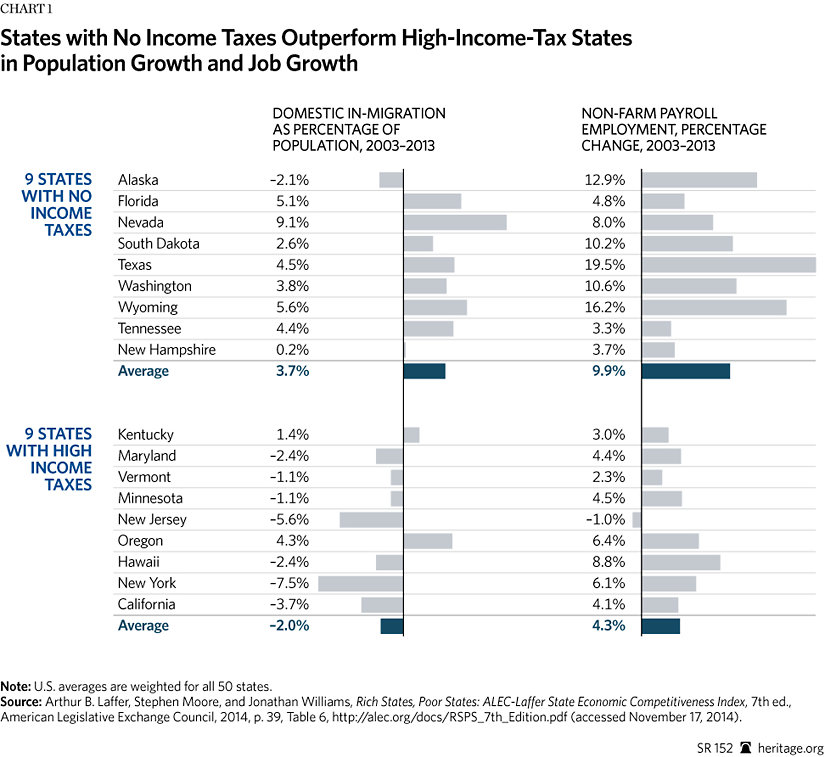

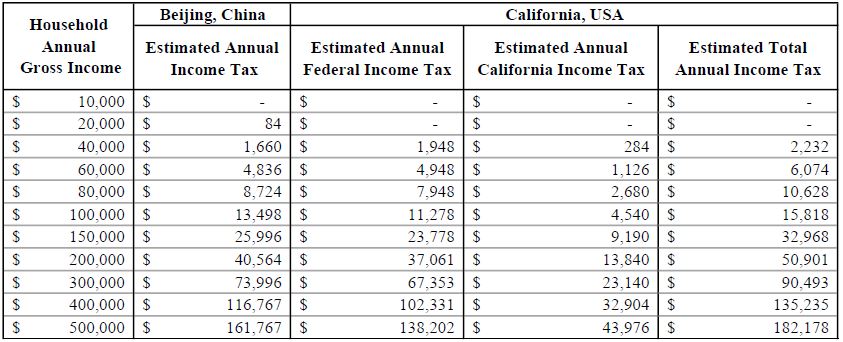

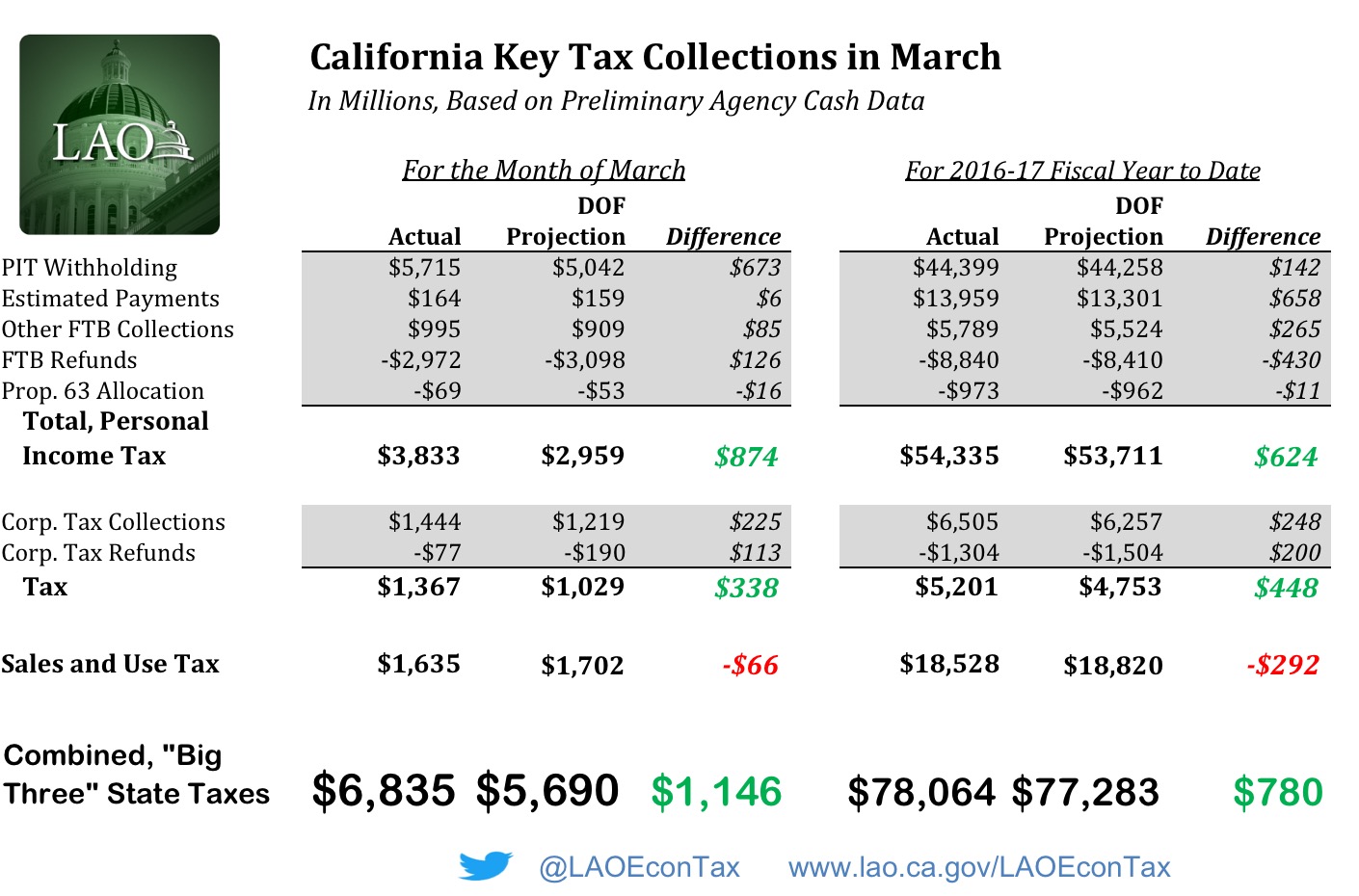

