Do I Have To Pay Back Covered California

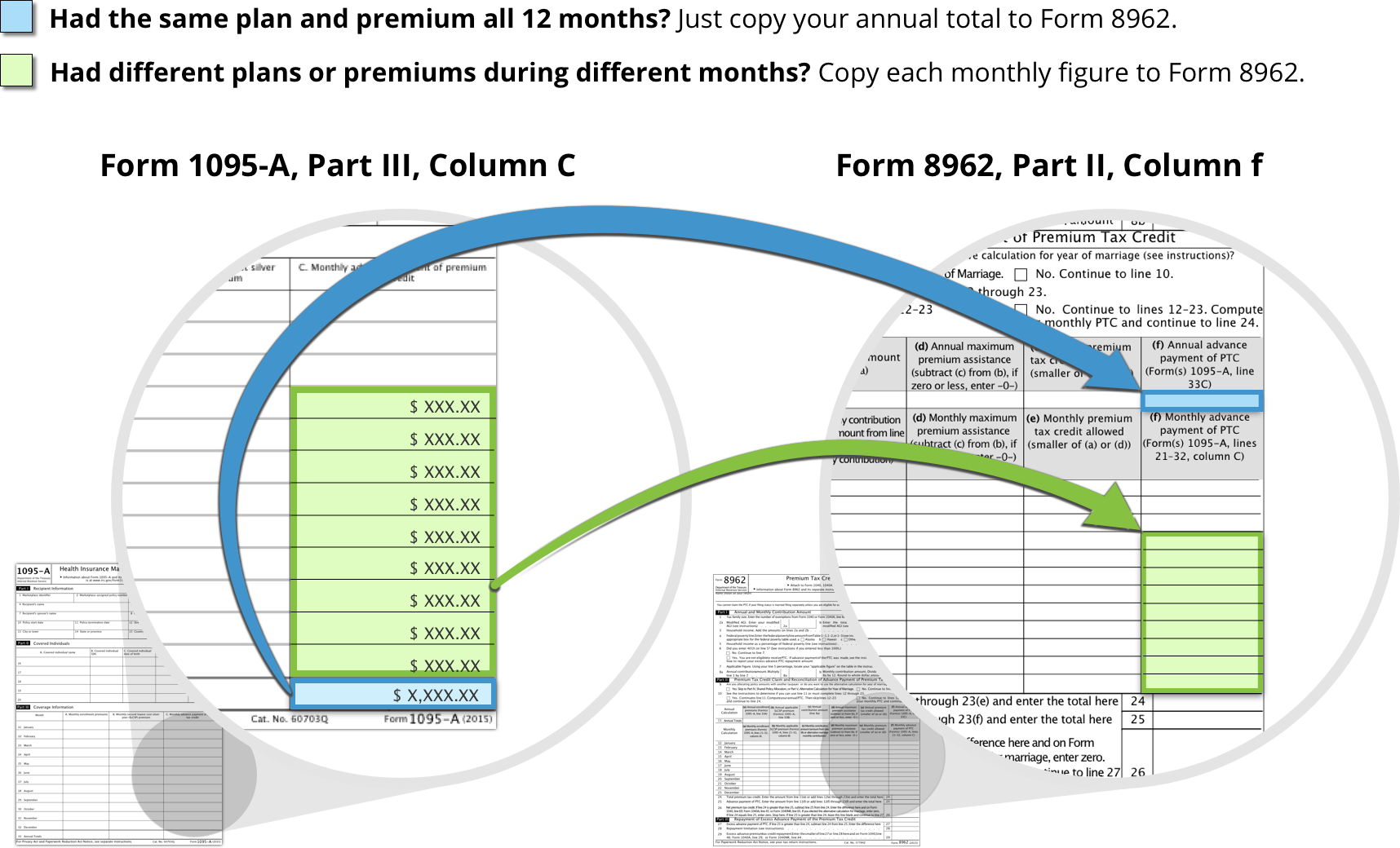

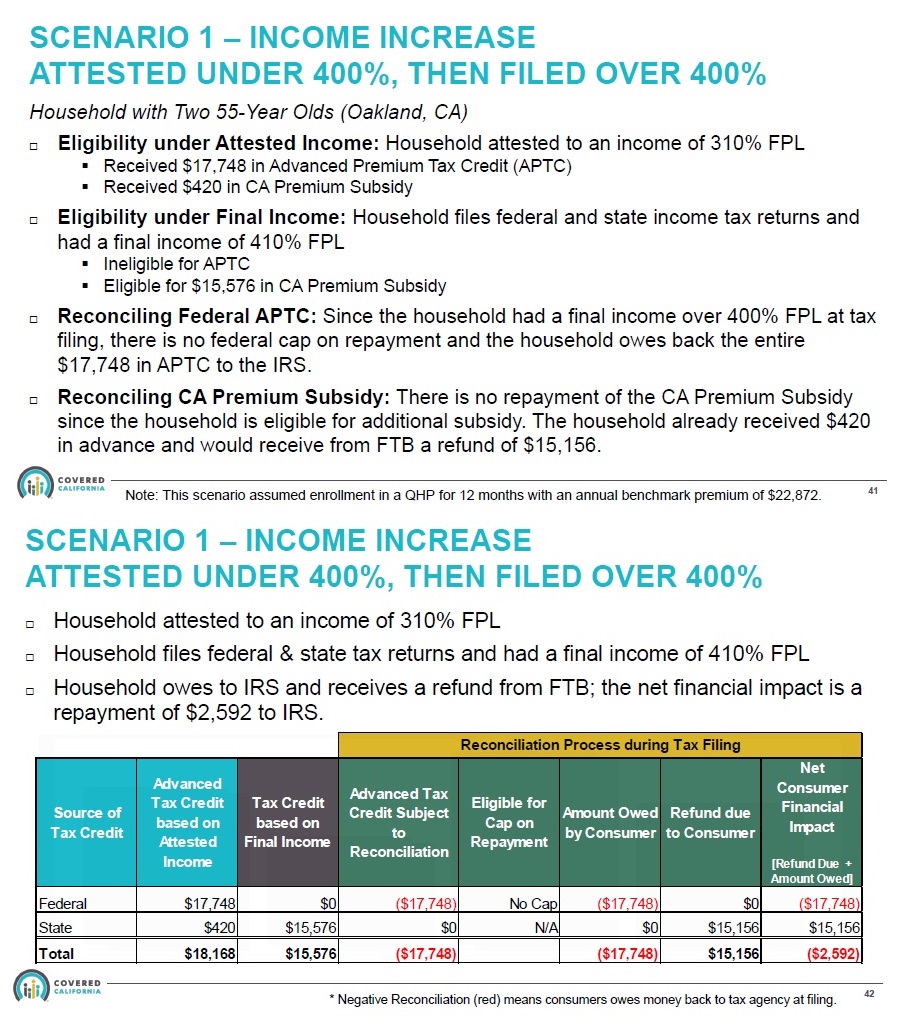

