated tax payment vouchers for use by individuals who must file quarterly estimated tax payments. The undersigned certify that as of june 22 2019 the internet website of the franchise tax board is designed developed and maintained to be in compliance with california government code sections 7405 and 11135 and the web content accessibility guidelines 21 or a subsequent version june 22 2019 published by the web accessibility.

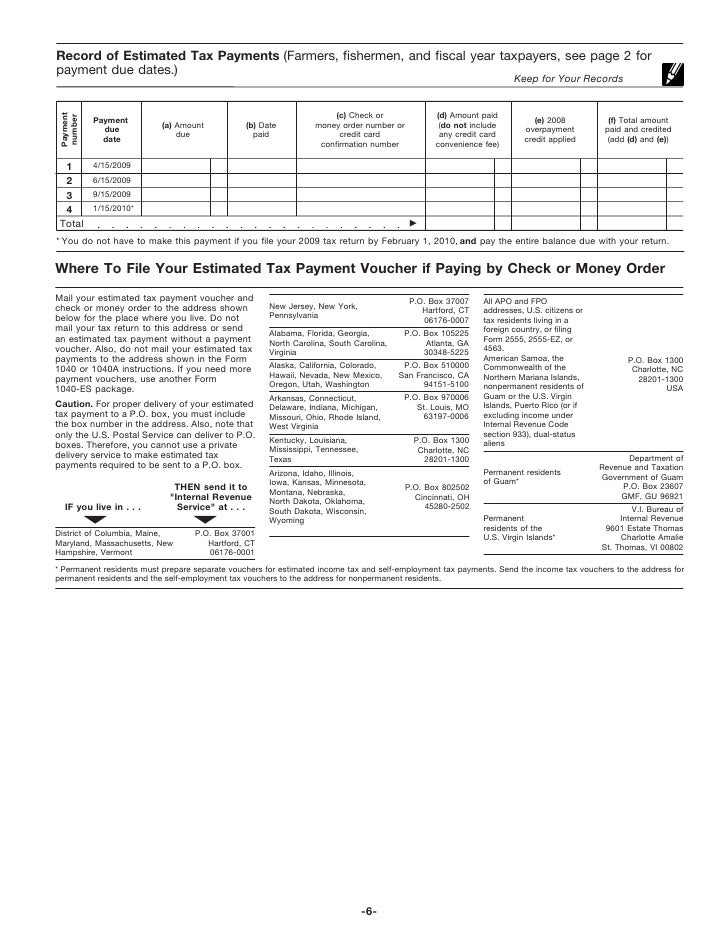

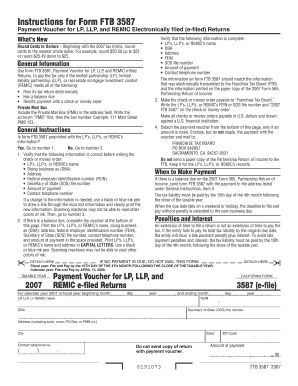

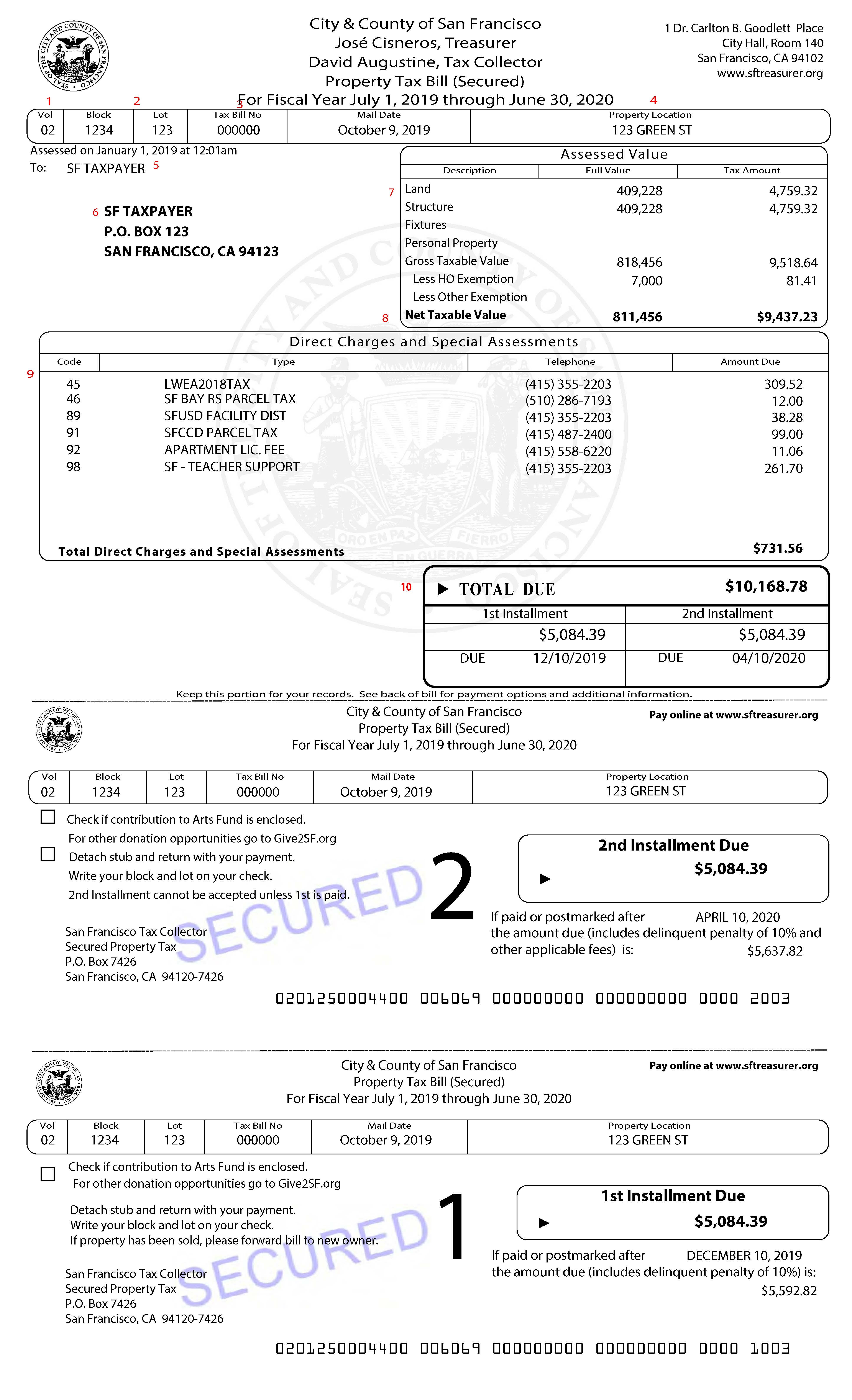

Franchise tax board po box 942867 sacramento ca 94267 0008. If no payment is due do not mail this form. Consider making your tax payment electronicallyits easy you can make electronic payments online by phone or from a mobile device.