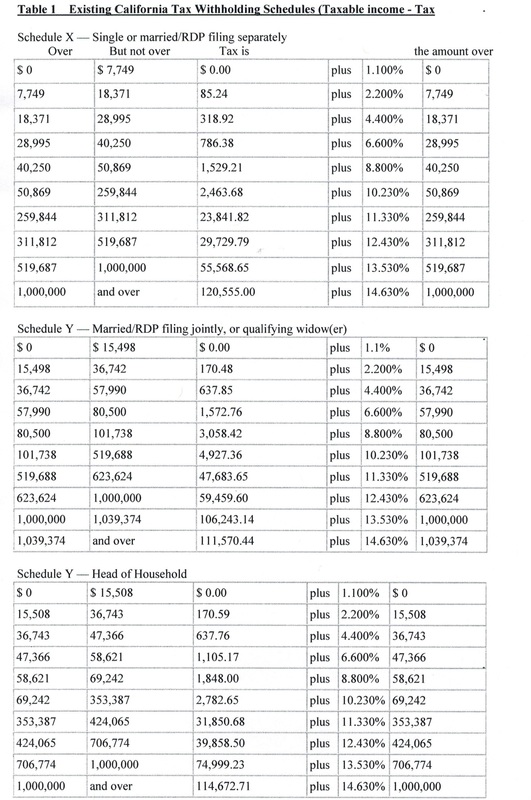

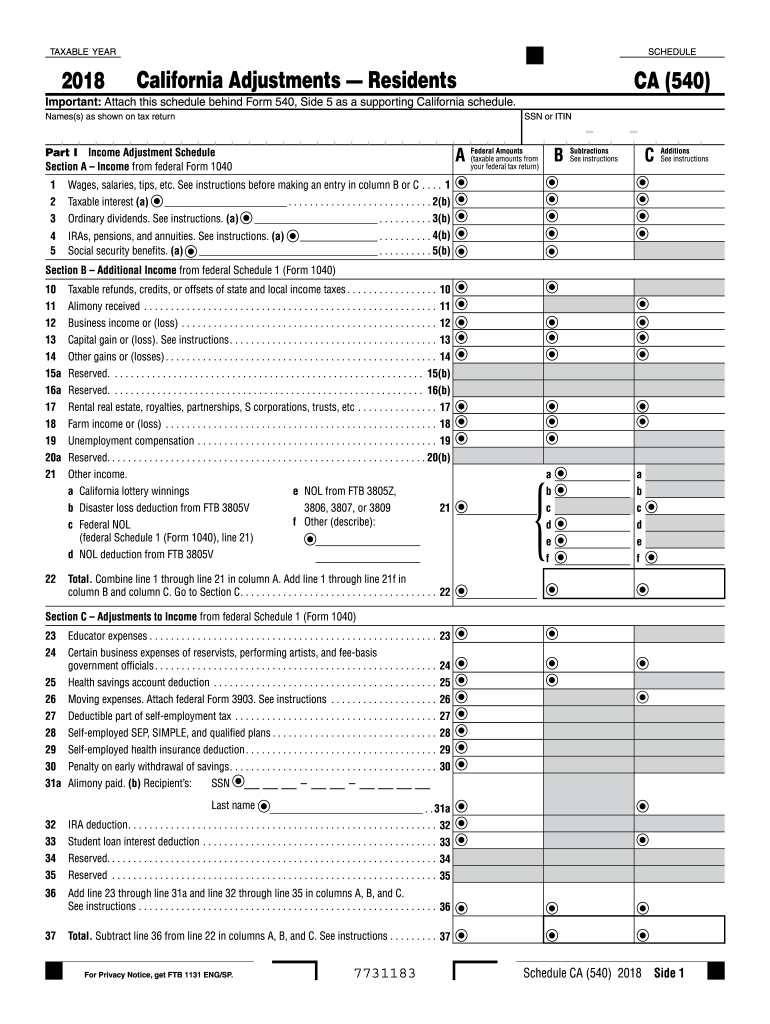

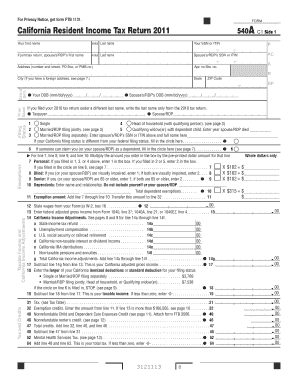

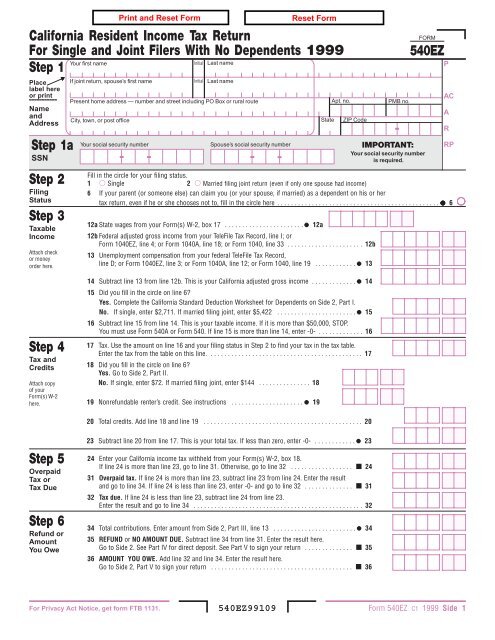

California Income Tax Table

Find prior year tax tables using the forms and publications search.

