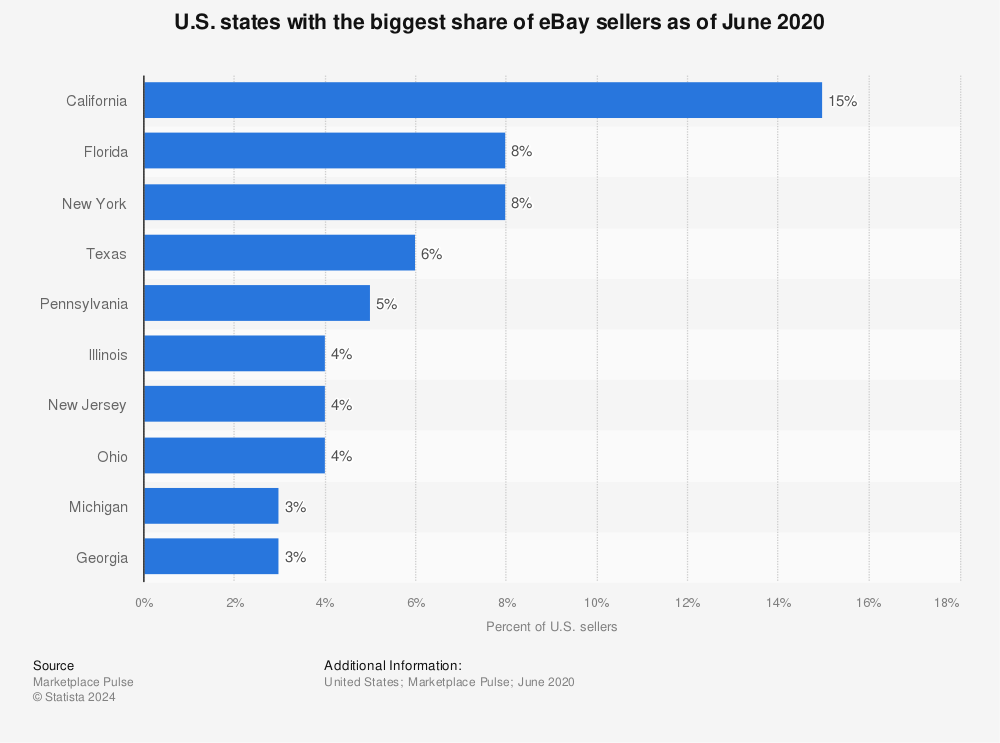

California Sales Tax 2020 Ebay

We recommend checking with a tax advisor to understand your responsibilities.

California sales tax 2020 ebay. It defines a sale as an occasional sale if the item sold in question is going to be used in the same manner by the buyer as the seller. Retroactively as of april 1 2019 an out of state seller must register with the california department of tax and fee administration cdtfa and collect and remit california sales and use tax if its total combined sales of tangible personal property for delivery in the state exceed 500000 in the preceding or current calendar year. Alabama department of revenue opens in new window or tab.

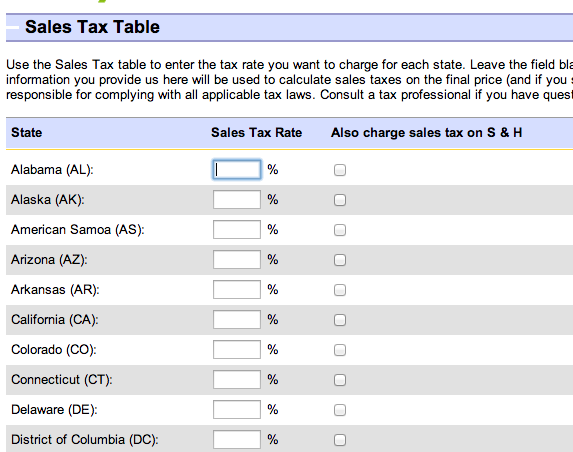

Learn more about internet sales tax on our help pages or from your tax advisor. California sales and use tax law section 60056 defines what an occasional sale is. You will continue to collect the 9 sales tax for intrastate sales and send it to the california boe with your quarterly filing.

