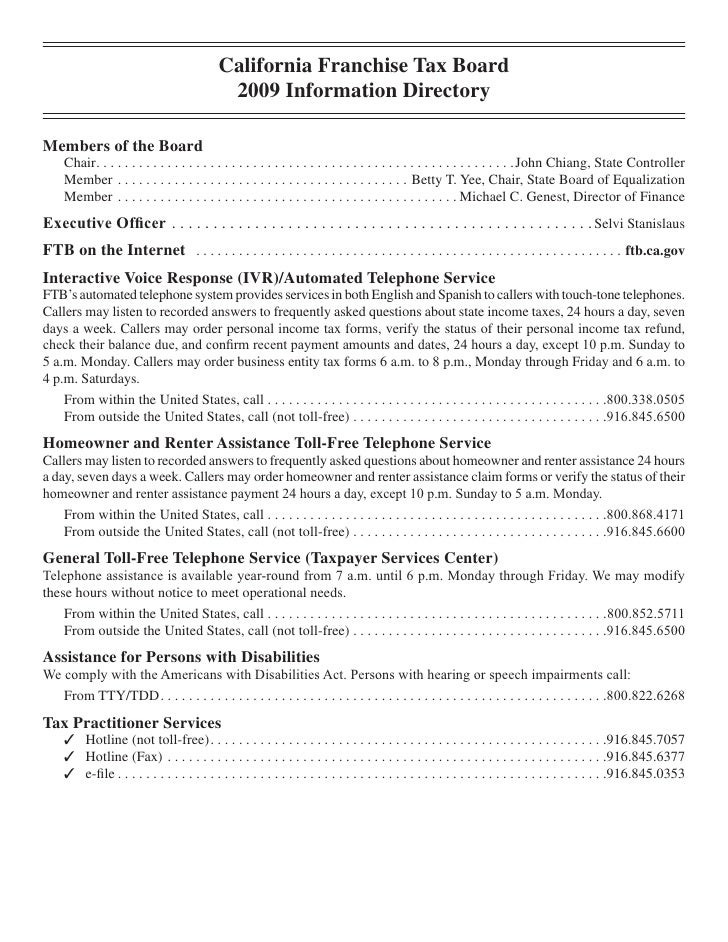

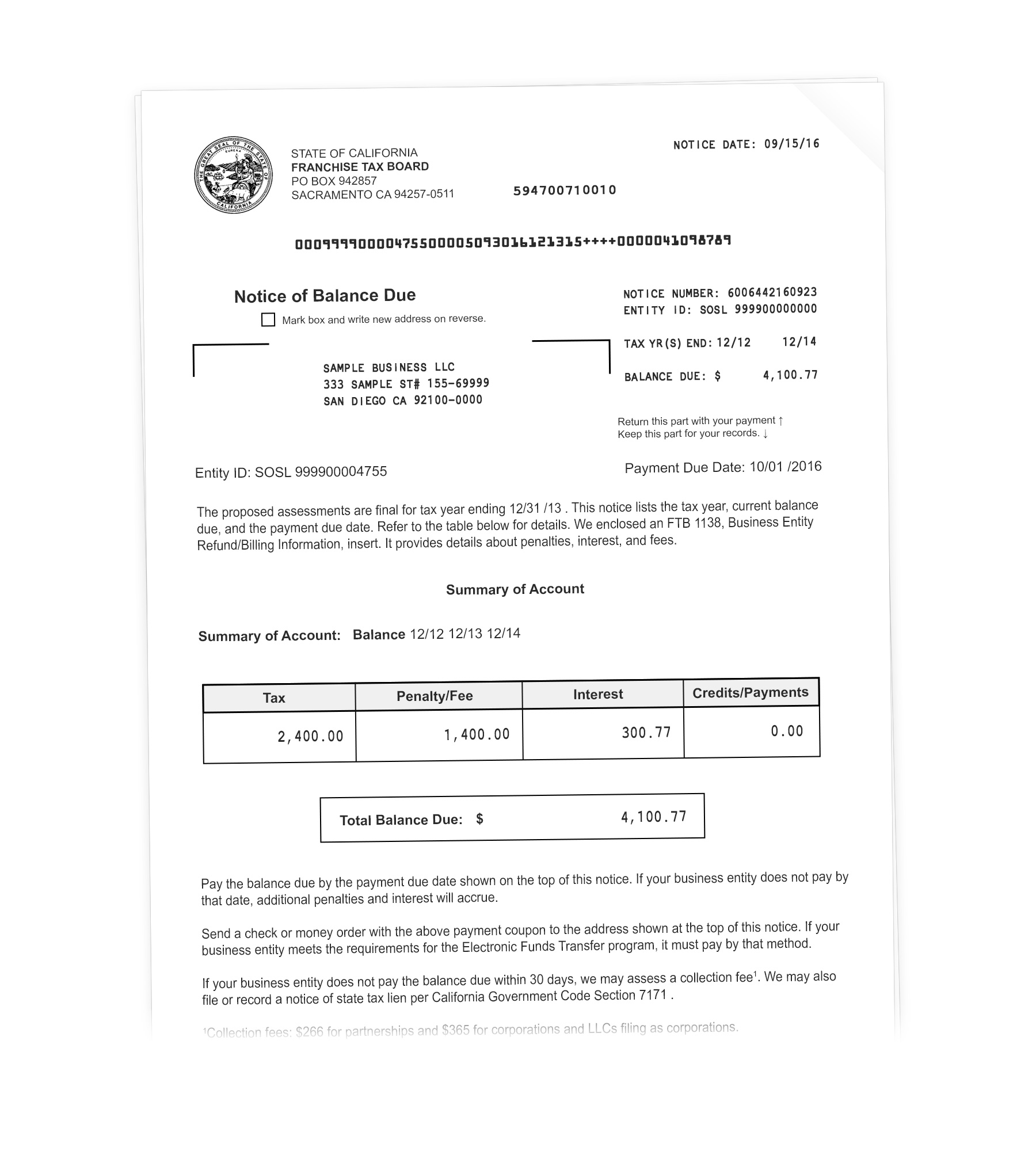

California Franchise Tax Board

Check your 2019 refund status.

