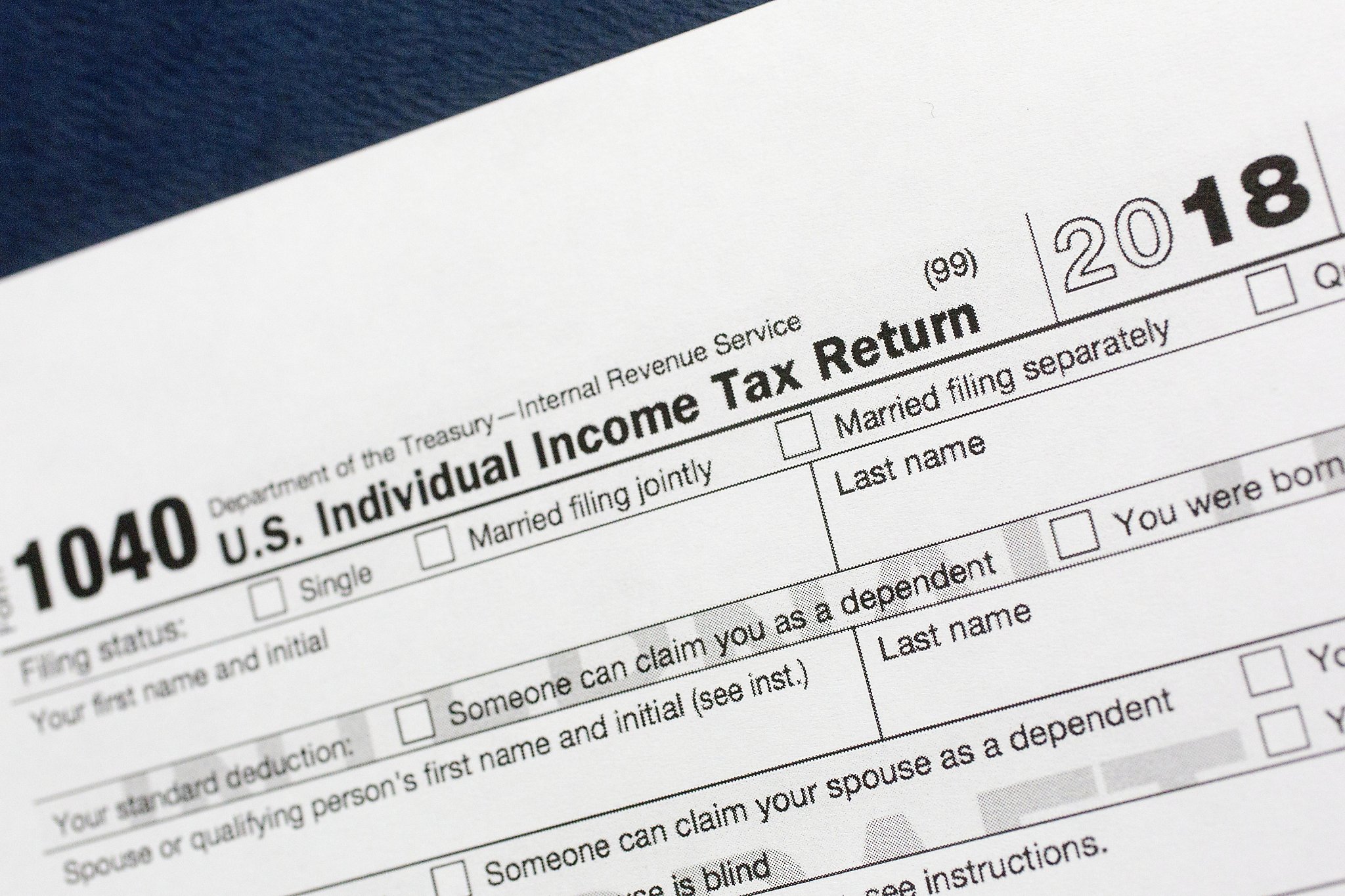

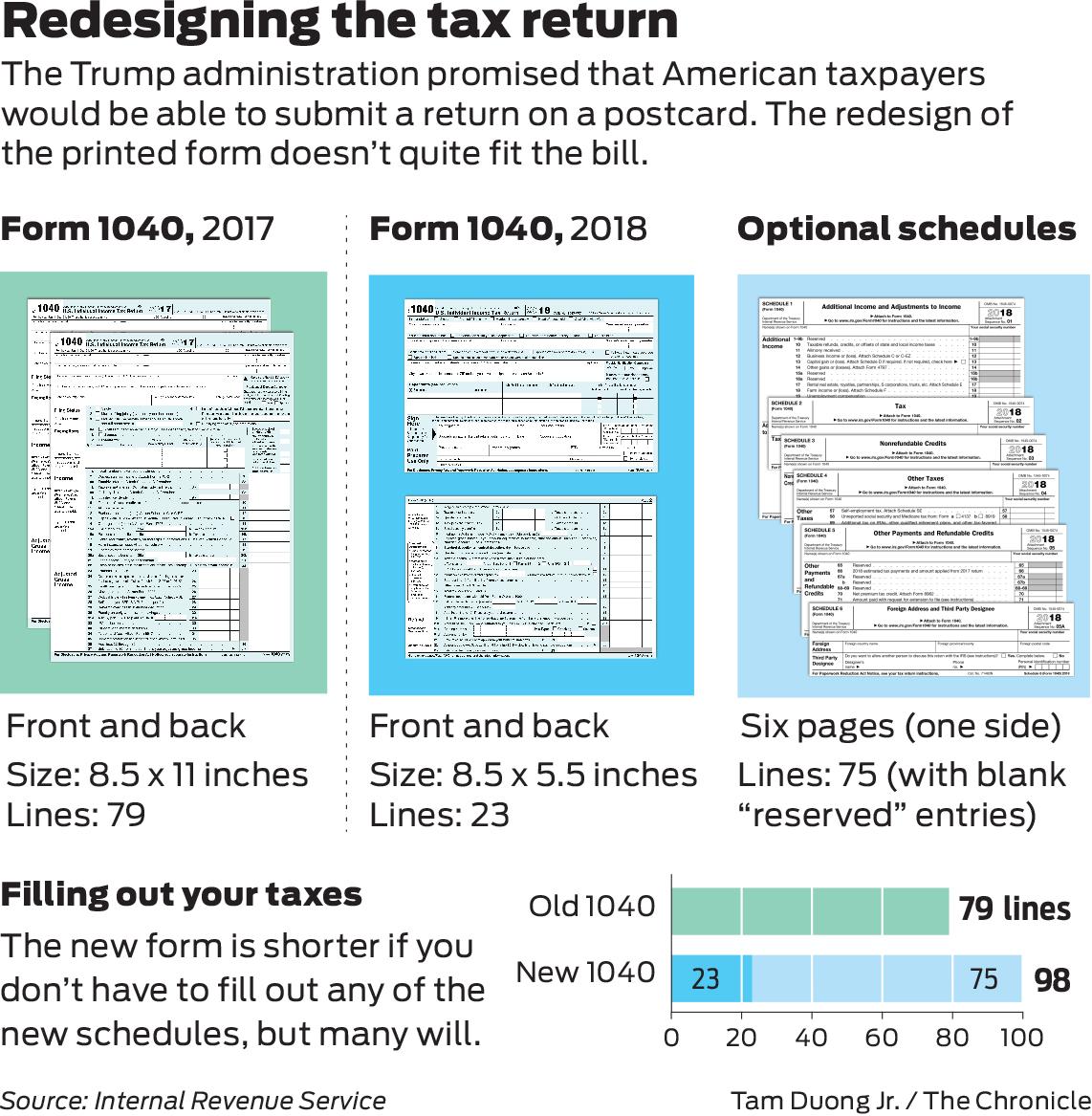

California State Tax Withholding Form 2019

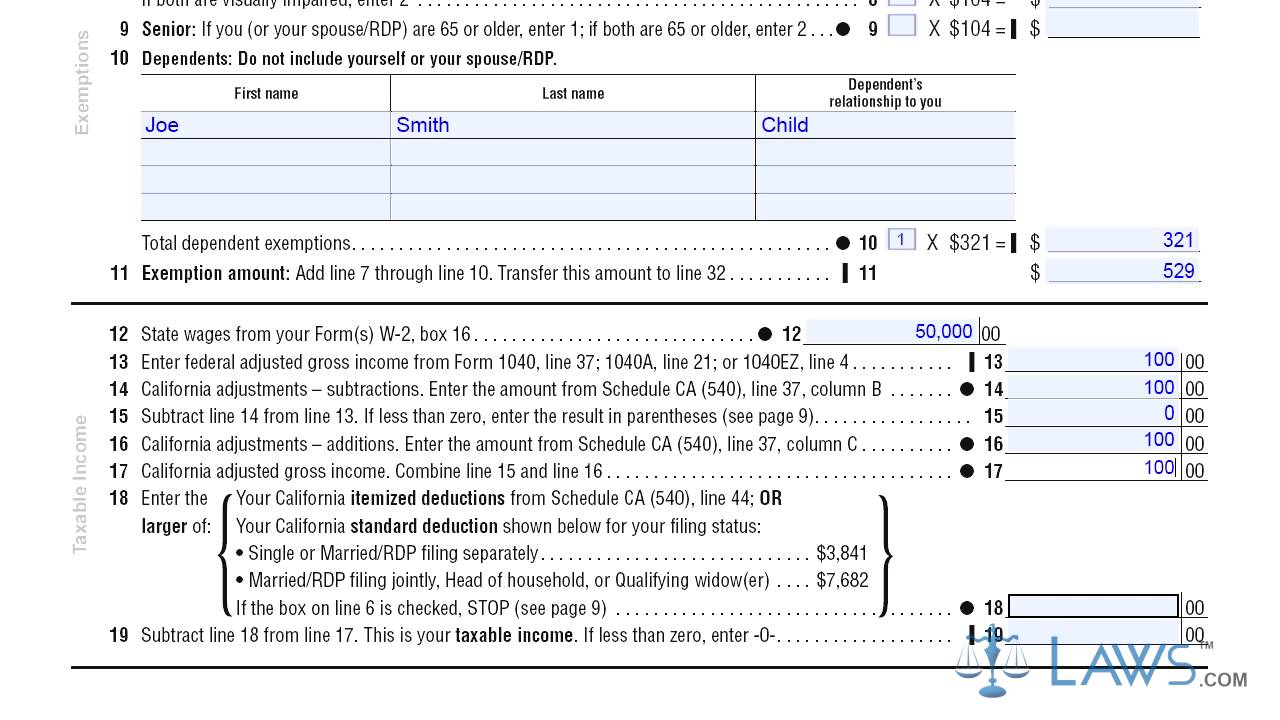

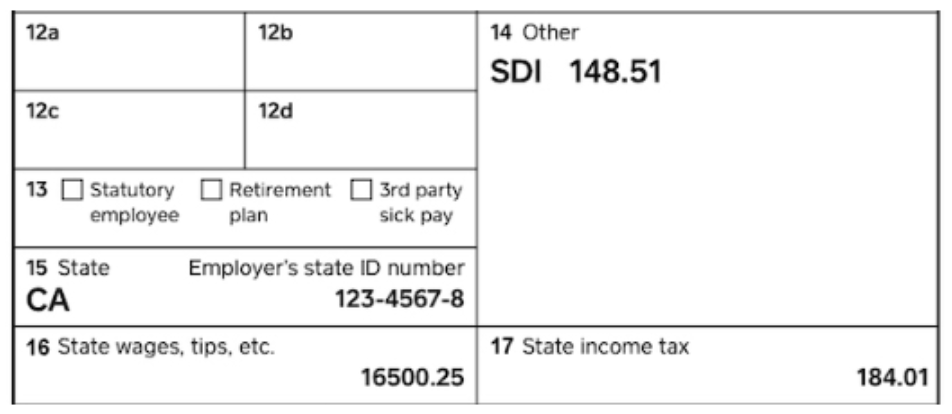