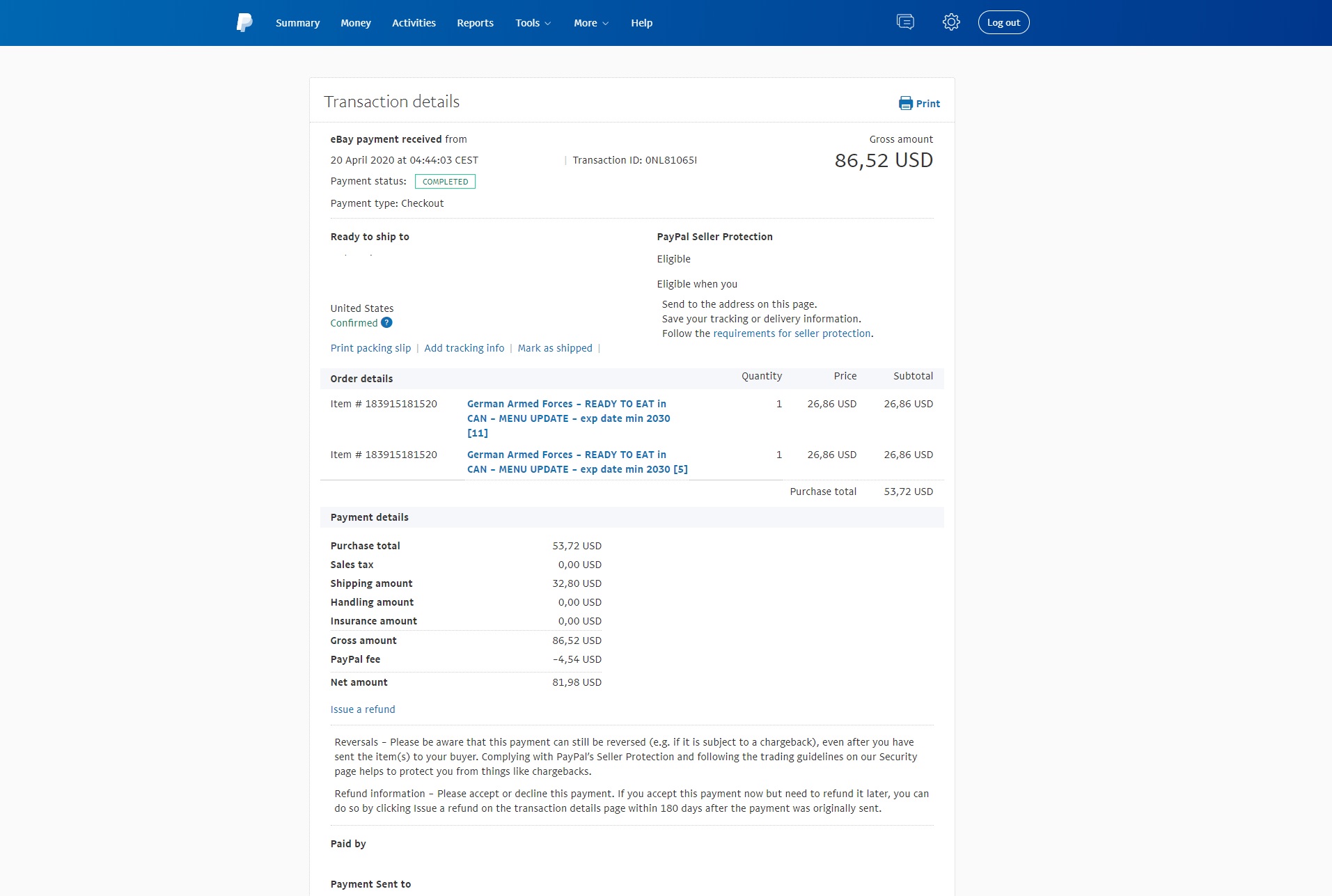

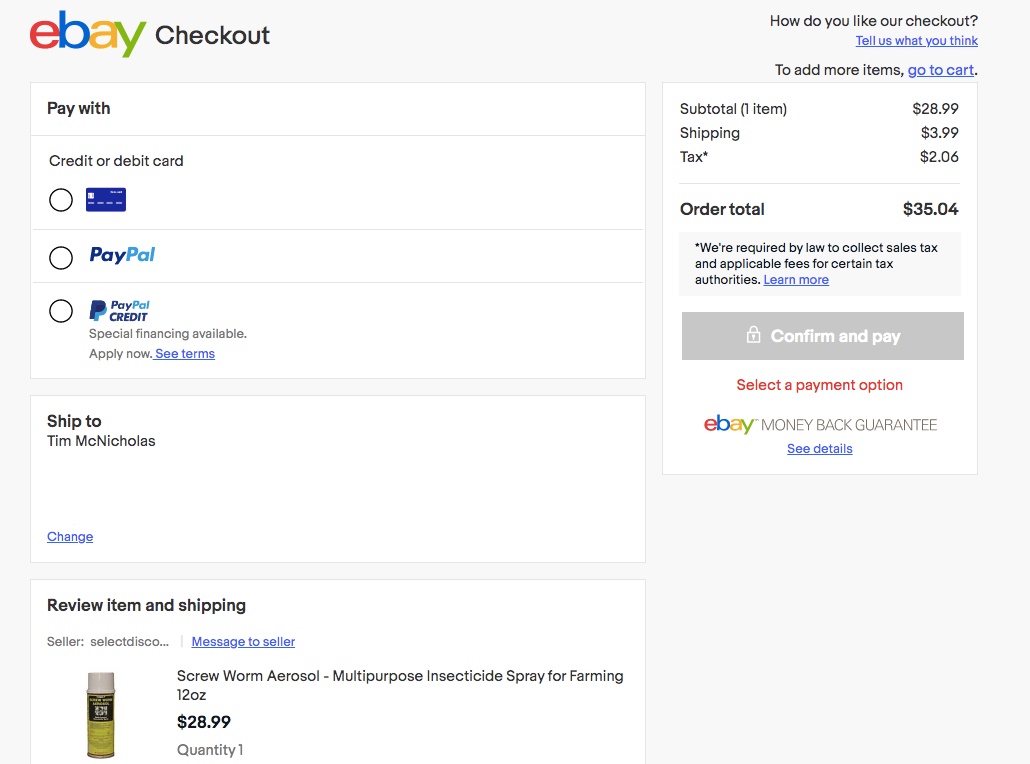

The state of alabama has a program for simplified sellers use tax ssut under statute 40 23 192. In such cases ebay collects and remits internet sales tax on your behalf. Ebay has collected simplified sellers use tax on taxable transactions delivered into alabama and the tax of flat eight percent 8 will be remitted on the customer.