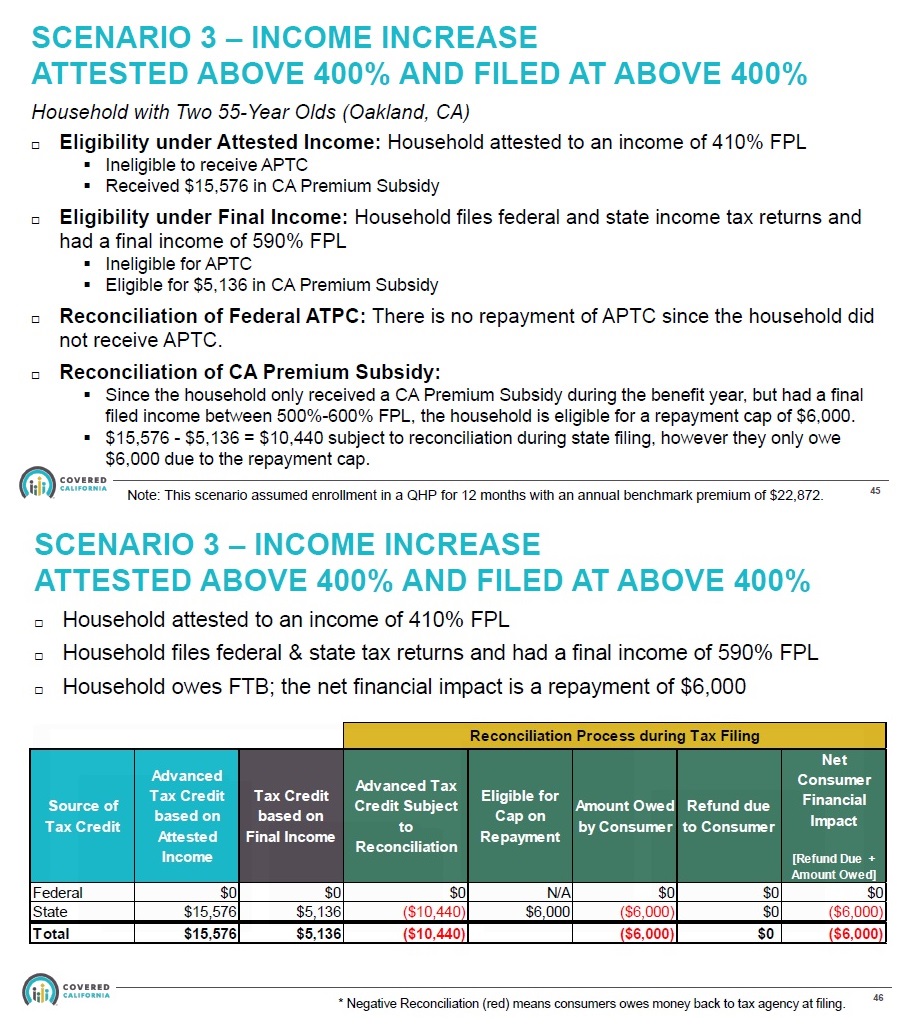

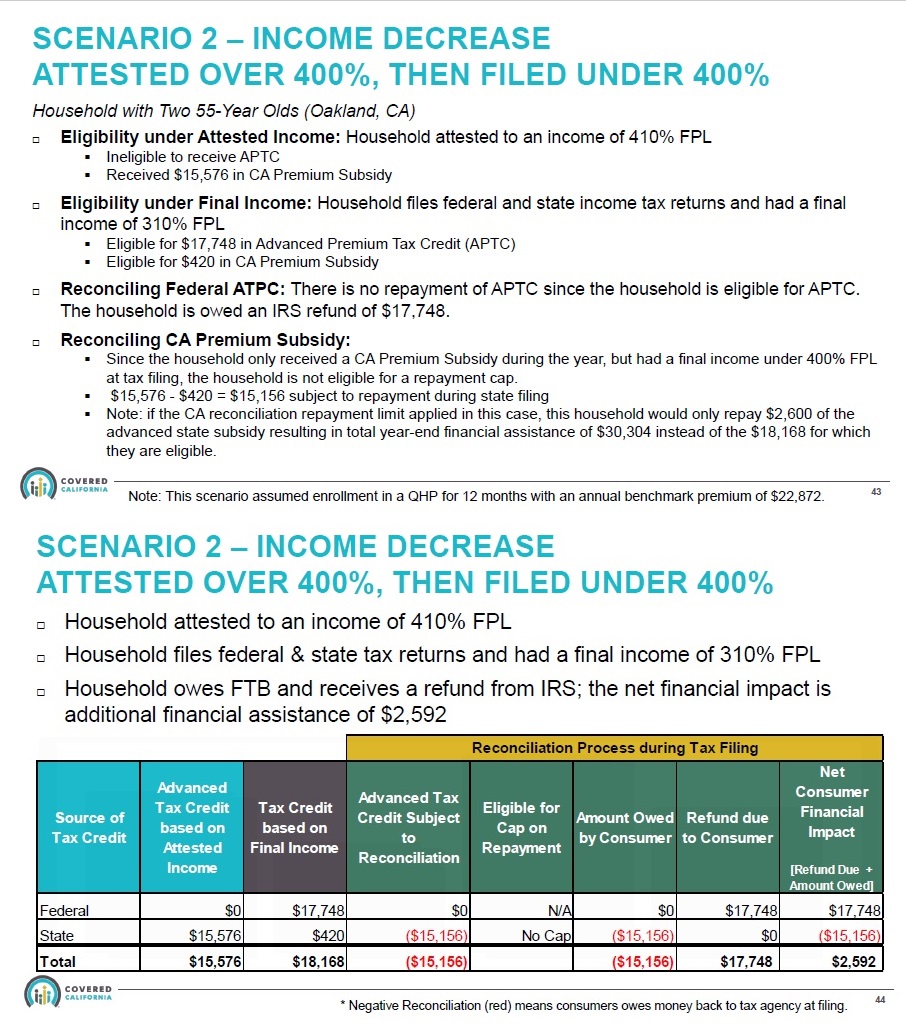

