Covered California Bronze Plan

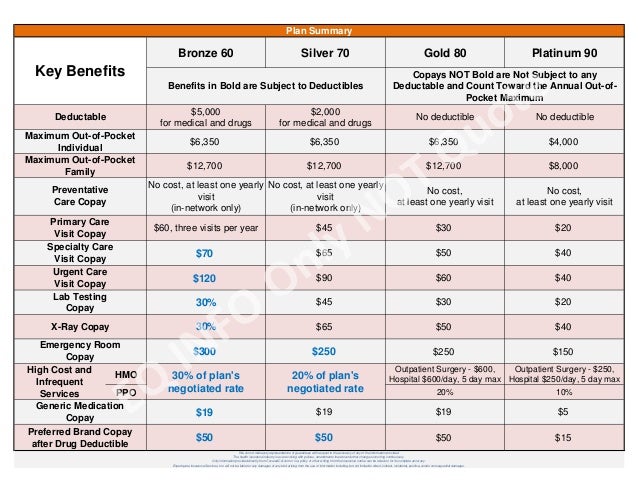

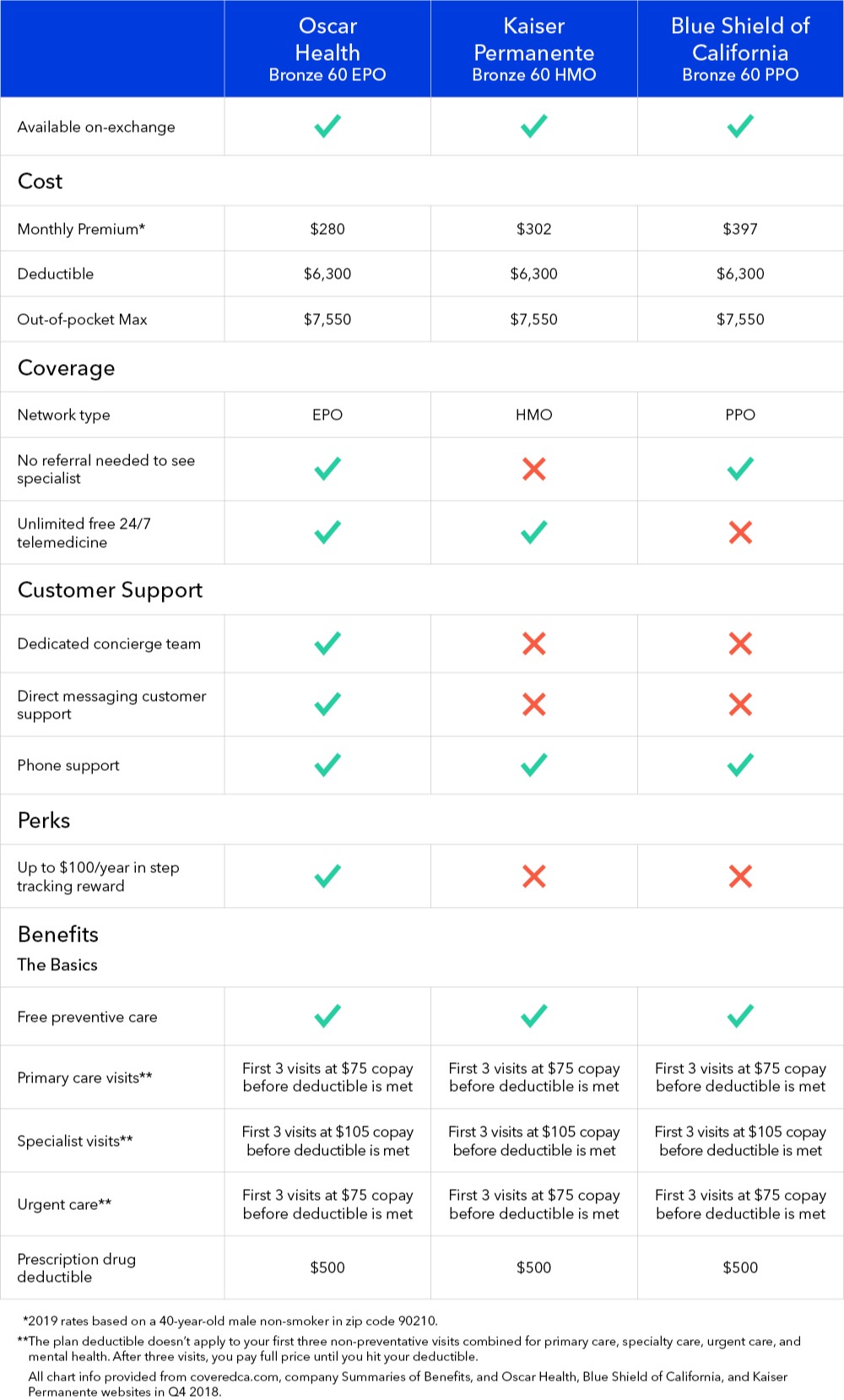

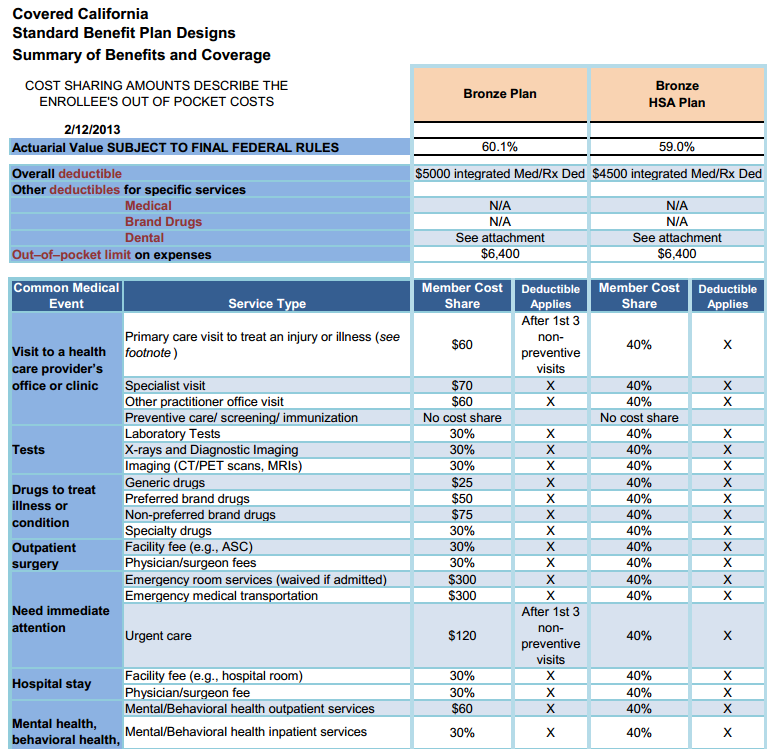

Bronze 60 plan when comparing these 2 plans the main factors are the premium cost the 3 free primary care office visits a year and the deductible.