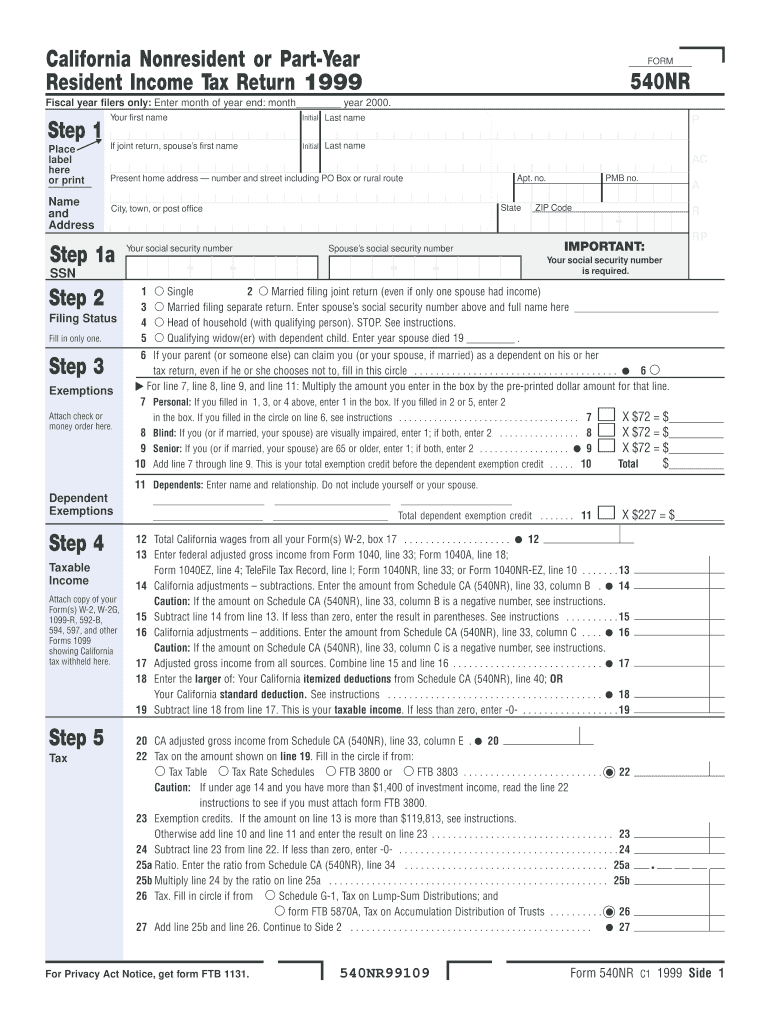

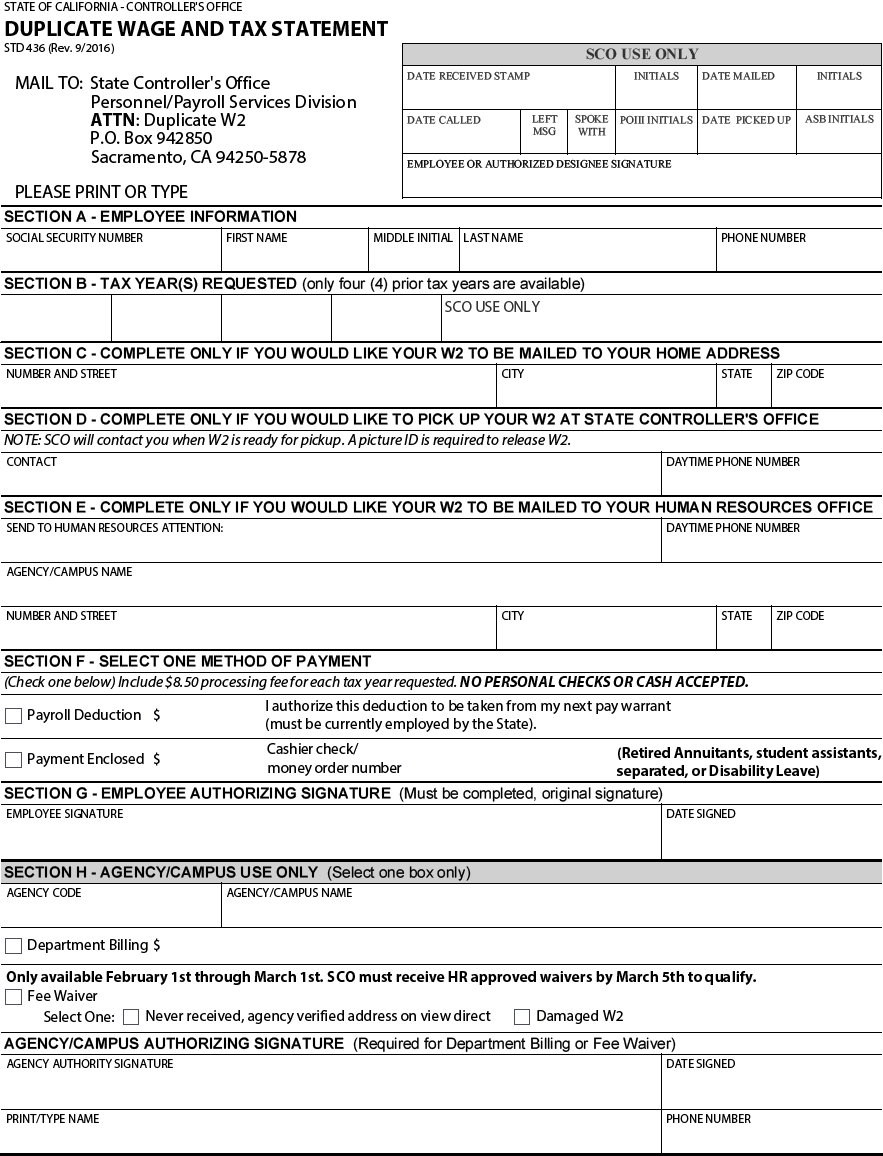

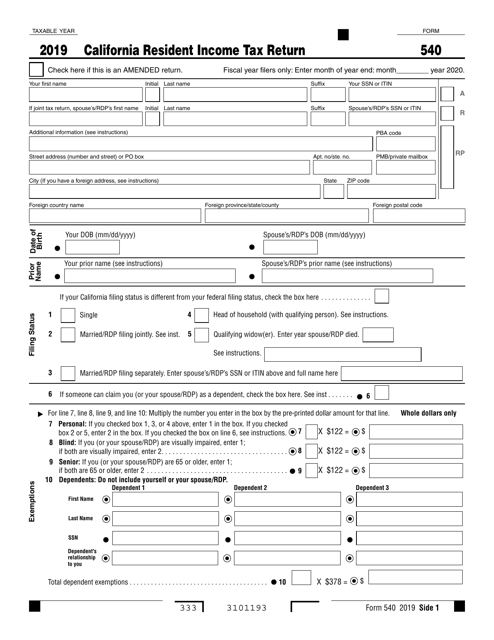

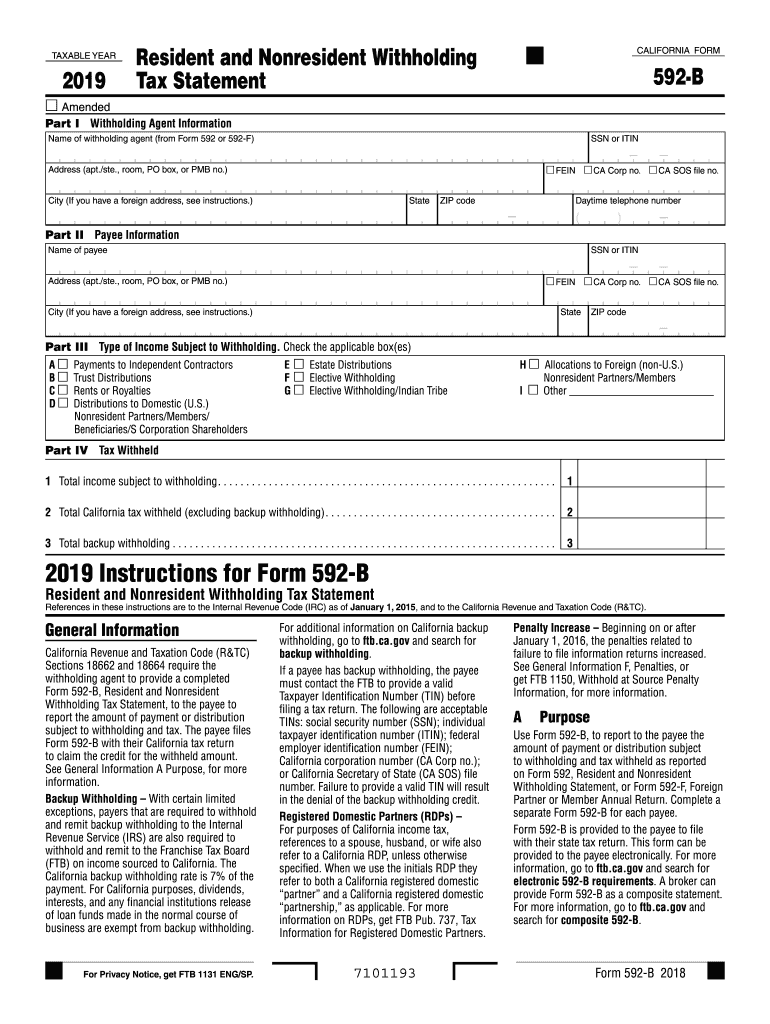

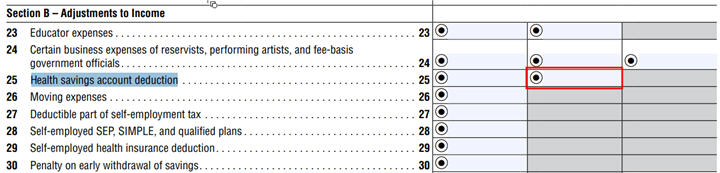