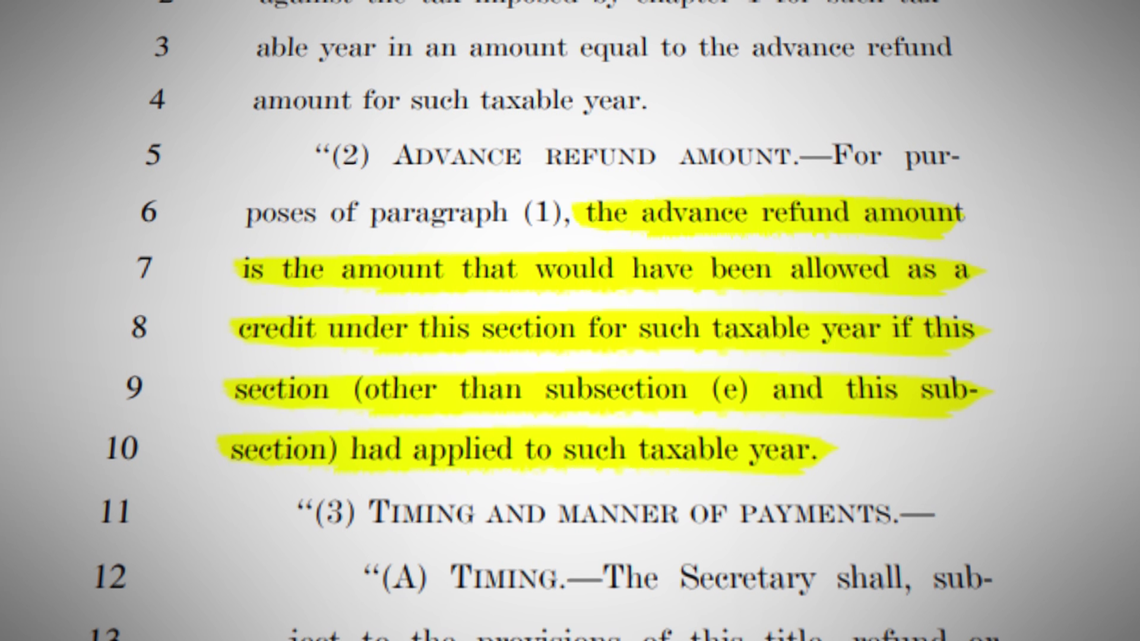

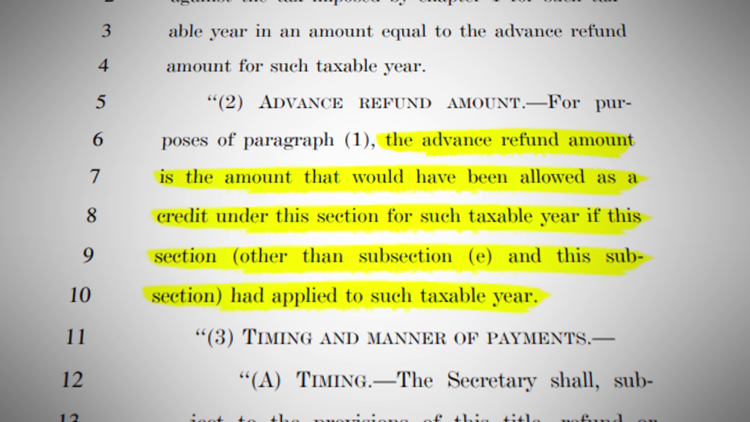

If this happens you may get money back when you file your taxes or you will have to repay the extra amount you received when you file taxes.

