California Tax Brackets 2019 Head Of Household

Part i marital status.

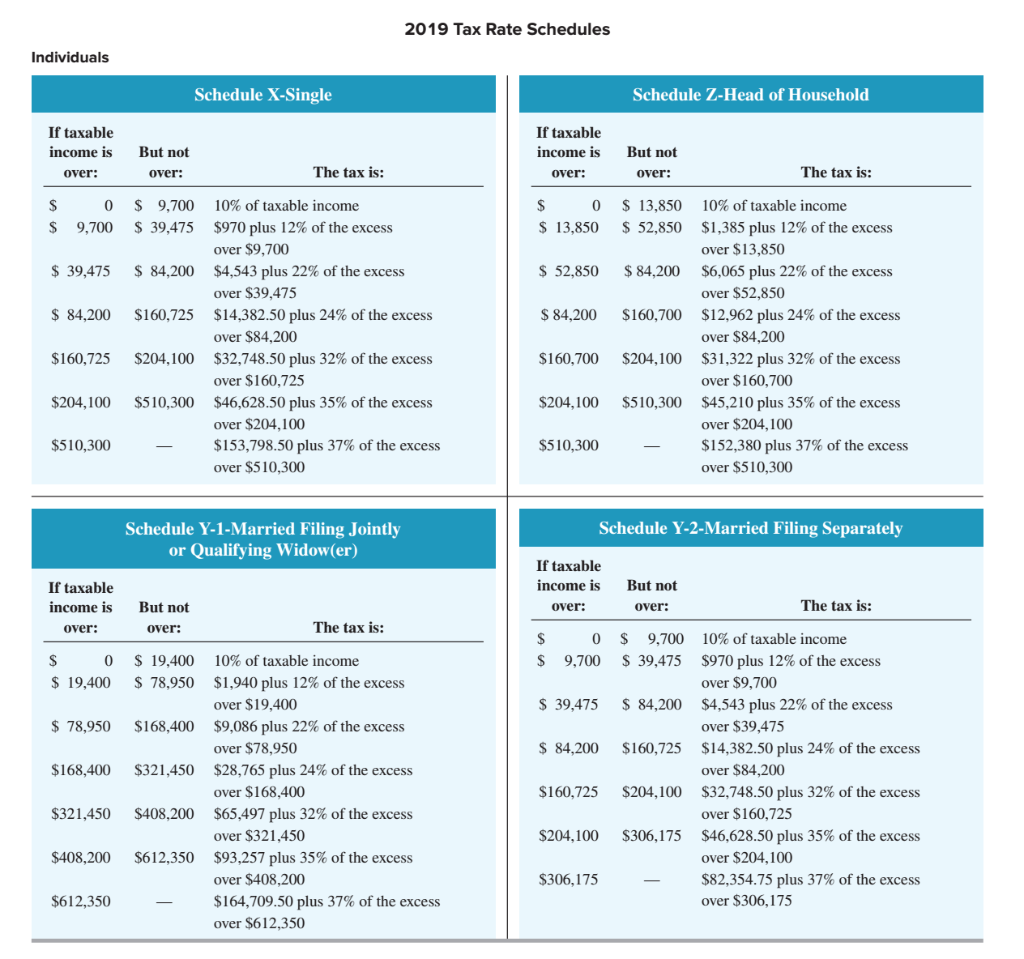

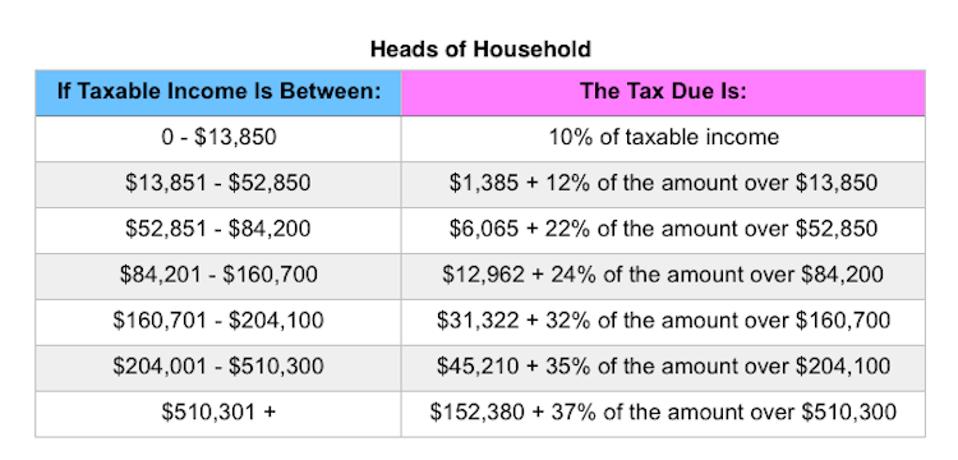

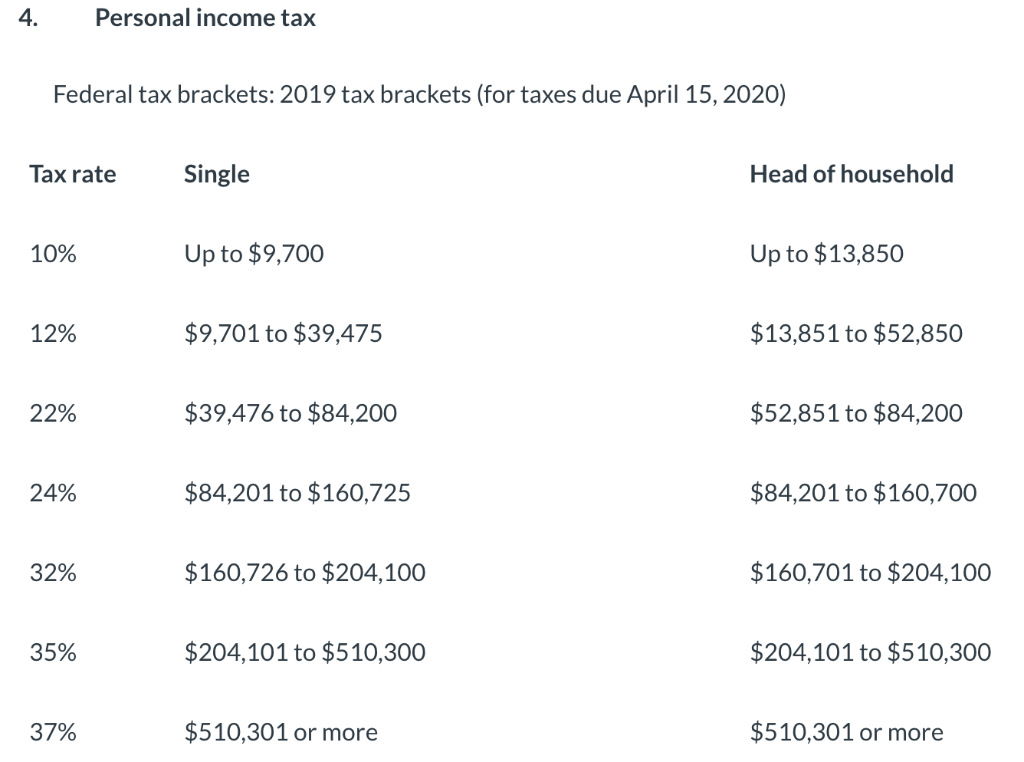

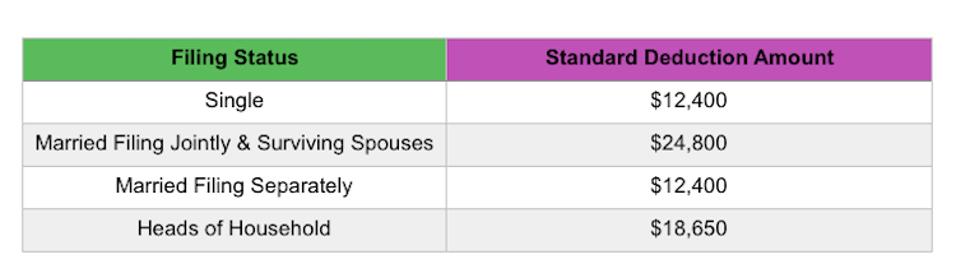

California tax brackets 2019 head of household. To estimate your credit amount. The california head of household filing status tax brackets are shown in the table below. In california different tax brackets are applicable to different filing types.