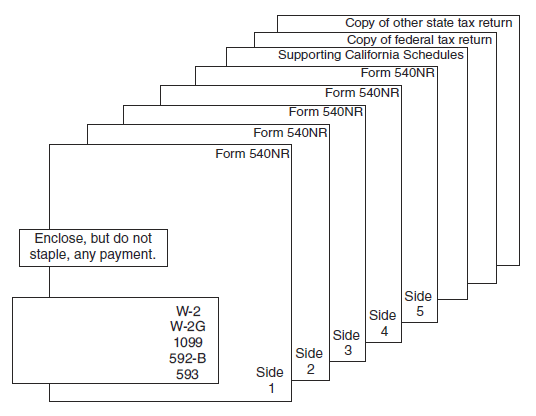

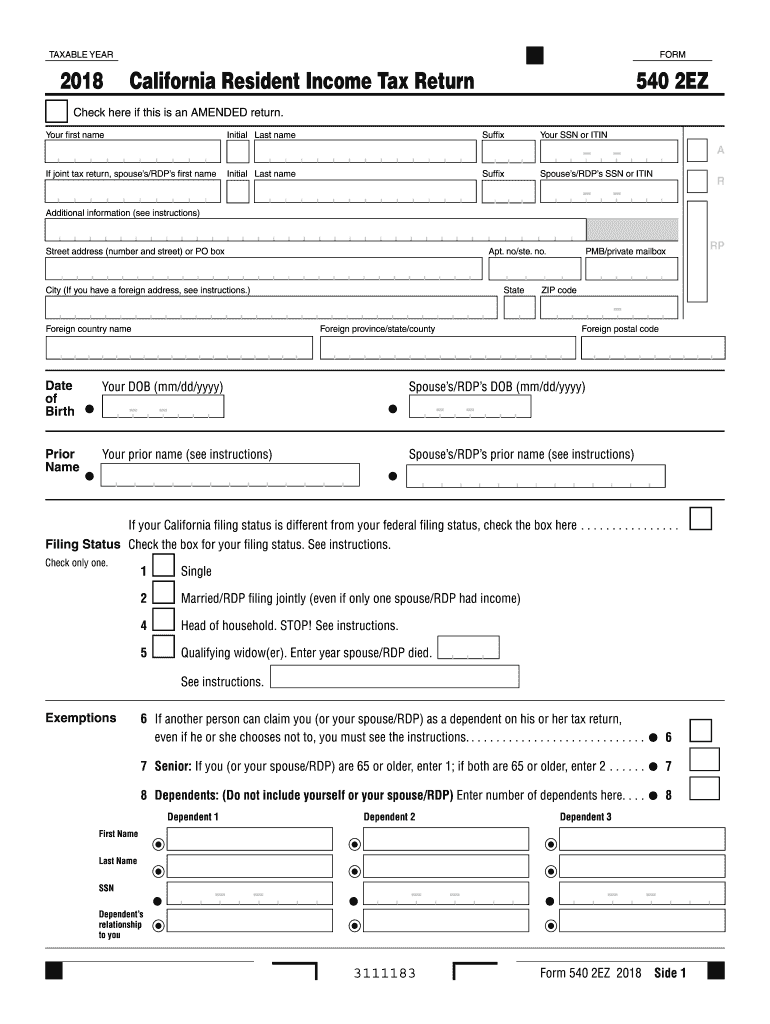

Line 73 withholding form 592 b andor 593 enter the total of california withholding from form 592 b and form 593.