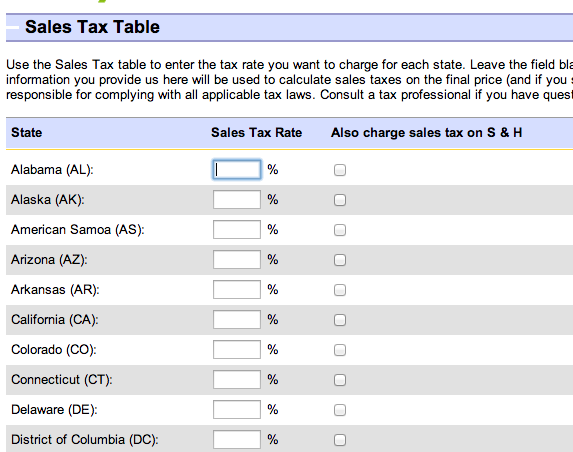

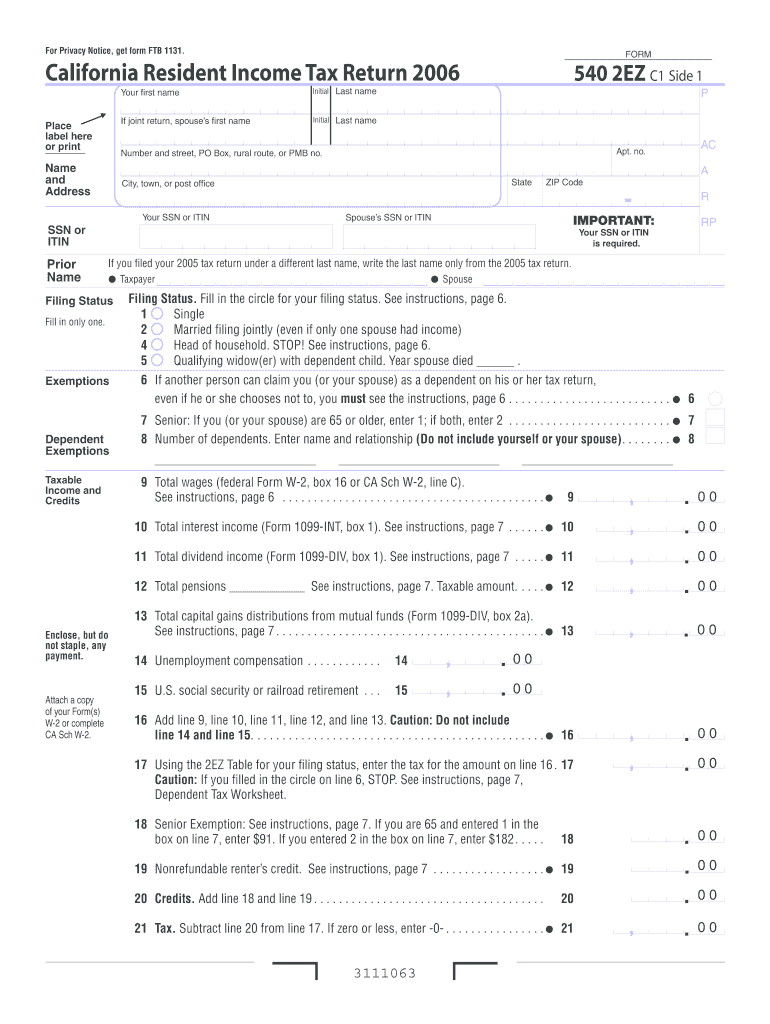

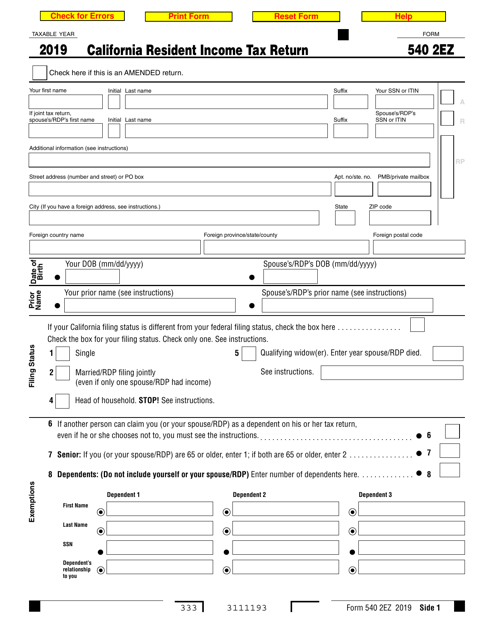

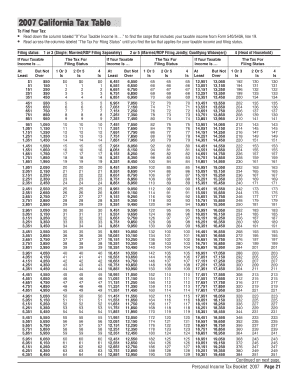

California income tax table. We last updated california 540 tax table in march 2020 from the california franchise tax board. Read across the columns labeled the tax for filing status until you find the tax that applies for your taxable income and filing status. Follow the links to popular topics online services.

Detailed california state income tax rates and brackets are available on this page. Log in to your myftb account. California franchise tax board.