File your income tax return. California franchise tax board certification date july 1 2019 contact accessible technology program. Enter the amount from california resident income tax return form 540 line 19.

Visit credit for senior head of household under special credits and nonrefundable credits for more. Beginning in tax year 2018 if you do not attach a completed form ftb 3532 to your tax return we will deny your hoh filing status. See california head of household filing status ftb pub 1540 for more in depth information.

Multiply the amount by 2. Enter the result or 1478 whichever is less on line 43 or 44. These income tax brackets and rates apply to california taxable income earned january 1 2019 through december 31 2019.

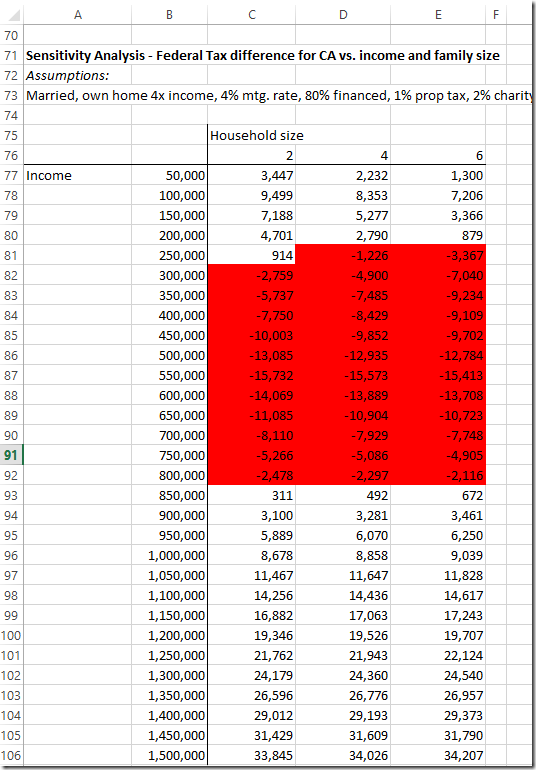

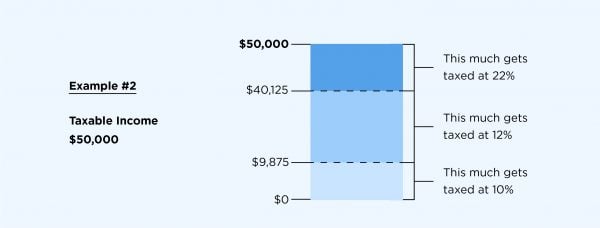

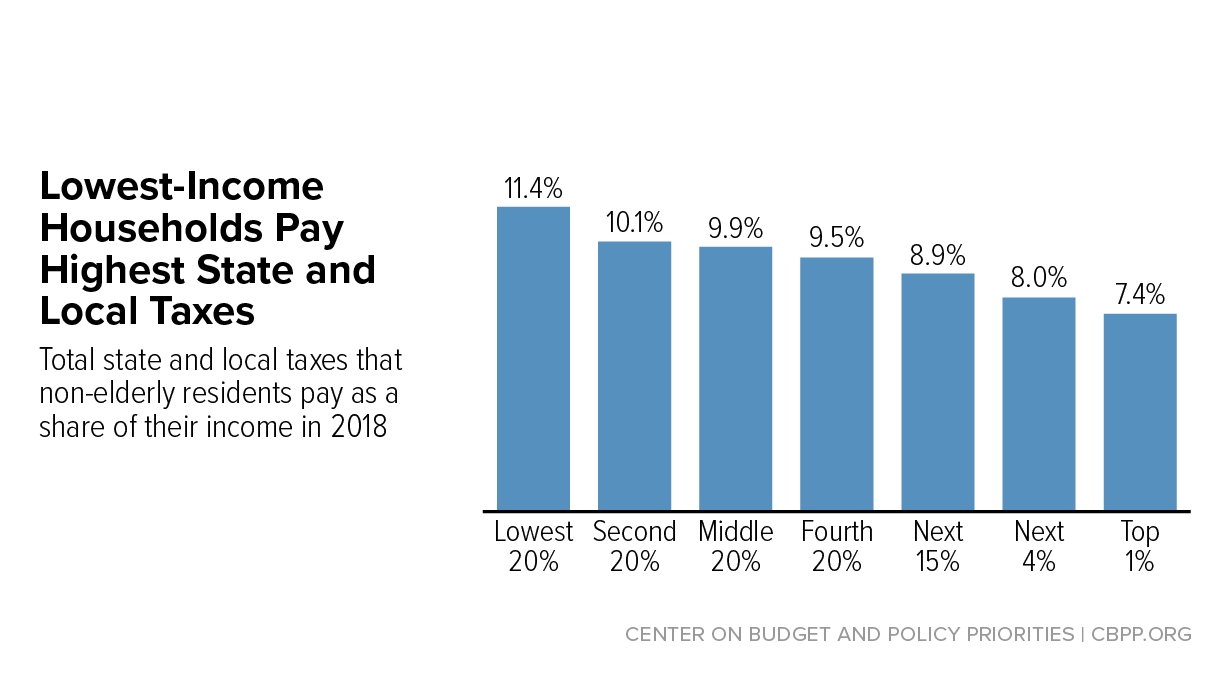

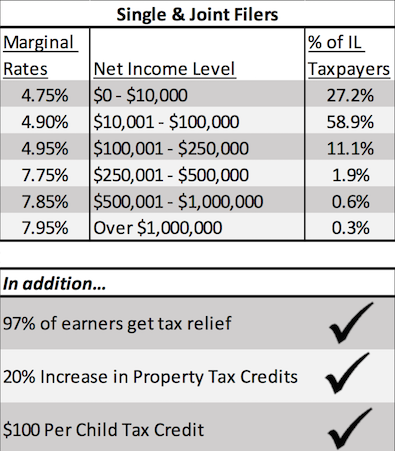

The brackets below show the tax rates for 2019. Divide that by your earnings of 80000 and you get an effective tax rate of 168 percent which is lower than the 22 percent bracket youre in. Each marginal rate only applies to earnings within the applicable marginal tax bracket.