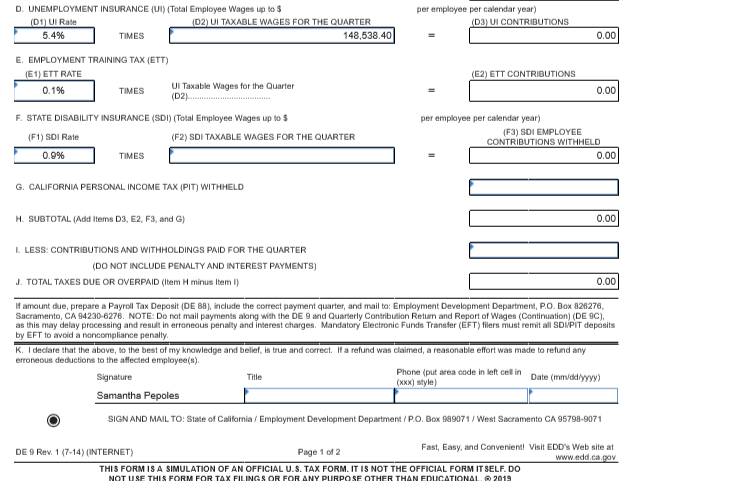

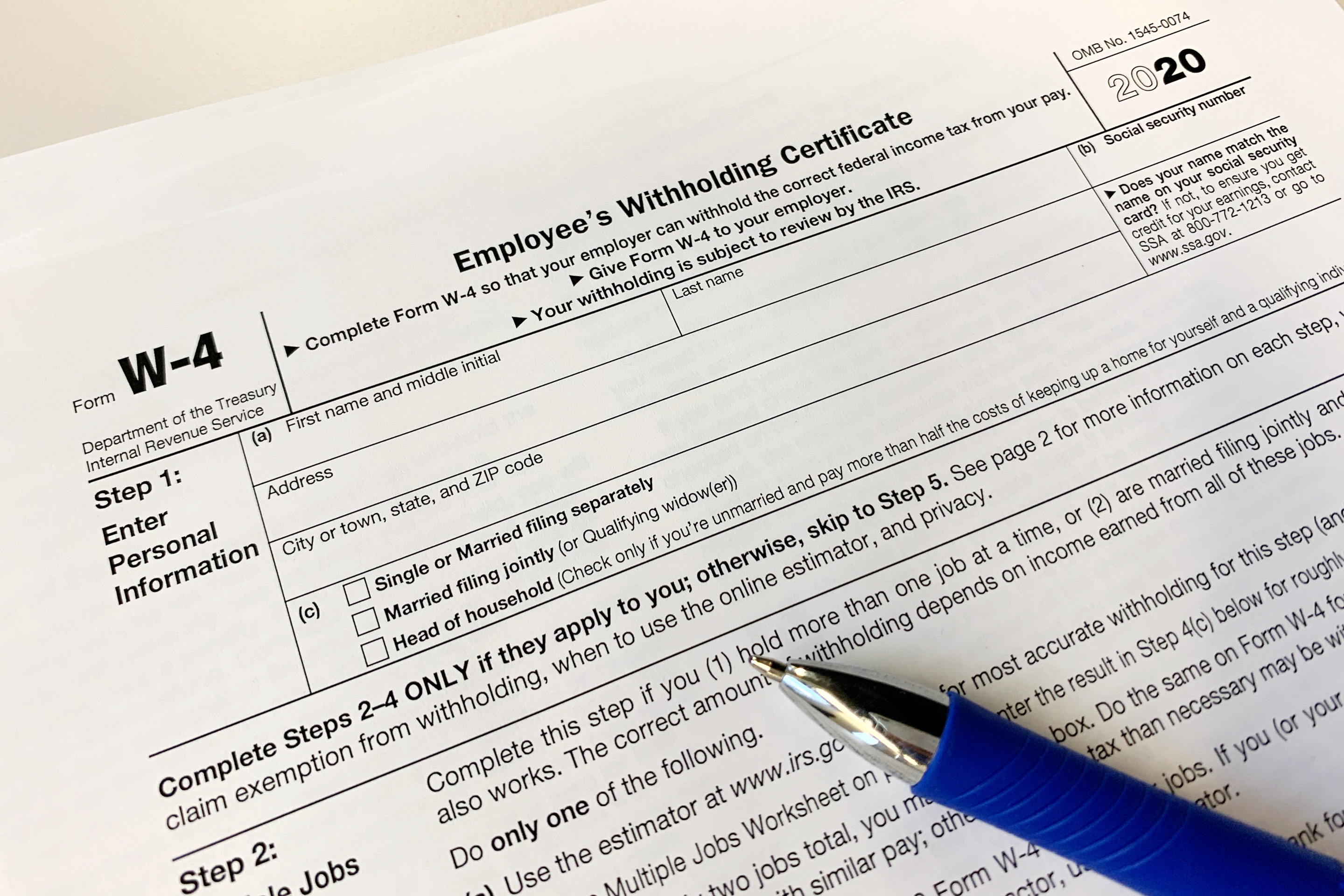

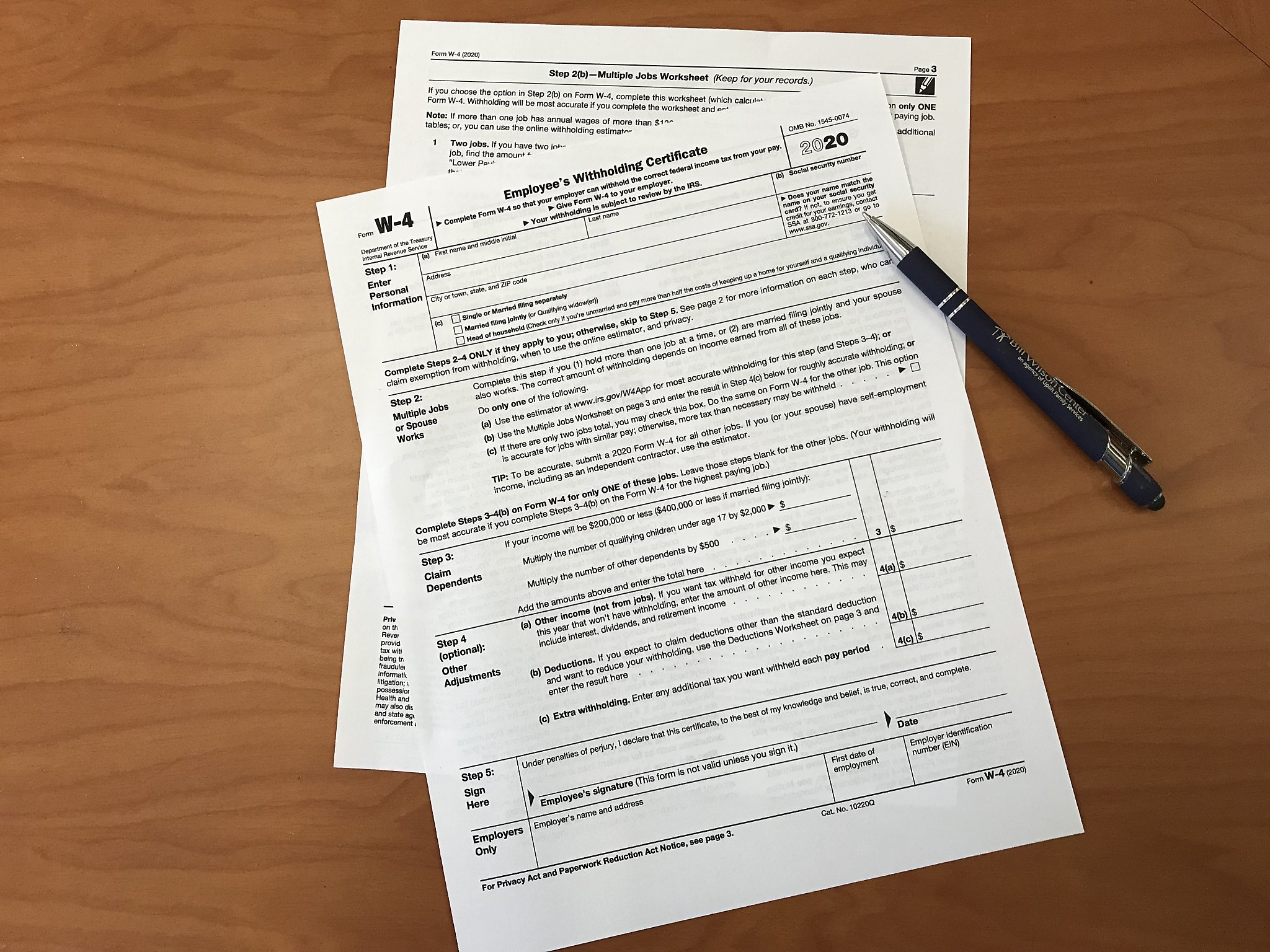

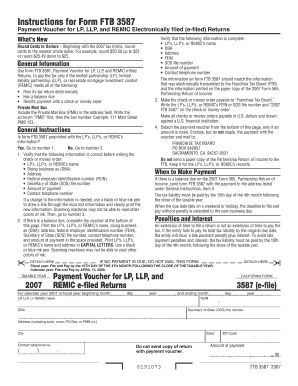

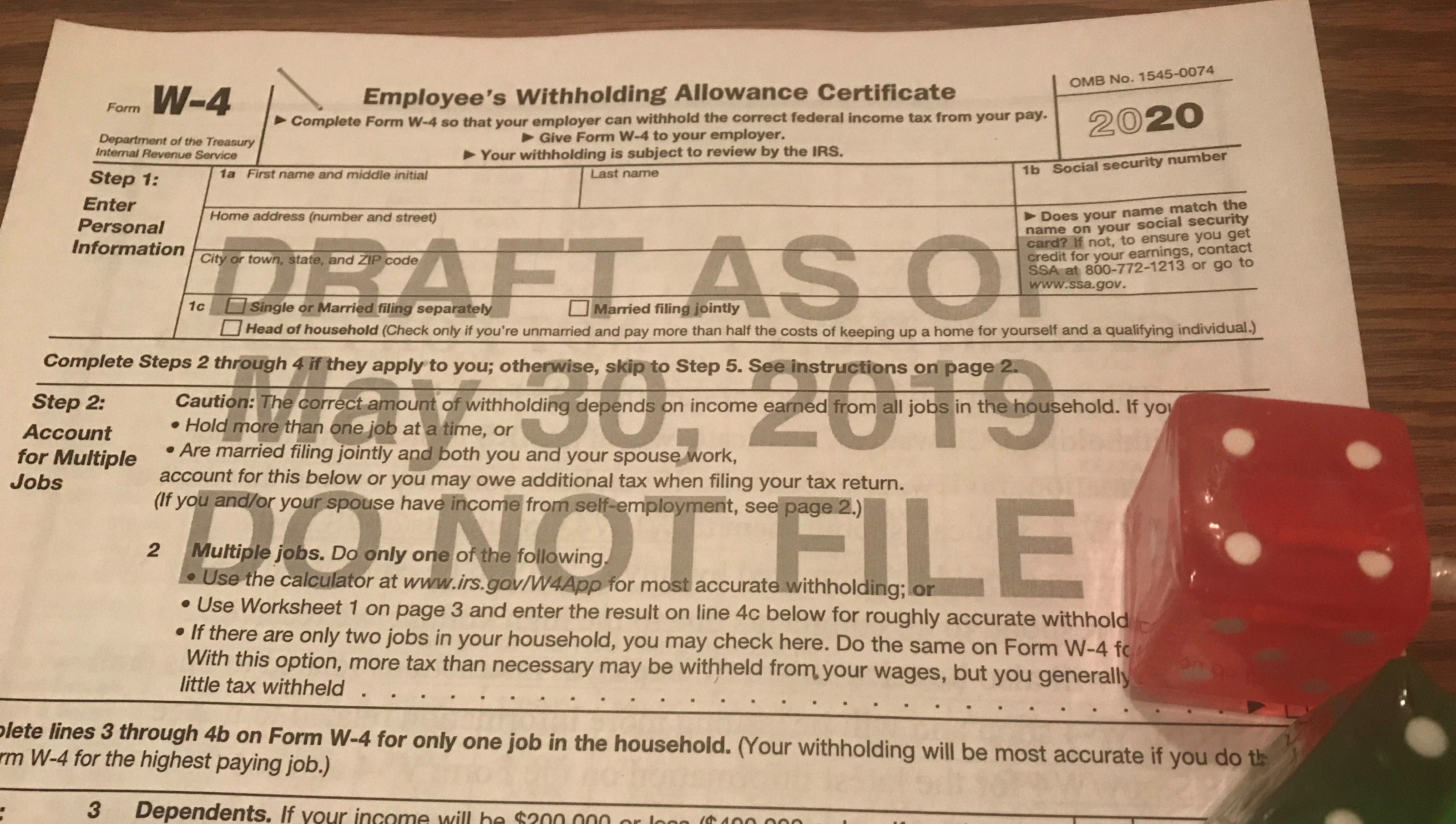

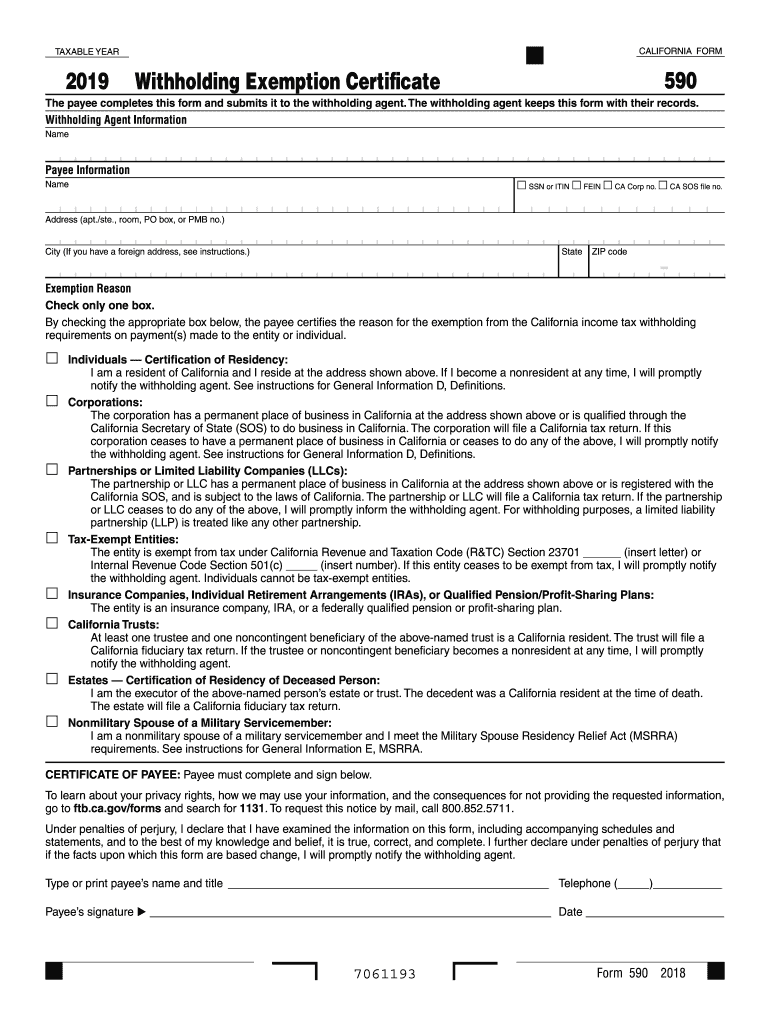

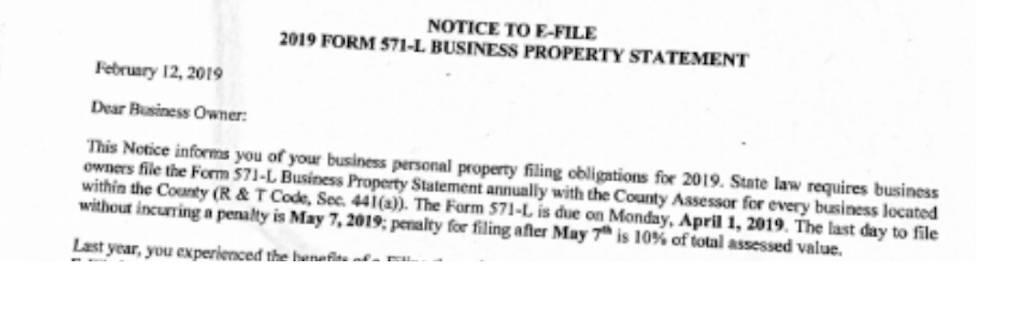

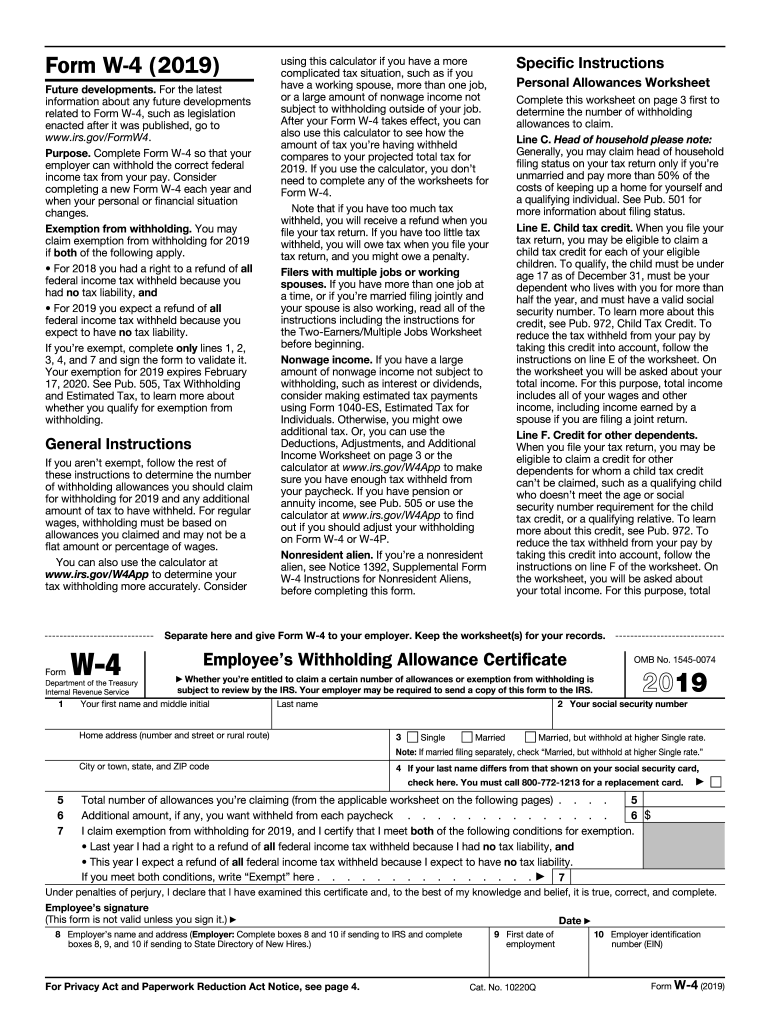