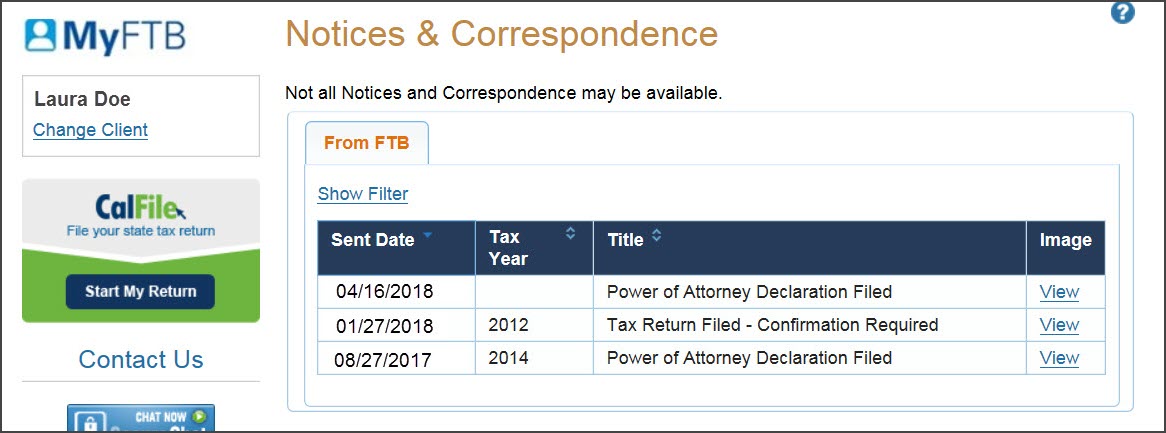

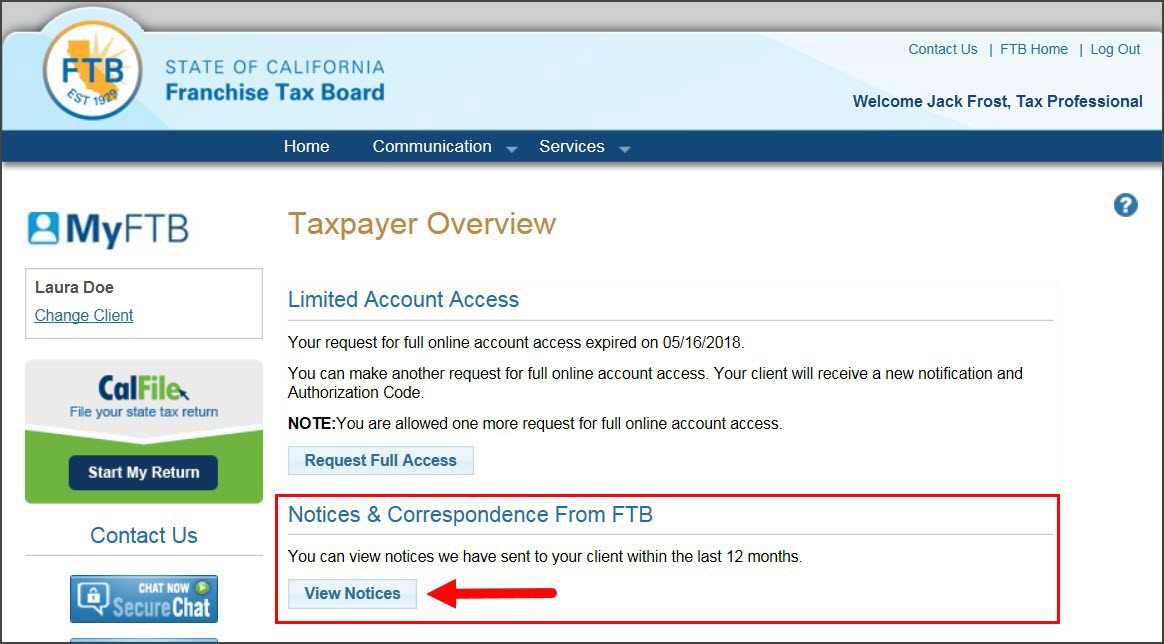

California franchise tax board. Log in to your myftb account. Below you can compare and contrast the 7 ways to contact california franchise tax board by looking at which ones are the fastest and which. Follow the links to popular topics online services.

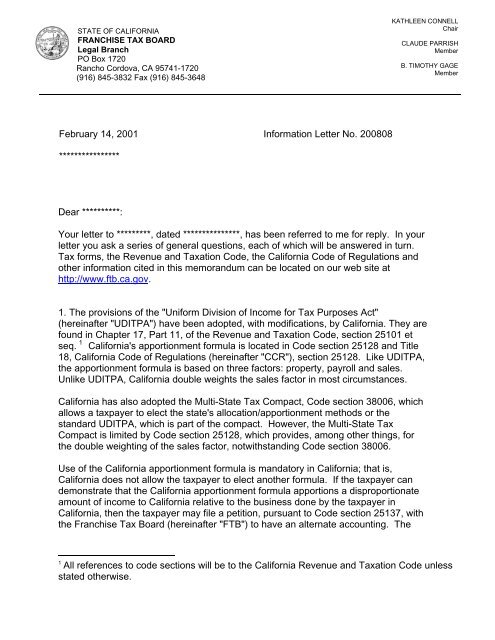

Above are our top recommendations for how to contact california franchise tax board including their top phone number and live chat options. California franchise tax board. The california franchise tax board ftb collects state personal income tax and corporate income tax of californiait is part of the california government operations agency.