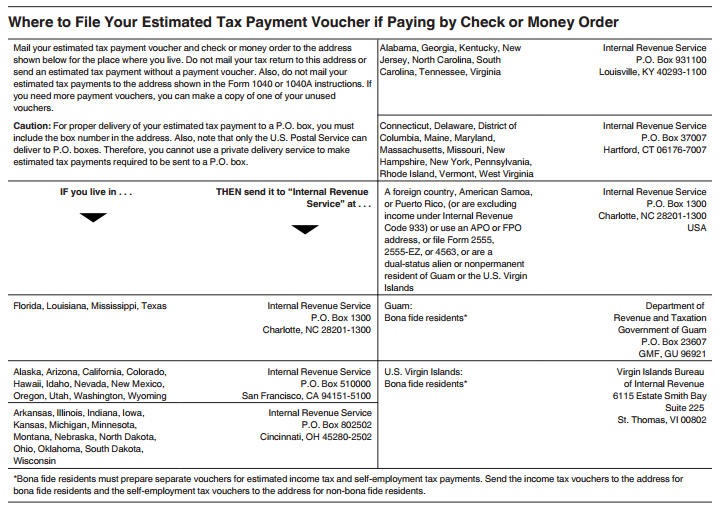

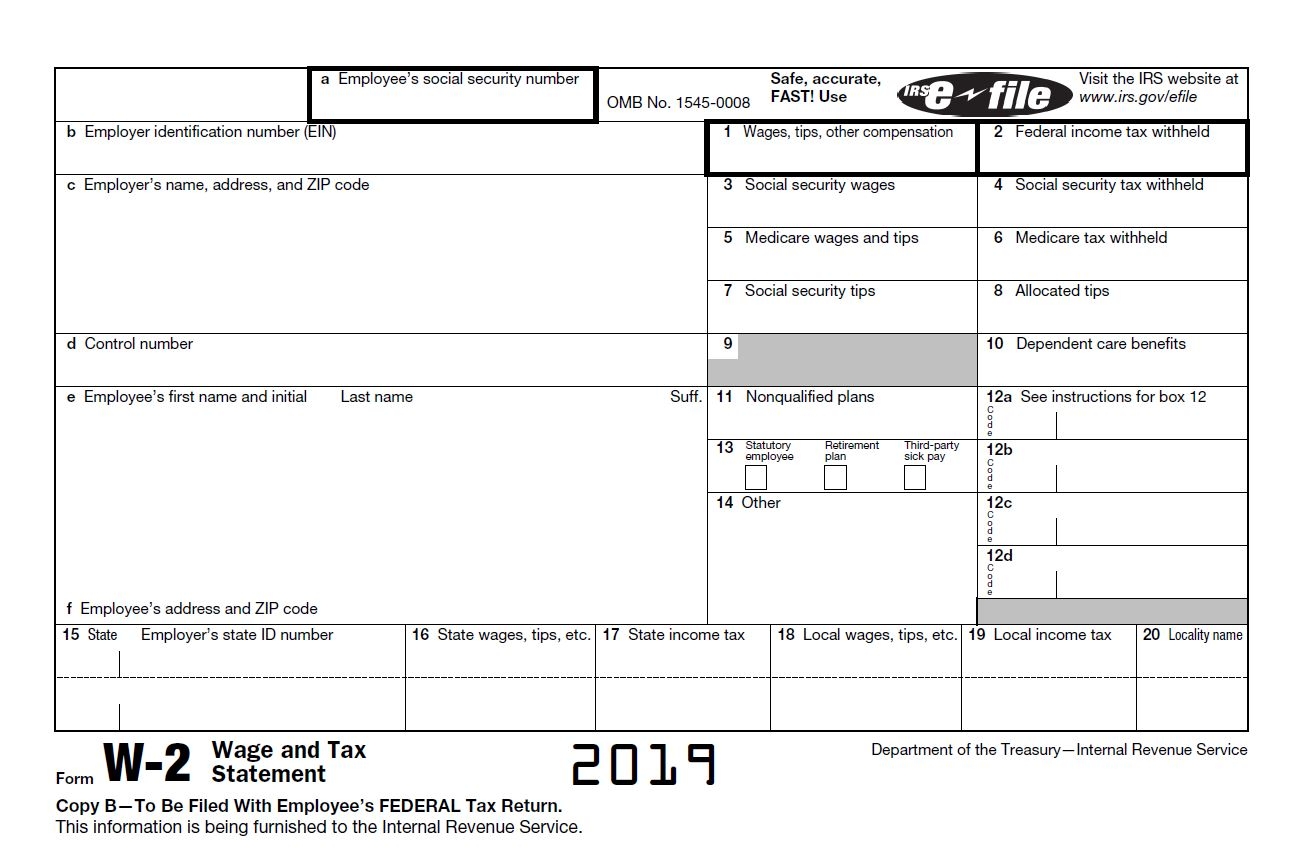

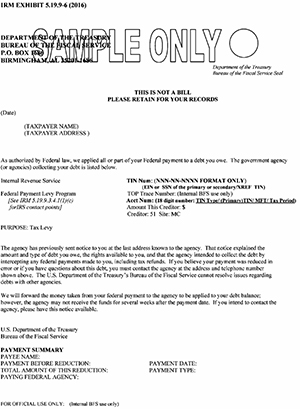

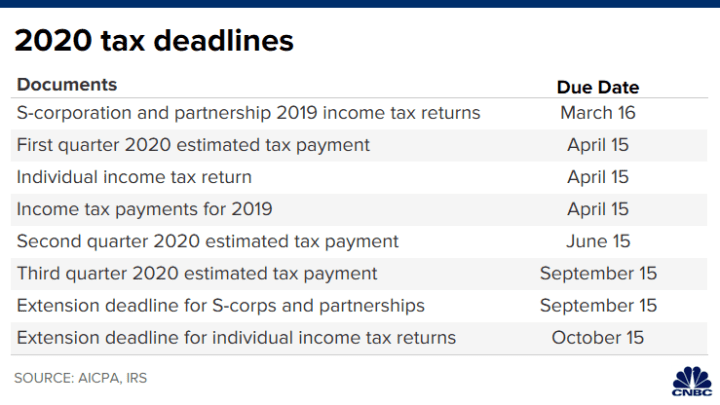

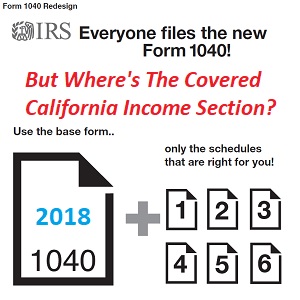

For more information about the california income tax see the california income tax page. Form 1040 es estimated tax for individuals department of the treasury internal revenue service purpose of this package use form 1040 es to figure and pay your estimated tax for 2020. Form 1040 es is used by persons with income not subject to tax withholding to figure and pay estimated tax.

How to pay online to make your payment online. Mail franchise tax board po box 942867 sacramento ca 94267 0008. If you expect to owe over a certain amount you must make estimated tax payments throughout the year.

Information about form 1040 es estimated tax for individuals including recent updates related forms and instructions on how to file. Write your social security number or individual taxpayer identification number and 2019 form 540 es on it. Use this form to figure and pay your estimated tax.

