California Overtime Calculator Spreadsheet

See other state labor offices.

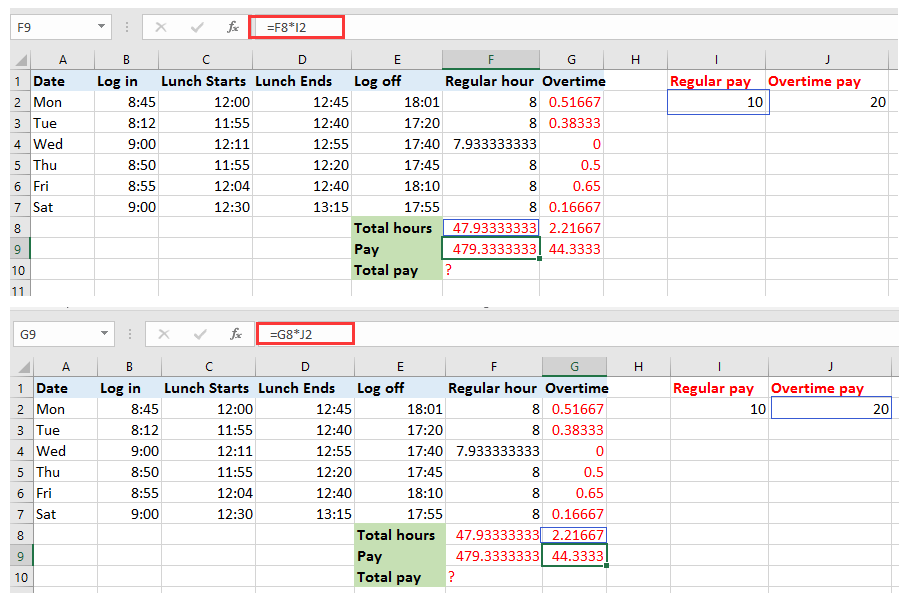

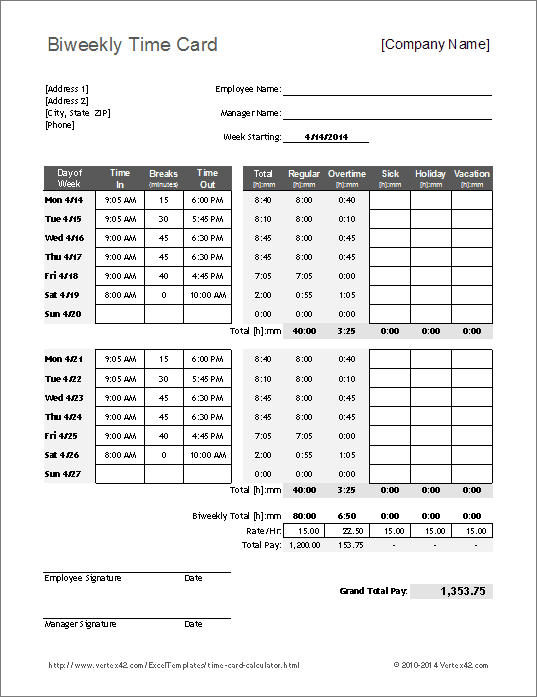

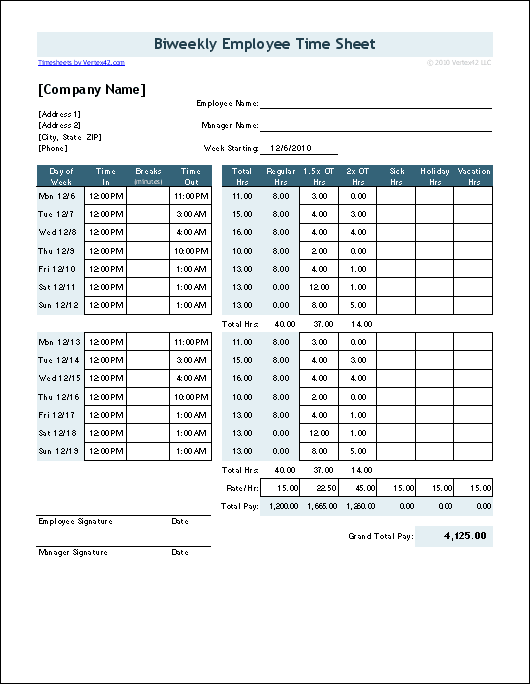

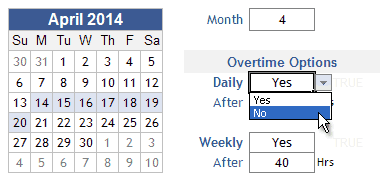

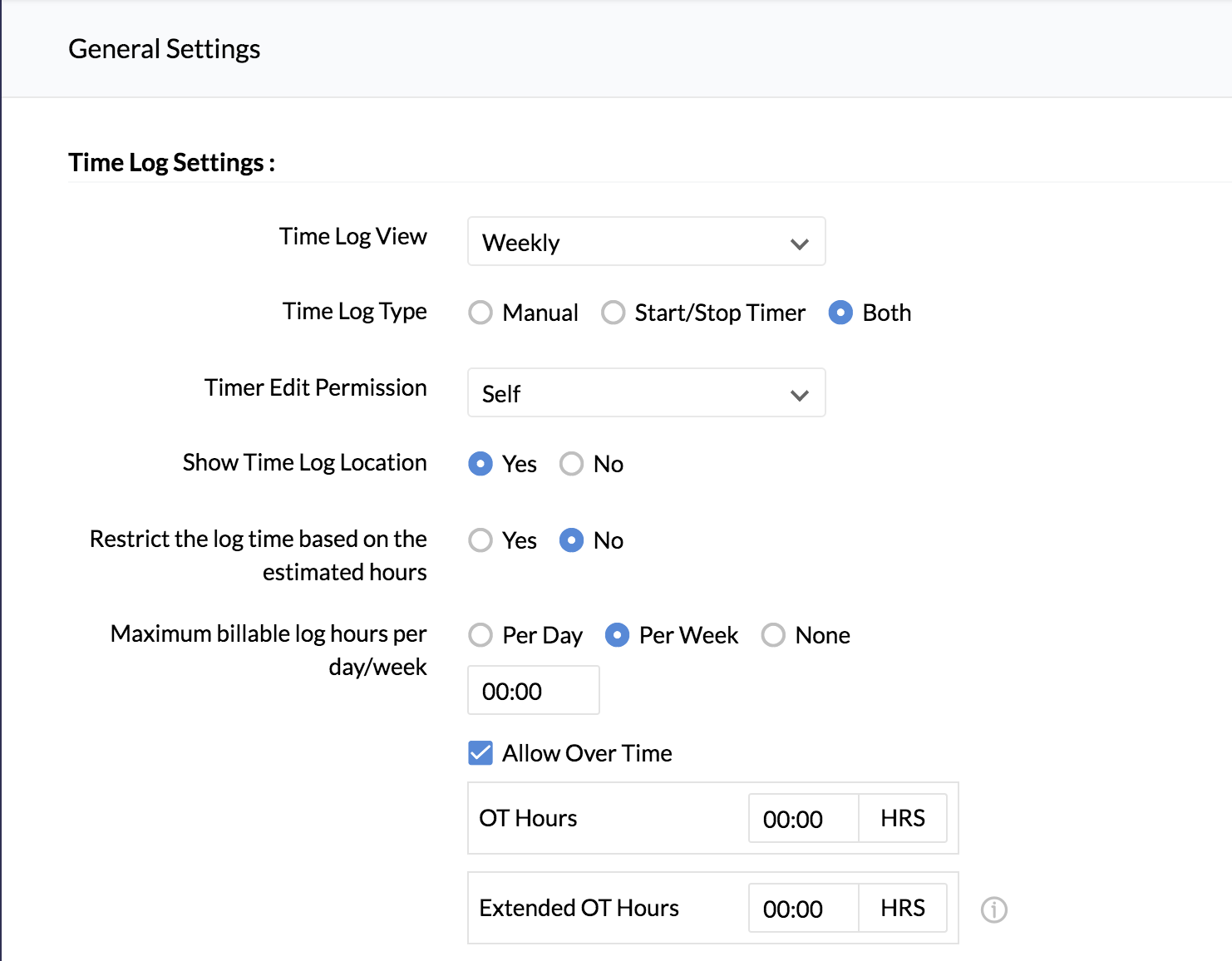

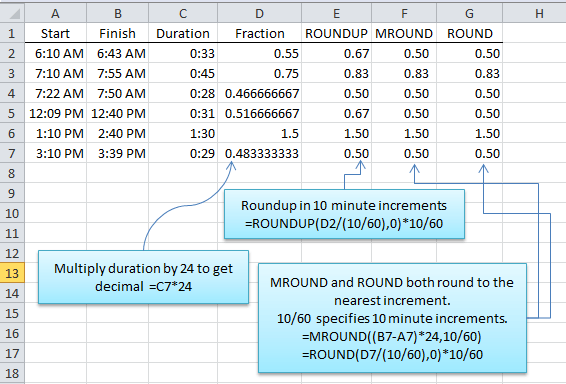

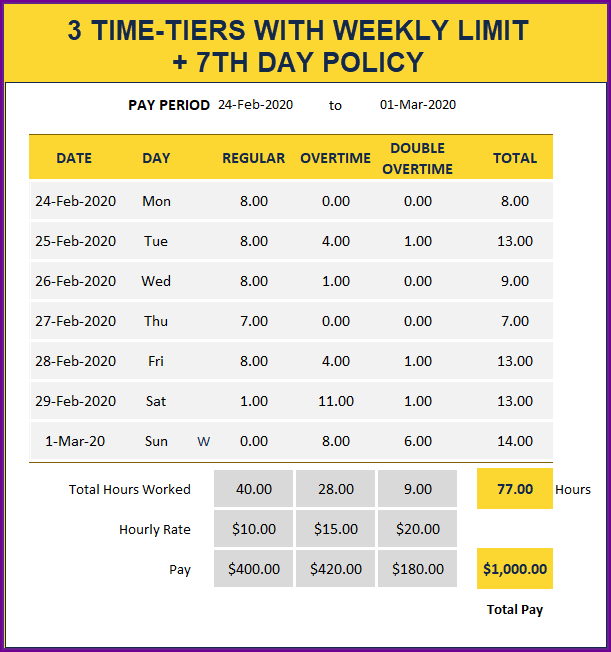

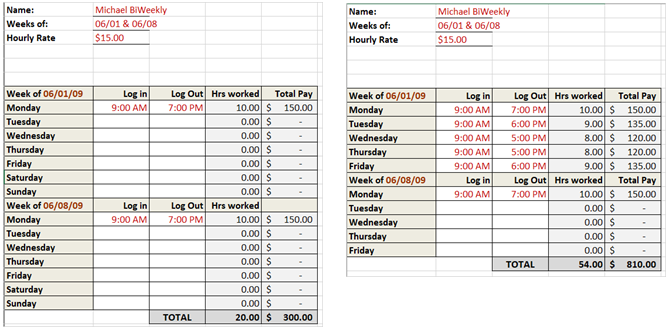

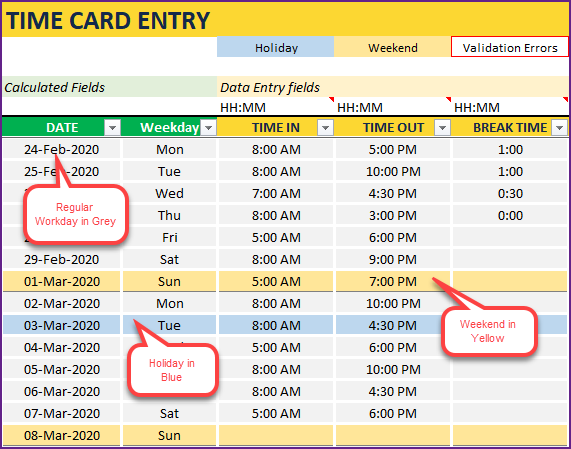

California overtime calculator spreadsheet. Calculate overtime based on daily andor weekly hours. The amount of overtime depends on the length of the employees shift and the number of days he or she has worked in the workweek. The us government department of labor overtime law of after 40 hours per week applies to many states.