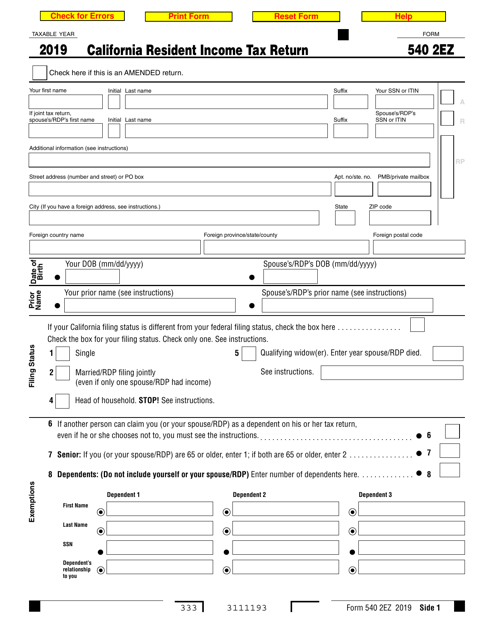

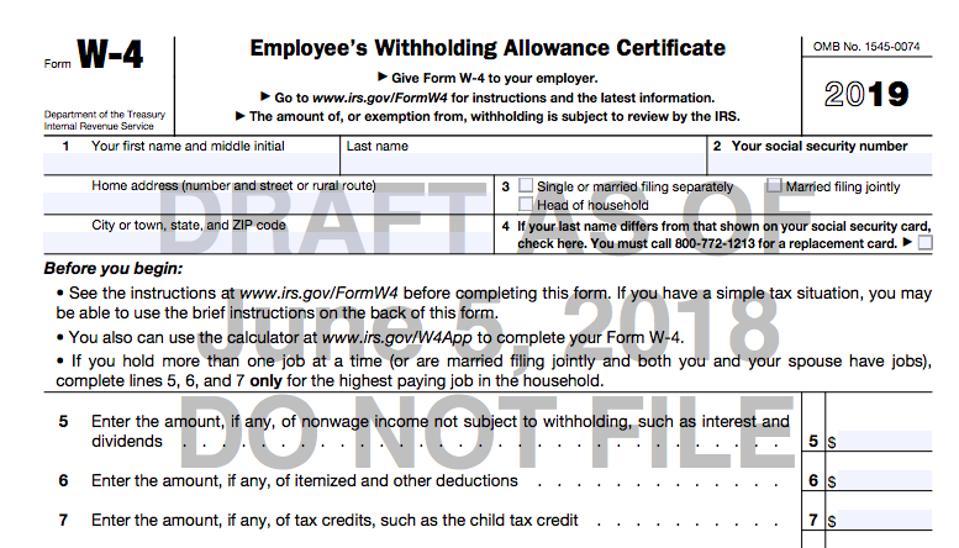

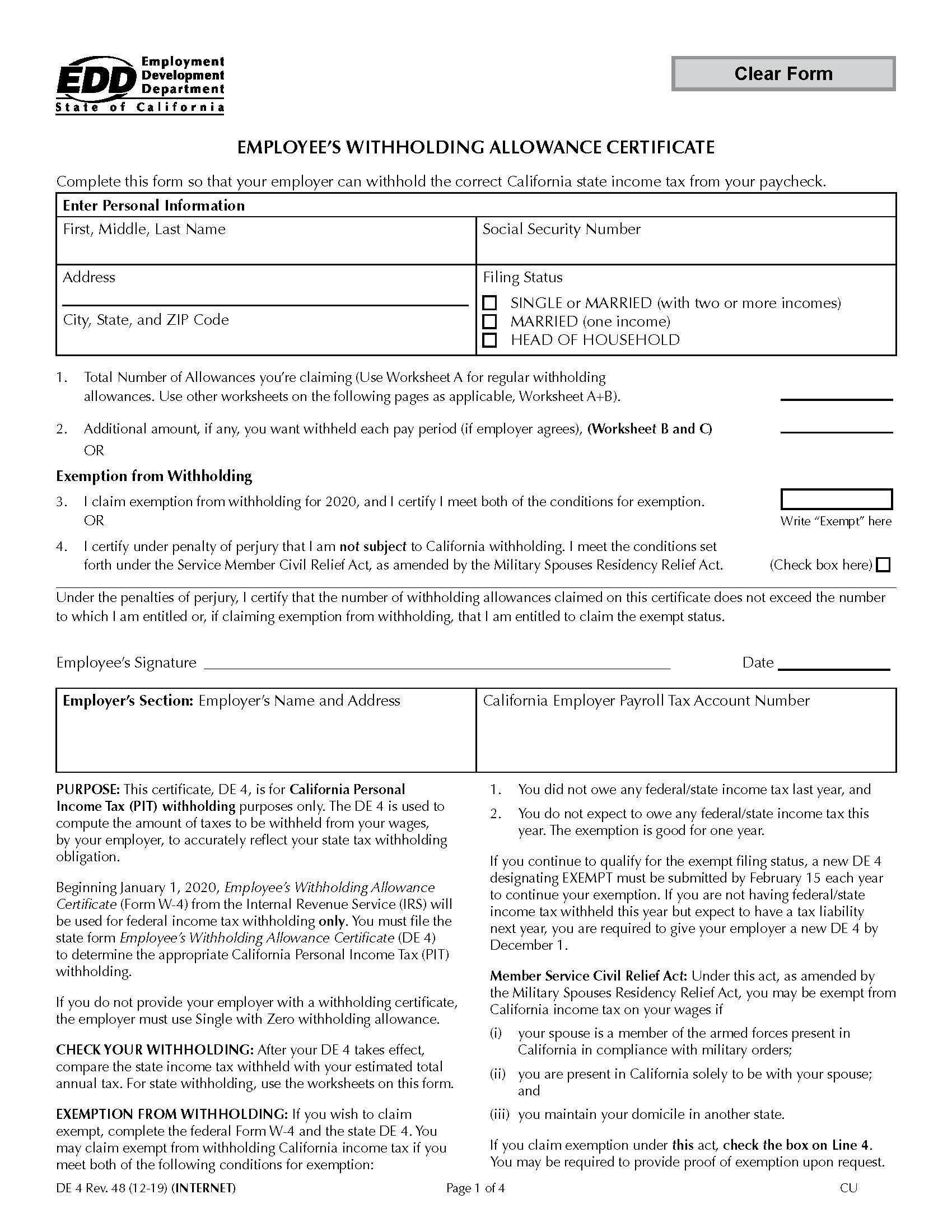

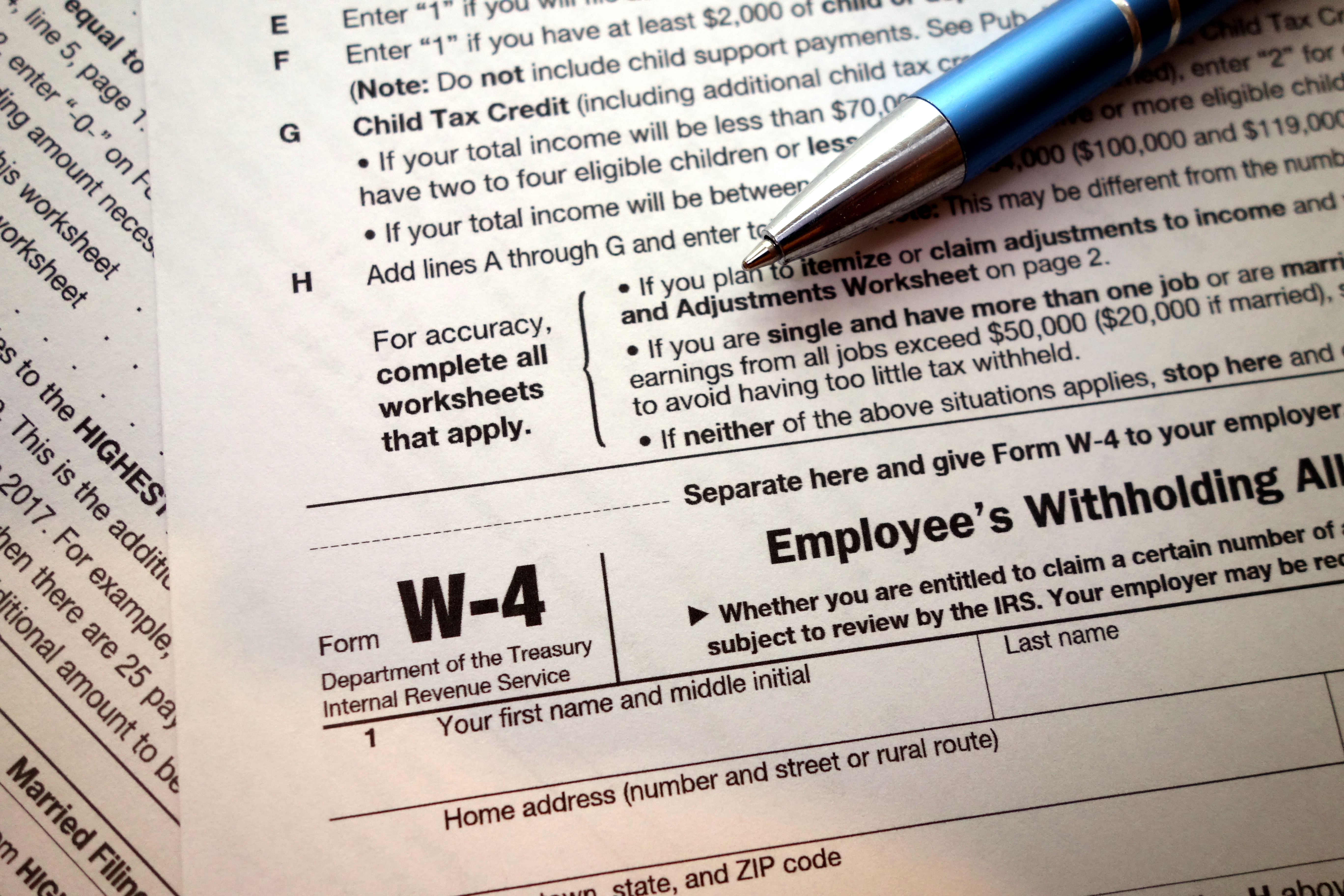

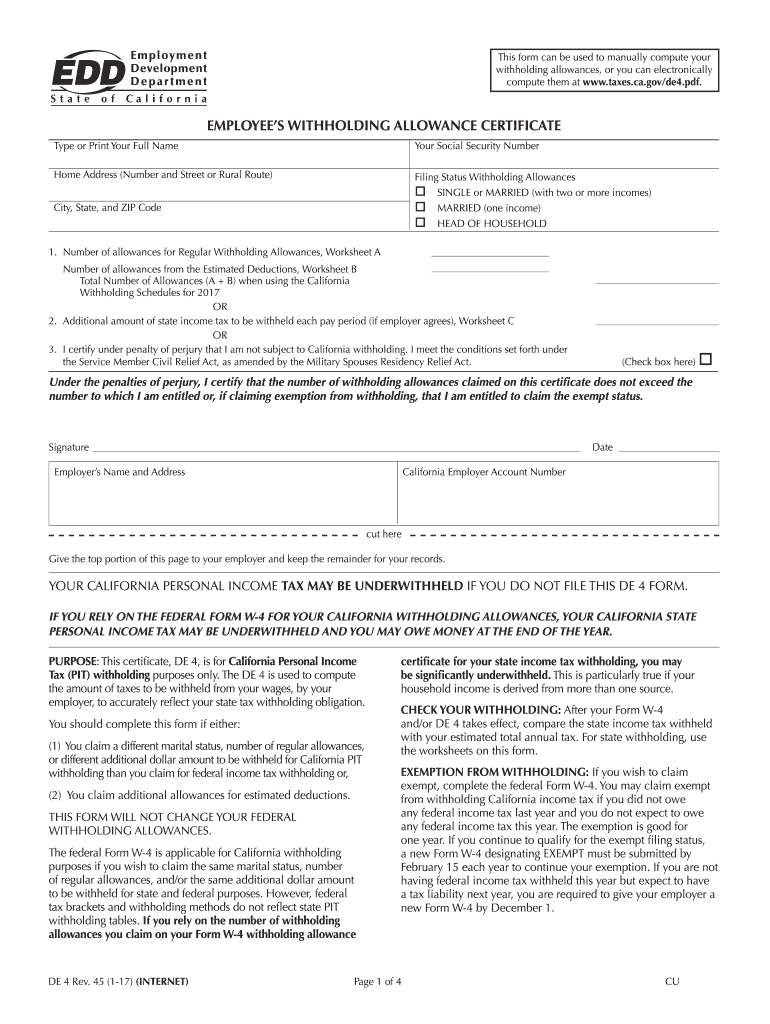

California state tax withholding form 2019. California withholding schedules for 2019 wwweddcagov t a c 2019 withholding schedules method b internet page 01 of 10 california withholding schedules for 2019 california provides two methods for determining the amount of wages and salaries to be withheld for state personal income tax. Exempt complete the federal form w 4 and the state de 4. The exemption is good for one year.

