California Fair Plan Insurance Coverage

The plan was established under insurance code statute section 10091 et.

/coordination-of-benefits-1850523021ff453f8f4f2e19a99324ea.png)

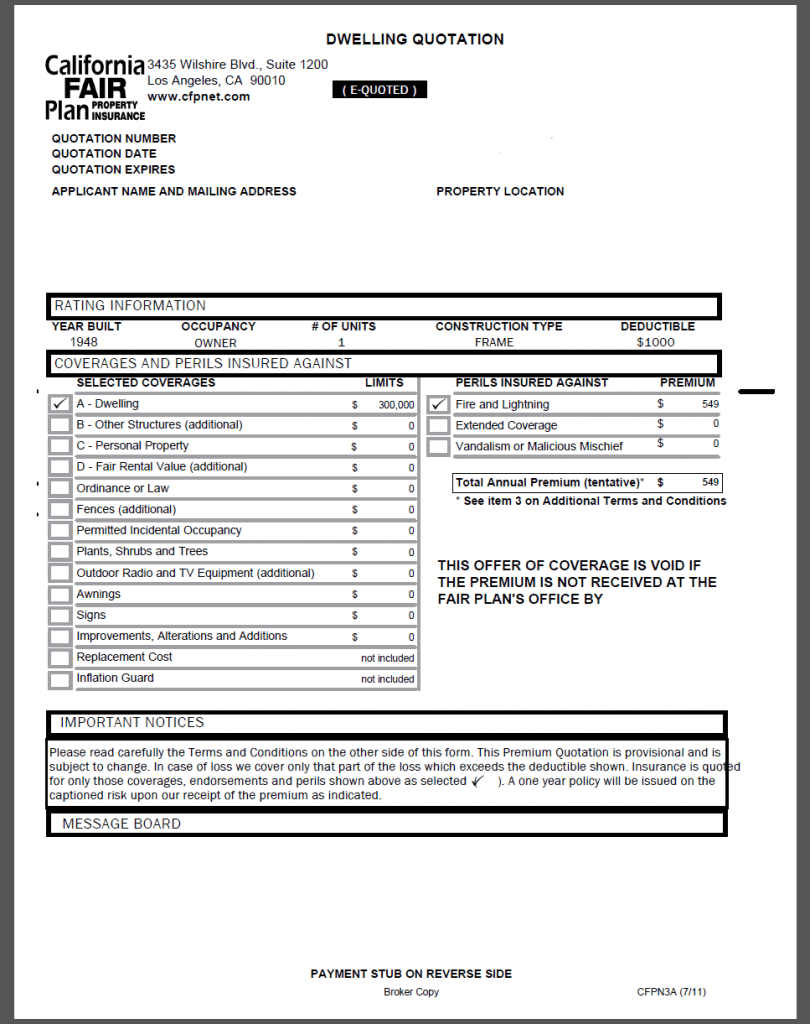

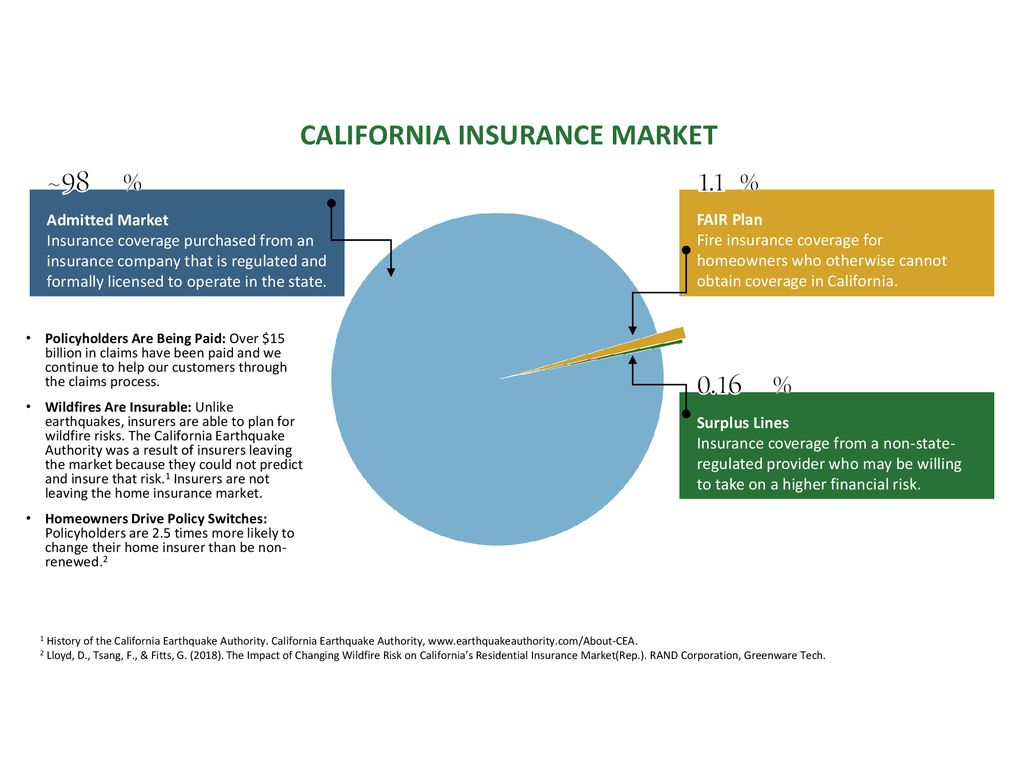

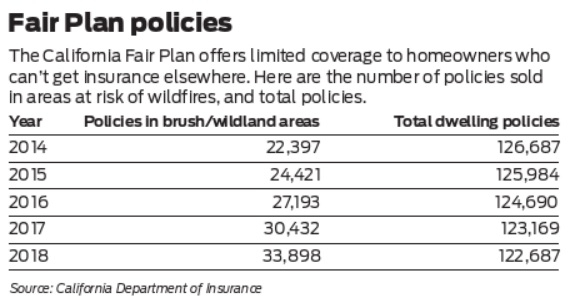