Beginning with the 2015 tax year all taxpayers who file using the head of household hoh filing status must submit a completed ftb 3532 head of household filing status schedule with their tax return. Attach to your california form 540 form 540nr or form 540 2ez. The undersigned certify that as of june 22 2019 the internet website of the franchise tax board is designed developed and maintained to be in.

Part ii qualifying person. The undersigned certify that as of june 22 2019 the internet website of the franchise tax board is designed developed and maintained to be in compliance with california government code sections 7405 and 11135 and the web content accessibility guidelines 21 or a subsequent version june 22 2019 published by the web accessibility.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/457995115-F-56a938563df78cf772a4e248.jpg)

:max_bytes(150000):strip_icc()/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)

/TaxRates2-dc0366d01dd0491b91a1c3c93b4740db.jpg)

/TaxRates2-dc0366d01dd0491b91a1c3c93b4740db.jpg)

/head-of-household-filing-status-3193039-finalv4-ct-fa1b9cd4bb4a4b87adde82fa4c814ff5.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/19755440/Hollywood_For_Sale.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/FederalIncomeTaxBracketsandRates-7356bf2723da406e8701572aa3b9ea11.jpg)

:max_bytes(150000):strip_icc()/head-of-household-filing-status-3193039-finalv4-ct-fa1b9cd4bb4a4b87adde82fa4c814ff5.png)