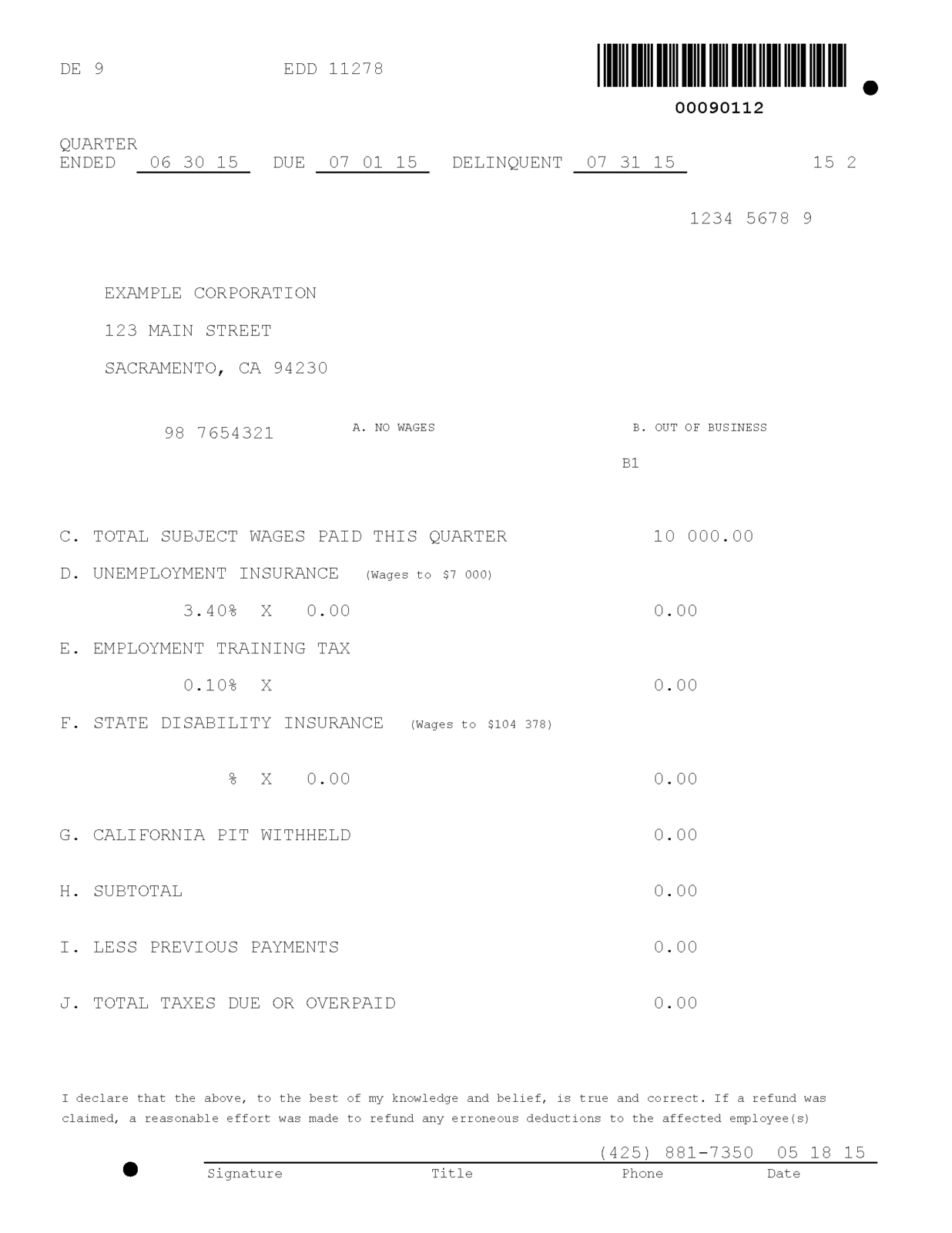

You do not expect to owe any federalstate income tax this year. De 4s request for state income tax withholding from sick pay. 1 claim a different number of allowances for california pit withholding than for.

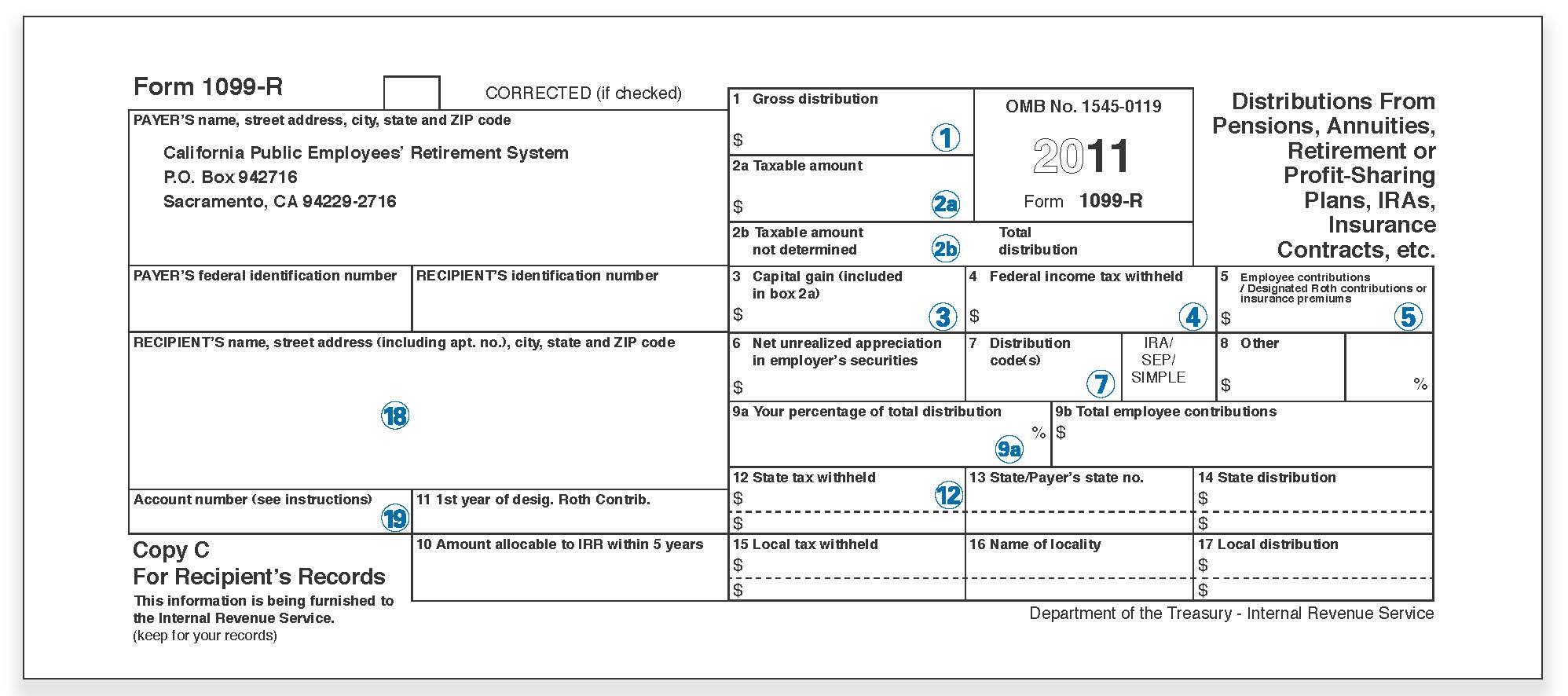

You may claim exempt from withholding california income tax if you meet both of the following conditions for exemption. De 4p withholding certificate for pension or annuity payments. Requires that california personal income tax pit be withheld from payments of pensions and annuities.

Internal revenue service withholding calculator identify your tax withholding to make sure you have the right amount of tax withheld. The undersigned certify that as of june 22 2019 the internet website of the franchise tax board is designed developed and maintained to be in compliance with california government code sections 7405 and 11135 and the web content accessibility guidelines 21 or a subsequent version june 22 2019 published by the web accessibility. The undersigned certify that as of june 22 2019 the internet website of the franchise tax board is designed developed and maintained to be in compliance with california government code sections 7405 and 11135 and the web content accessibility guidelines 21 or a subsequent version june 22 2019 published by the web accessibility.

You did not owe any federalstate income tax last year and 2. You do not have to make estimated tax payments if you are a nonresident or new resident of california in 2020 and did not have a california tax liability in 2019.