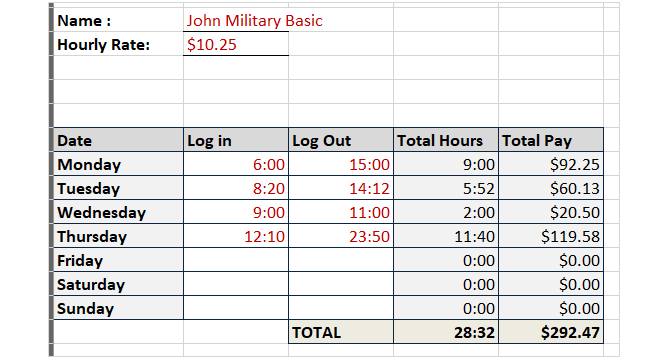

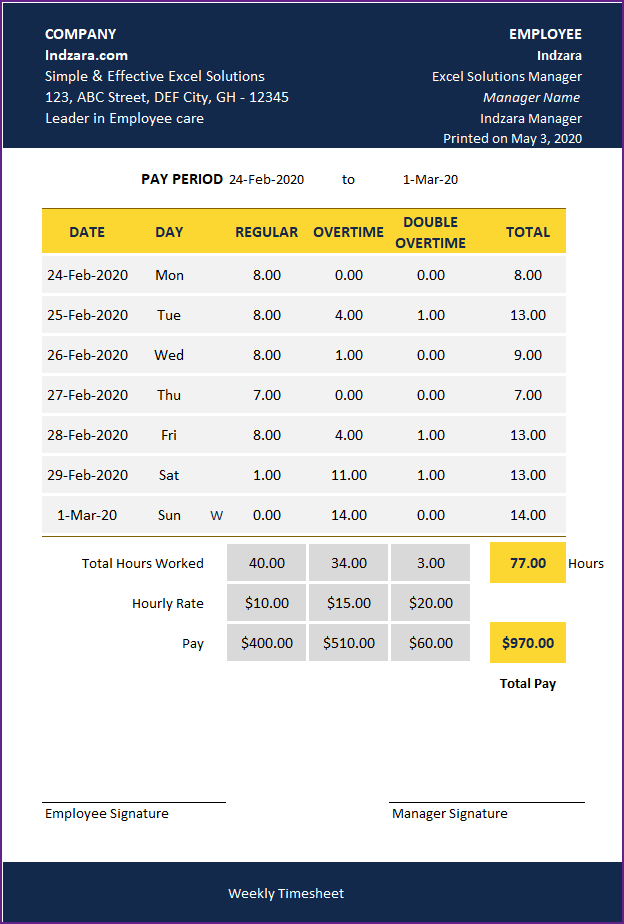

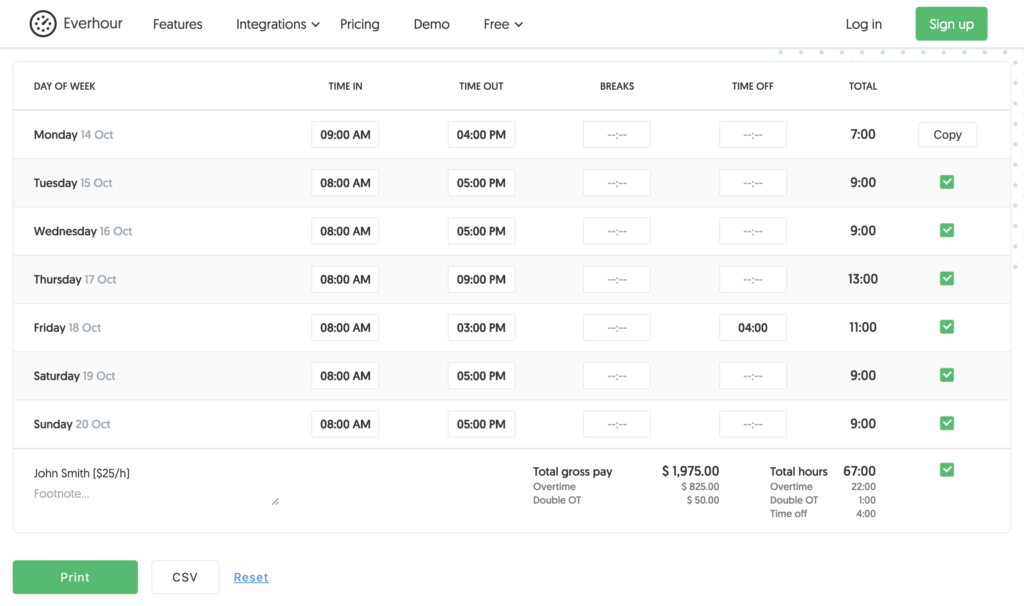

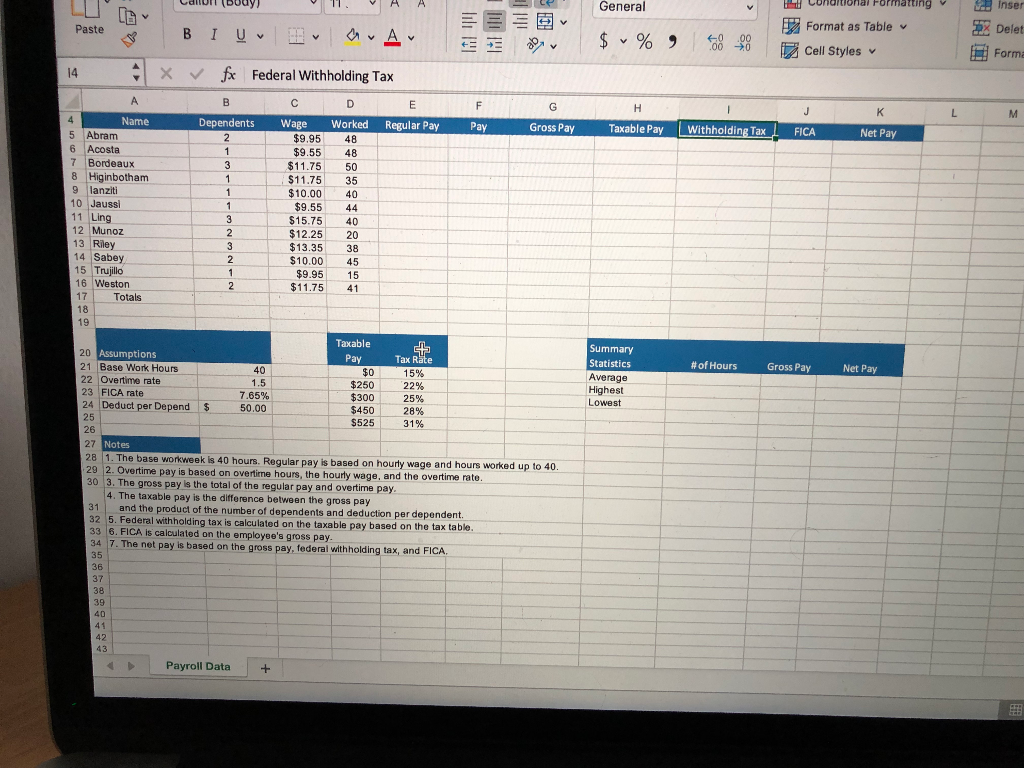

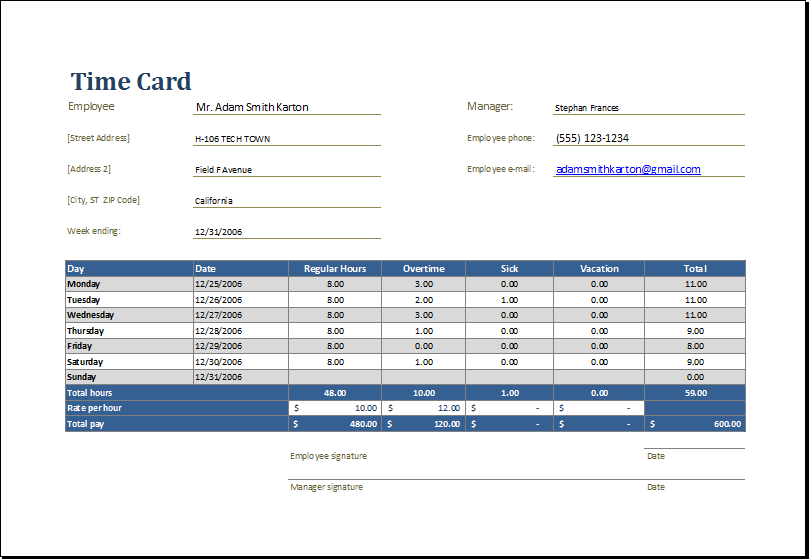

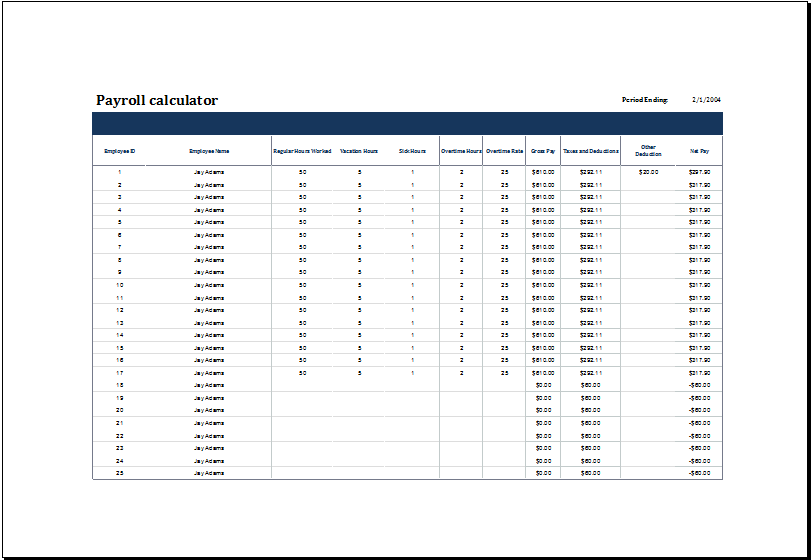

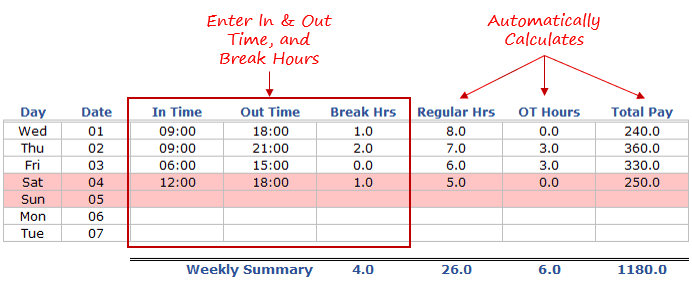

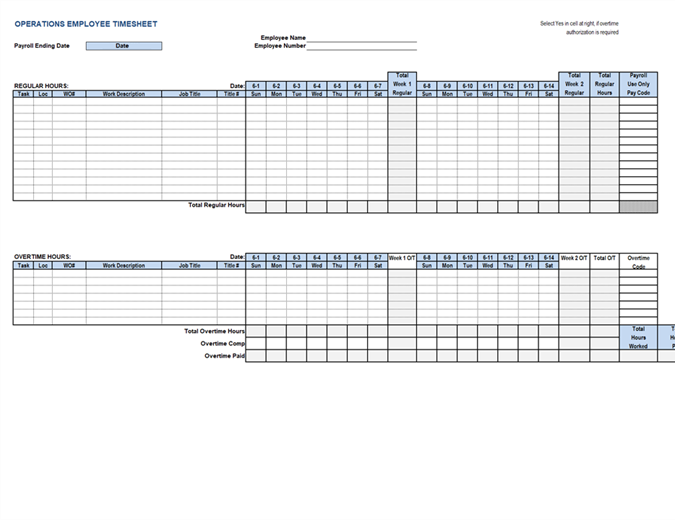