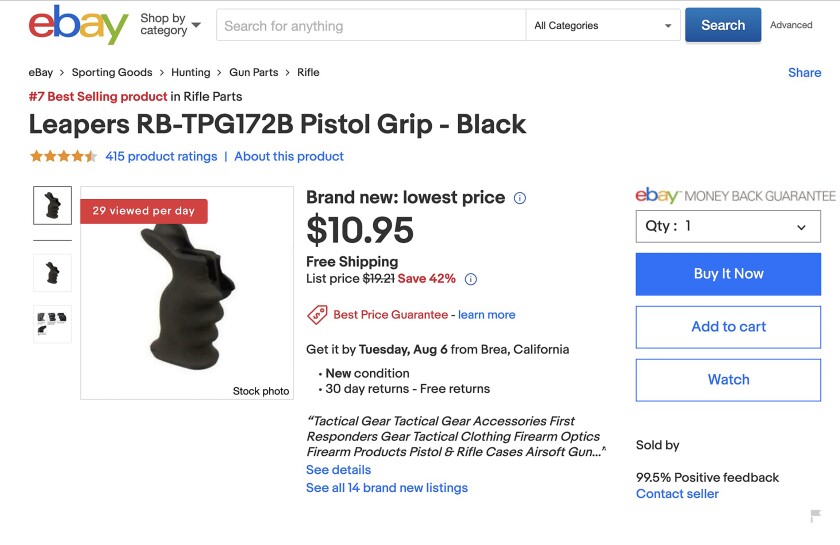

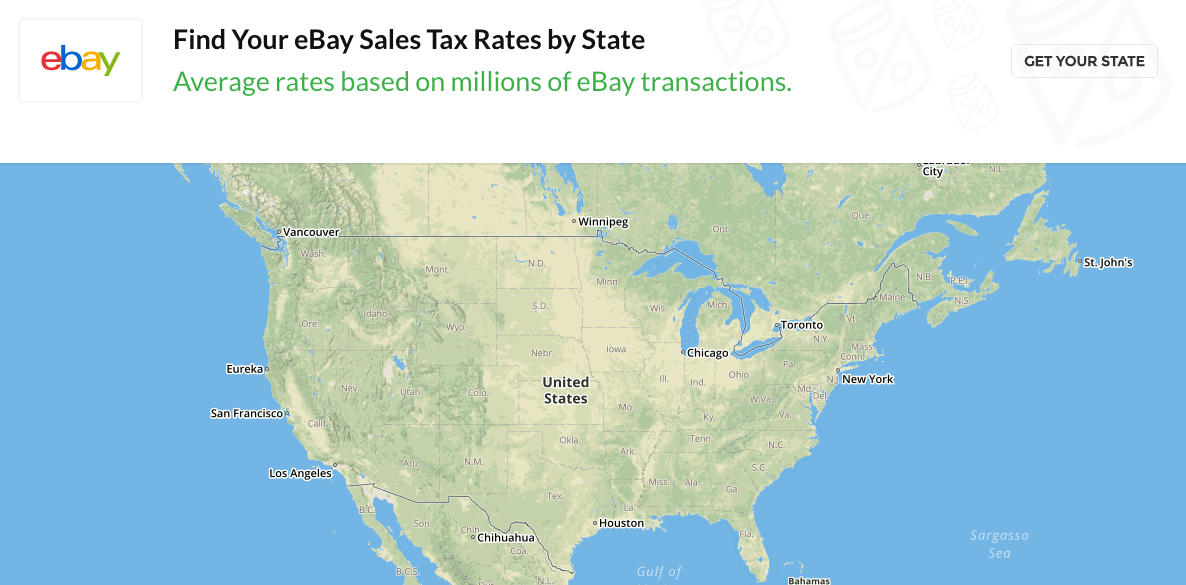

Sellers must follow all tax regulations that apply to ebay sales. The state tax rate the local tax rate and any district tax rate that may be in effect. For a list of your current and historical rates go to the california city county sales use tax rates webpage.