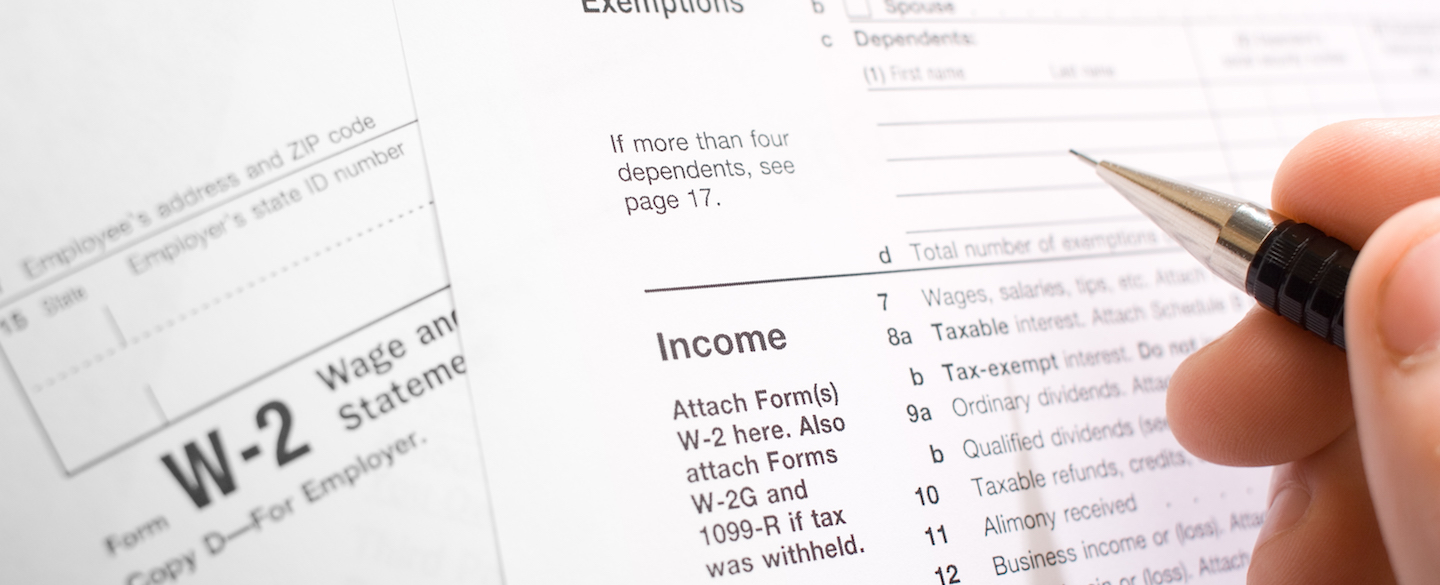

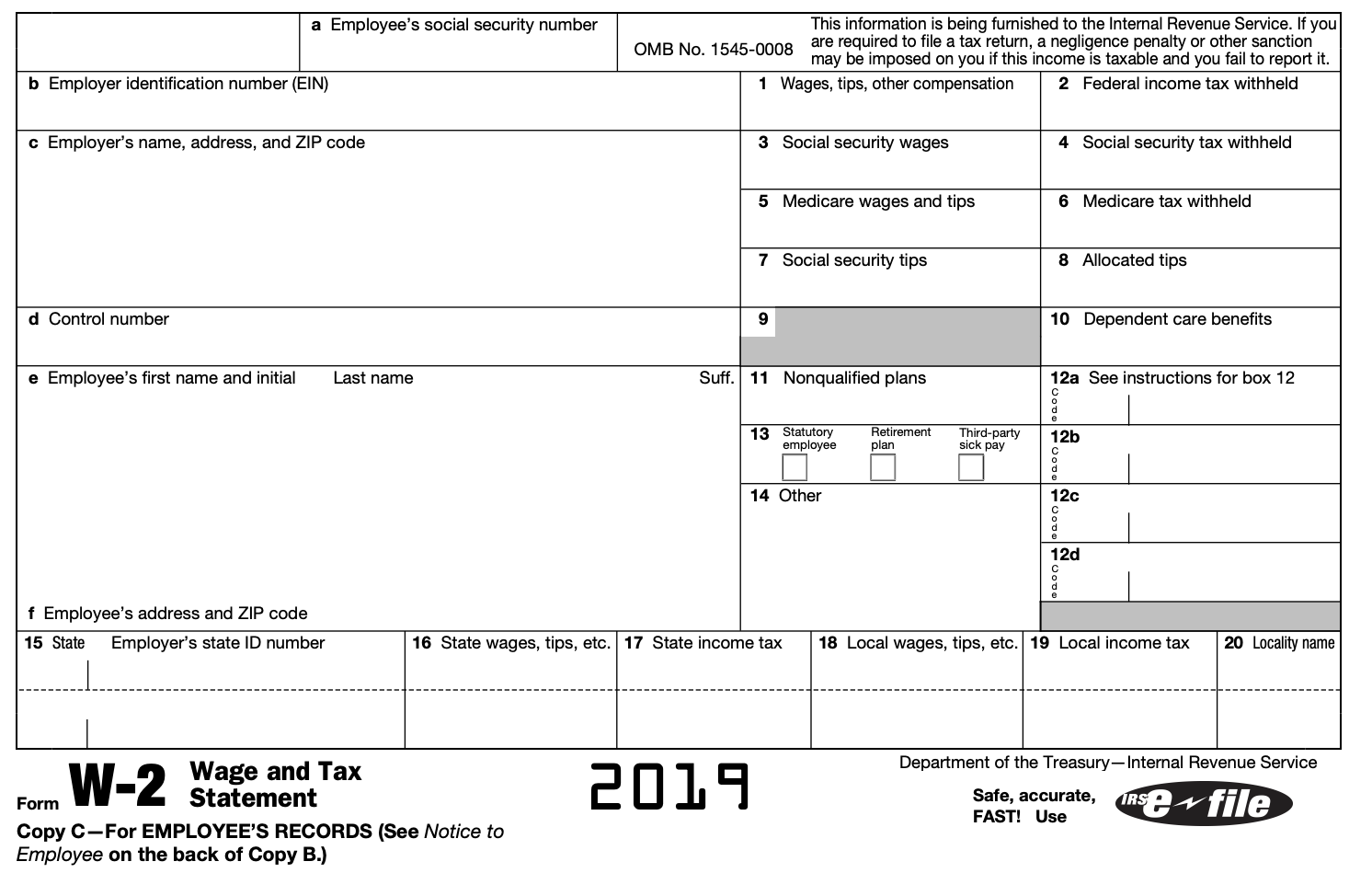

:max_bytes(150000):strip_icc()/understanding-form-w-2-wage-and-tax-statement-3193059-v4-5bc643e646e0fb0026d3aafc-5c0ab974c9e77c000168e8d4.png)

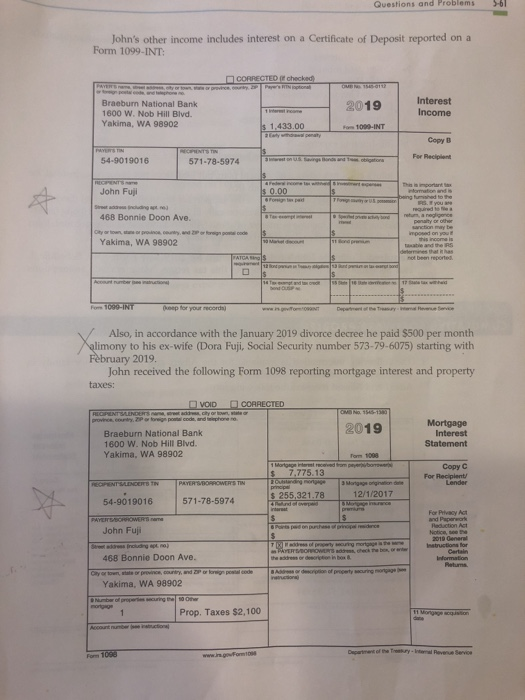

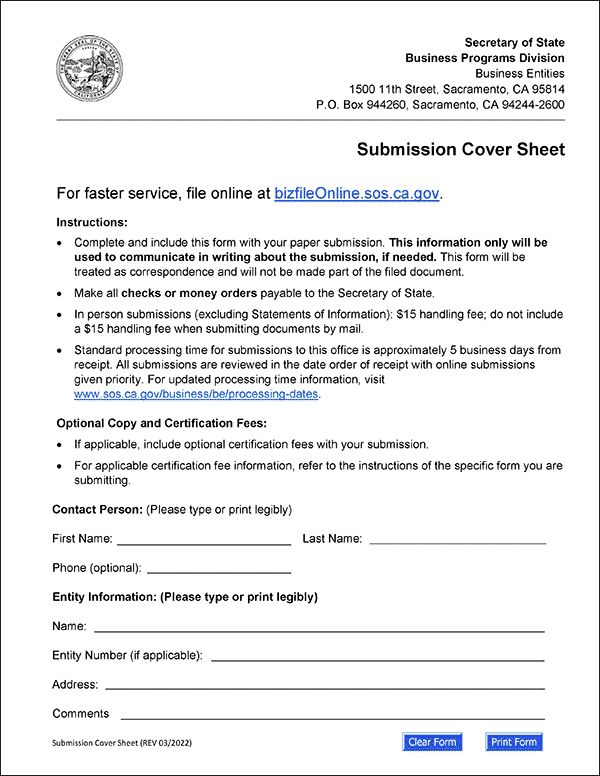

/ScreenShot2020-02-03at11.20.15AM-ed3d6962a8d74a509a58ce0cab7069bf.png)

:max_bytes(150000):strip_icc()/Form-w4-e54ebb209cbc48b48541a54b07e2d5c2.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png)

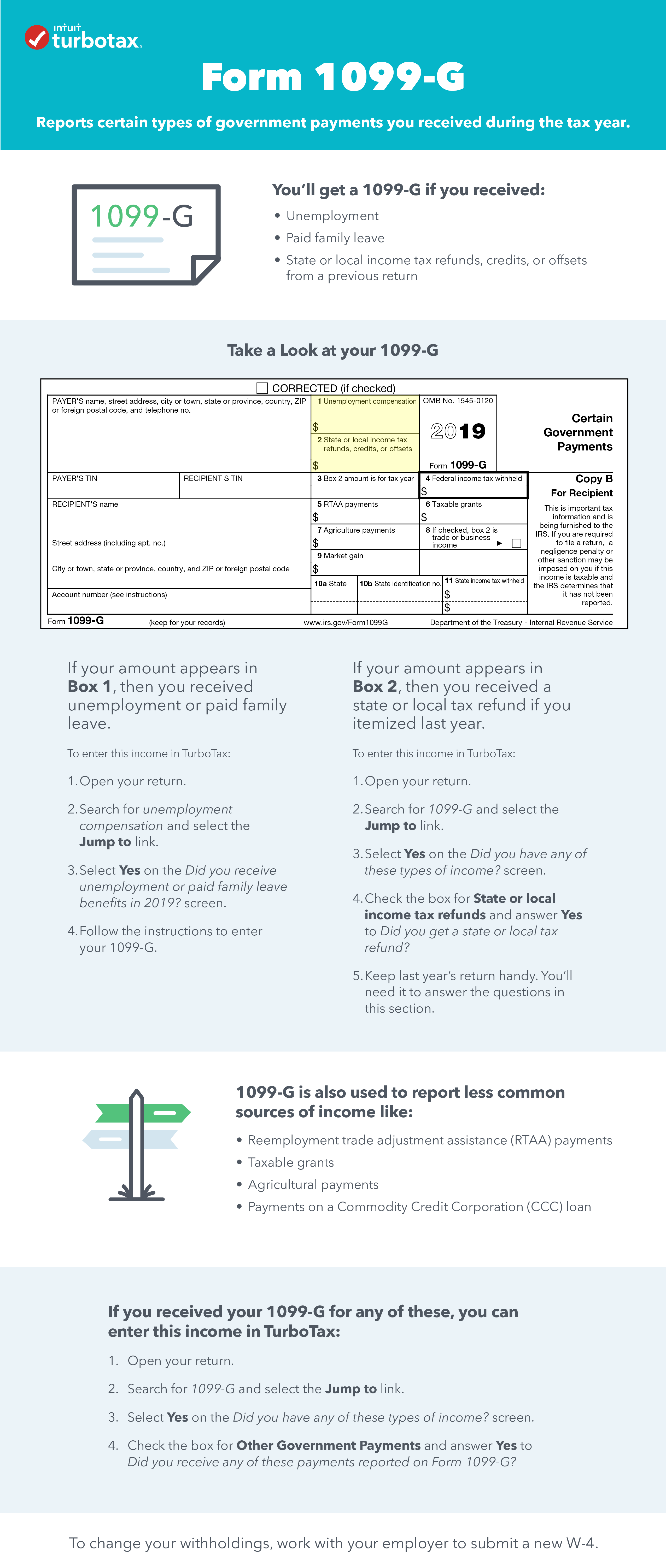

/i-received-a-1099-misc-form-what-do-i-do-with-it-35d7e9d37e8949de8c556777494dde39.png)