California Tax Calculator

To use our california salary tax calculator all you have to do is enter the necessary details and click on the calculate button.

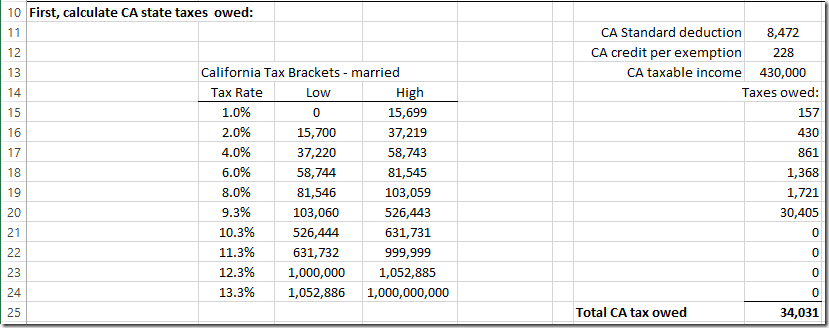

California tax calculator. That means that your net pay will be 43606 per year or 3634 per month. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The california state state tax calculator is updated to include.

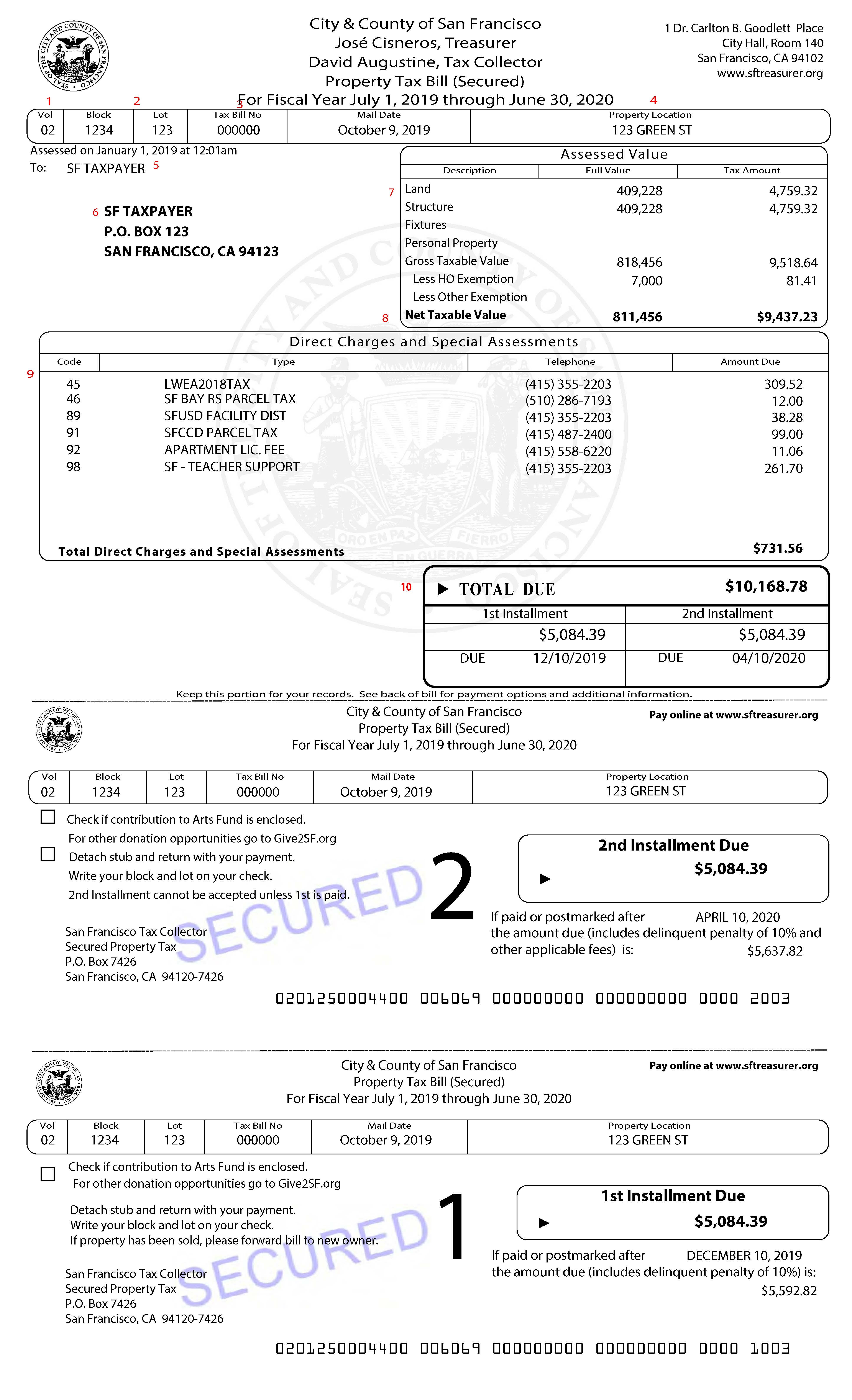