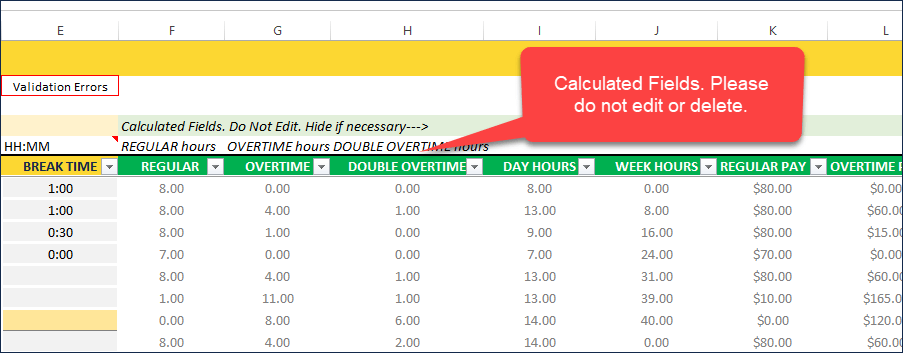

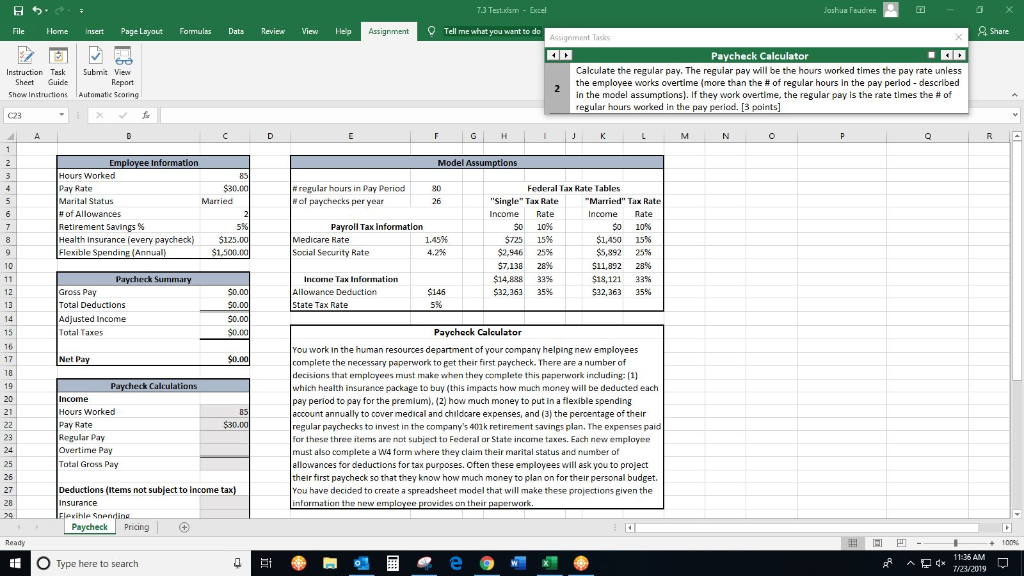

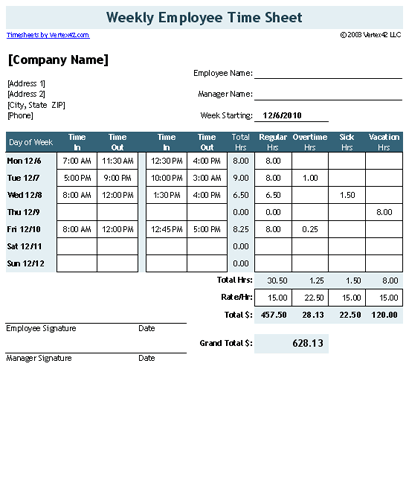

New overtime rules affecting millions of american workers are slated to the effect later this year. Below is a snapshot of the image from the template. Use a worksheet designed specifically for california overtime.