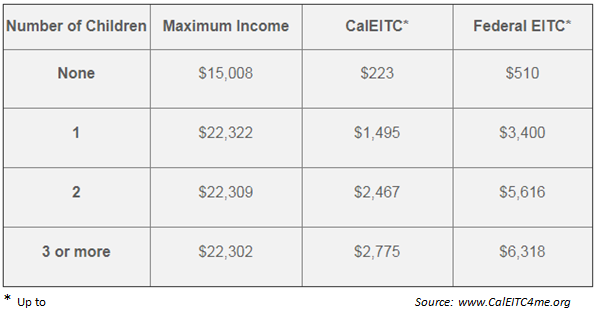

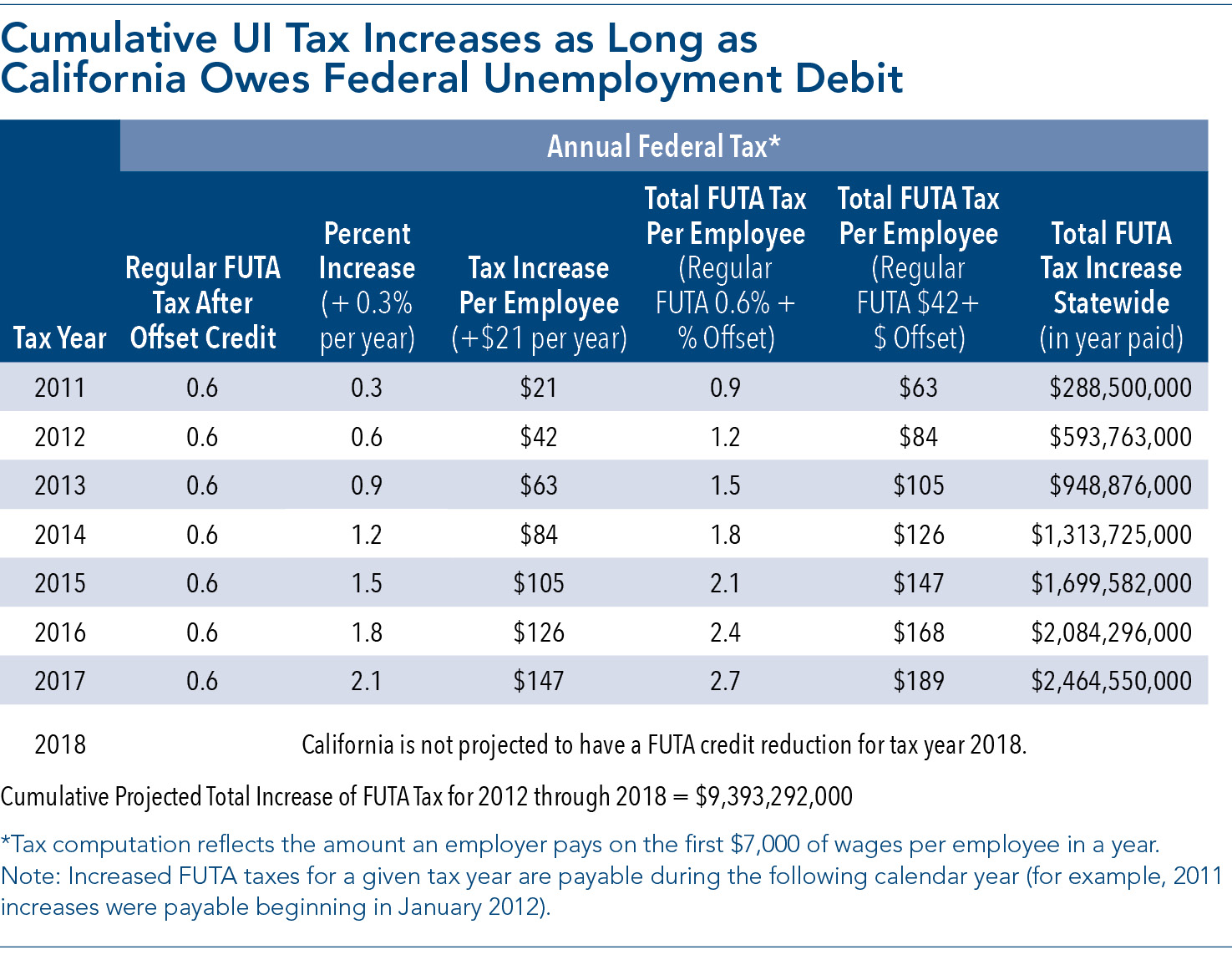

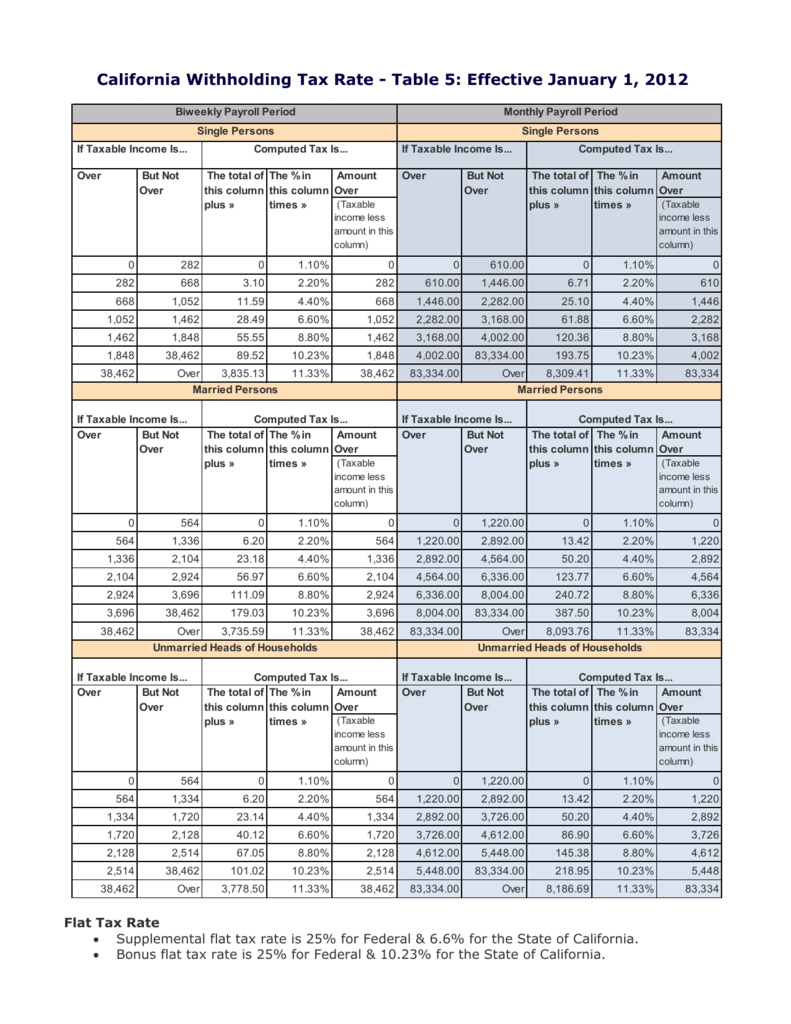

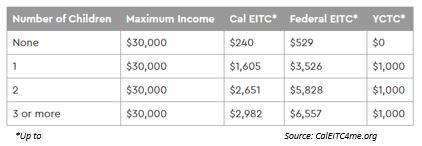

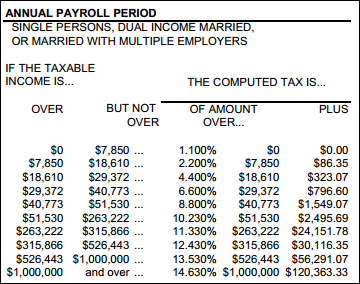

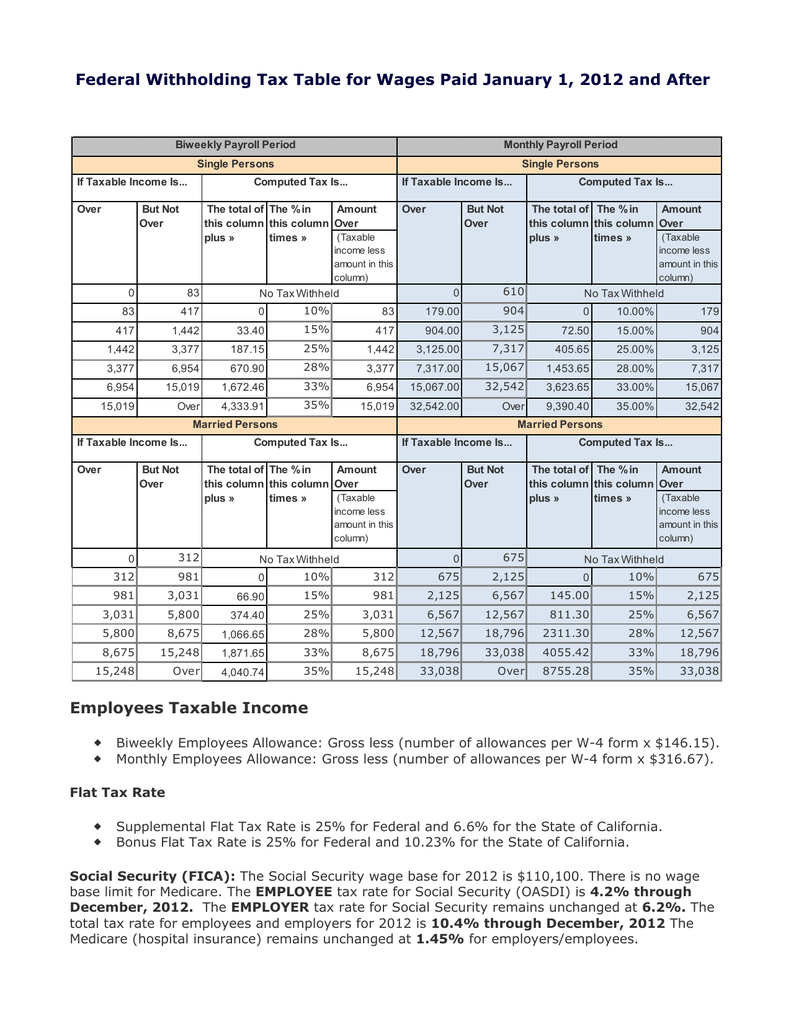

They are unemployment insurance ui and employment training tax ett which are employer contributions and state disability insurance sdi and personal income tax pit which are withheld from employees wages. The california income tax has ten tax brackets with a maximum marginal income tax of 1330 as of 2020. This page has the latest california brackets and tax rates plus a california income tax calculator.

Californias 2020 income tax ranges from 1 to 133. Read down the column labeled if your taxable income is to find the range that includes your taxable income from form 540 line 19. Income tax tables and other tax information is sourced from the california franchise tax board.

In keyword field type tax table tax rate schedules 2019. Marriedrdp filing jointly or qualifying widower joint. This form is for income earned in tax year 2019 with tax returns due in april 2020we will update this page with a new version of the form for 2021 as soon as it is made available by the california government.

2020 california state income tax tables california has four state payroll taxes which are administered by the employment development department edd. File a return make a payment or check your refund. To find your tax.

California state income tax rate table for the 2019 2020 filing season has nine income tax brackets with ca tax rates of 1 2 4 6 8 93 103 113 and 123 for single married filing jointly married filing separately and head of household statuses.

/california-state-taxes-amongst-the-highest-in-the-nation-3193244-finalv2-8a746a2ad14c4fba8d21382f812c7c76.png)

:max_bytes(150000):strip_icc()/ScreenShot2020-04-03at11.52.59AM-9d0f626d45704b75a451679182d740ef.png)

/TaxRates2-dc0366d01dd0491b91a1c3c93b4740db.jpg)