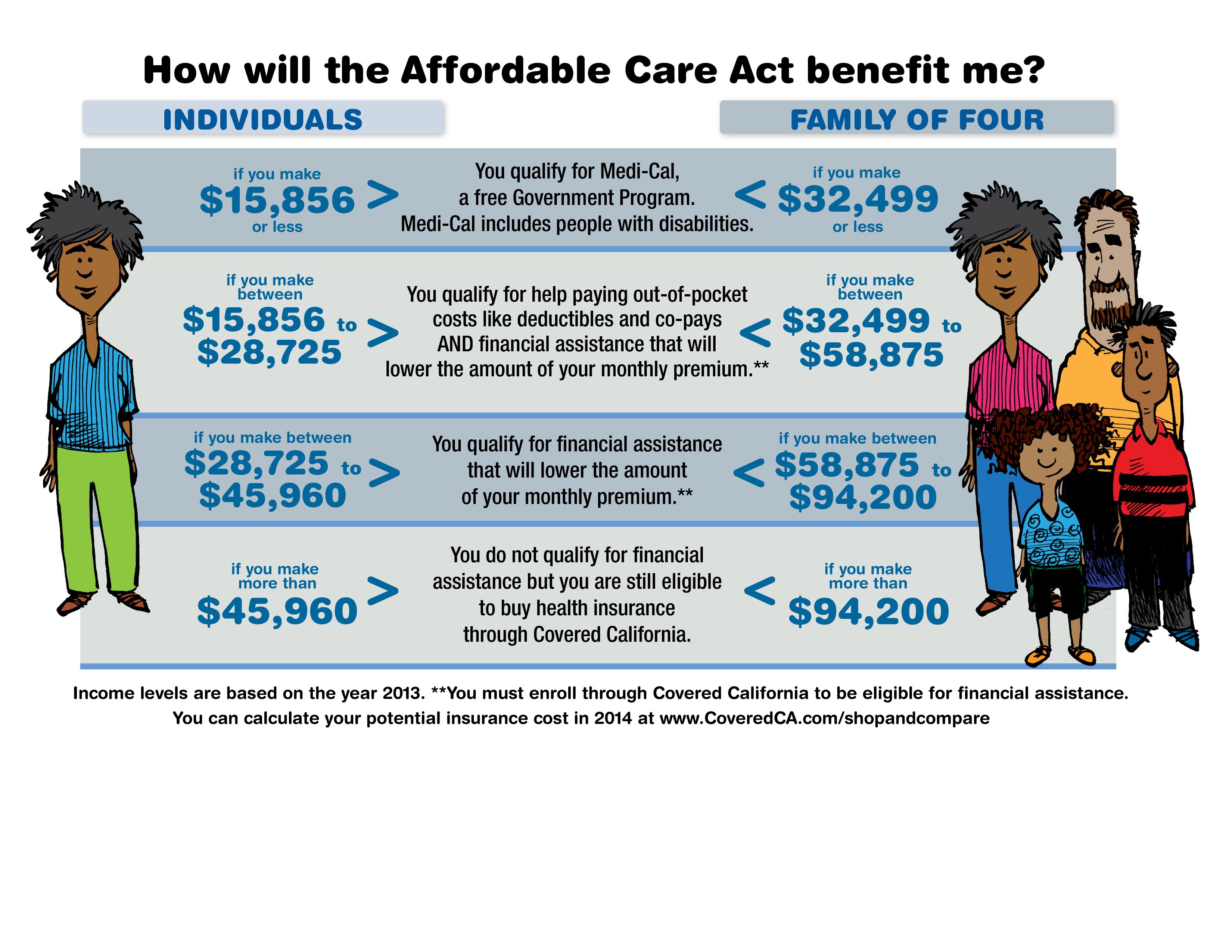

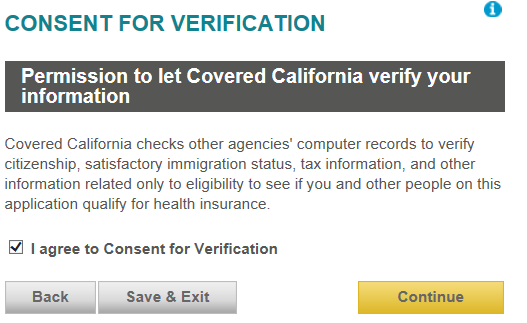

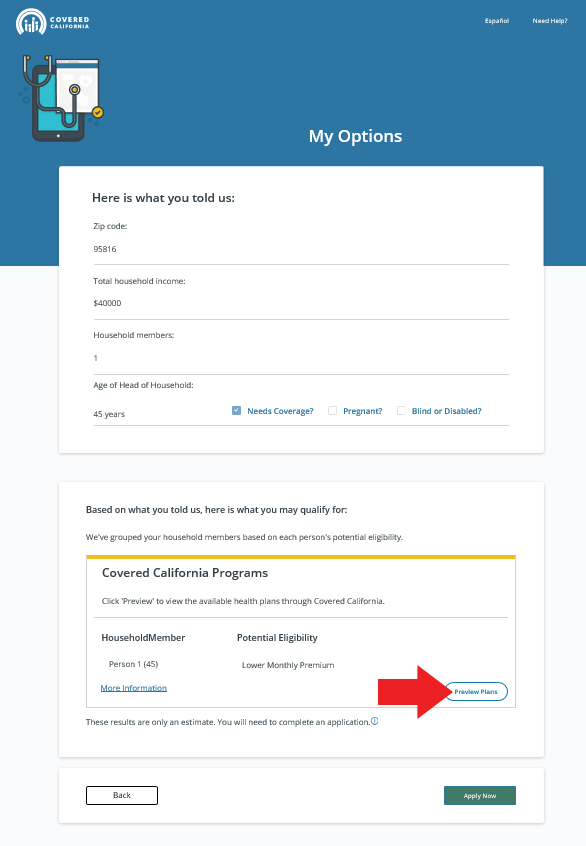

Do i have to pay back covered california. Speak with a covered california certified agent. Companies have to submit a form which shows the employees that they enroll on group health plans. Covered californias answer is generally no.

