California Property Tax Rate Increase

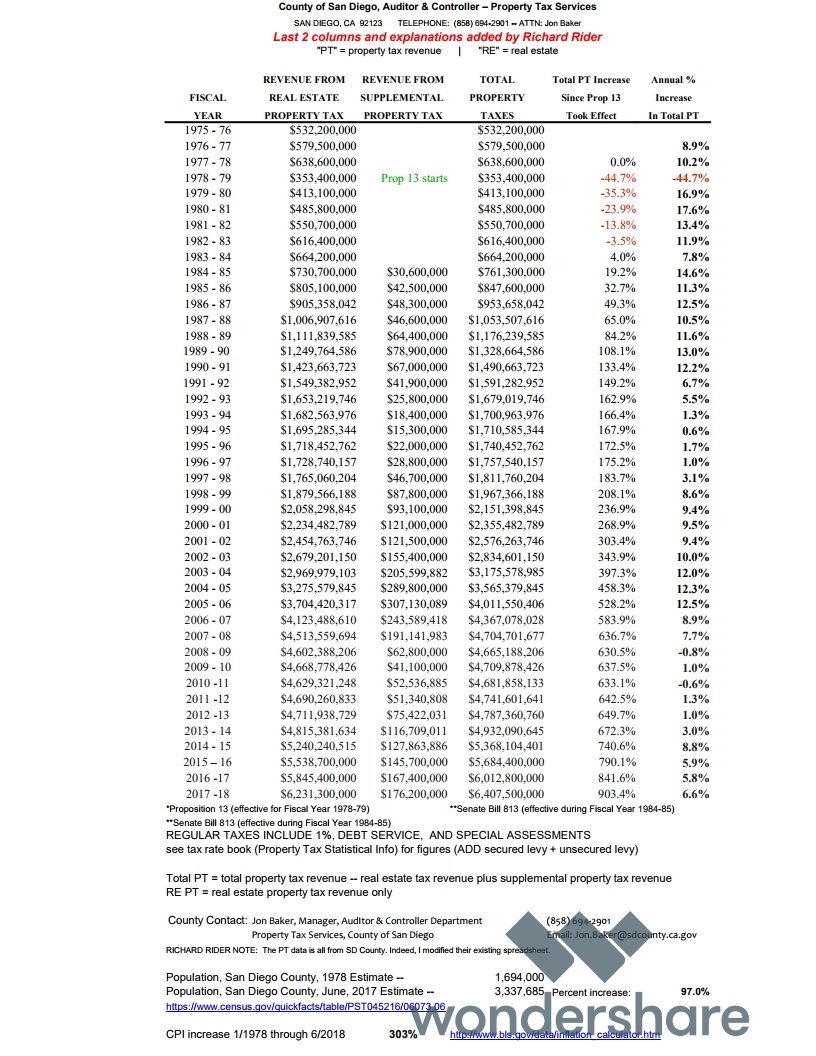

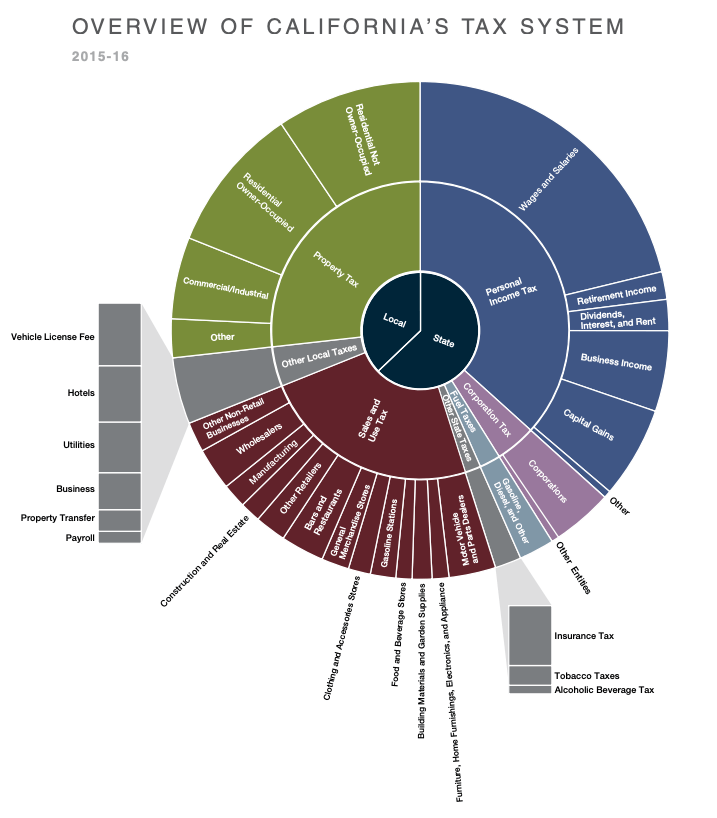

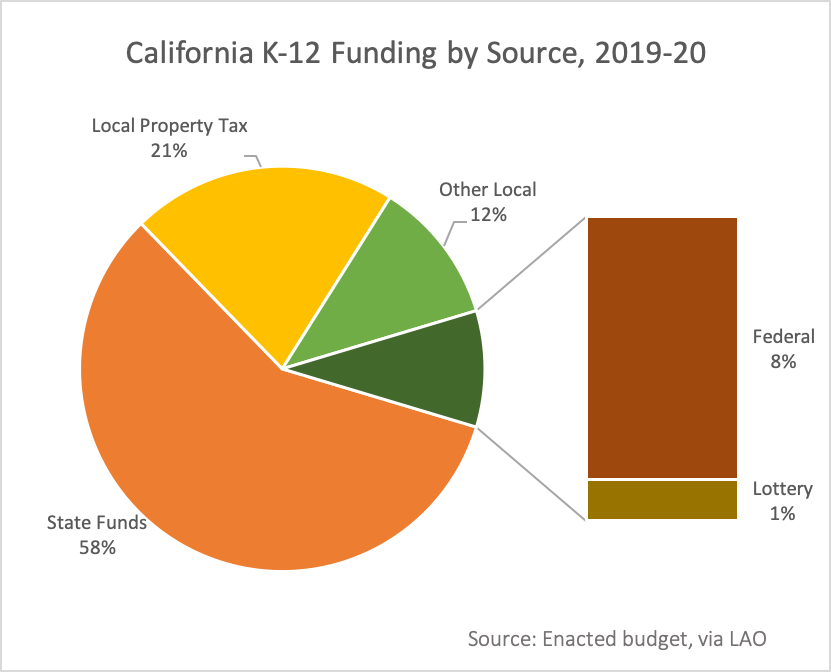

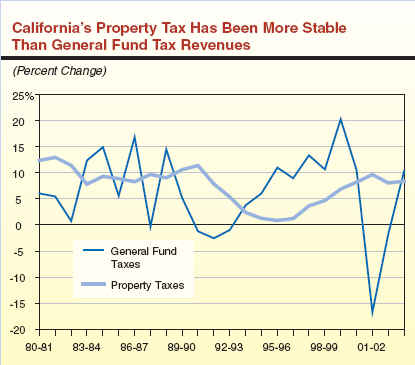

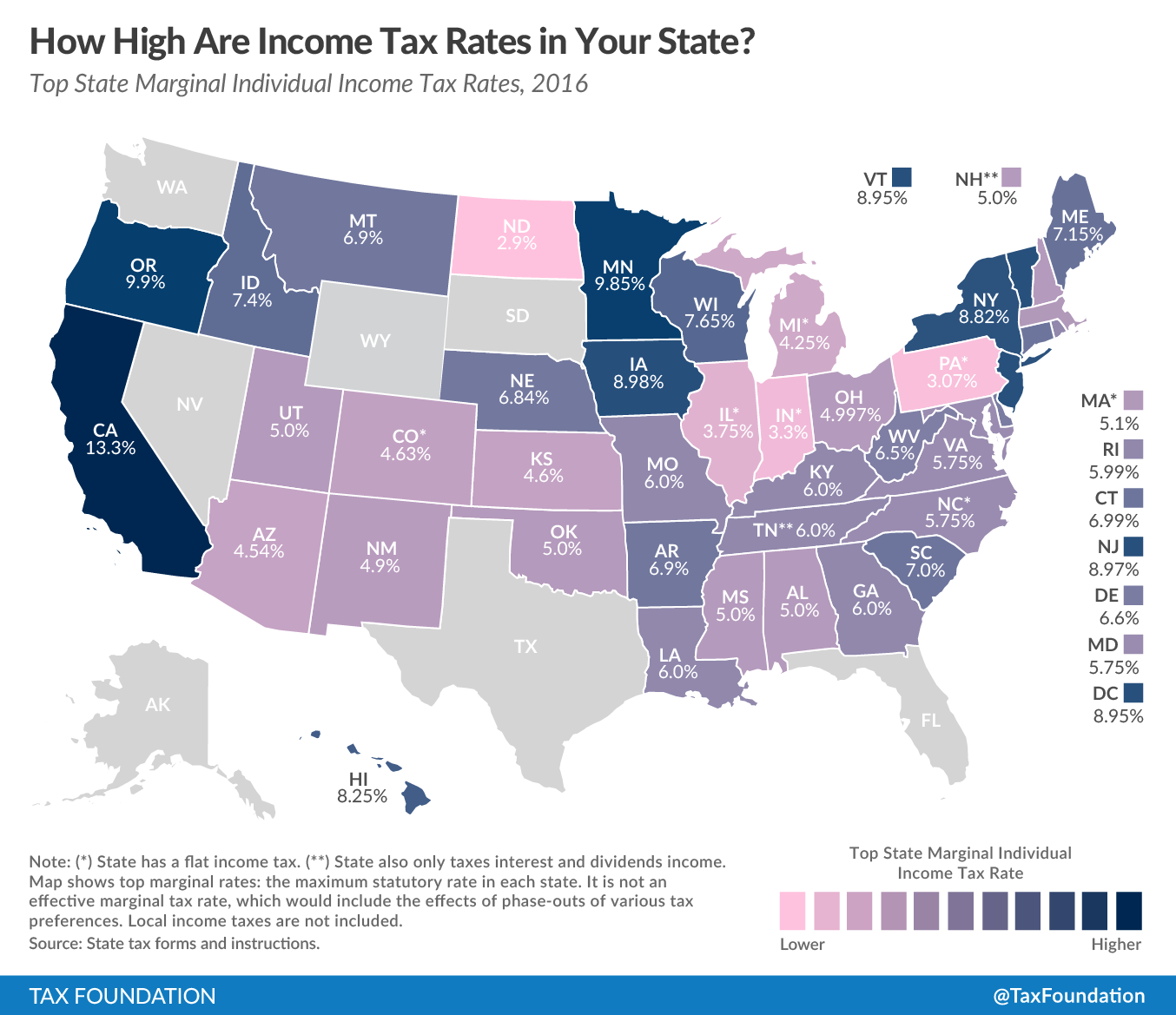

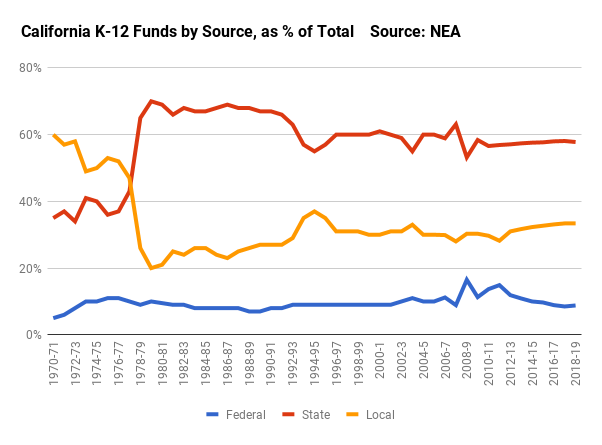