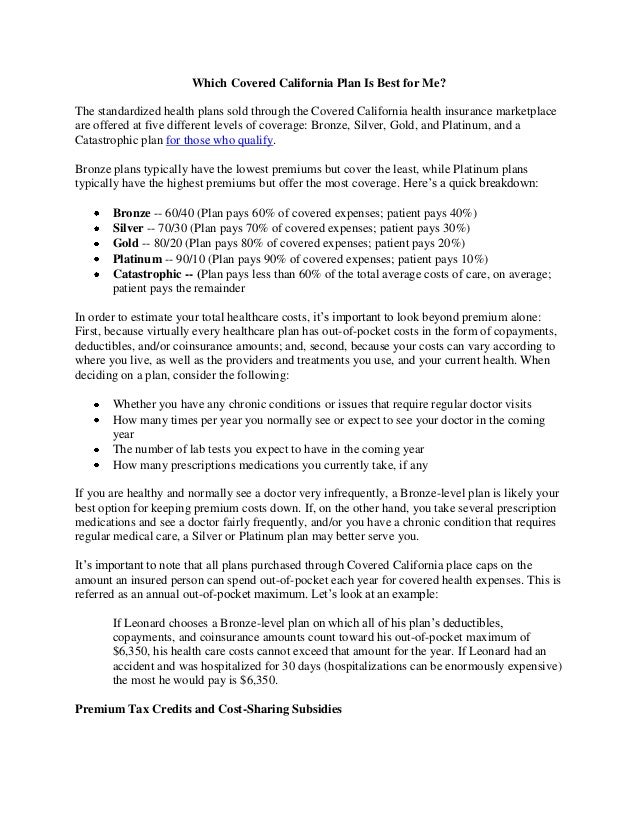

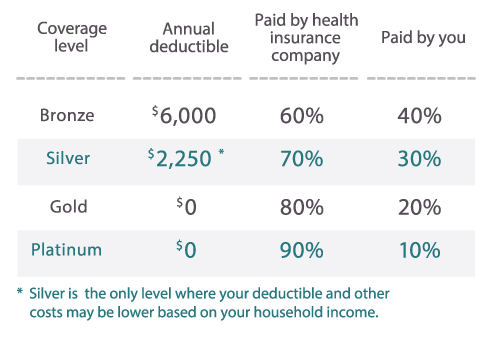

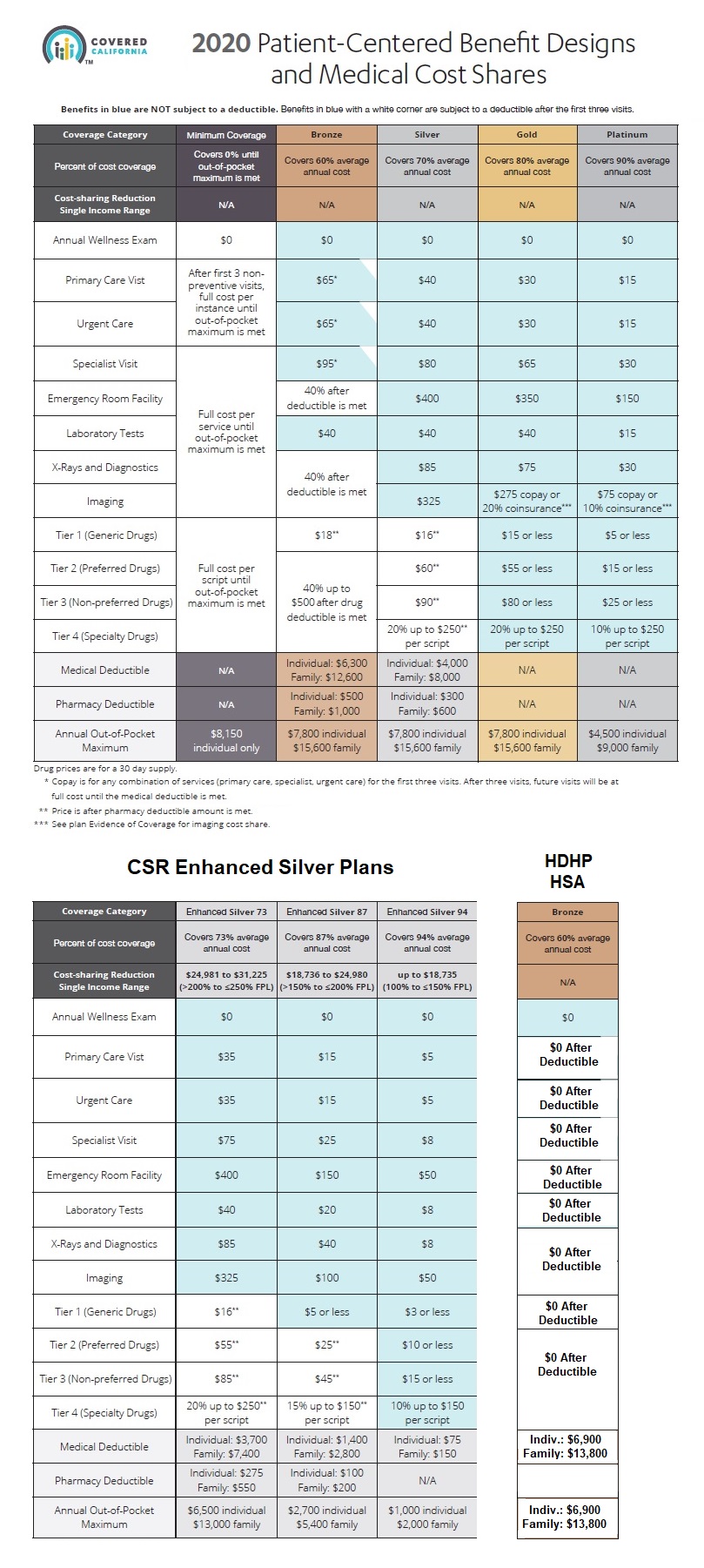

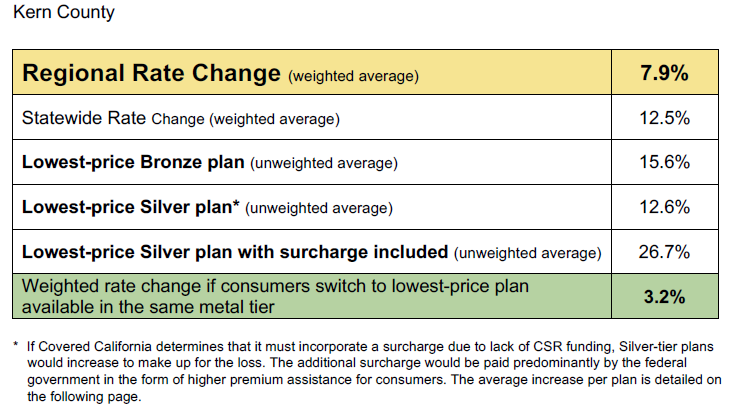

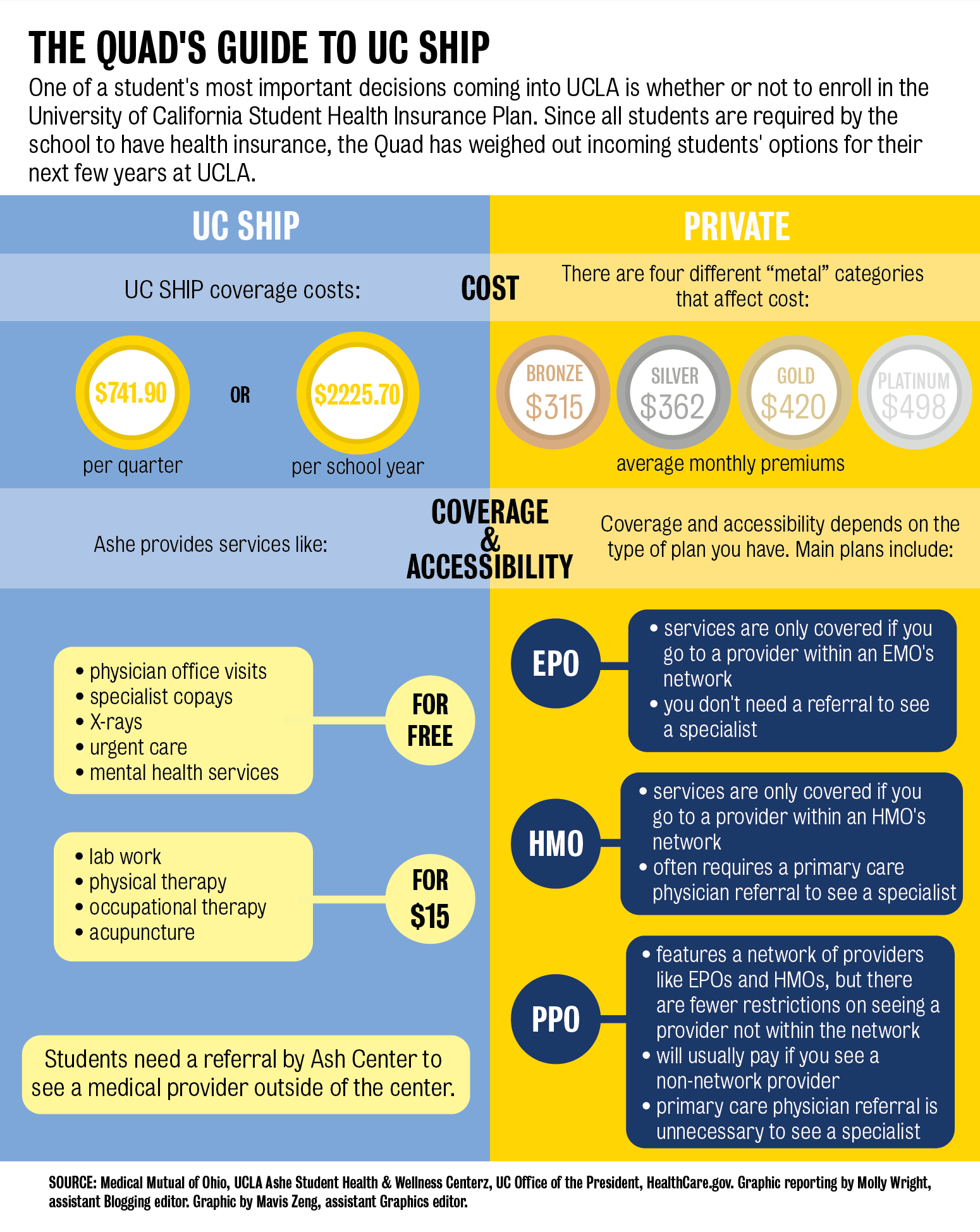

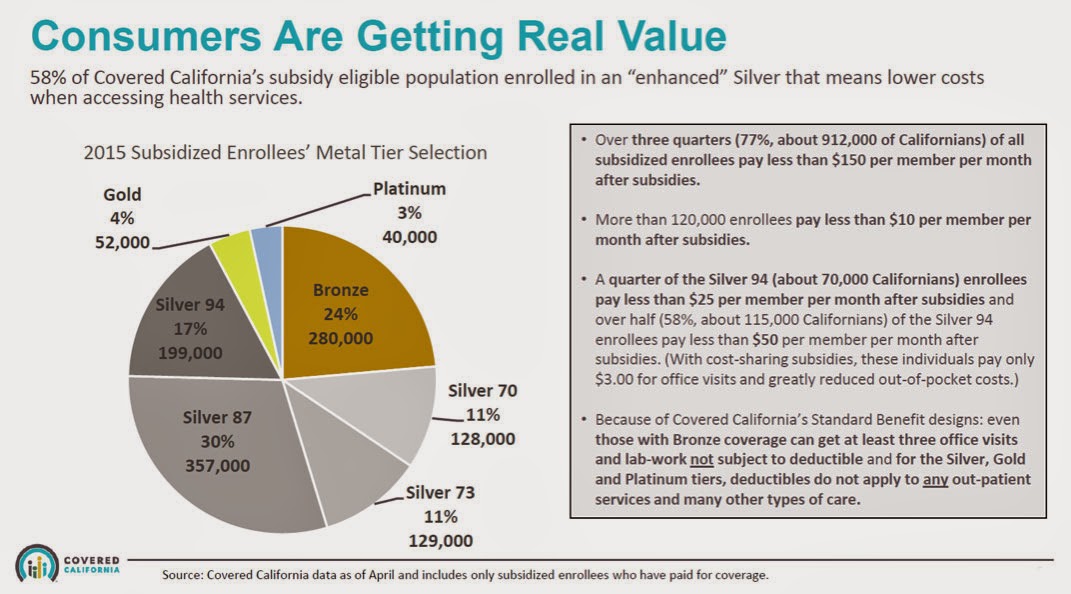

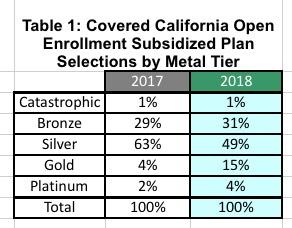

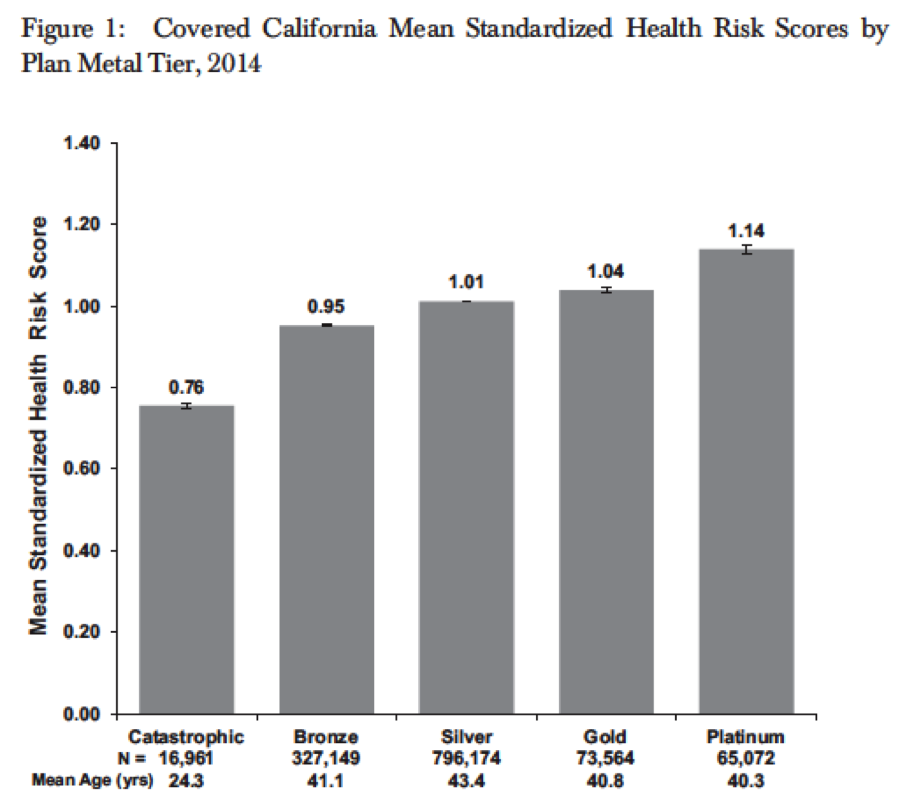

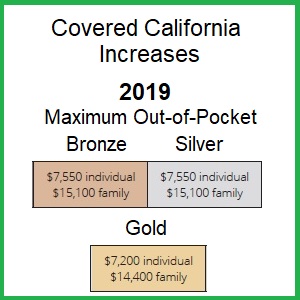

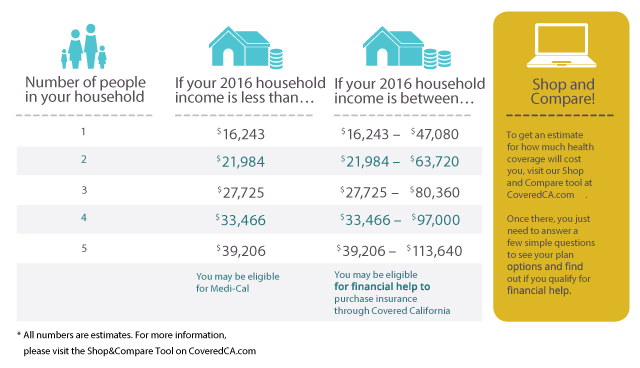