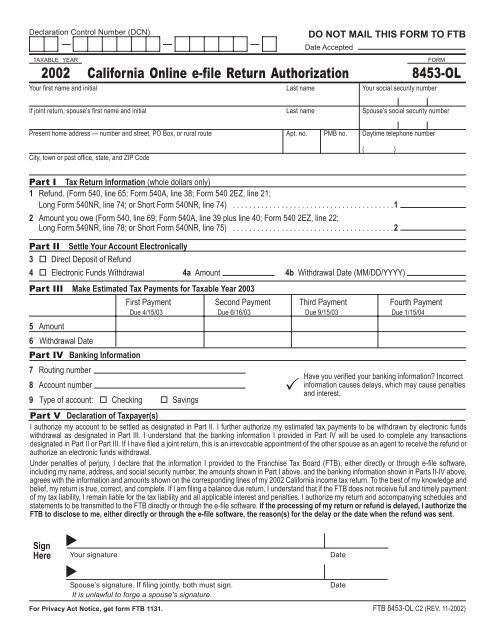

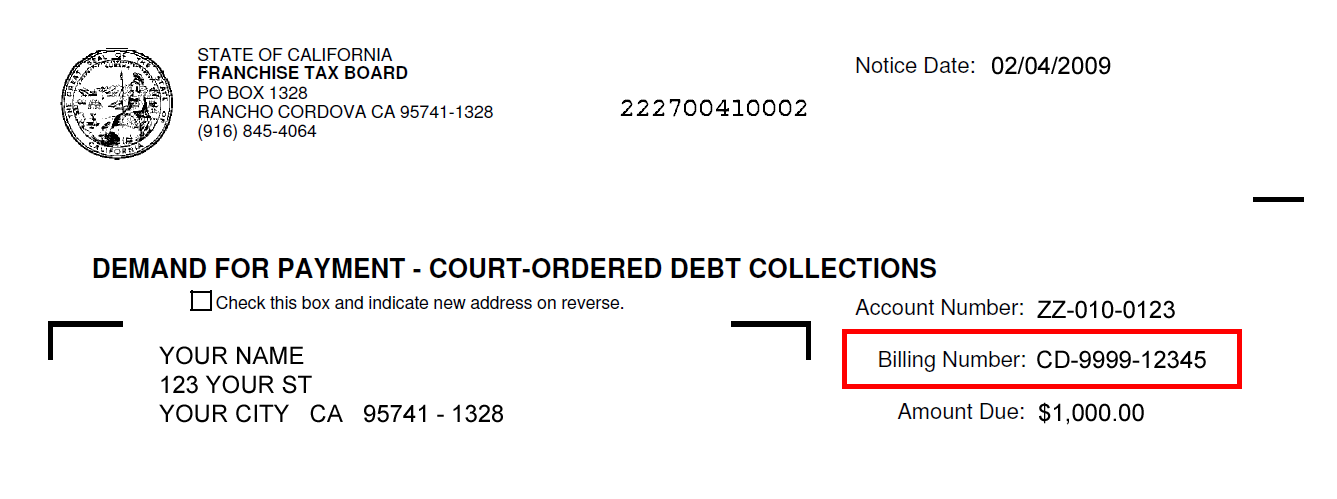

Required field social security number 9 numbers no spaces or dashes. The combination must match our records in order to access this service. Unauthorized access to account information is unlawful as described in section 502 of the california penal code.