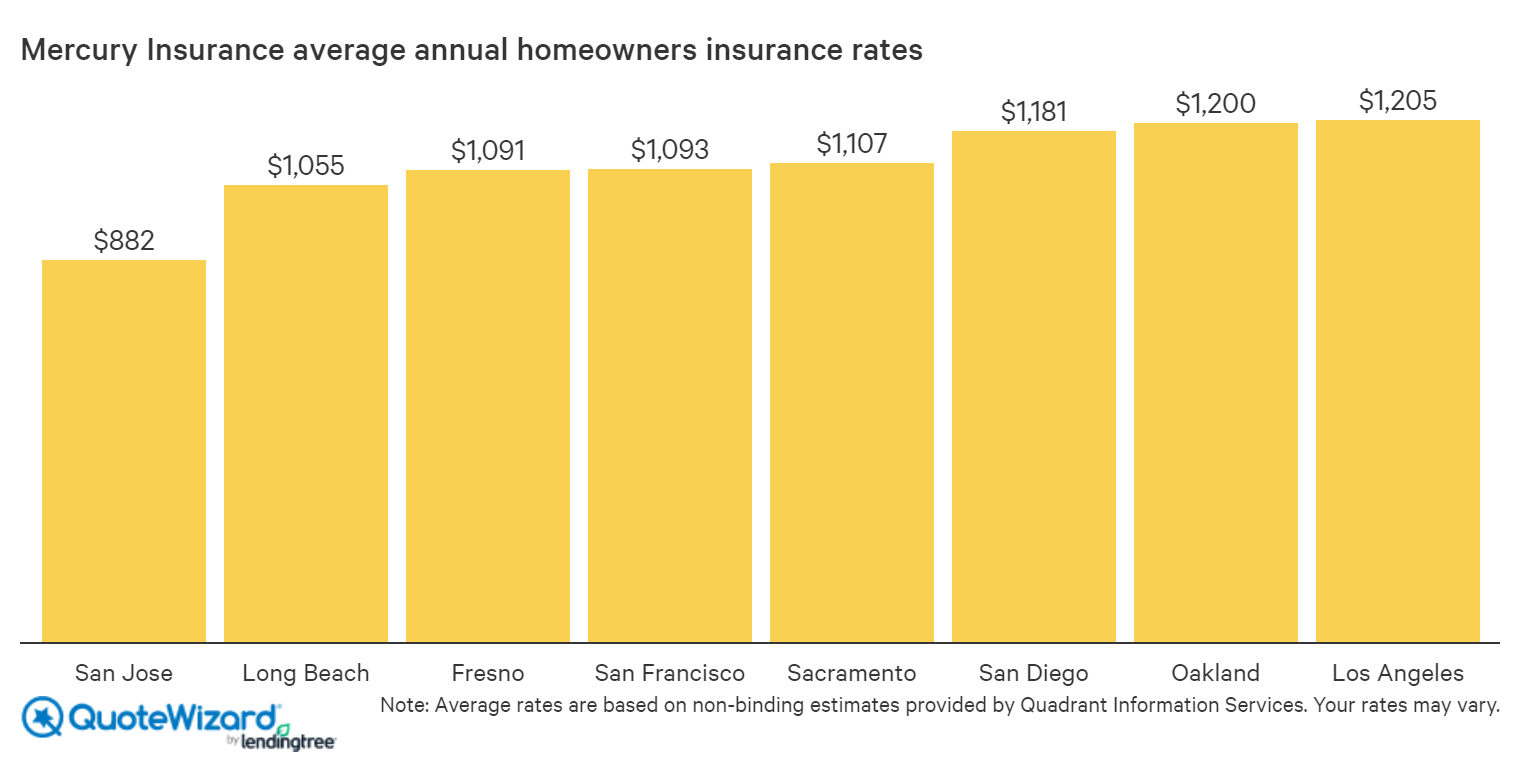

California fair plan insurance coverage. Al in august 1968 as an insurance placement facility. The fair access to insurance requirements fair plan is a state mandated program that provides fair access to insurance for individuals who are having trouble insuring their property due to the fact that insurers consider them high risk. How to obtain coverage.

The california department of insurance allowed the fair plan to increase the rates with a cap of 100. We are adjacent to bailey. The fair plan is a shared market plan.