Prior to implementation of proposition 13 the state of california saw significant increases in property tax revenue collection with the share of state and local revenues derived from property taxes increasing from 34 at the turn of the decade to 44 in 1978 schwartz 1998.

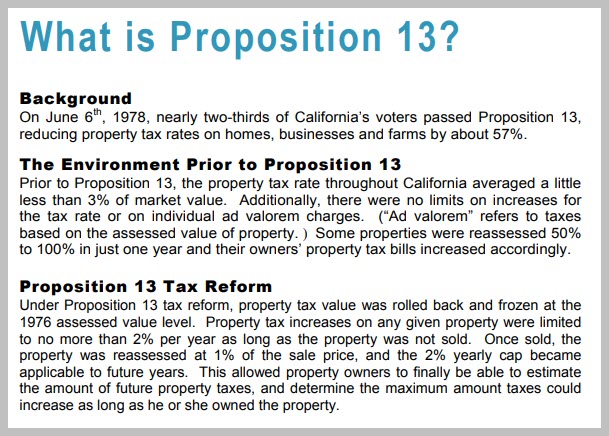

California property tax rate increase. Californias proposition 13 passed in 1978 defines how property taxes are calculated and reassessed. Proposition 13 has long been defended as a lifeline to senior citizens in california who without it might have. Property taxes are calculated by multiplying the propertys tax assessed value by the tax rate.