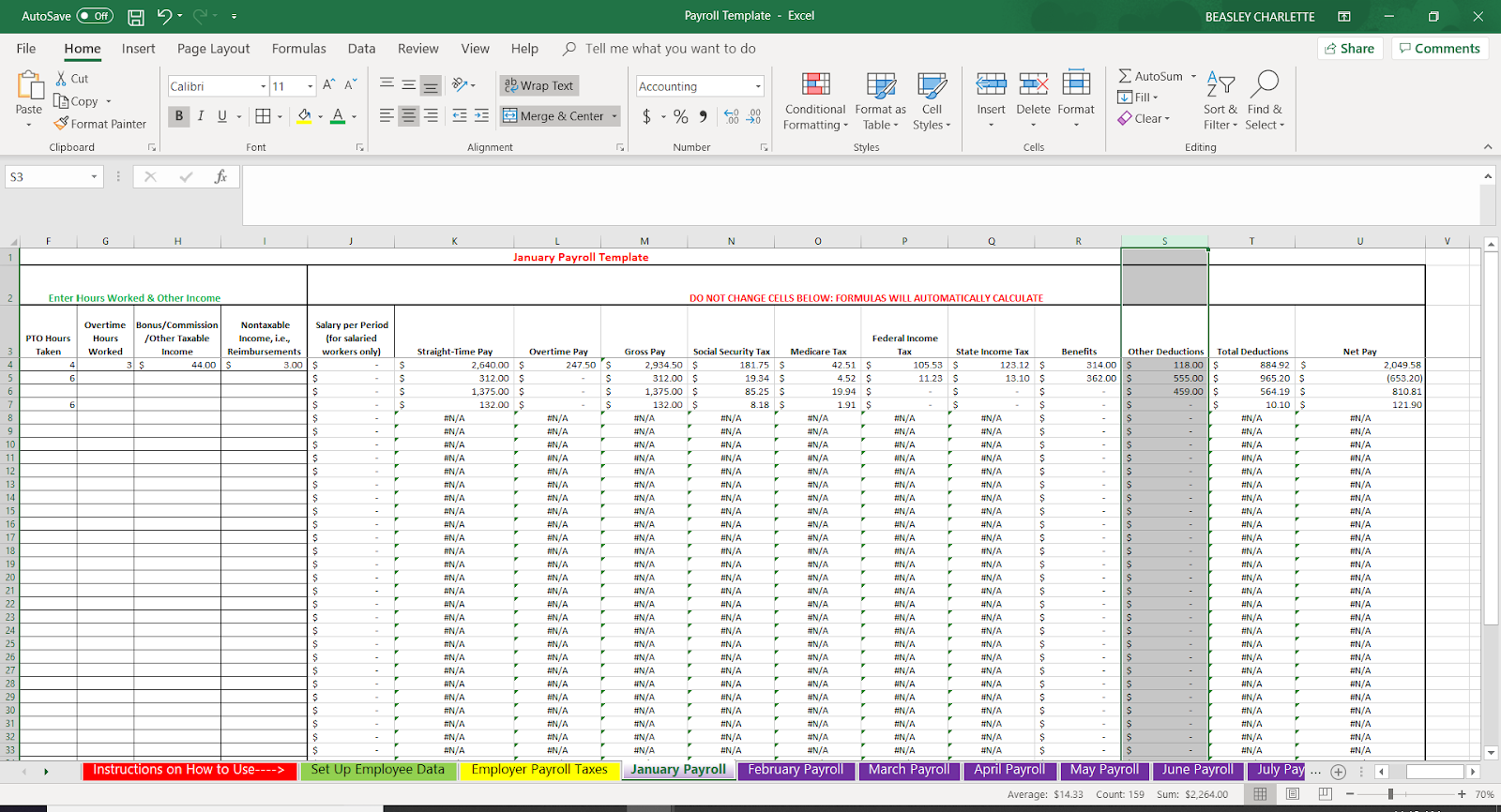

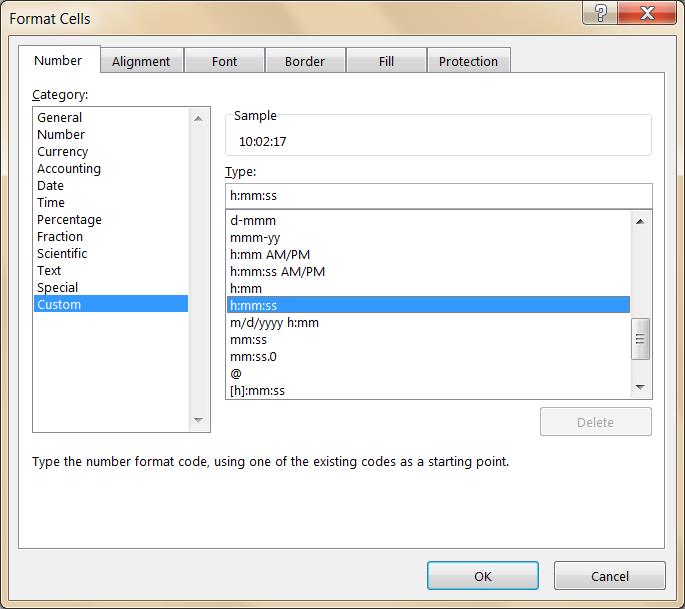

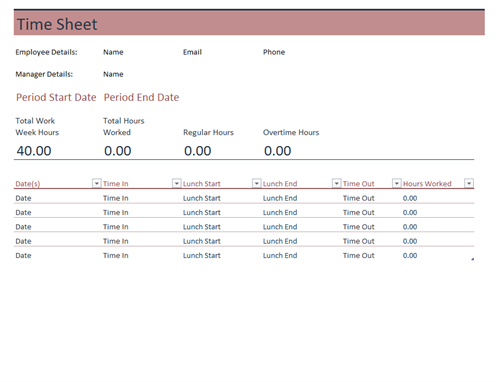

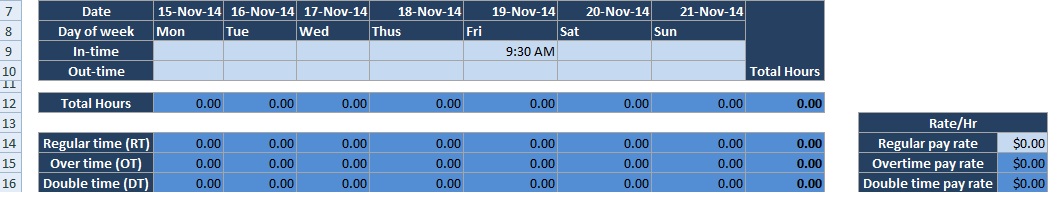

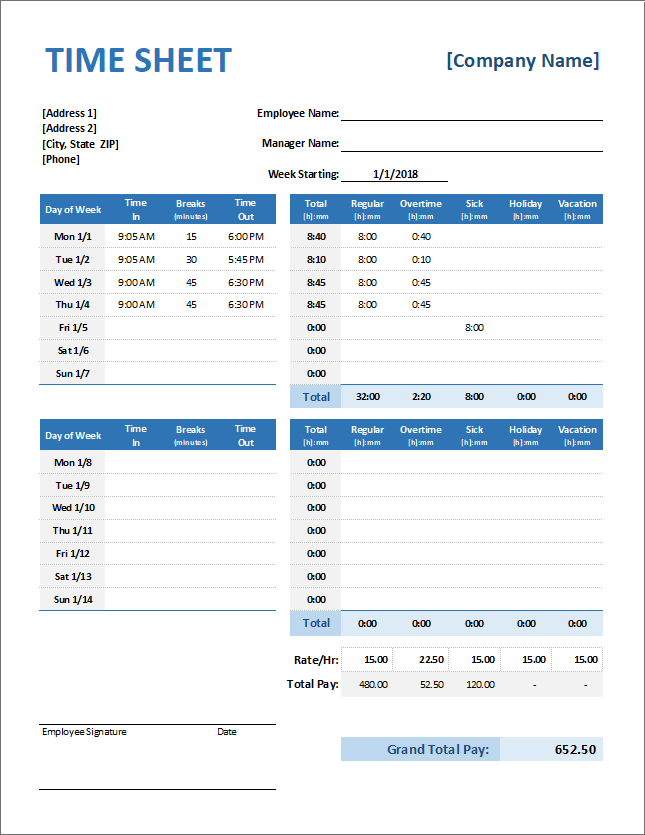

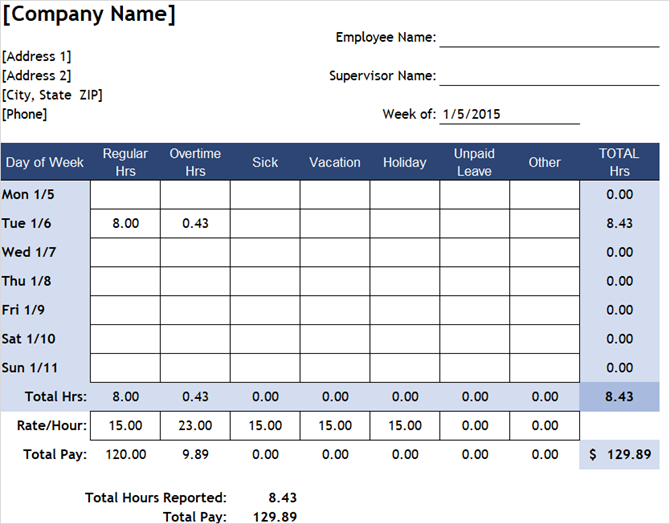

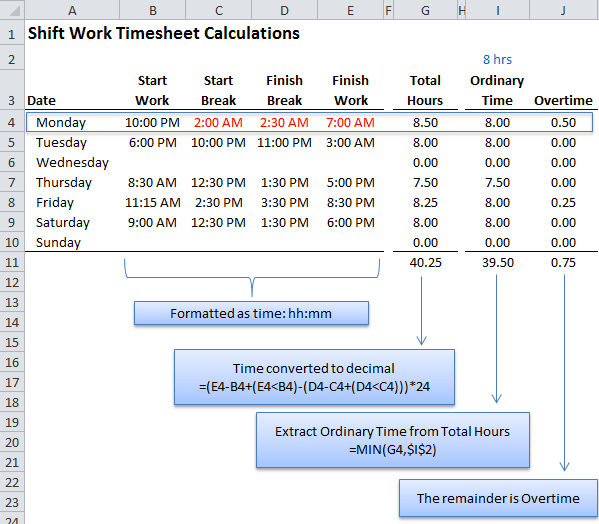

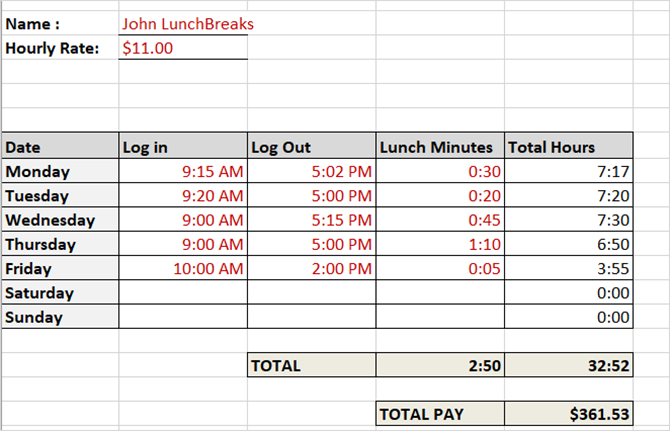

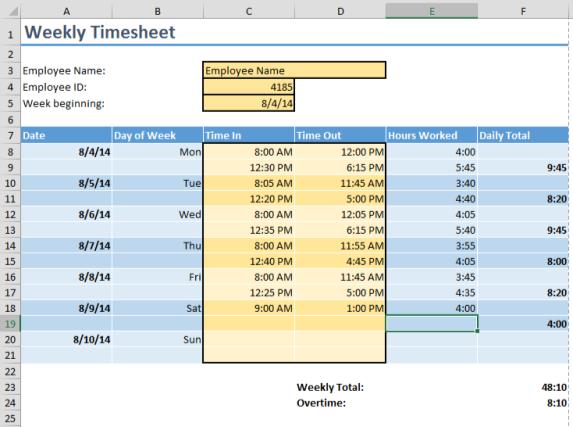

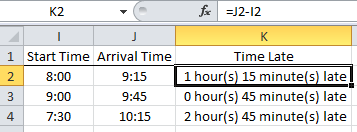