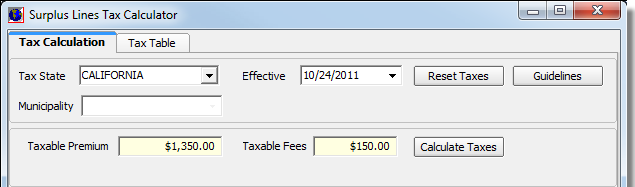

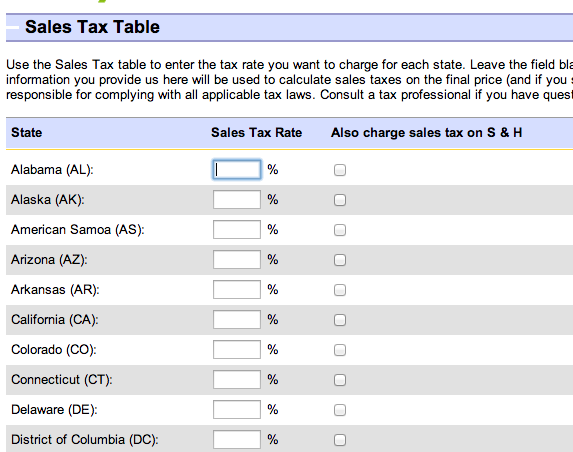

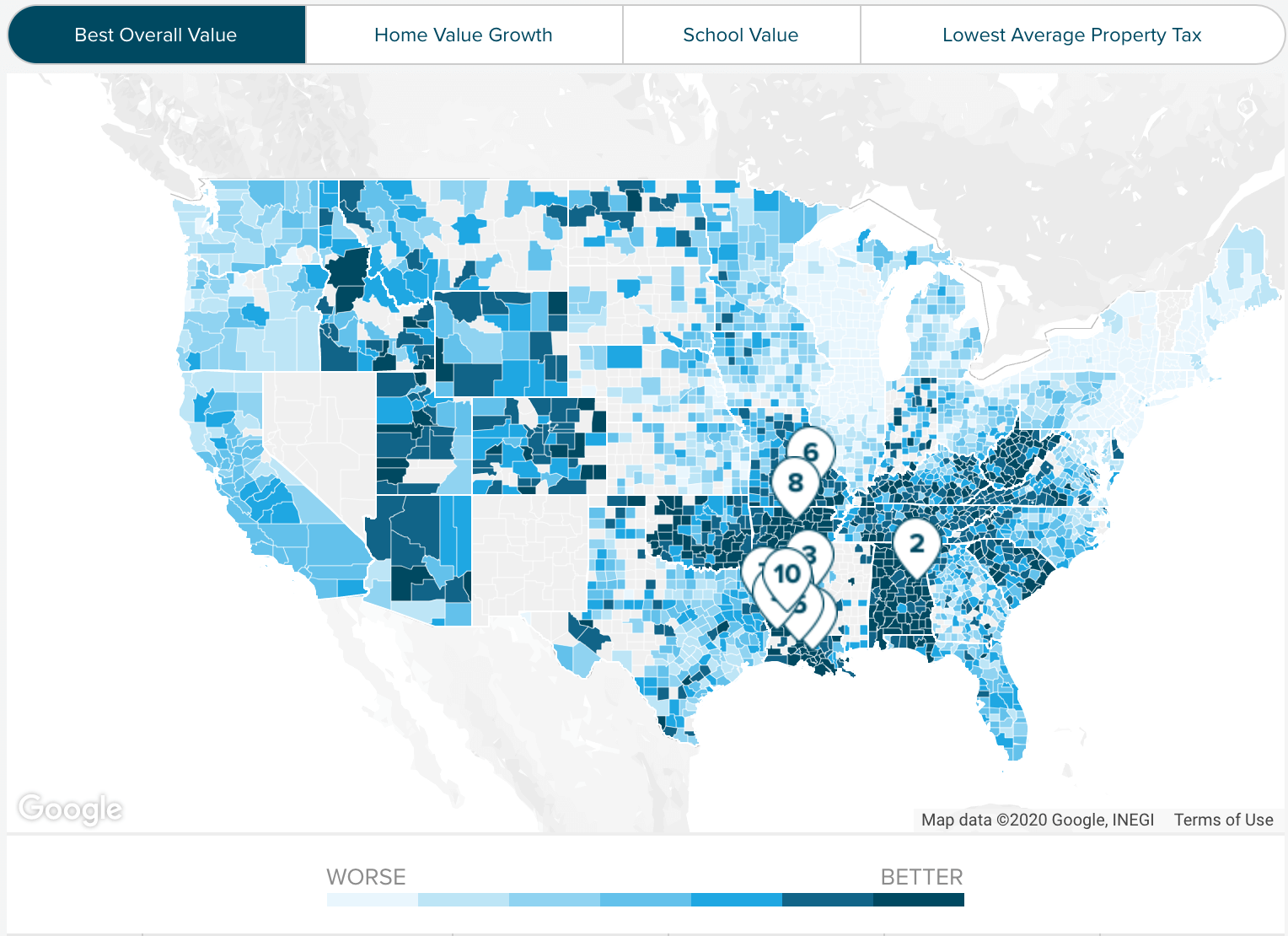

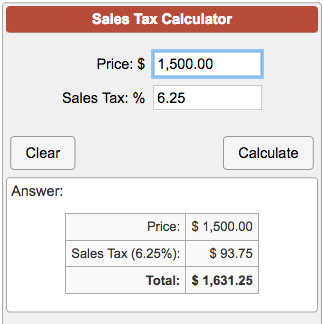

California sales tax calculator you can use our california sales tax calculatorto look up sales tax rates in california by address zip code. Your average tax rate is 2072 and your marginal tax rate is 3765. The golden state fares slightly better where real estate is concerned though.

After a few seconds you will be provided with a full breakdown of the tax you are paying. The undersigned certify that as of june 22 2019 the internet website of the franchise tax board is designed developed and maintained to be in compliance with california government code sections 7405 and 11135 and the web content accessibility guidelines 21 or a subsequent version june 22 2019 published by the web accessibility. If you make 55000 a year living in the region of california usa you will be taxed 11394.

