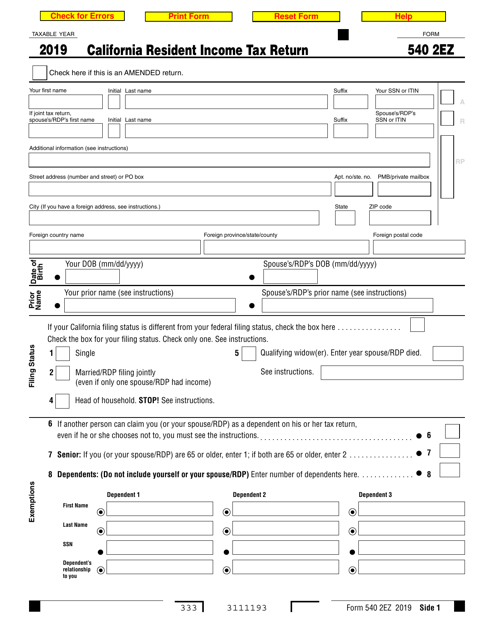

California Tax Forms 540ez 2019

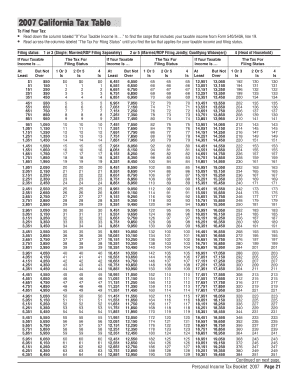

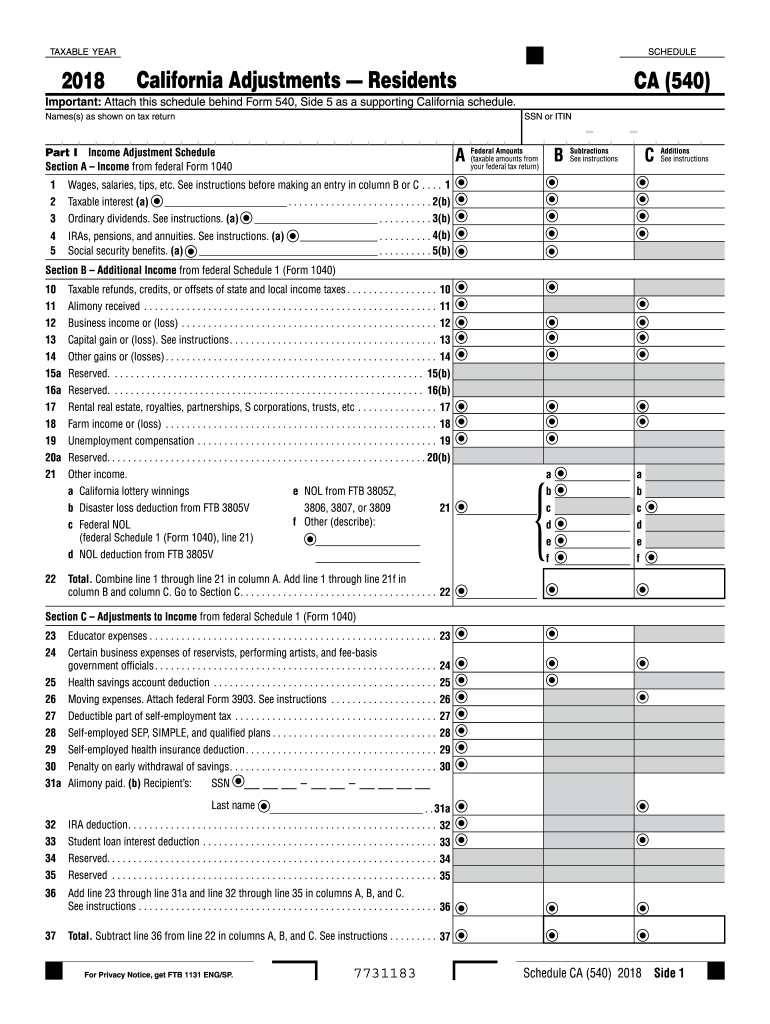