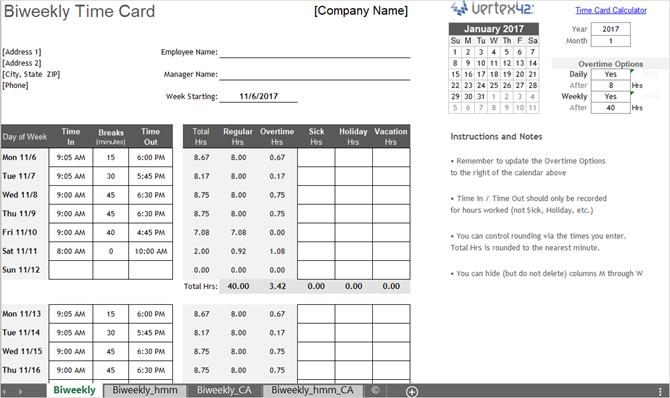

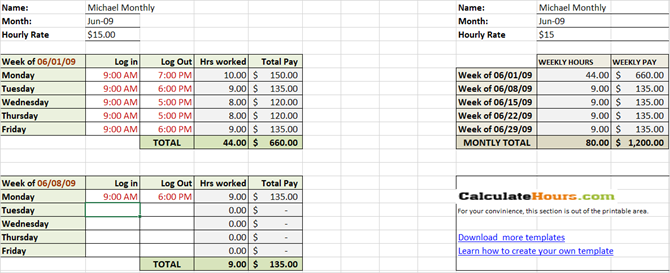

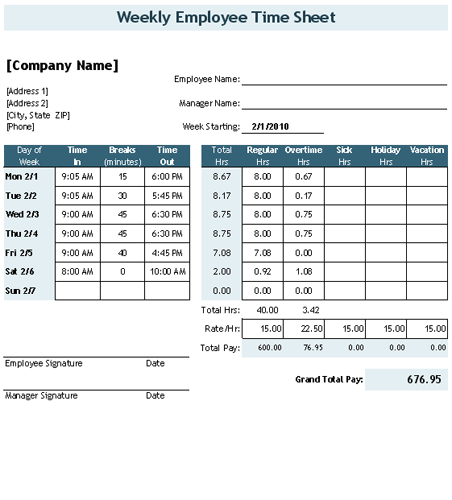

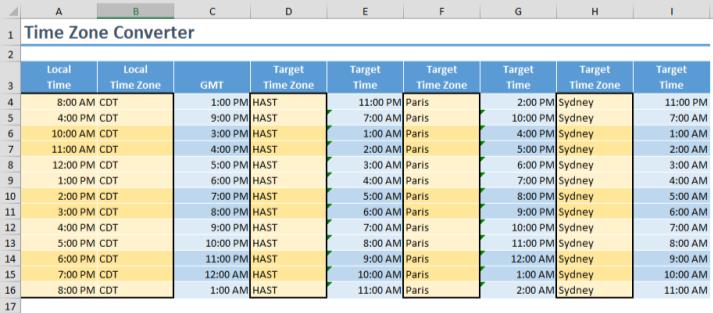

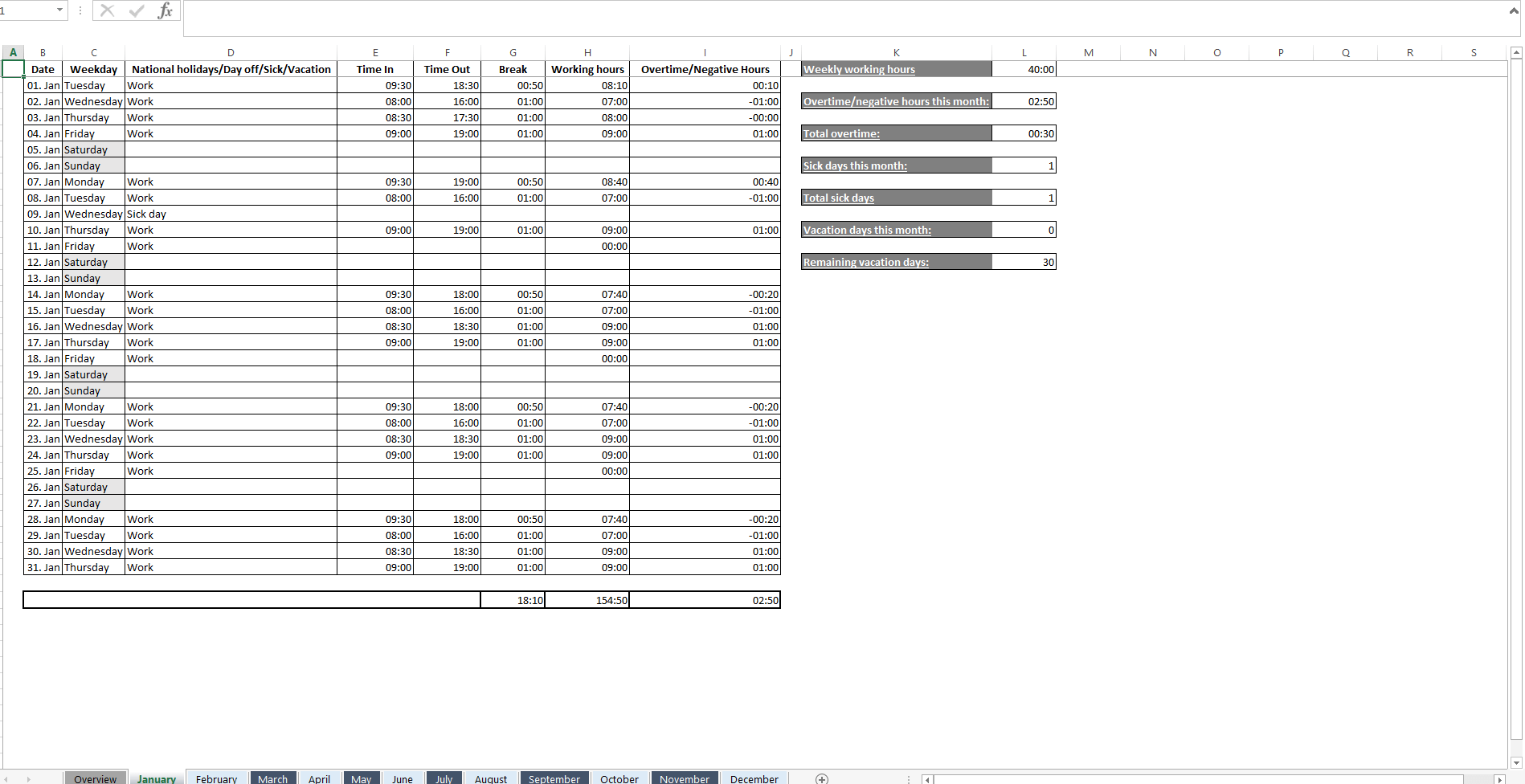

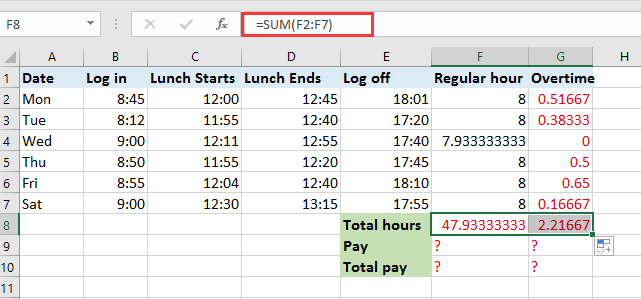

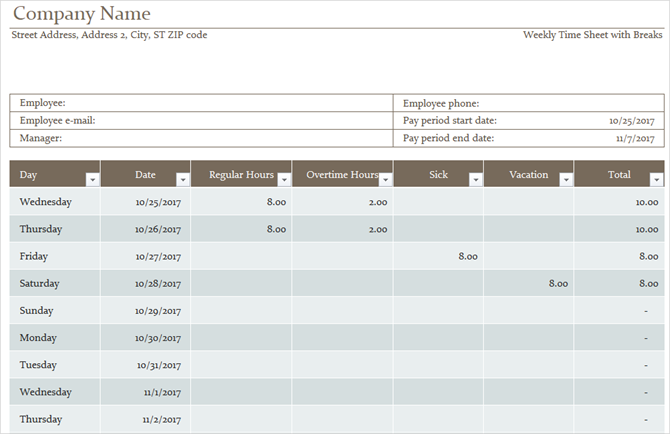

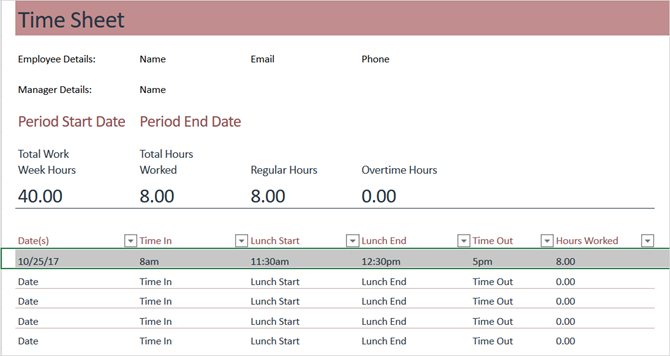

Calculate and display total hours worked in decimal or hmm format. A dynamic excel