California Ui Rate Lookup

File for unemployment overview unemployment insurance.

California ui rate lookup. Californias labor market by the numbers. How to enroll. As a result of the ratio of the california ui trust fund and the total wages paid by all employers continuing to fall below 06 the 2020 sui tax rates will continue to include a 15 surcharge.

For more information refer to how unemployment insurance benefits are computed pdf or the unemployment insurance benefit table pdf. Ui online is the fastest and most convenient way to file or reopen your claim certify for benefits and get up to date claim and payment information. Once you file your claim the edd will verify your eligibility and wage information to determine your weekly benefit amount wba.

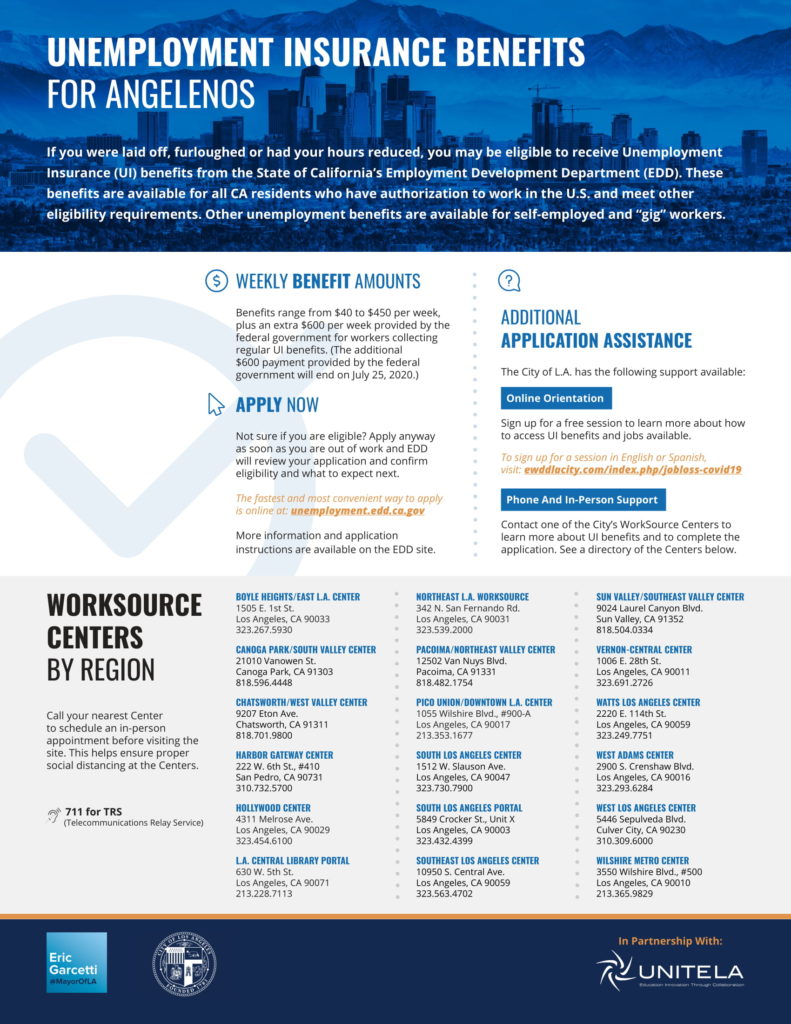

If you are out of work or have had your hours reduced you may be eligible to receive unemployment benefits. Learn how to qualify for unemployment benefits. Enroll as an employer.

All other services are available 24 hours a day 7 days a week. Then follow these steps to register and apply for unemployment certify your benefits and manage your claim. Log in or register benefit programs online.