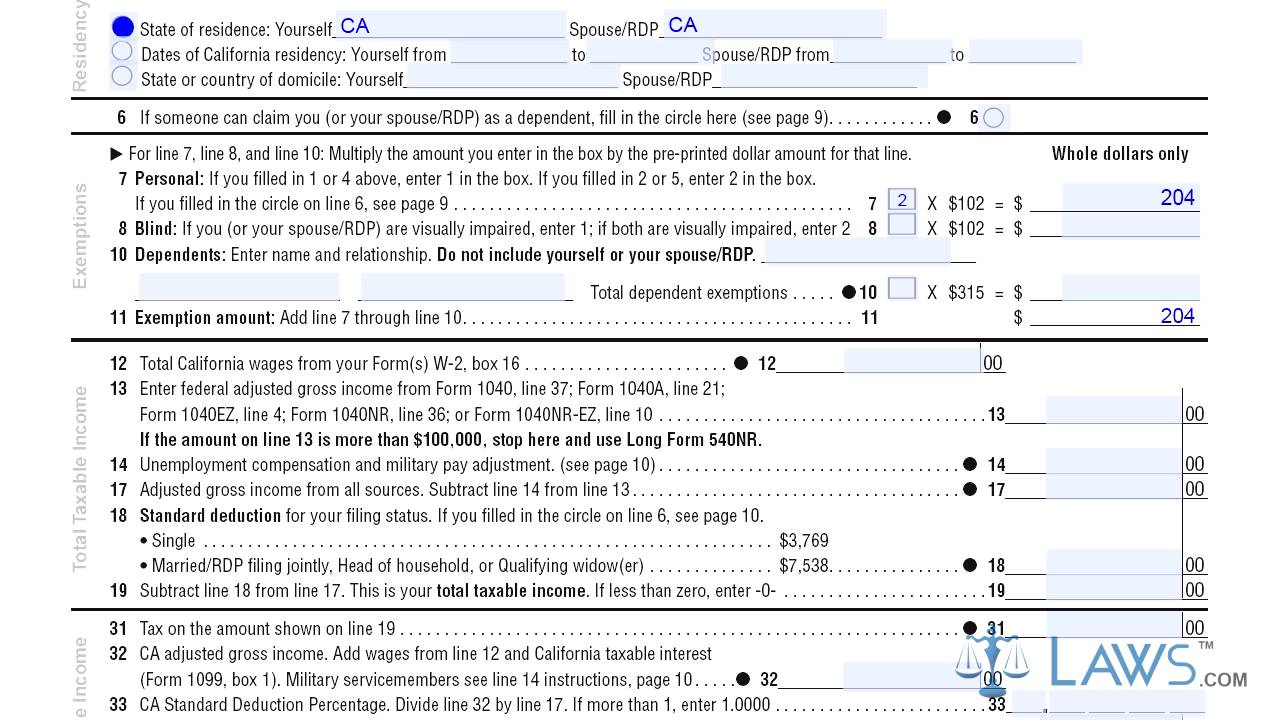

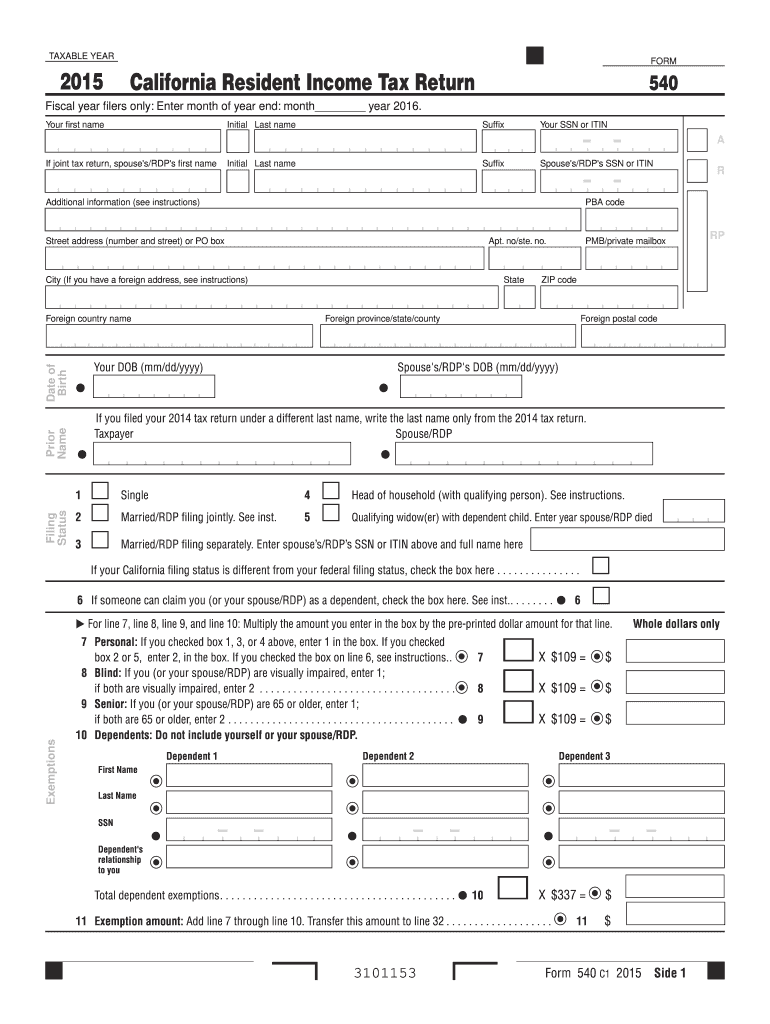

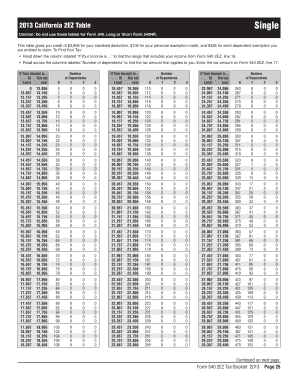

Do not use this table for form 540 or form 540nr.