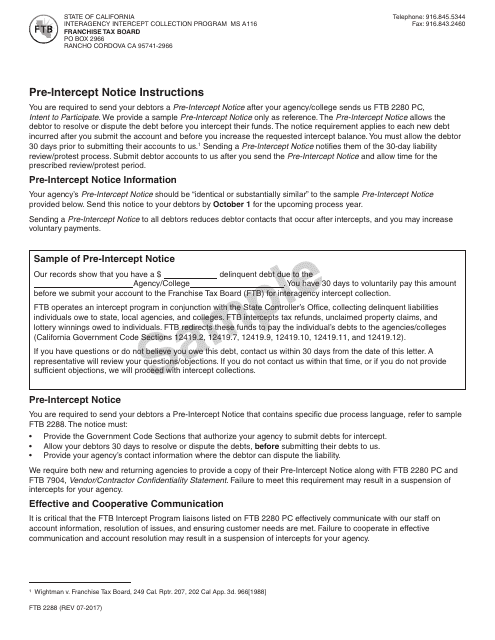

California franchise tax board contact information compared. State of california franchise tax board corporate logo. California franchise tax board certification date july 1 2019 contact accessible technology program.

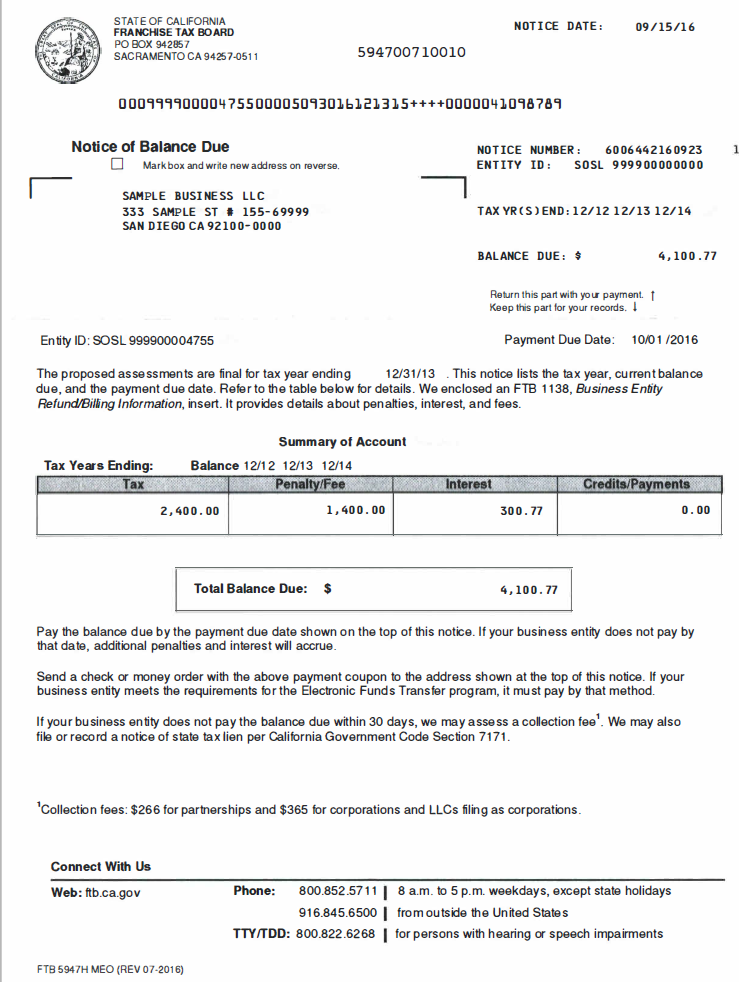

Refund amount claimed on your 2019 california tax return. The board is composed of the california state controller the director of the california department of finance and the chair of the california board of equalizationthe chief administrative official is the executive. Our partnership of tax agencies includes board of equalization california department of tax and fee administration employment development department franchise tax board and internal revenue service.