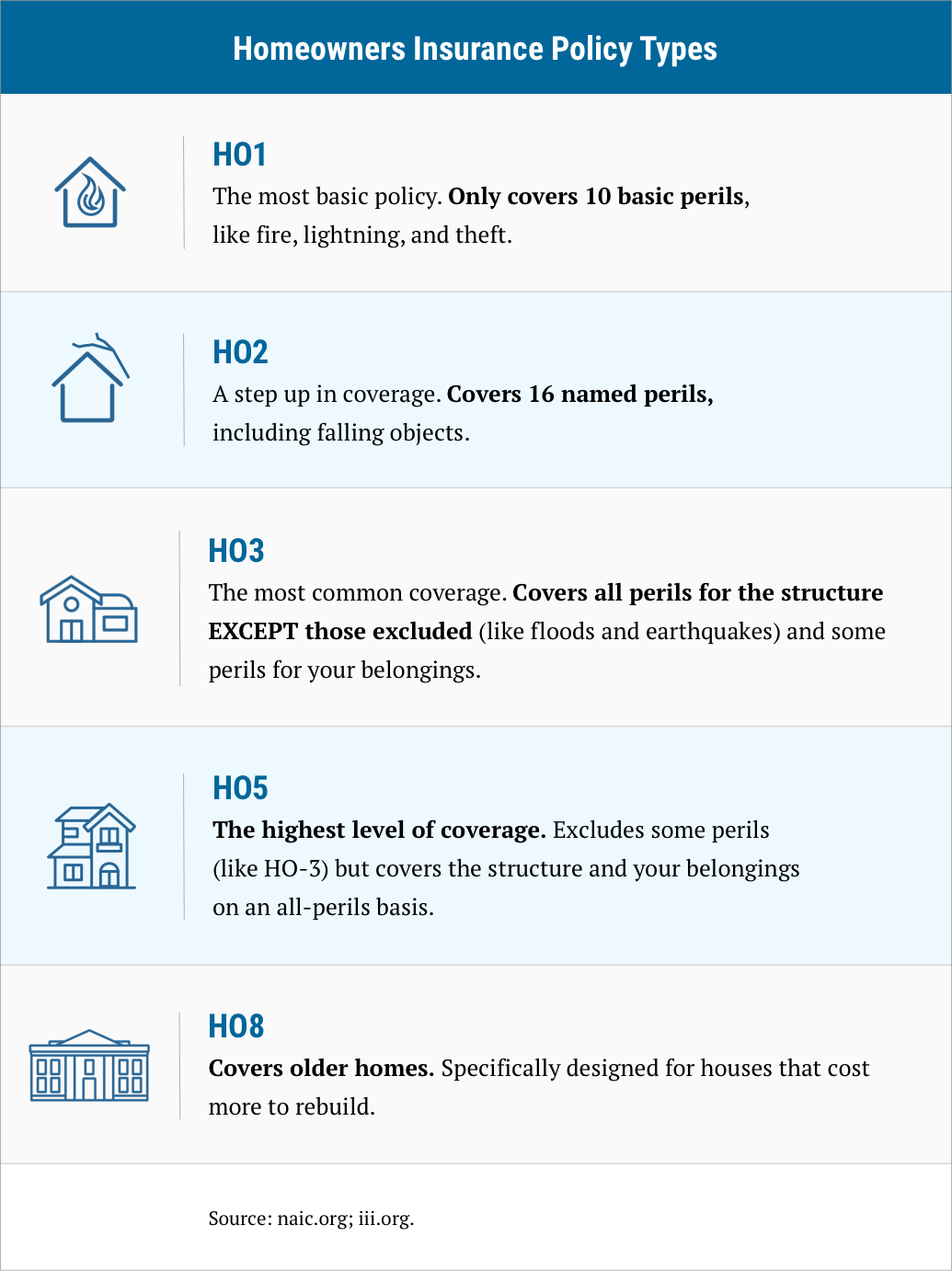

There are times when an insured will purchase an additional insurance policy in addition to the fair plan policy. An insurance agent or broker registered with the fair plan can submit an application for coverage via the fair plan website after a diligent search has been made to obtain coverage in the voluntary insurance market. The california fair plan is an insurance association that offers coverage to high risk homeowners in the state who have trouble obtaining coverage through another insurer.

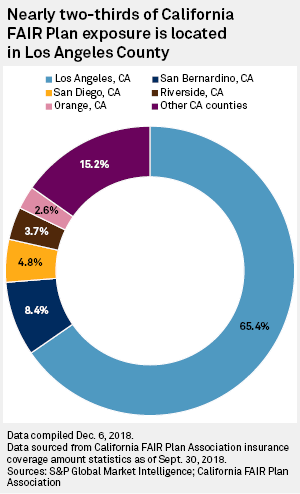

The fair plan is an association located in los angeles comprised of all insurers authorized to transact basic property insurance in california. The fair plan established under california law is. This is typically either an excess or difference in conditions policy.