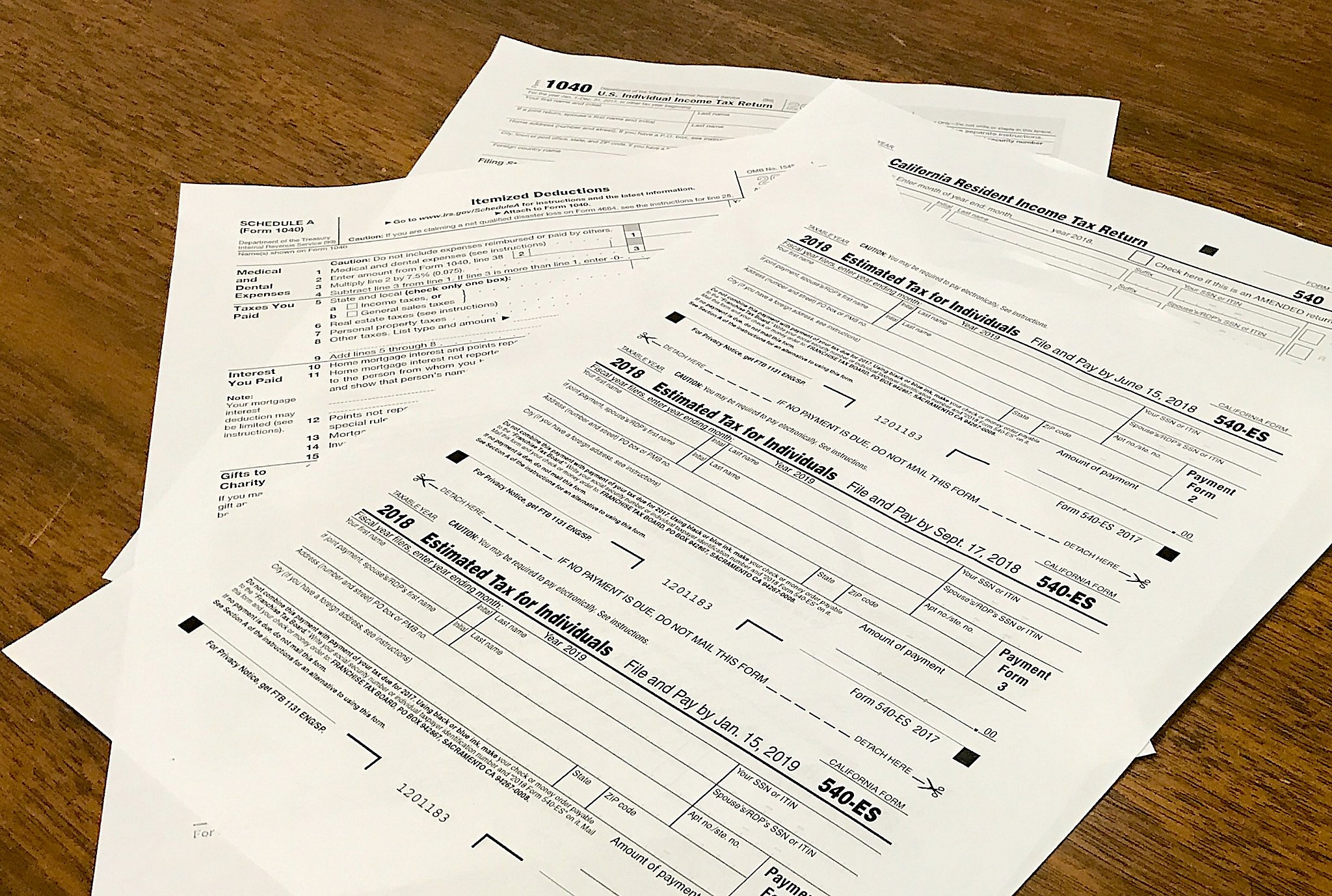

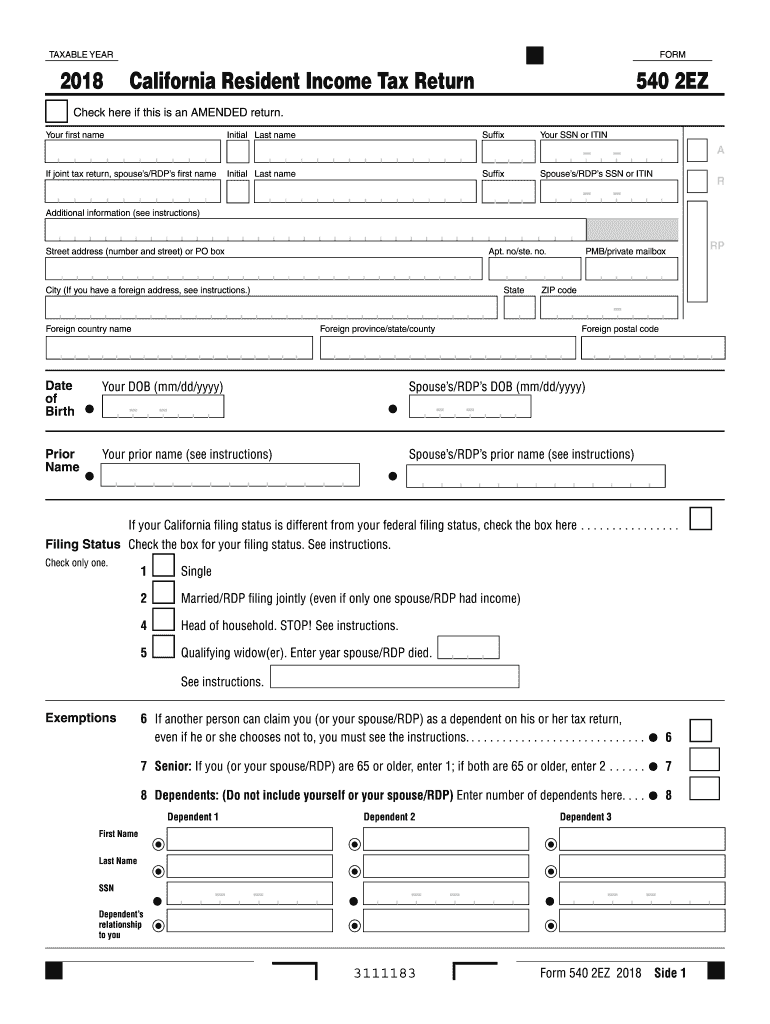

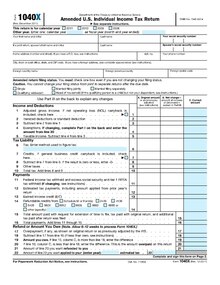

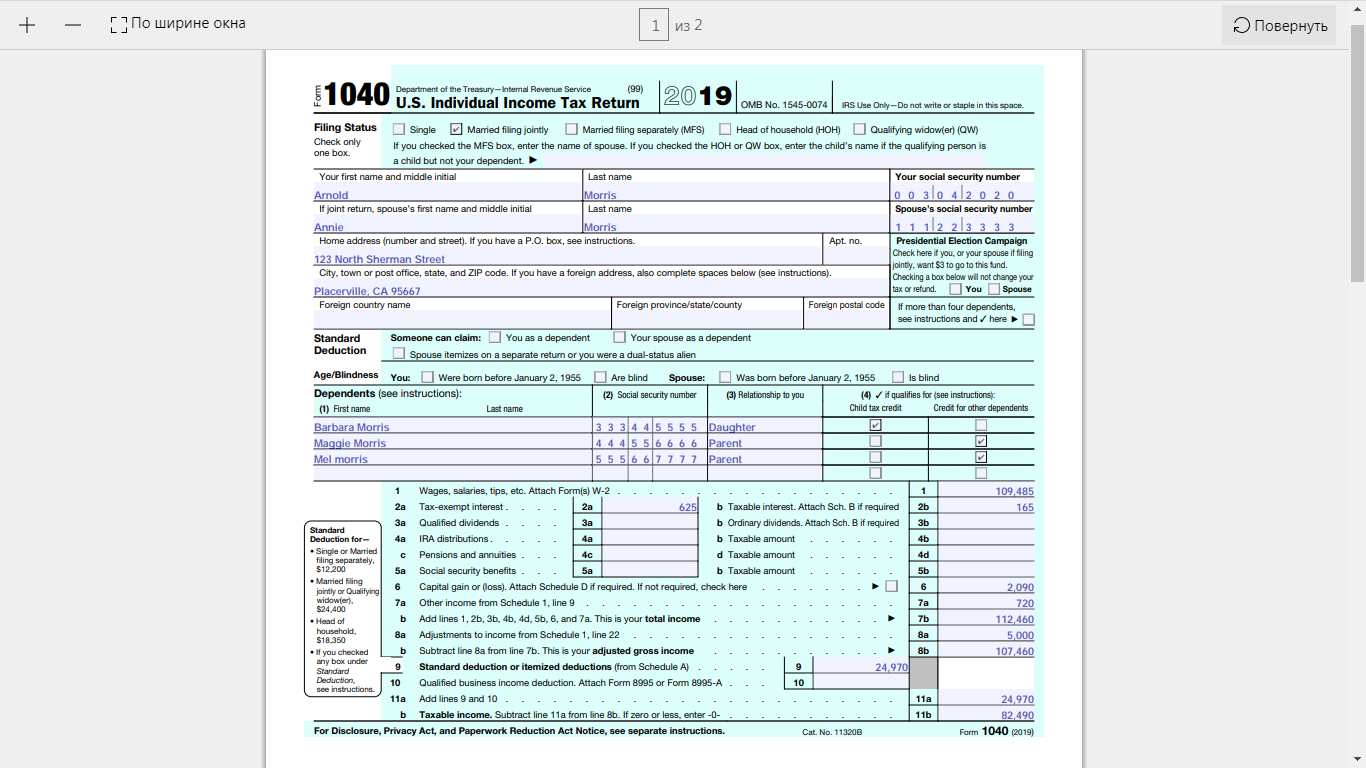

California tax forms 540ez 2019. Real estate withholding statement effective january 1 2020 the real. Form 5402ez is a simplified tax form for individuals who do not have complex taxes. California franchise tax board.