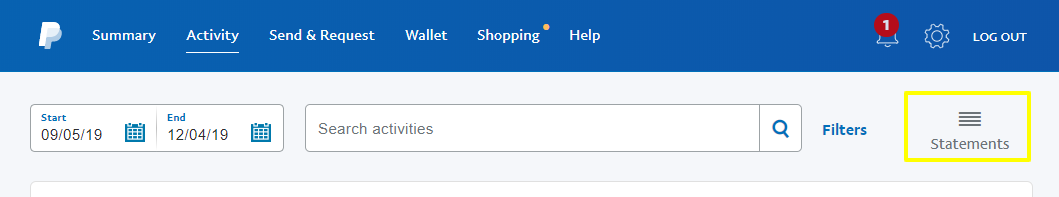

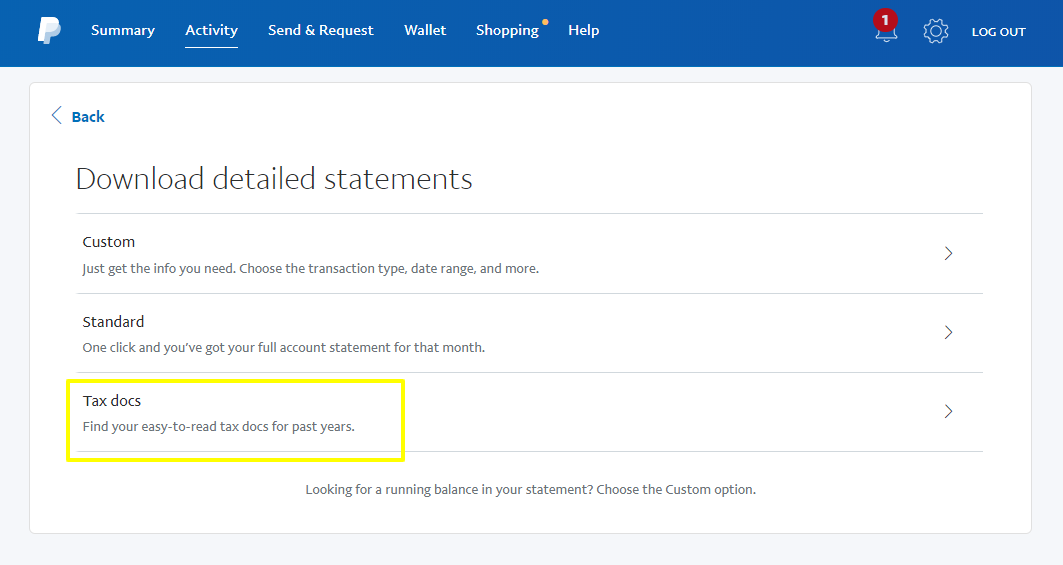

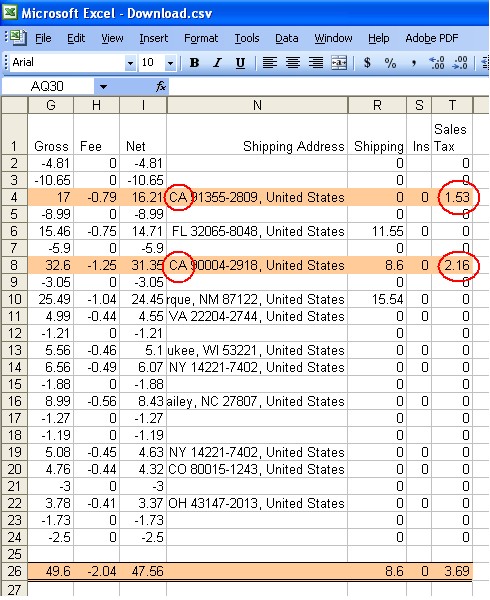

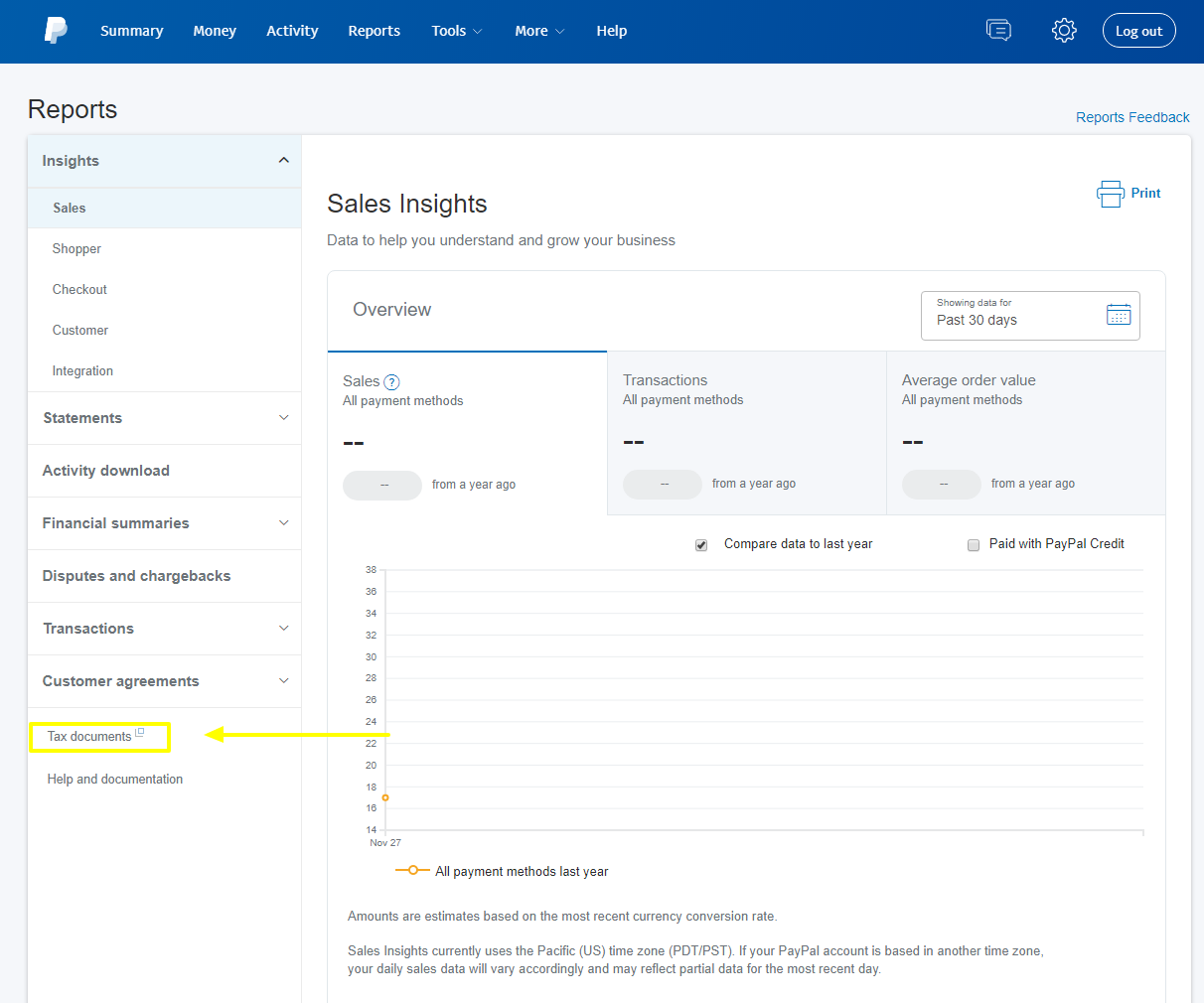

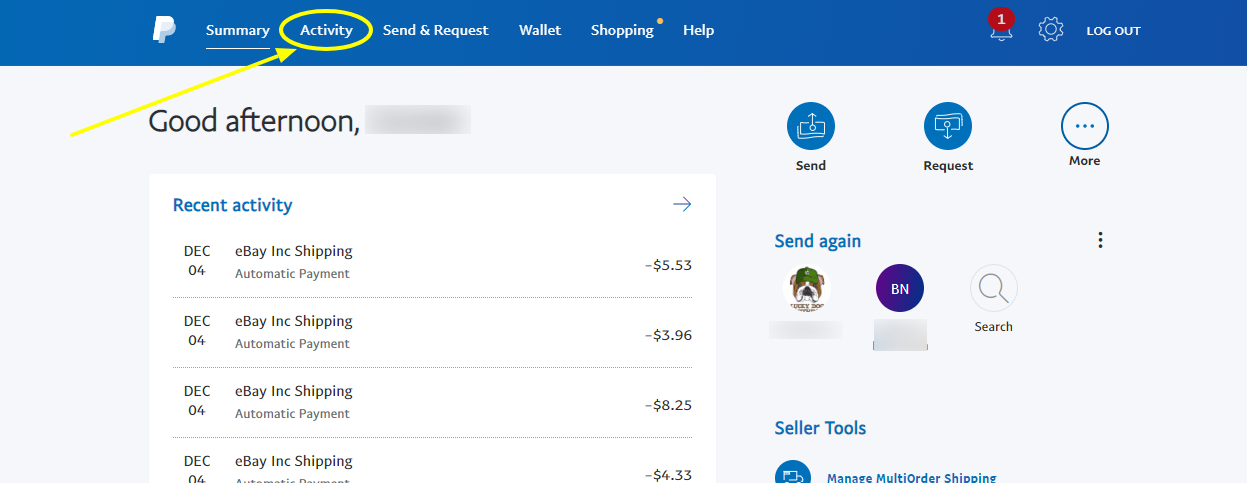

The sales and use tax rate in a specific california location has three parts. 1099 k forms and income tax on ebay sales. Obligating ebay to collect california sales and use taxes and for those purposes only.

By law sellers have to declare and pay taxes on income earned from ebay sales. Look up the current sales and use tax rate by address. Sellers are not able to opt out of selling items into the states listed above or opt out of ebay automatically collecting sales tax.