template for calculating employee working hours and overtime. California overtime calculator.

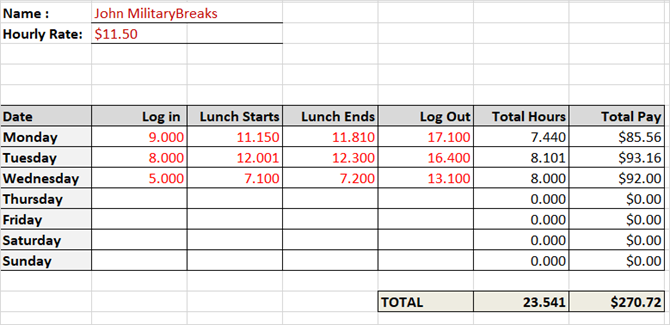

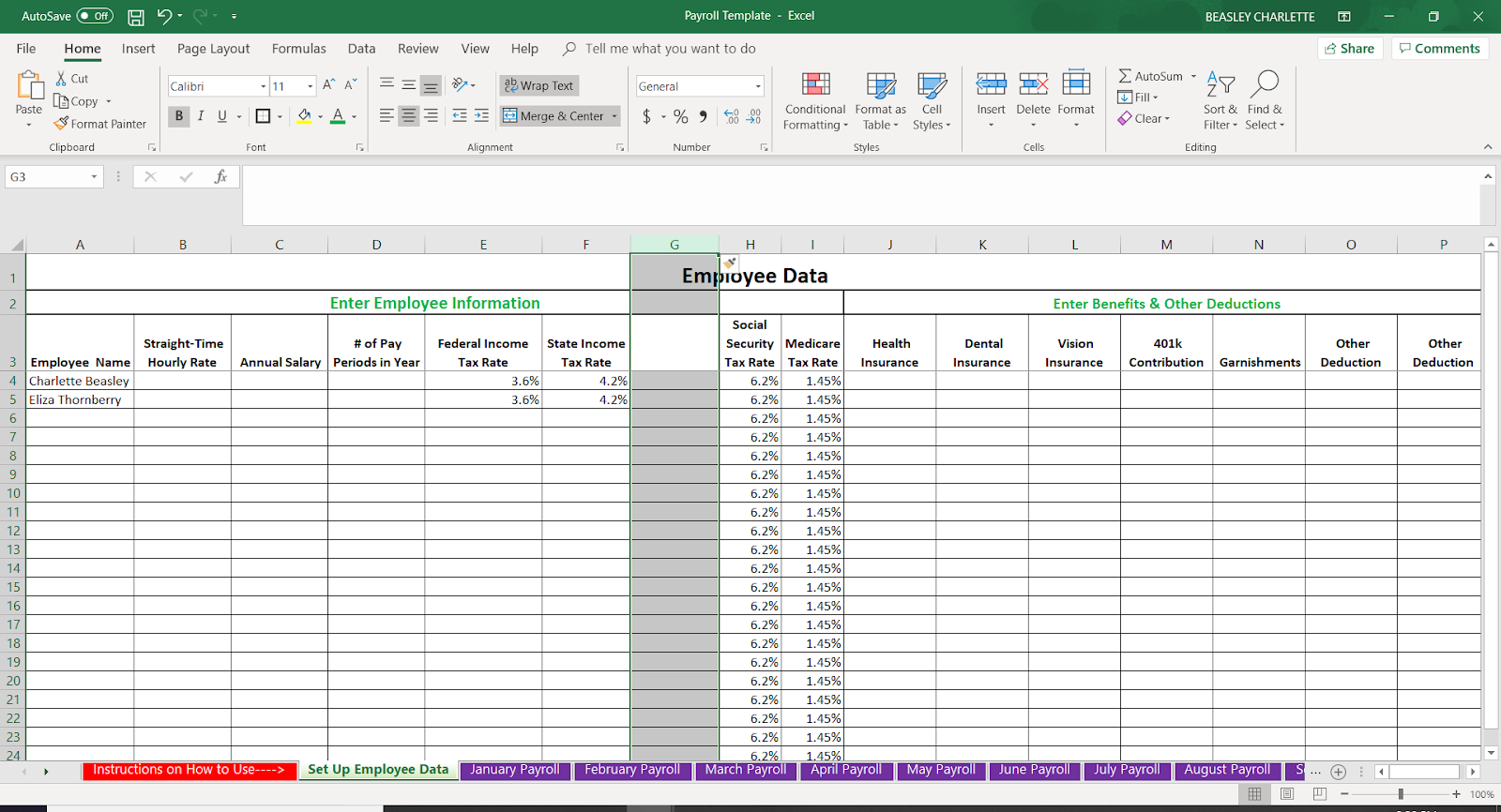

These timesheet templates require you to enter the hours in an hhmm format. You can specify the start and end time regular time hours overtime charges as well as weekends. This is a ready to use template that you can manage your timesheet.