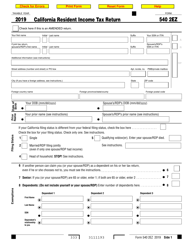

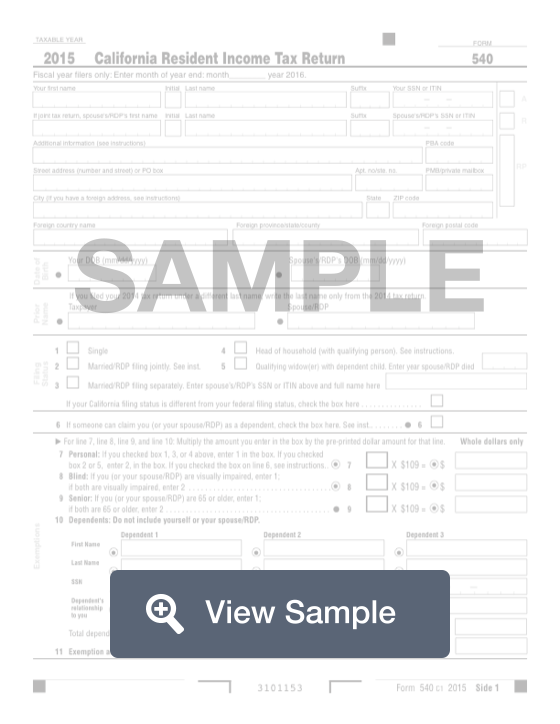

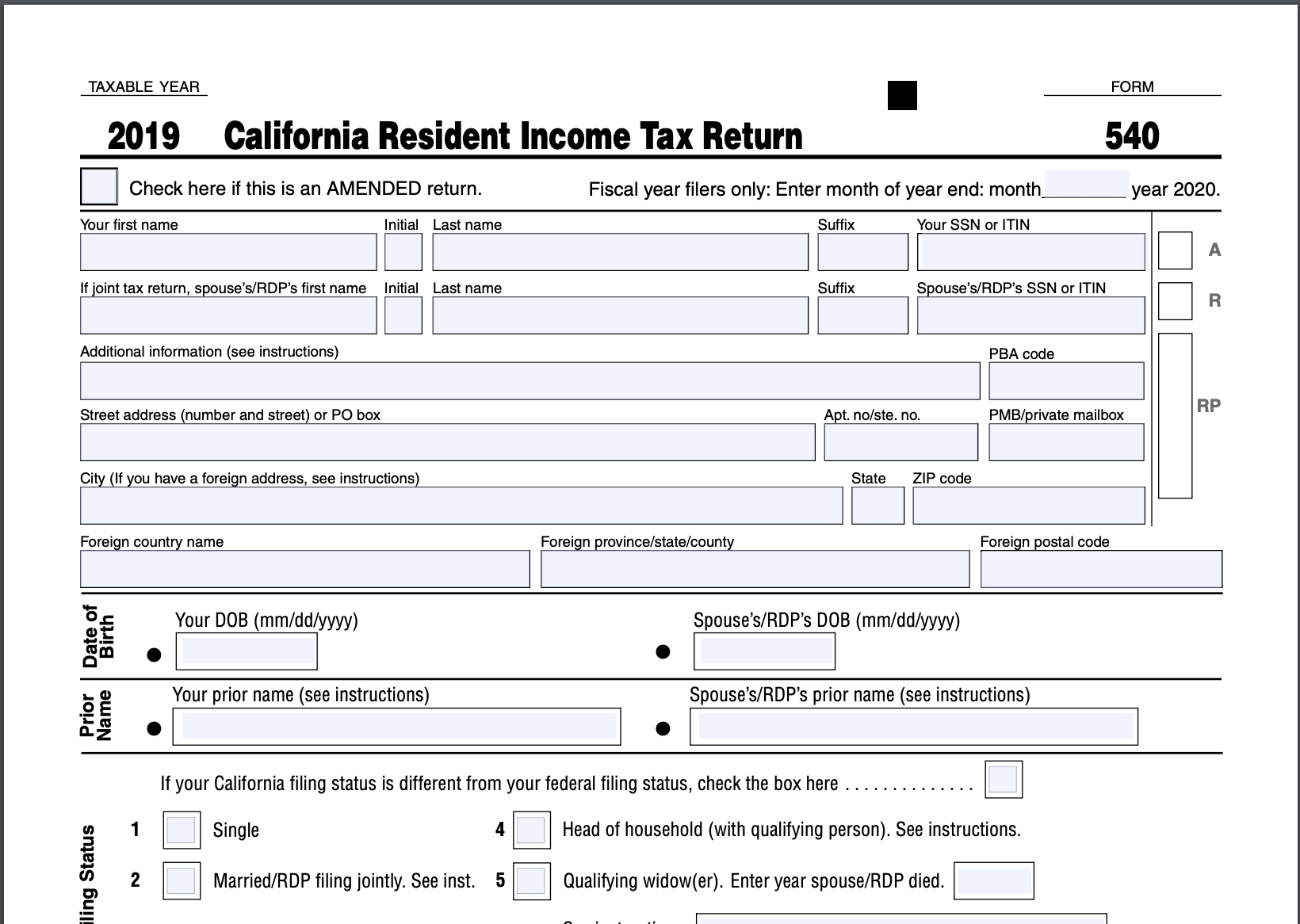

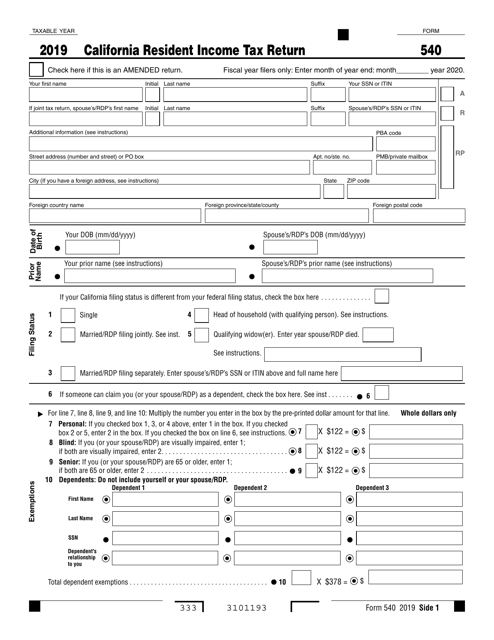

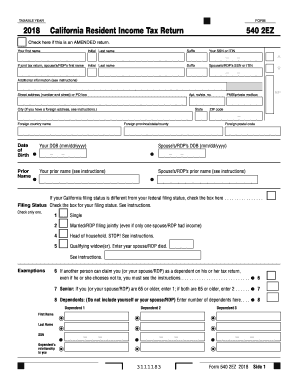

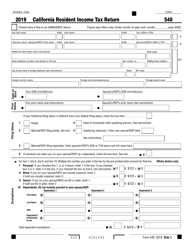

To find your tax. 2019 form 540 2ez california resident income tax return. We last updated california form 540 2ez in february 2020 from the california franchise tax board.

File a return make a payment or check your refund. We last updated california 540 2ez ins in february 2020 from the california franchise tax board. If joint tax return spousesrdps first name.

You may now qualify for the refundable eitc if you have earned income of less than 30001. You can download or print current or past year pdfs of form 540 2ez directly from taxformfinder. 333 3111193form 540 2ez 2019side 1.