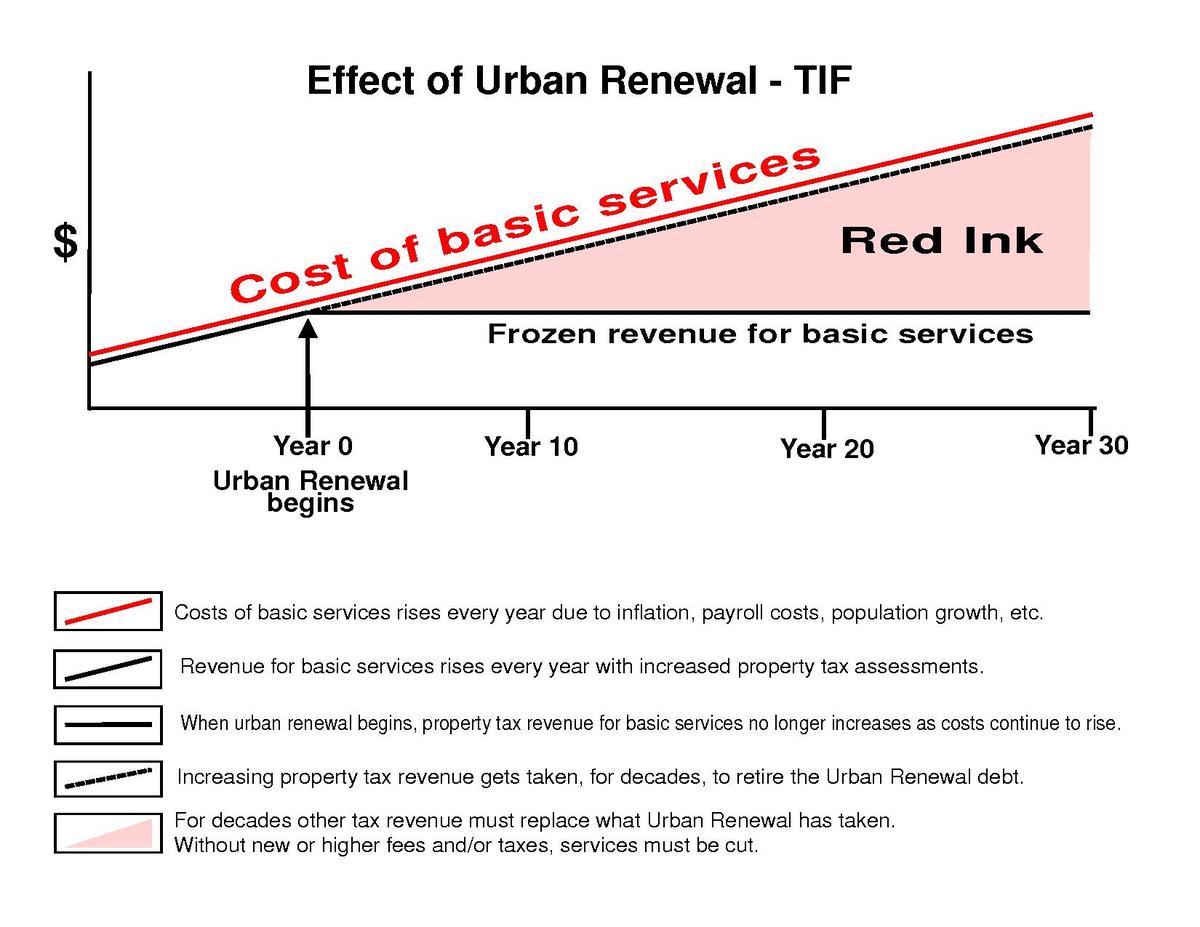

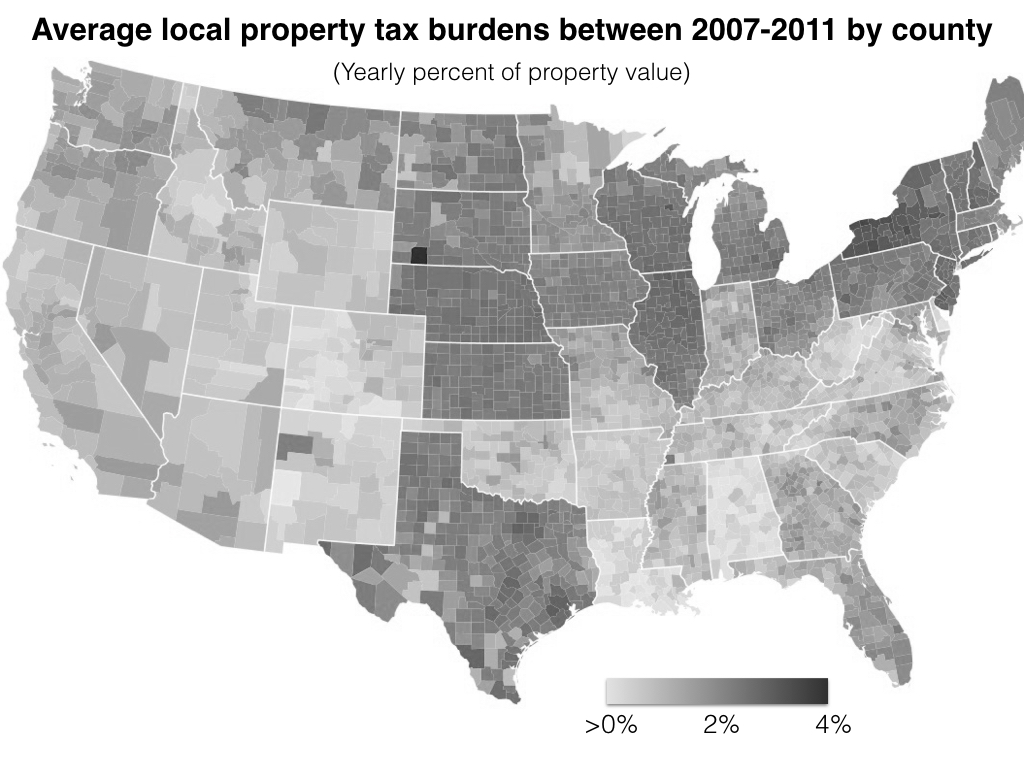

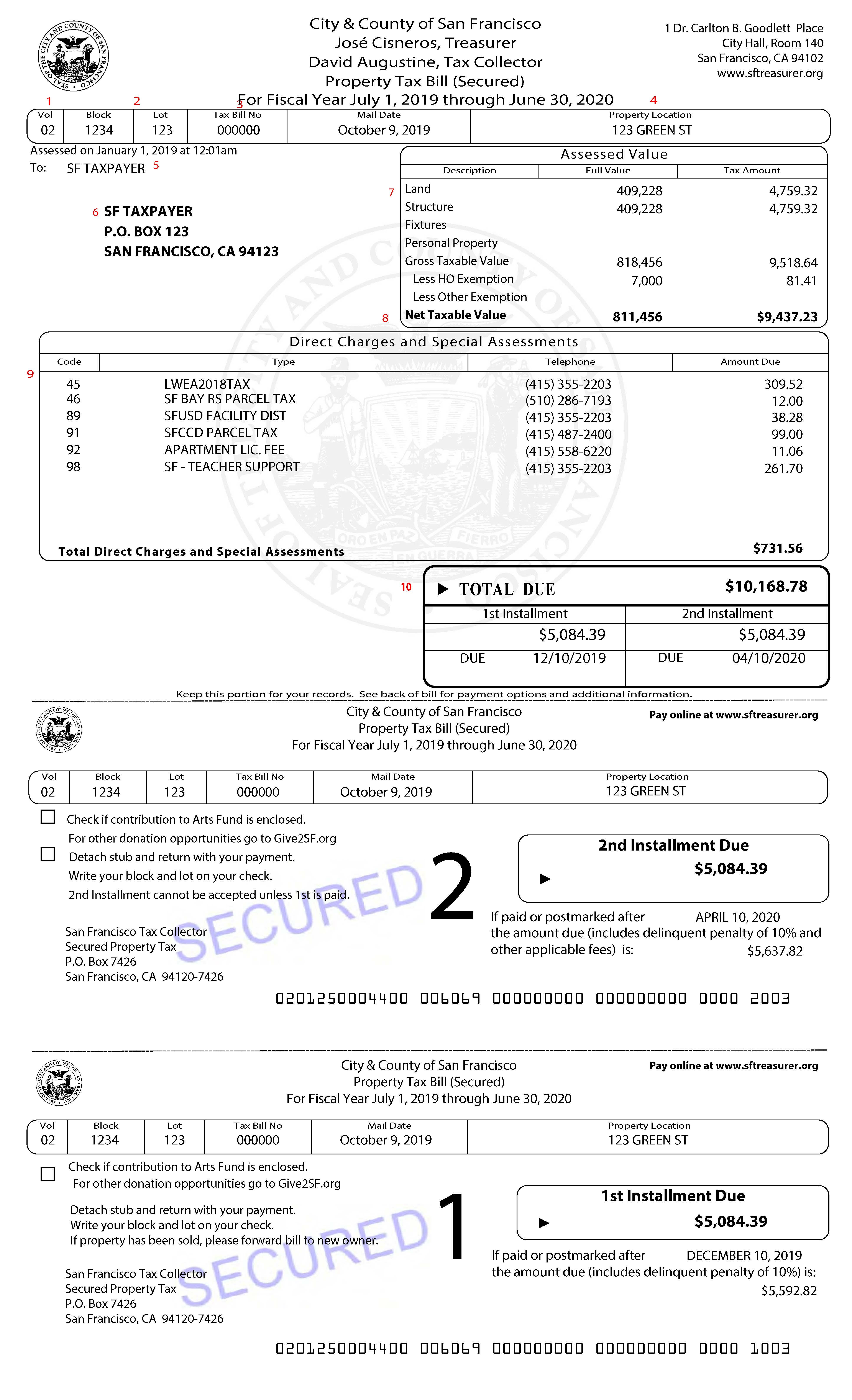

The new law would hold the maximum tax rate to 1 while offering some exemptions. However special district voter approved assessments add small percentages to their property taxes. Prop 13 capped property taxes at one percent of assessed value at time of acquisition and limited upward reassessments of property values to 2 percent per year so long as the property didnt.