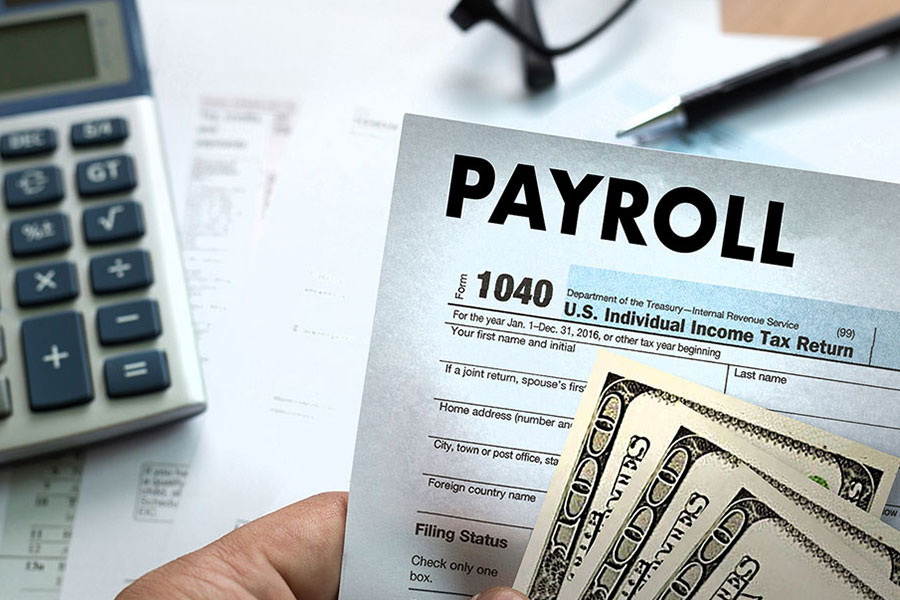

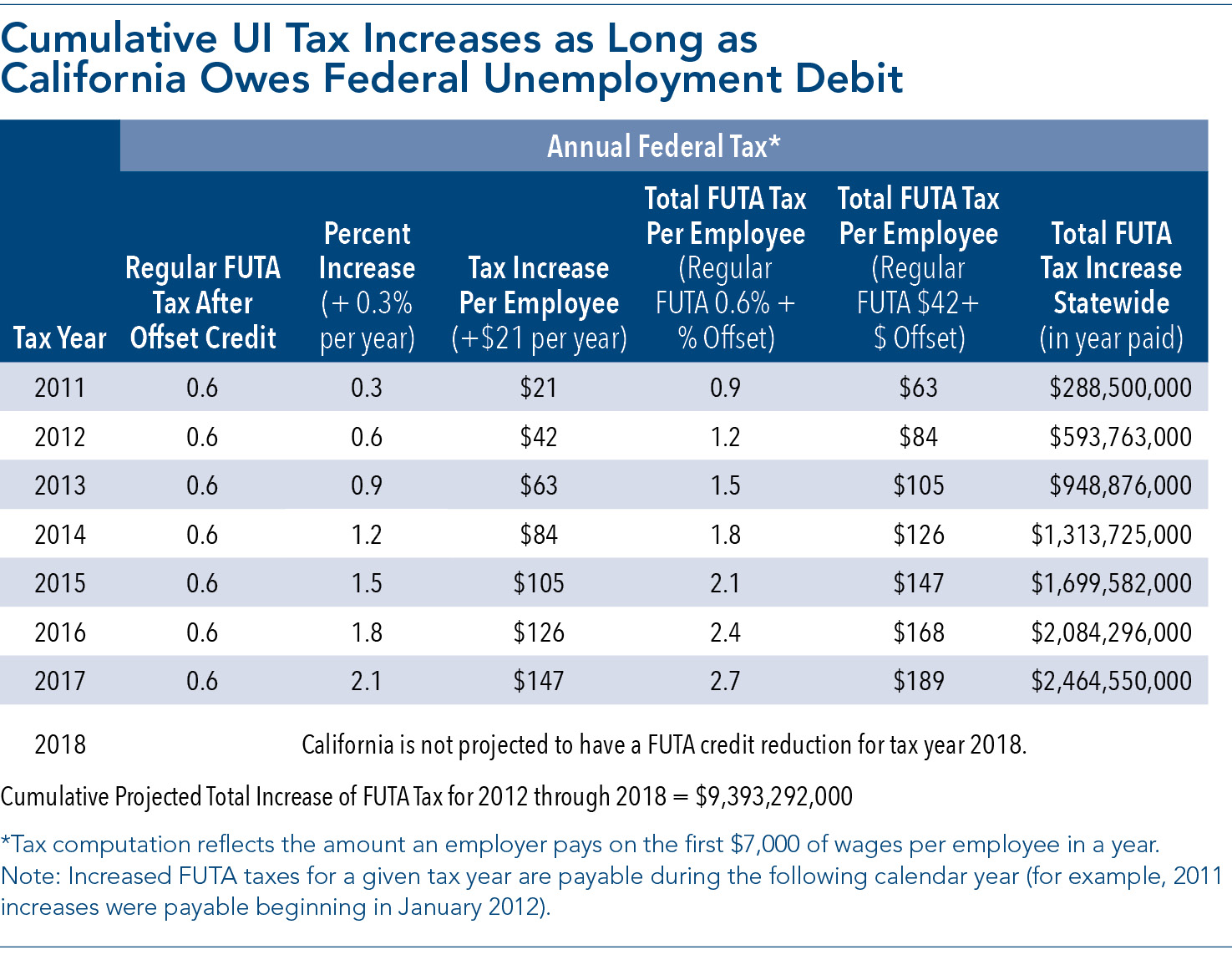

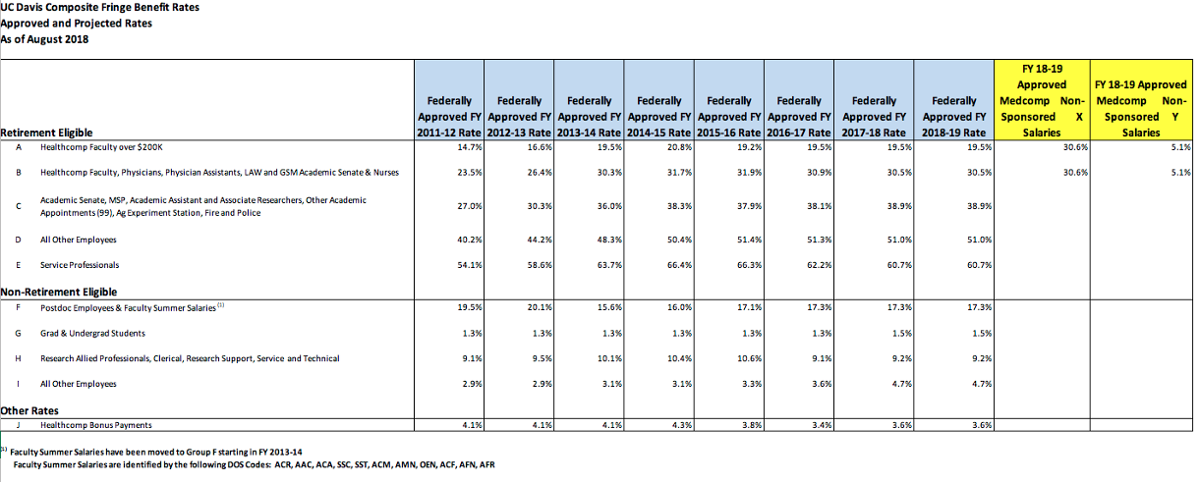

State disability insurance sdi tax. Unemployment insurance trust fund surcharge. You are assigned a 34 percent ui tax rate for a period of two to three years.

Ui online mobile sm is available for smartphone and tablet users. Enroll for a username and password to use employer services online. California system of experience rating de 231z pdf.

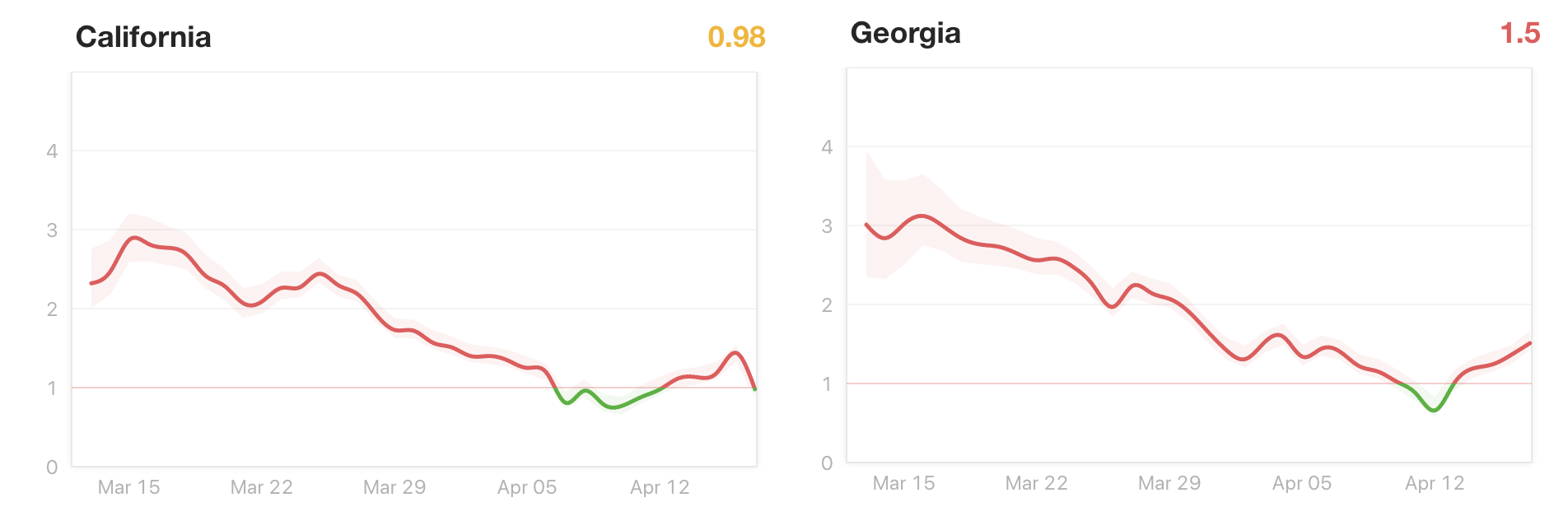

Enter your employer payroll tax account number. To access your 2020 ui rate. Californias month over non farm payroll job loss of 2344700 2 for april is the largest.

To 12 midnight pacific time 7 days a week. For more information about how your ui rate is determined refer to information sheet. This will depend on when you meet the criteria under section 982b of the california unemployment insurance code cuic.

Select get my ui rate. Mailing of 2020 rate notices and protest deadline. Unemployment rate and labor force.

Home by customer by subject by geography data library online services each month the employment development department releases revised and preliminary civilian labor force unemployment rates and industry employment by geography for california metropolitan areas counties and sub county areas. Take the necessary steps. The tax rate is set at 01 percent 001 of ui taxable wages for the employers with positive ui reserve account balances and employers subject to section 977c of the california unemployment insurance code.

Select view your payroll tax rates under more online services. The maximum tax is 7 per employee per year 7000 x001. Enroll as an representative.

The report of new employees de 34 and report of independent contractors de 542 can be filed from 5 am. The states unemployment rate spiked an unprecedented 10 percent in april to 155 percent 1 eclipsing the previous record high rate in the current data series of 123 percent at the height of the great recession march october and november of 2010.