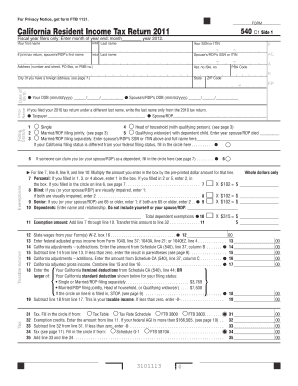

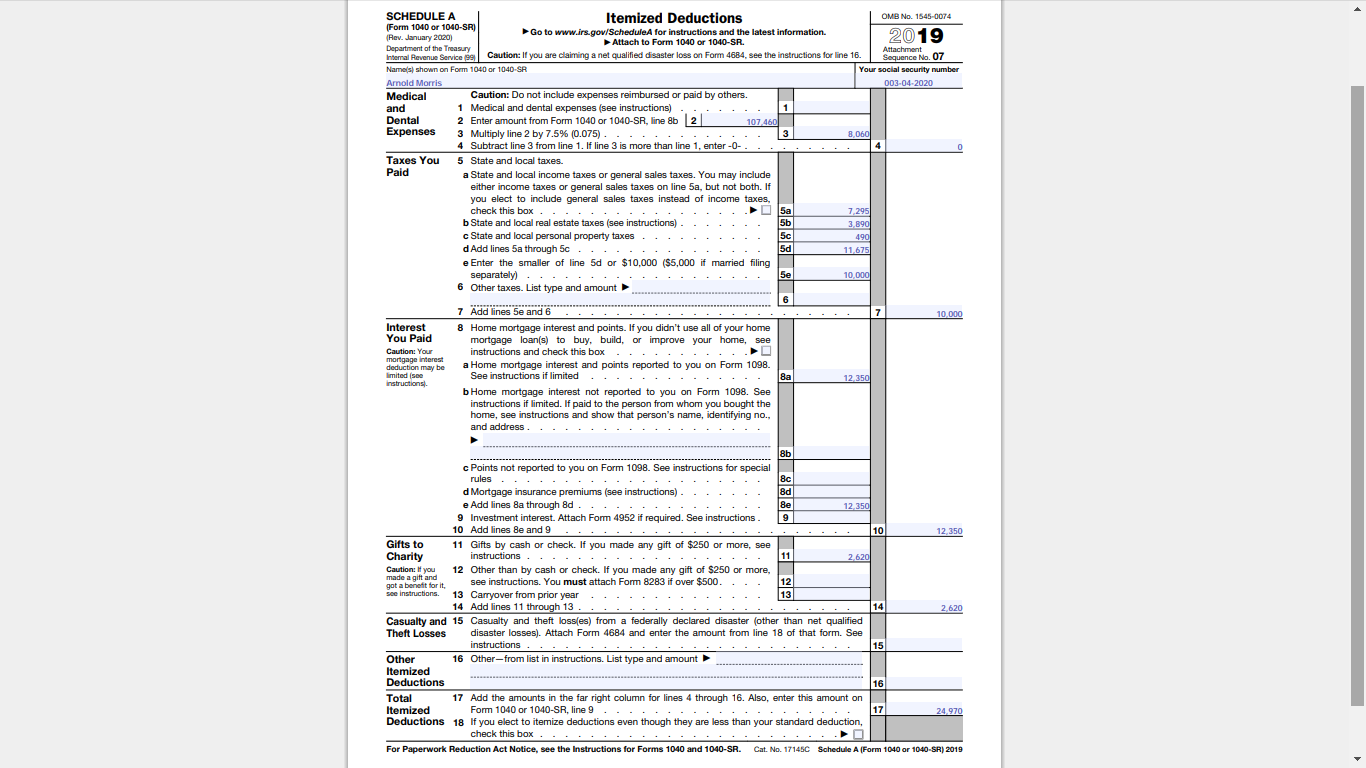

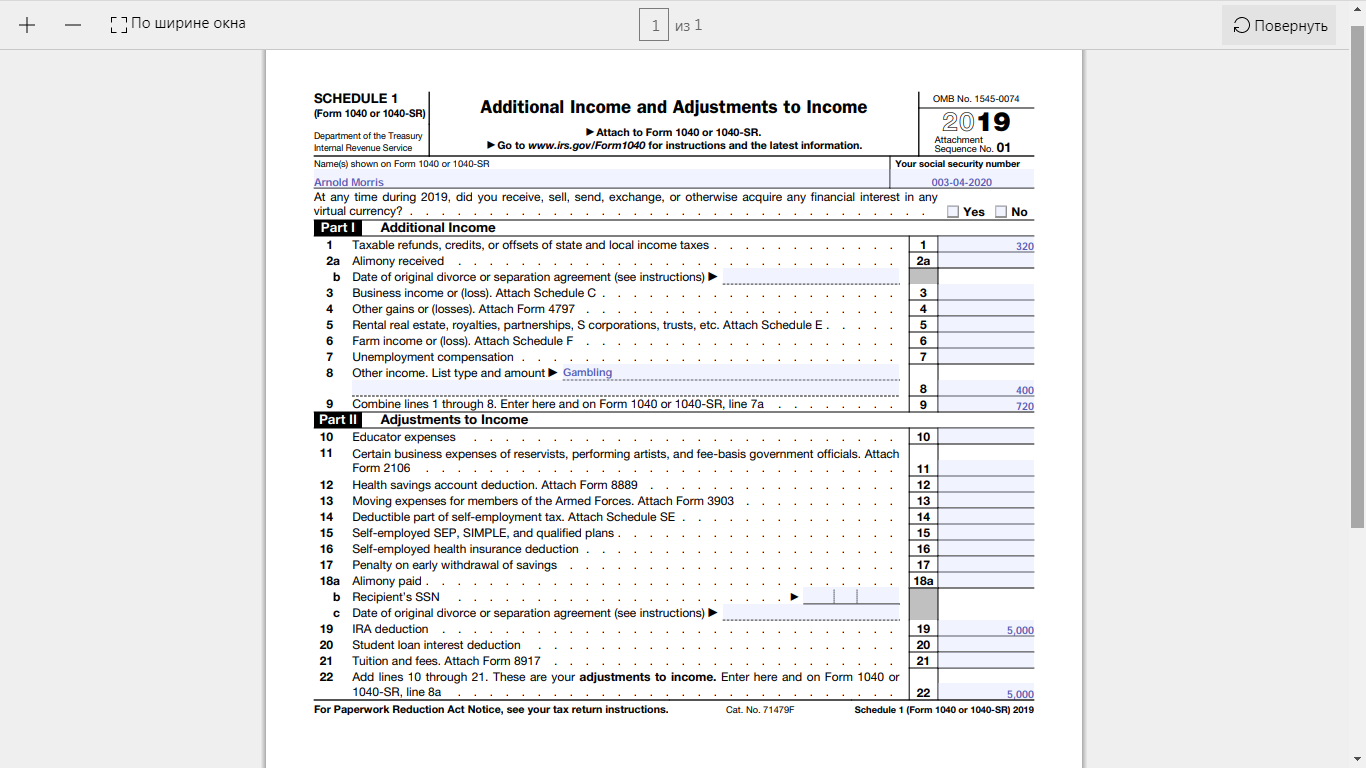

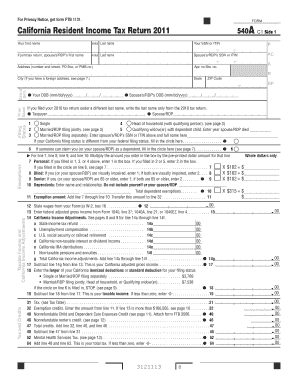

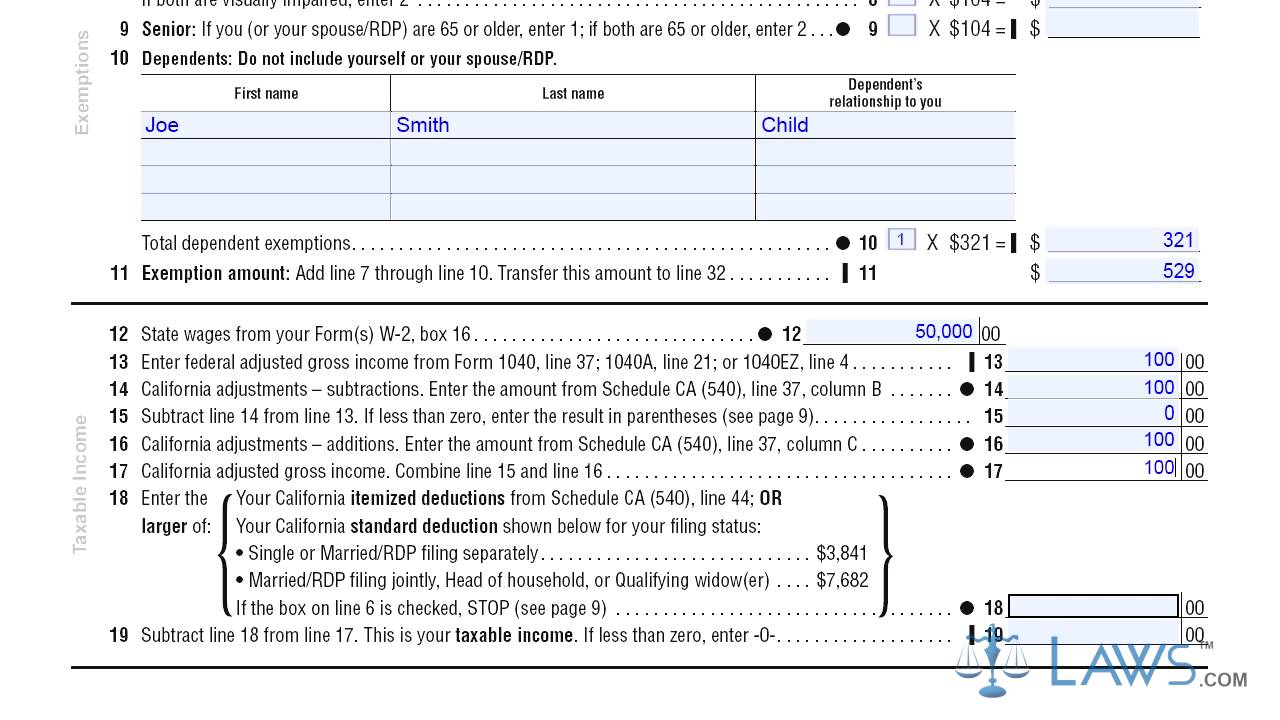

Get form 540 california resident income tax return at ftbcagovforms or e file. This table gives you credit of 4537 for your standard deduction 122 for your personal exemption credit and 378 for each dependent exemption you are entitled to claim. This form is for income earned in tax year 2019 with tax returns due in april 2020.

Follow the links to popular topics online services. Use form 540 2ez. You are marriedrdp and file a separate tax return.