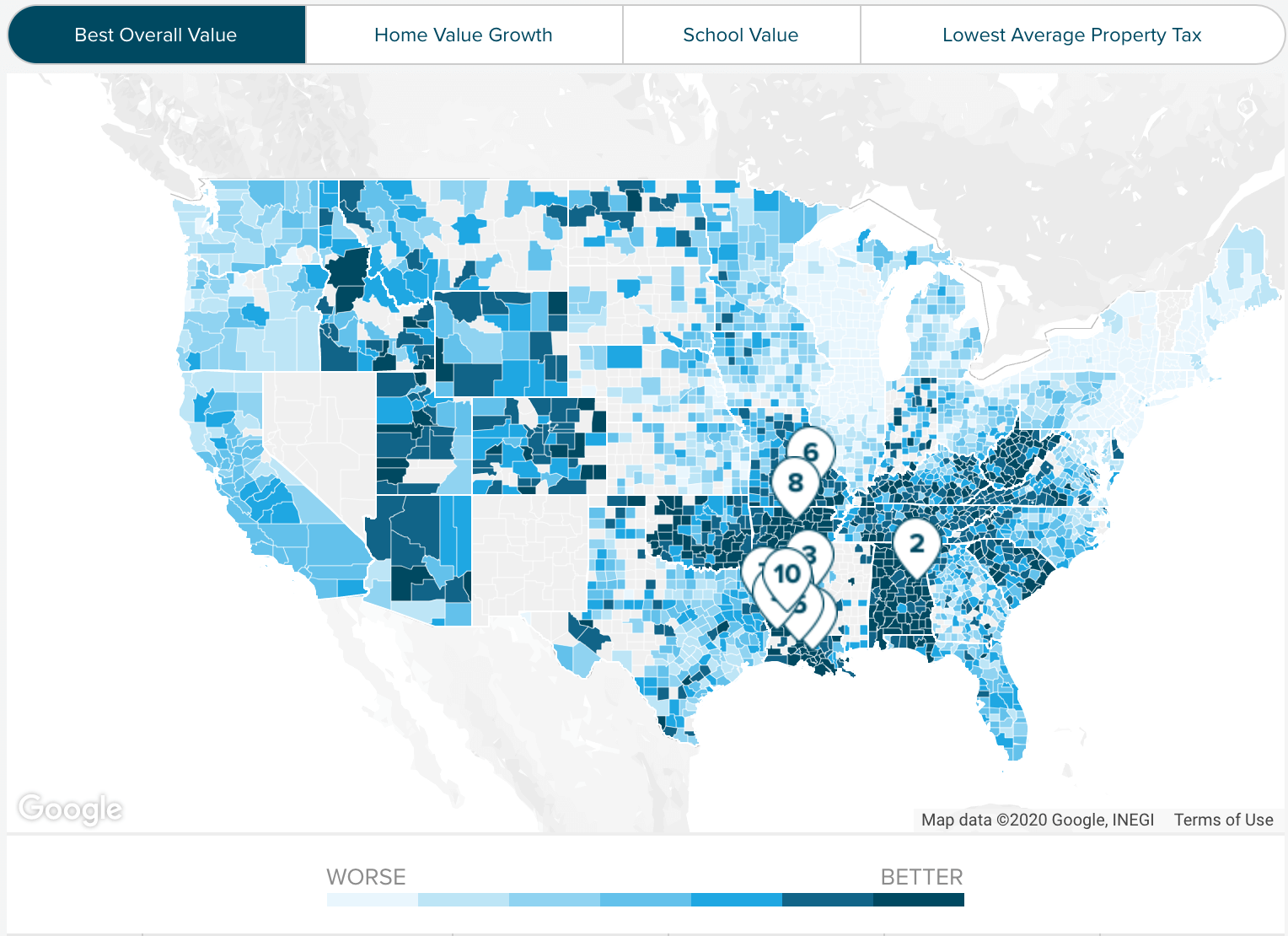

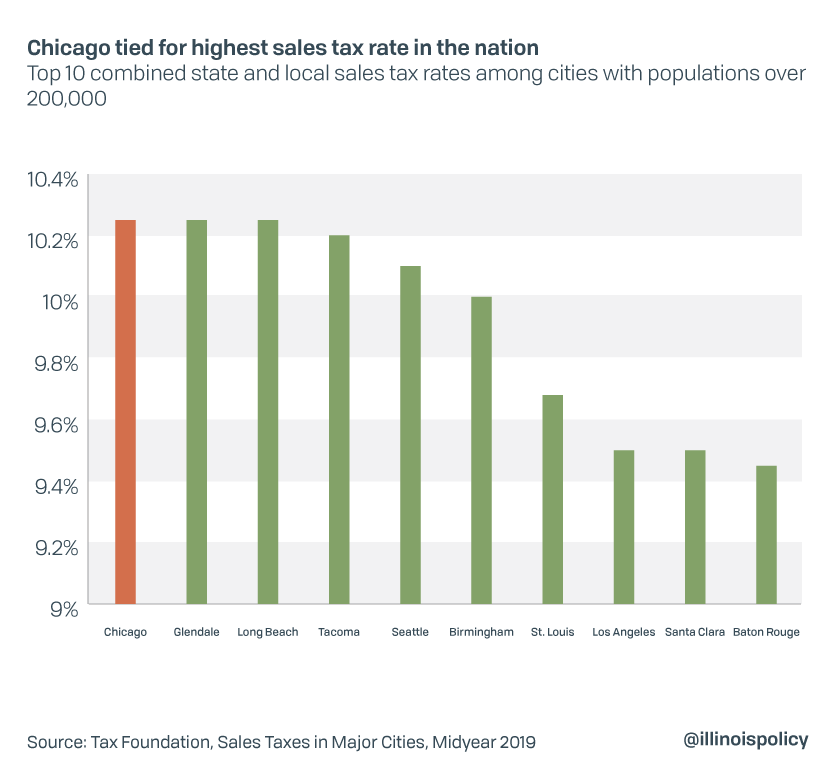

California has one of the highest average property tax rates in the country with only nine states levying higher property taxes. Property taxes are around 125 of your homes value rates vary slightly depending on where you live in the state. The median property tax in california is 283900 per year for a home worth the median value of 38420000.

Counties in california collect an average of 074 of a propertys assesed fair market value as property tax per year. California property tax rates vary since proposition 13 froze the statewide property tax rate at 1 percent plus a maximum of 2 percent per year between sales for inflation the rates do not vary much.

:max_bytes(150000):strip_icc()/LafferCurve2-3509f81755554440855b5e48c182593e.png)

/california-state-taxes-amongst-the-highest-in-the-nation-3193244-finalv2-8a746a2ad14c4fba8d21382f812c7c76.png)