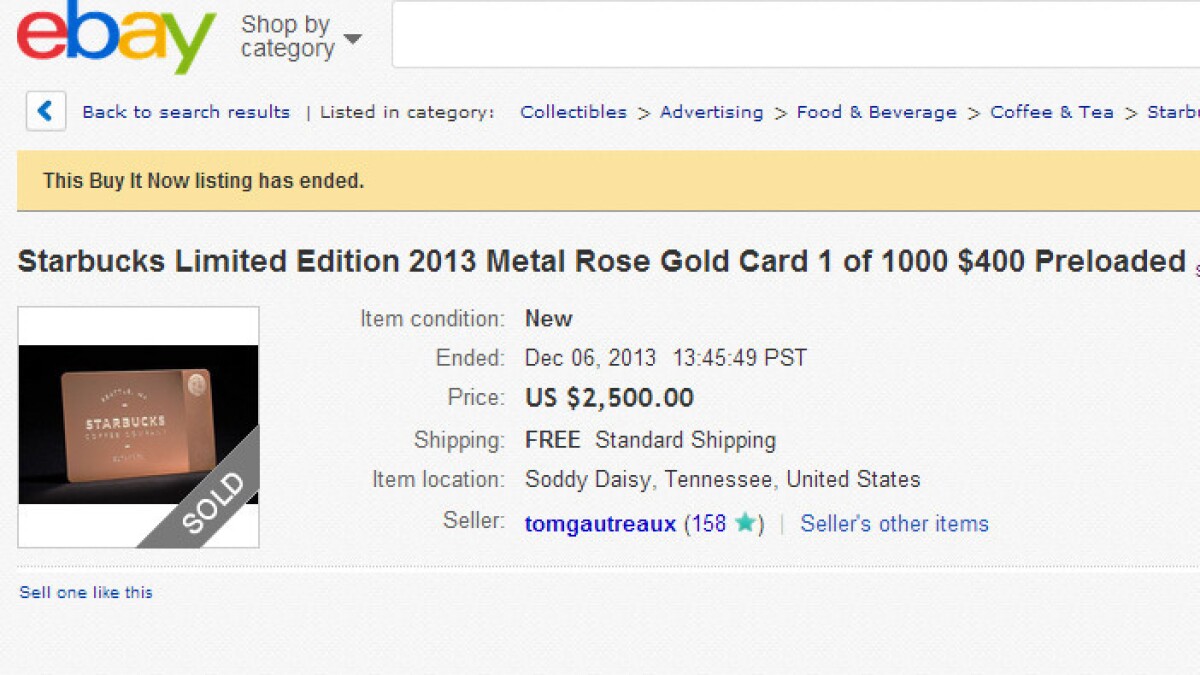

The recent ebay update is for buyers in california that buy from out of state sellers. State sales and use taxes provide revenue to the states general fund to cities and counties through specific state fund allocations and to other local jurisdictions. California city county sales use tax rates effective july 1 2020 these rates may be outdated.