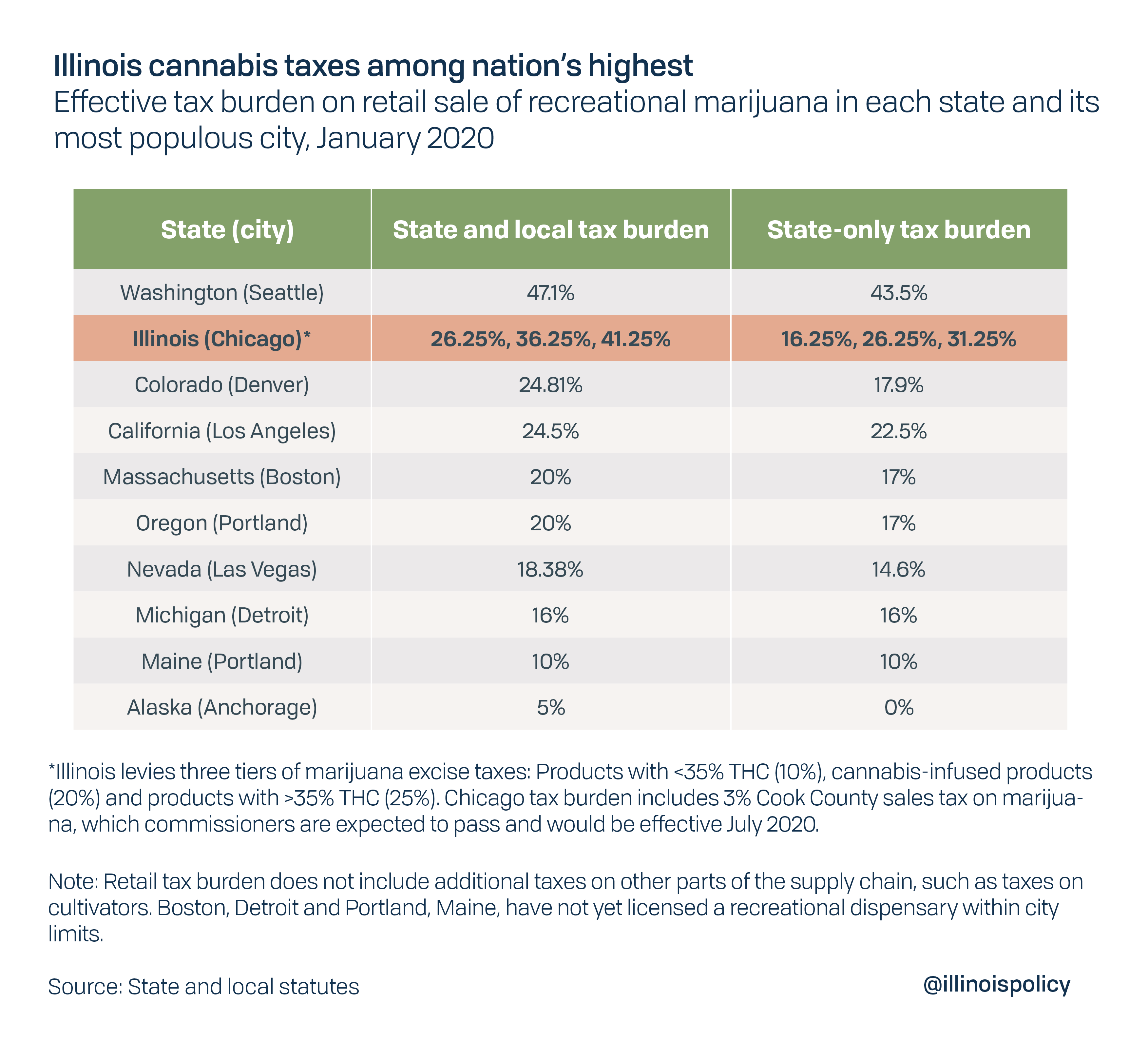

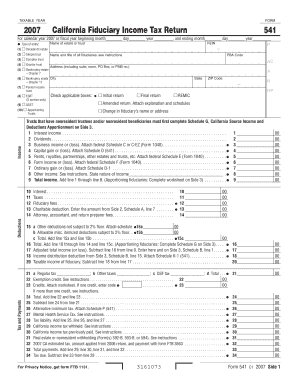

The latest federal tax rates for 2015 16 tax year as published by the irs the latest state tax rates for 20202021 tax year and will be update to the 20212022 state tax tables once fully published as published by the various states. California has among the highest taxes in the nation. This marginal tax rate means that your immediate additional income will be taxed at this rate.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Use This Sales Tax Calculator To Figure Sales Tax Or Vat Gst At A Rate Of 5 3 Free To Download And Print Sales Tax Calculator Tax

www.pinterest.com