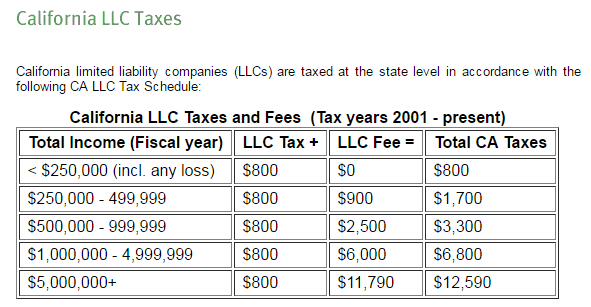

540 2ez line 29. There is an exemption on paying the franchise tax in the first year of doing business in california for certain entrepreneurs. State of california franchise tax board corporate logo.

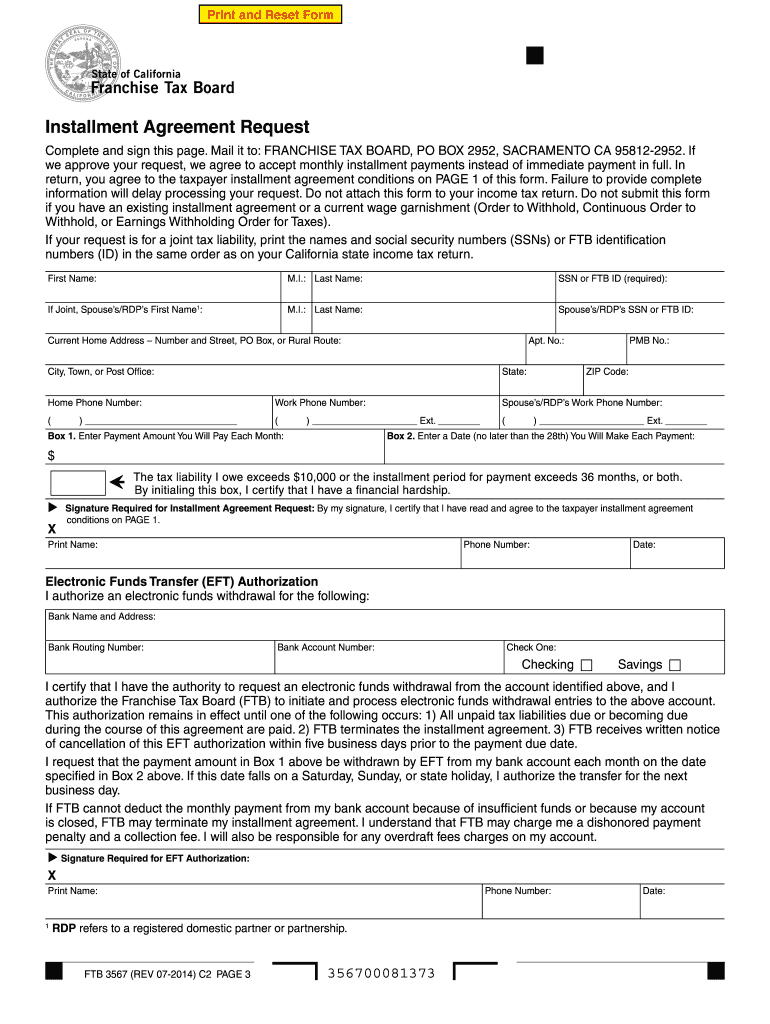

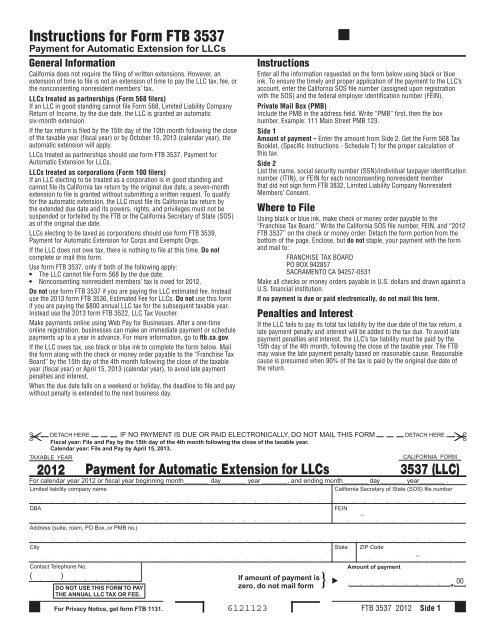

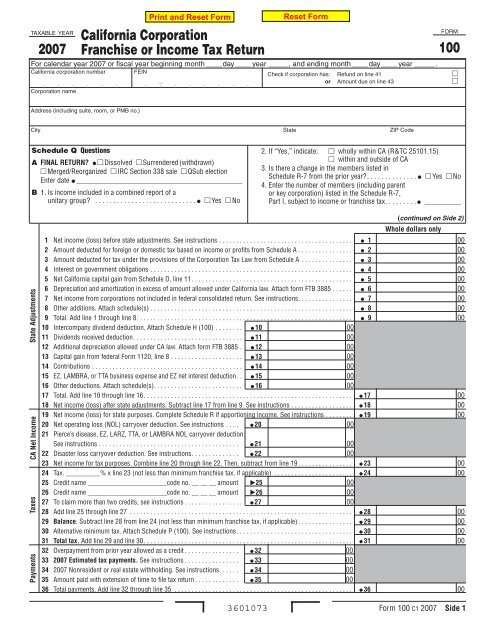

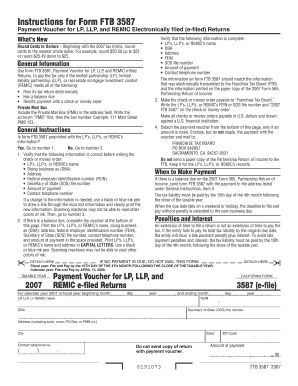

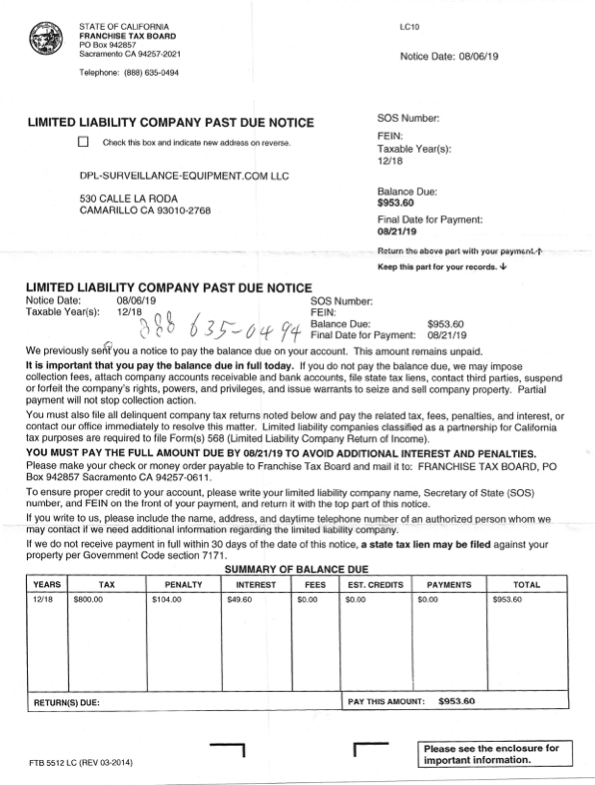

Paying the minimum franchise tax may be done by either using form ftb 100 es or californias web pay for businesses both of which are submitted to the franchise tax board. The first year franchise tax exemption. Enter your social security number and last name below.

The undersigned certify that as of june 22 2019 the internet website of the franchise tax board is designed developed and maintained to be in compliance with california government code sections 7405 and 11135 and the web content. Check your refund status. The ca franchise tax board waives the first year minimum franchise tax for new corporations that qualify or incorporate with the california secretary of state.

Because of its unusually high franchise tax rate california has gained a reputation as being a state unwelcoming to new businesses even though. Login for individuals required field. File a return make a payment or check your refund.

-4.png)