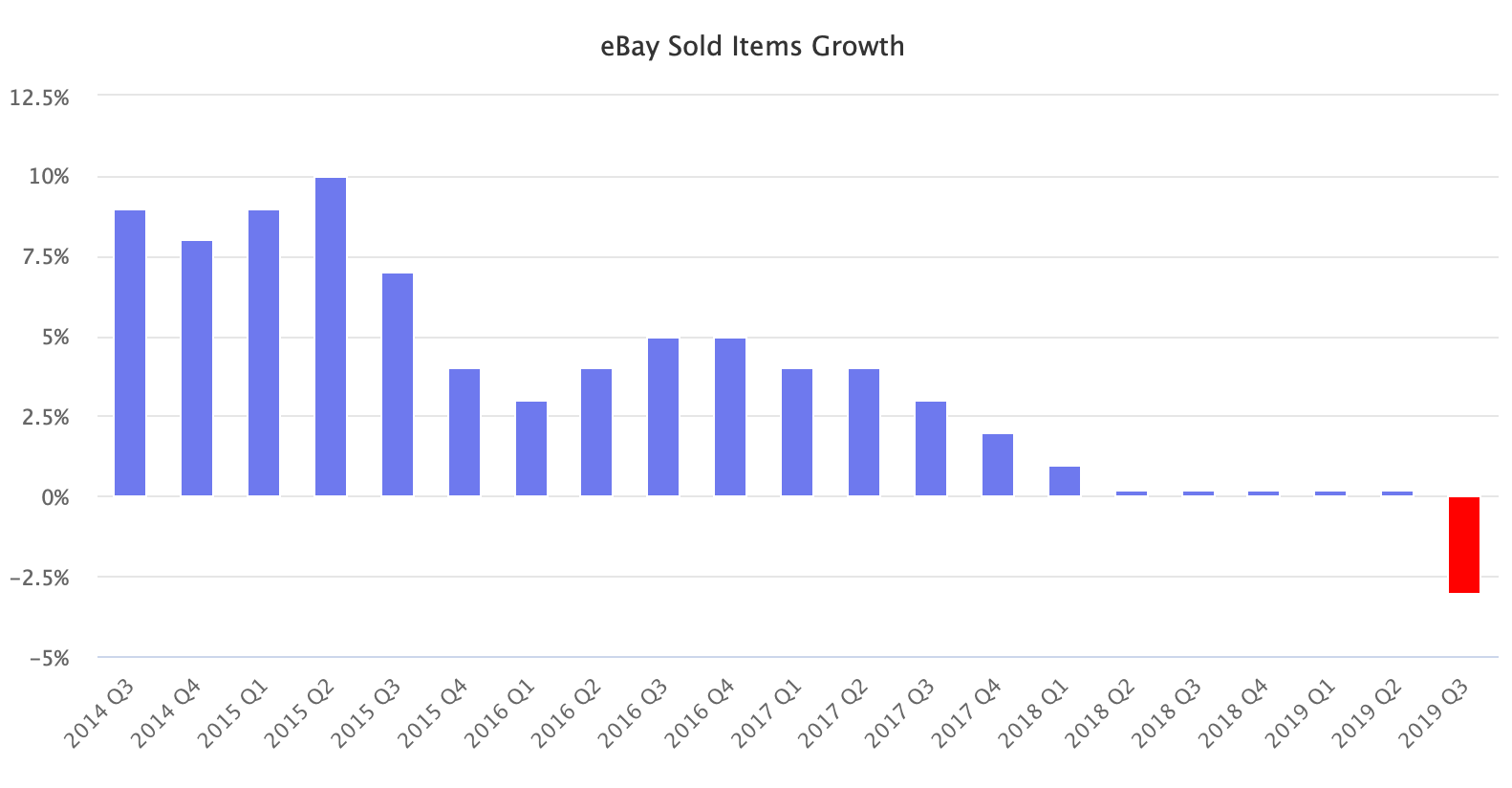

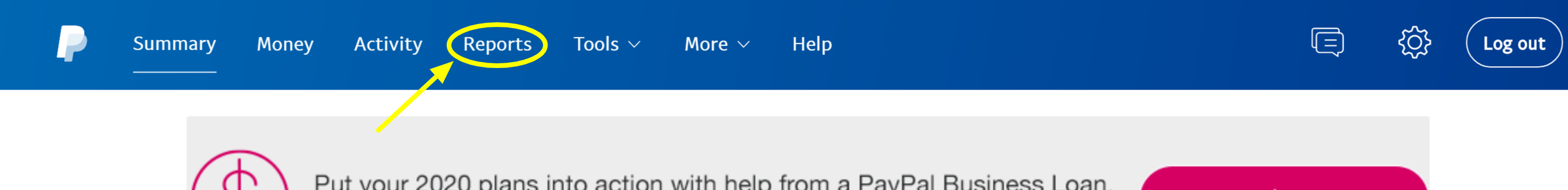

From 1 april 2020 when a buyer in norway purchases an item below a value of 3000 nok from outside norway. As of april 1 2020 a total of 40 jurisdictions require the collection of sales tax. Until such time as ebay makes the announcement that they are going to collect and remit it i will continue to do so as it is my responsibility and if the tax is not collected on my sales i am liable for paying the tax duemy understanding of what i read is that ebay should be collecting and remitting the sales tax.

I already have a ca resale license so already collect sales tax for ca.

/best-and-worst-states-for-sales-taxes-3193296_final-5833bed0517f402abab0d55179d65e7d.png)