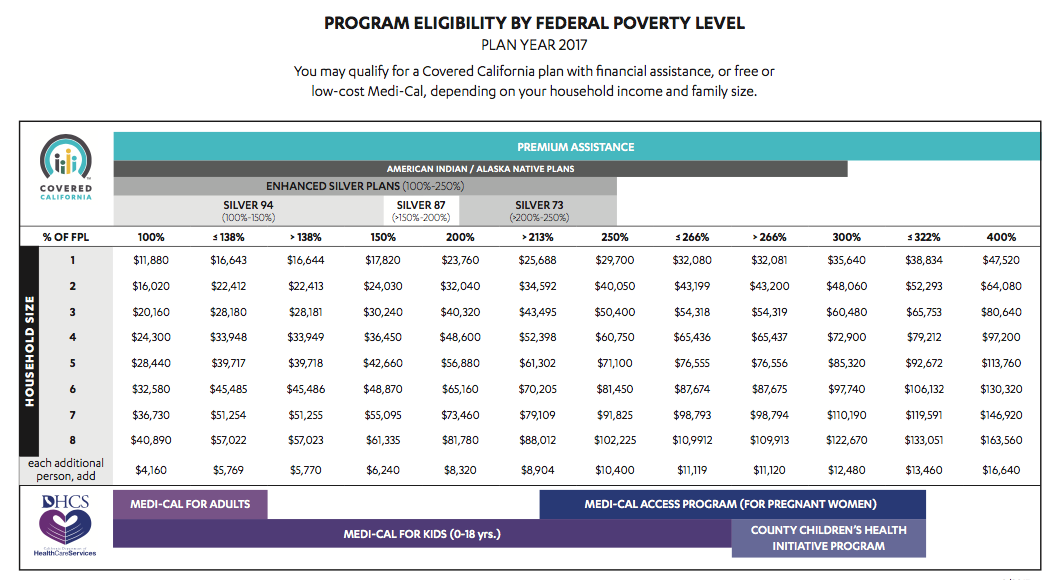

Covered california bronze plan. Covered californias bronze plan covers 60 of your annual medical services on average and is the least expensive plan available that qualifies for premium assistance. As the metal category increases in value so does the percentage of medical expenses that a health insurance plan covers compared with what you are expected to pay in copays and deductibles. In most plans the deductible applies only to inpatient services and prescription drugs.