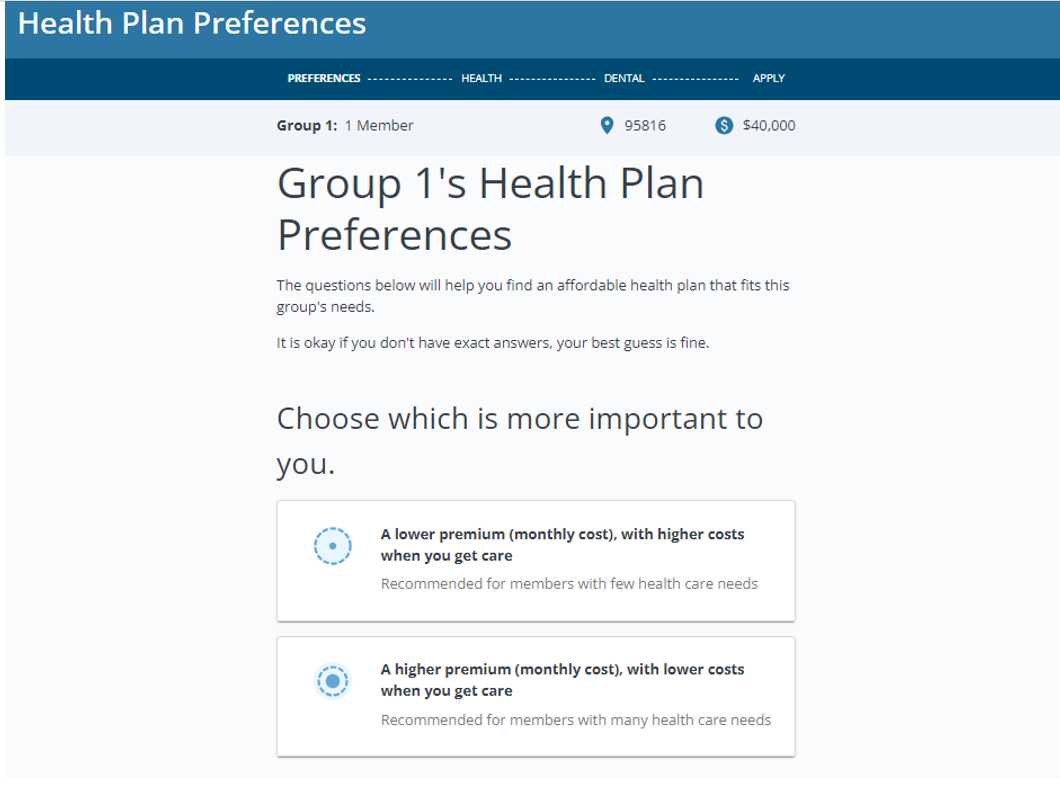

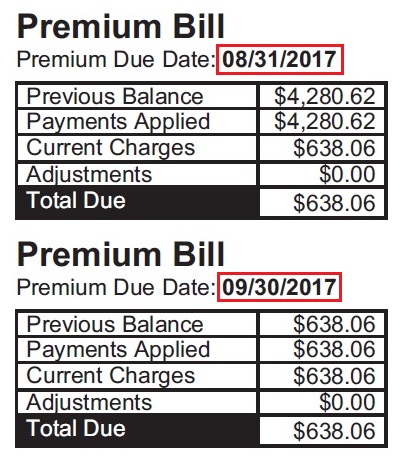

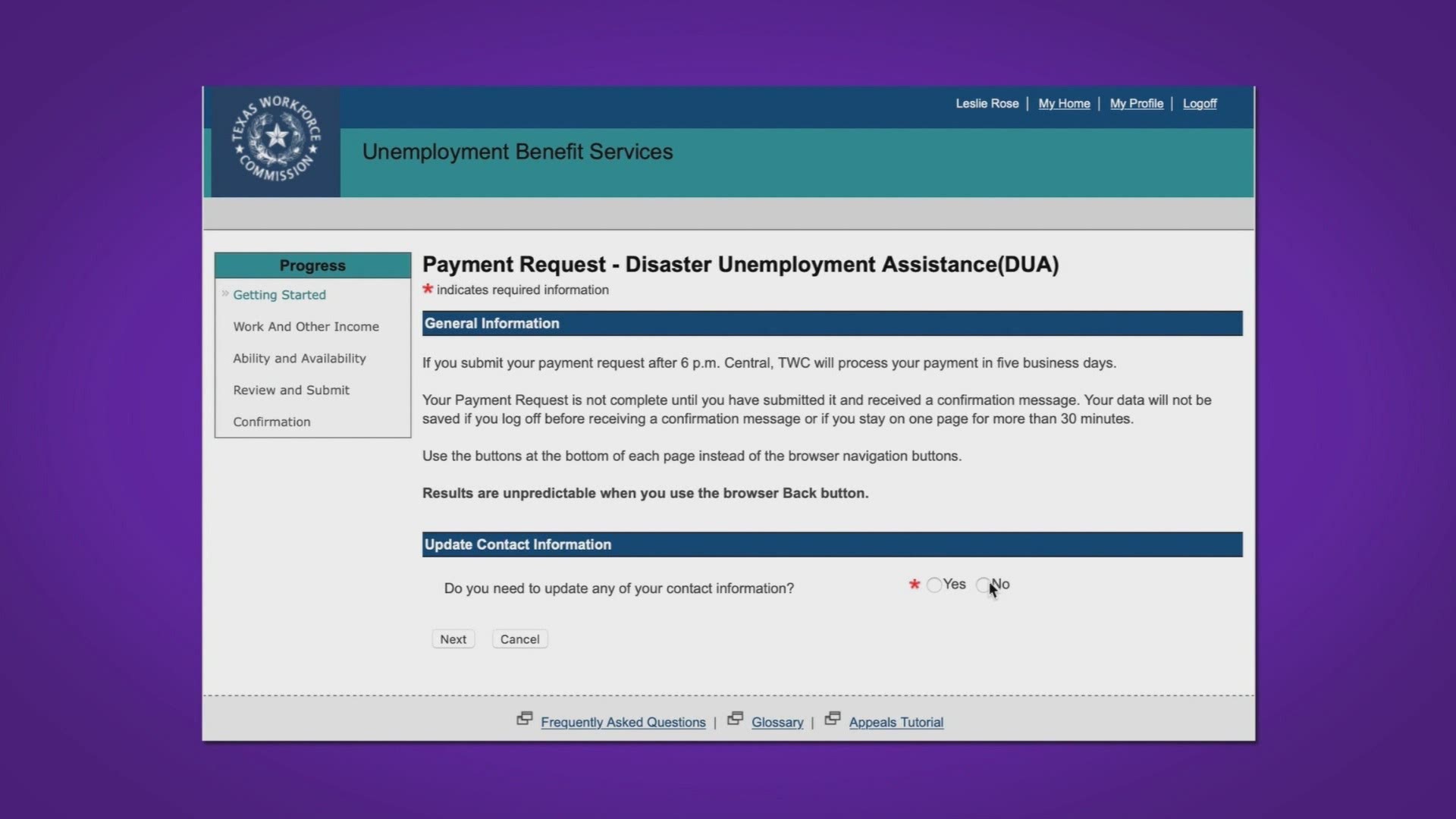

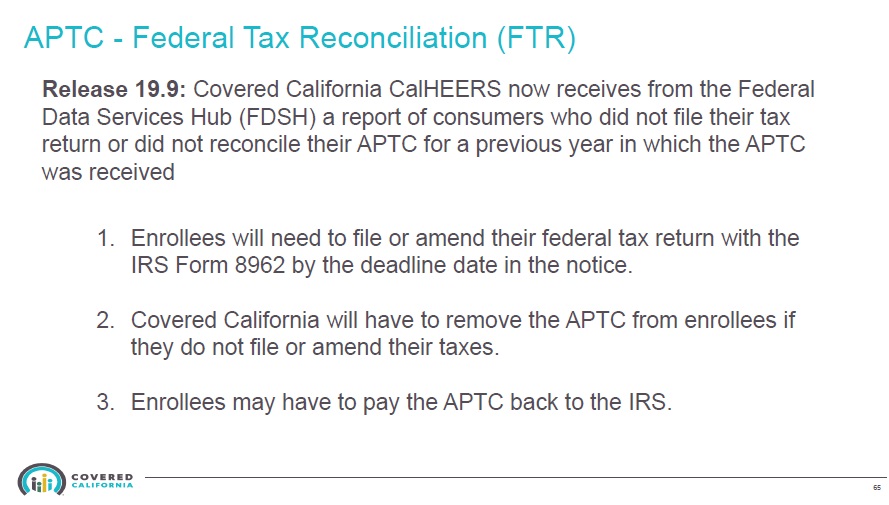

The irs will compare this with the exchange tax credit list. It is possible that you will qualify for more or less financial help than you received because at the end of the year your income or your tax household size was different from what you reported to covered california. If you have not received a bill contact your selected plan or make your first payment using the specific information listed below for each company.

It means they will have to pay back some of the subsidies they received. It is your responsibility to report this change to covered california. Now you need to pay your premium for your coverage to start.