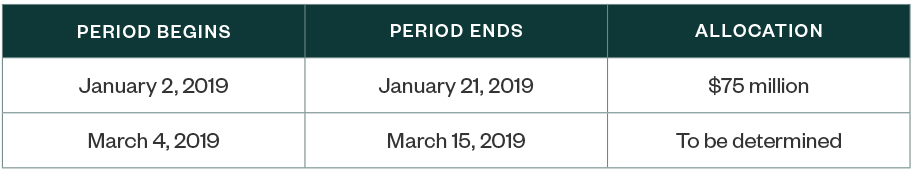

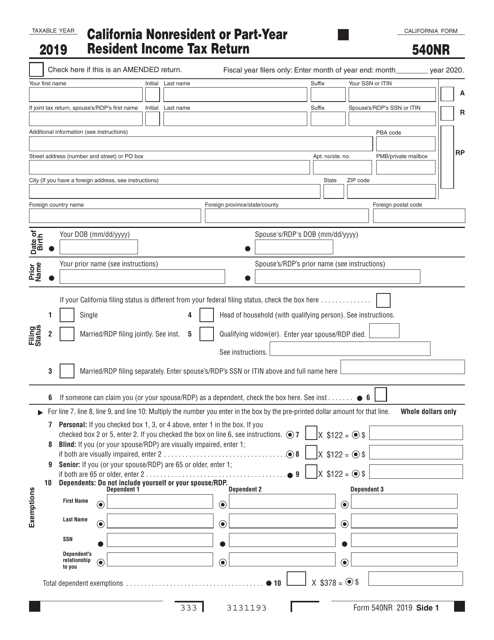

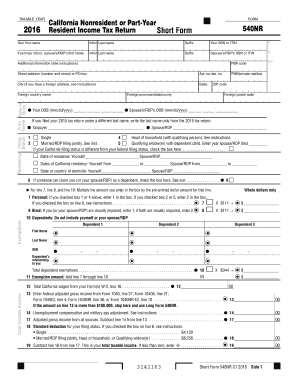

Earned income thresholds have also increased. The undersigned certify that as of june 22 2019 the internet website of the franchise tax board is designed developed and maintained to be in compliance with california government code sections 7405 and 11135 and the web content accessibility guidelines 21 or a subsequent version june 22 2019 published by the web accessibility. Use form 540nr california nonresident or part year resident income tax return.