This plan offers a low monthly premium. Also it gives you the peace of mind of knowing you have coverage in the case of a catastrophic event. See cost savings below.

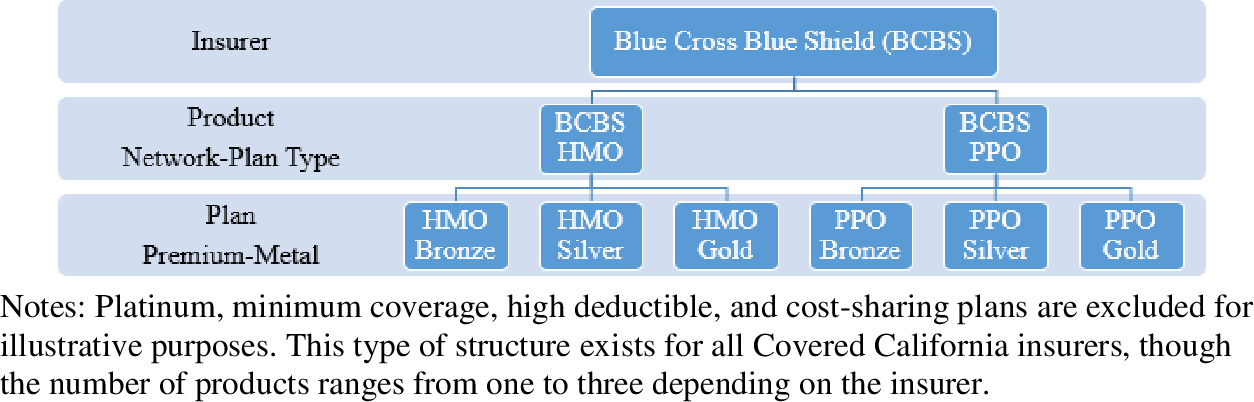

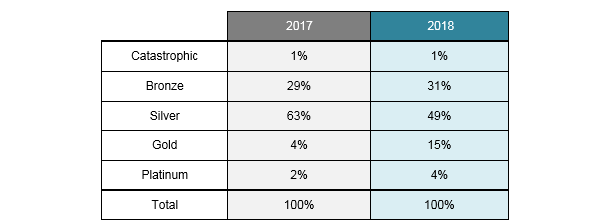

Covered california health insurance plans and all health plans in the individual and small group markets are sold in four primary levels of coverage. Covered california offers two bronze 60 plans. Coinsurance is a percentage you pay for a service with the plan covering the remainder.

The minimum coverage plan usually wins on premium cost and since the first 3 primary care visits a year are free it gives better benefits than the bronze 60. Prescription drugs not covered by a health plan in general you will need to ask your doctor to help you file an appeal so that your health insurance company grants you an exception. Bronze silver gold and platinum.

Or ask your doctor if alternative drugs that are covered could substitute for the drug you need. Subsequent visits are full cost until the deductible is met. Generally we recommend the standard bronze 60 plan over the bronze 60 hsa plan because you will have lower out of pocket costs.

Bronze 60 plan members will pay no more than 500 per 30 day supply.