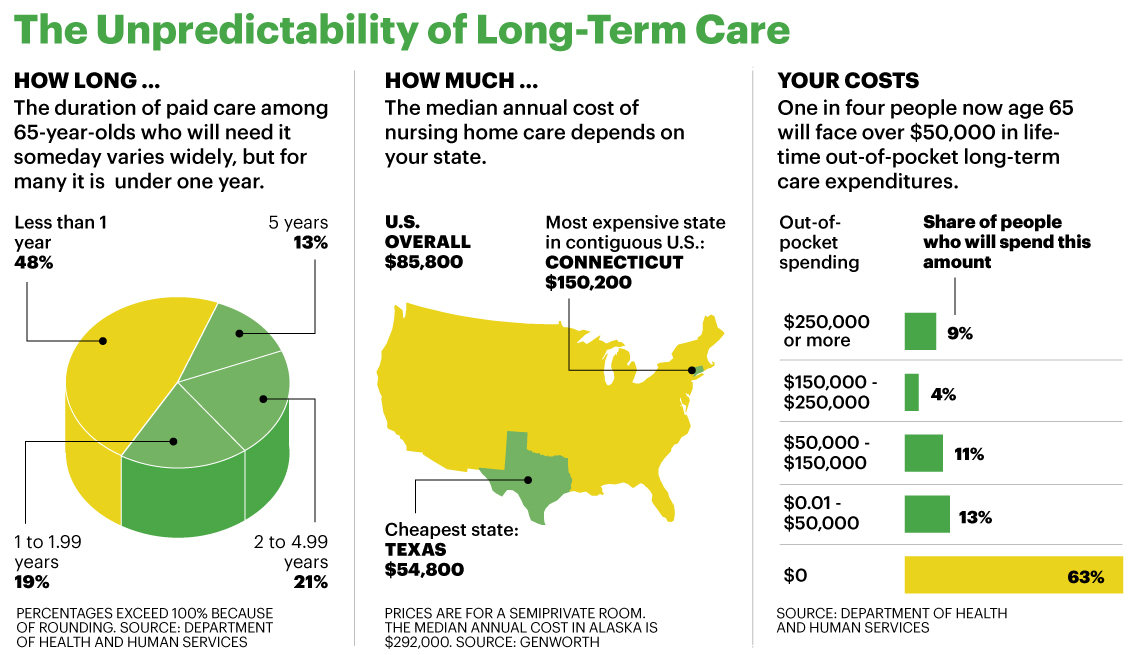

There are many people that taking tax credits and may have to pay it all back in april. If your income is below 400 of the federal poverty level there is a cap on the amount youll have to pay back even if you received more in assistance than the amount of the cap. A change in income this year should report it promptly to covered.

If you get a bill from your health insurance plan or family dental plan please follow the instructions on the bill for making a payment. If youre names on both that could be trouble. If we go over the tax credit cap see amounts above well have to pay back the entire tax credit.

Was less than 48500 you wont pay back more than 600. However at higher income levels youll have to pay back the entire amount you received which could be a lot. Congratulations on enrolling in a health insurance plan through covered california.

Its important to keep covered california updated about these changes so that your financial help can be adjusted if needed. Member supported news for southern california. If your income was over 400 of the fpl you will have to pay back all of the premium assistance.

If your income is verified as eligible for premium assistance and then later you become medi cal eligible you do not have to repay the premium assistance you received as long as you report the income change within 30 days. If youre a family of four and your 2017 income. Was more than 47080 you will have to pay back all of any premium tax credit you received in advance.

/short-term-disability-basics-1177839_V2-5bbd0f8146e0fb0051d0c4cf.png)