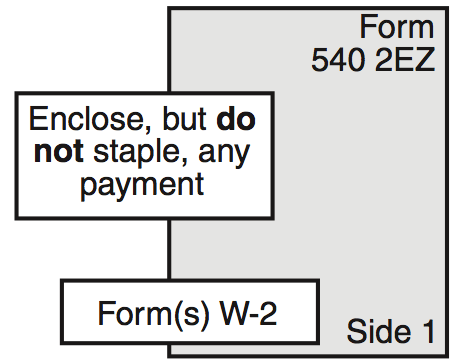

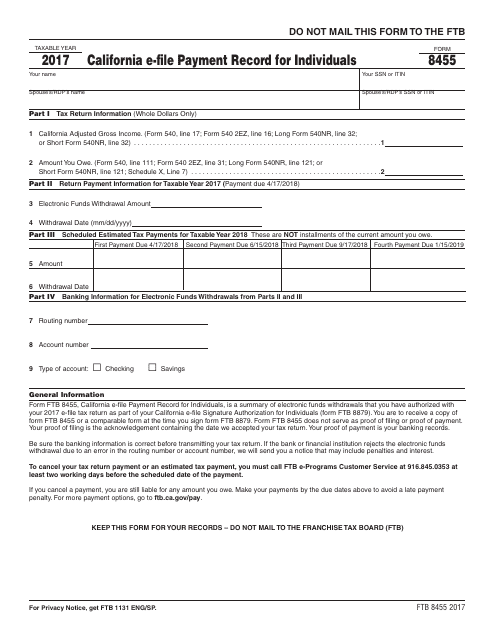

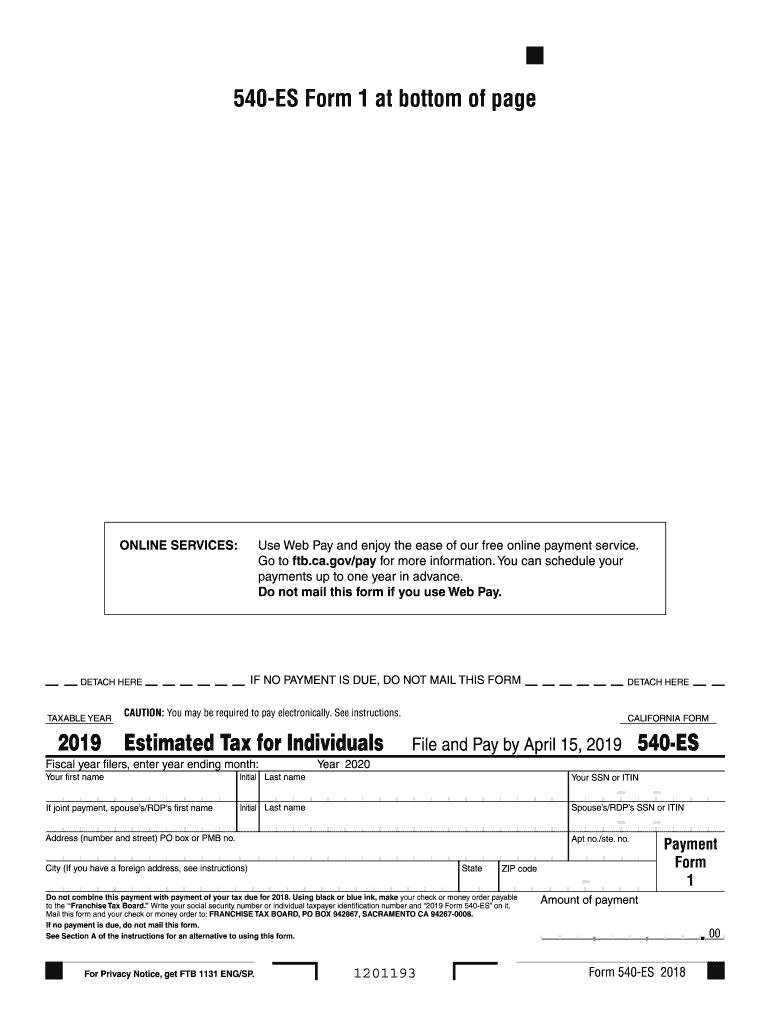

Log in to your myftb account. California state income tax form 540 must be postmarked by july 15 2020 in order to avoid penalties and late fees. Additional information see instructions street address number and street or po box.

We last updated the california resident income tax return in february 2020 so this is the latest version of form 540 2ez fully updated for tax year 2019. We will update this page with a new version of the form for 2021 as soon as it is made available by the california government. This form is for income earned in tax year 2019 with tax returns due in april 2020.

We will update this page with a new version of the form for 2021 as soon as it is made available by the california government. Check here if this is an amended return. 2019 tax table for form 540 2ez single filers.

Printable california state tax forms for the 2019 tax year will be based on income earned between january 1 2019 through december 31 2019.

/28061847524_d276393b0a_k-226e784d8d3846f4a1491612274b125d.jpg)

/california-state-taxes-amongst-the-highest-in-the-nation-3193244-finalv2-8a746a2ad14c4fba8d21382f812c7c76.png)