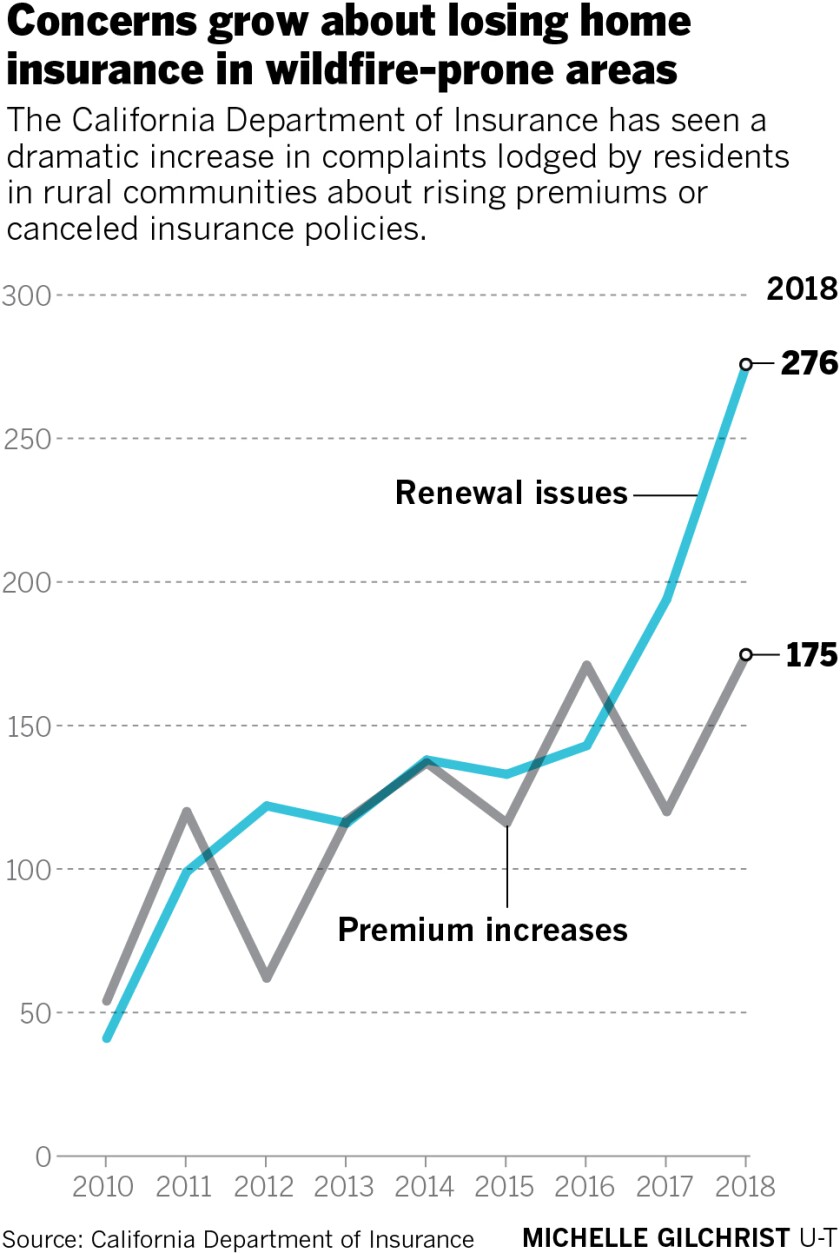

The fair plan also must obtain the approval of the insurance department prior to disbursing operating profits back to participating insurers. The california fair plan association is a syndicated fire insurance pool comprised of all insurers licensed to conduct propertycasualty business in california. The california fair plan is an insurance pool which was created to make sure basic property insurance is available to people who own property in california and who beyond their control cant get insurance thru other carriers due to wildfire exposure and high number of home insurance claims.

Coverage is available to all california property owners provided submission guidelines are met. Our house is cleared of all brush with gravel around the house.

/DEltaDental-9a11100e27cc4e6892e665aa679b7ecd.png)

:max_bytes(150000):strip_icc()/EarthQuakInsurance_2645855_Final_2-766403111a0d4c21bdfa1b5709a0e0b3.png)

:max_bytes(150000):strip_icc()/getting-your-first-home-insurance-policy-4040509_FINAL-f4d13668216345e6bdc64bbea77b2fa8.png)

)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/FAIR-plan-insurance-for-high-risk-properties-tornados-windstorm-flooding-hurricane-zones-5743a5b13df78c6bb026701f.jpg)