Write your social security number or individual taxpayer identification number and 2020 form 540 es on it. Mail this form and your check or money order to. Franchise tax board po box 942867 sacramento ca 94267 0008.

If no payment is due do not mail this form. Use form 540 es estimated tax for individuals and the 2020 ca estimated tax worksheet to determine if you owe estimated tax for 2020 and to figure the required amounts. Paying electronically is safe and secure.

If you are self employed or do not have taxes withheld from your salary you may need to file form 540es. Mail this form and your check or money order to. Visit our payment options.

:max_bytes(150000):strip_icc()/Form-w4-e54ebb209cbc48b48541a54b07e2d5c2.jpg)

/how-and-when-to-file-form-941-for-payroll-taxes-398365_FINAL-3e897153189040e99df9b89437493b7b.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-154920329-577423dd3df78cb62c196616.jpg)

/i-received-a-1099-misc-form-what-do-i-do-with-it-35d7e9d37e8949de8c556777494dde39.png)

/4868-ApplicationofExtensionofTime-1-088a69a2d6454cb5837a3a801d330a8d.png)

/state-income-tax-deduction-3192840_FINAL_v2-e43549dd9f264eab947794daf86ae338.png)

/GettyImages-1169954518-4b5ed12b6c33425c919c2c27f12c1ae2.jpg)