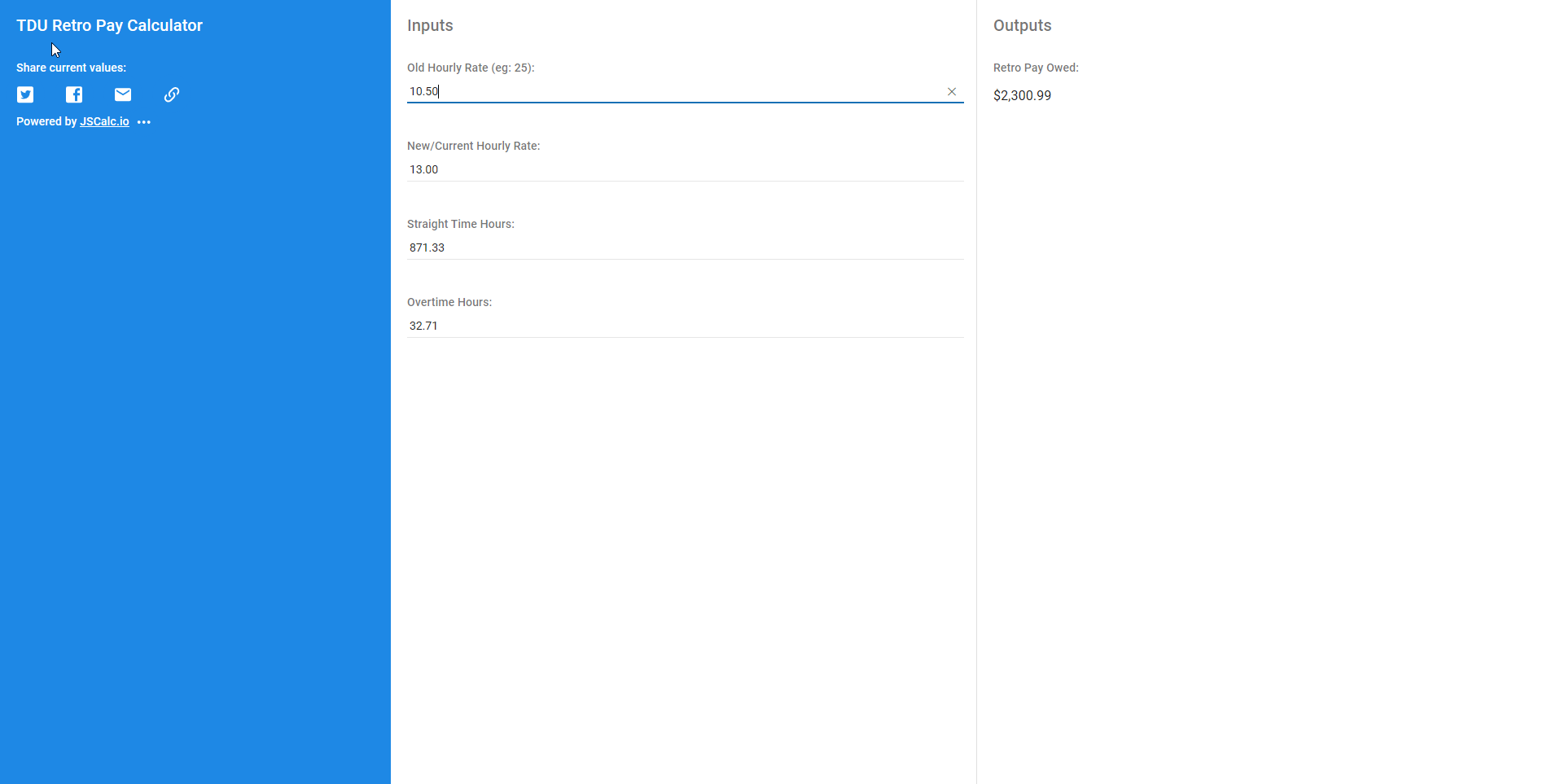

Below we cover some of the trickier california specific overtime scenarios. Set your calculator overtime choice under settings. Print an official timesheet with signature lines.

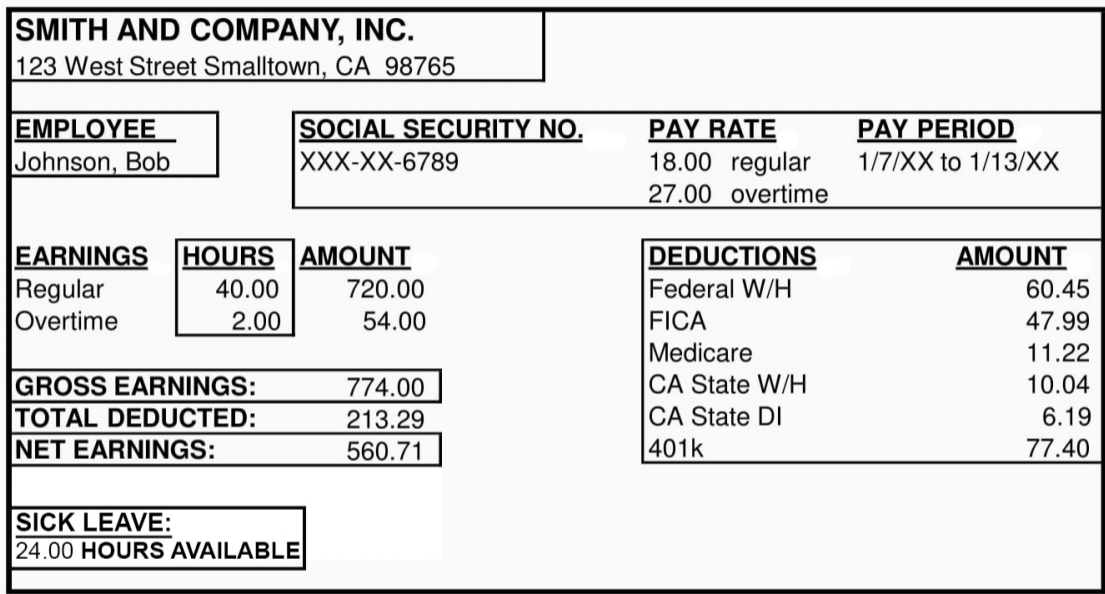

Overtime wages are a type of increased payment that employees can earn when they work more than a certain number of hours in a workday or workweek. California overtime law calculations. Enter your staffs details.

Download free excel timesheet calculator template. Click calculate button to view result. California requires employers to pay non exempt employees 15 times their regular rate of pay for.

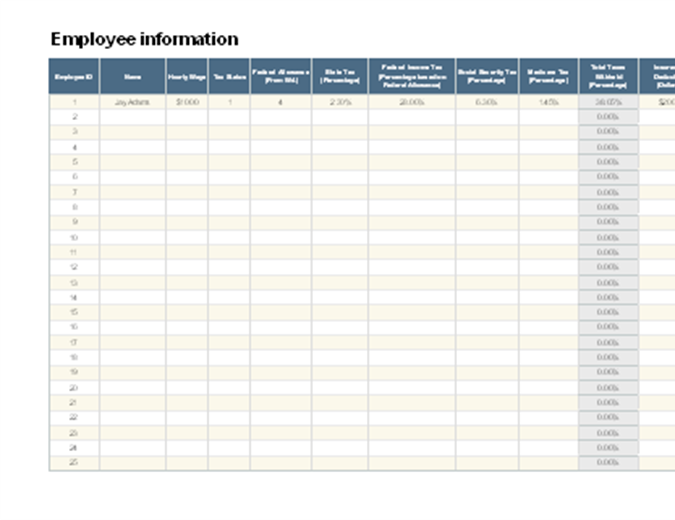

Overtime pay requirements of the flsasome states however such as california have their own overtime laws. Free convenient and user friendly calculator that shows overtime pay for multiple employees at once. California has specific rules that govern when overtime is due and how overtime is calculated.

It will help you in calculating weekly payroll taking care of all the rules. See fact sheet 23. Wondering how does the 7 th day rule work in california.

Hours worked over eight in a workday. The rules more than double the minimum salary threshold for employees to qualify as exempt from overtime from 23660 a year to over 47000. Use a mini monthly calendar to help you enter the correct start day.

It takes care of california overtime rules labor laws and also the 7 th consecutive working day rule. What every business needs to know. Most nonexempt employees in california have a legal right to receive overtime wages when they work long hours1.

All you need to do is enter the information in red and excel will calculate the hours and pay.