Does State Disability Count As Income For Covered California

Include these in your household income while using the shop and compare tool.

Does state disability count as income for covered california. The sdi program is state mandated and funded through employee payroll deductions. State disability insurance sdi when treated as unemployment compensation 1099 g. Be on company letterhead or state the name of the company.

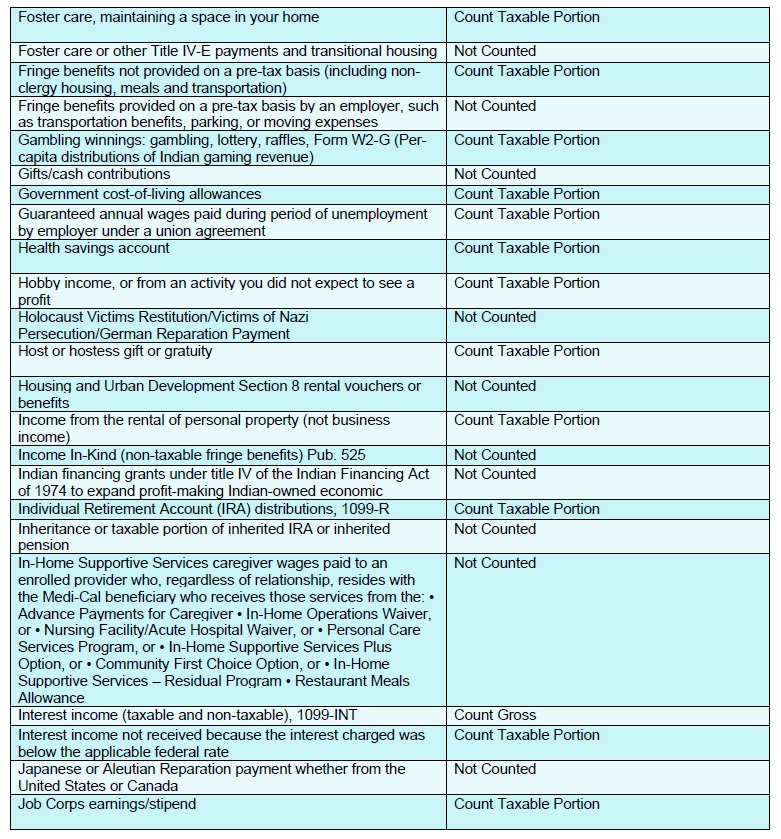

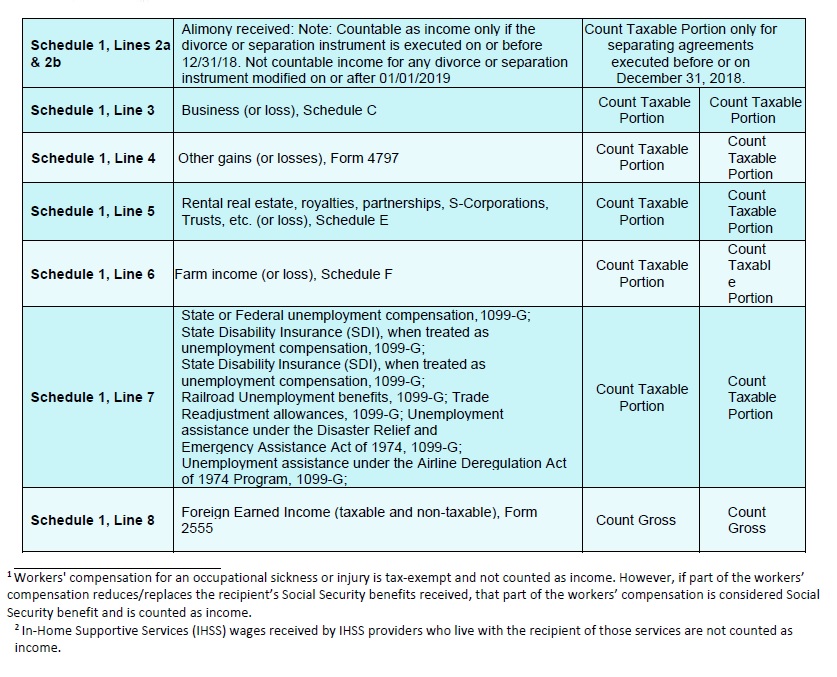

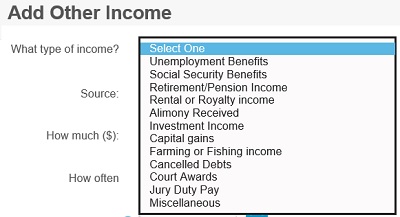

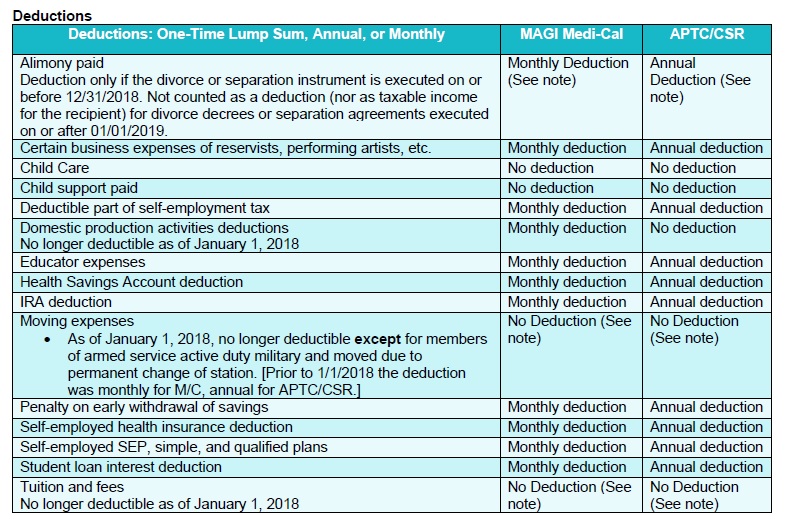

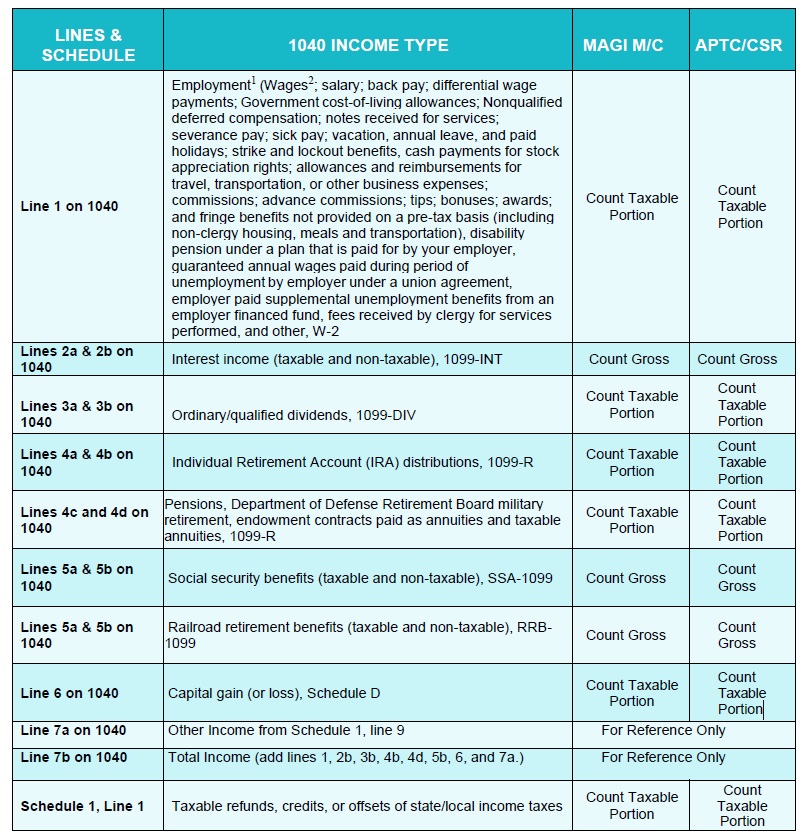

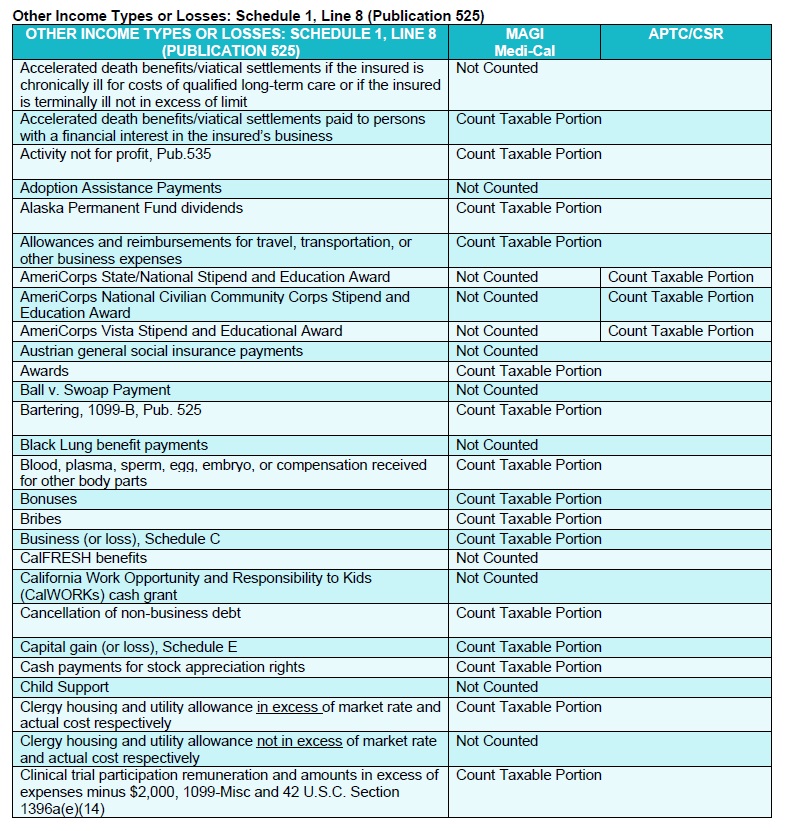

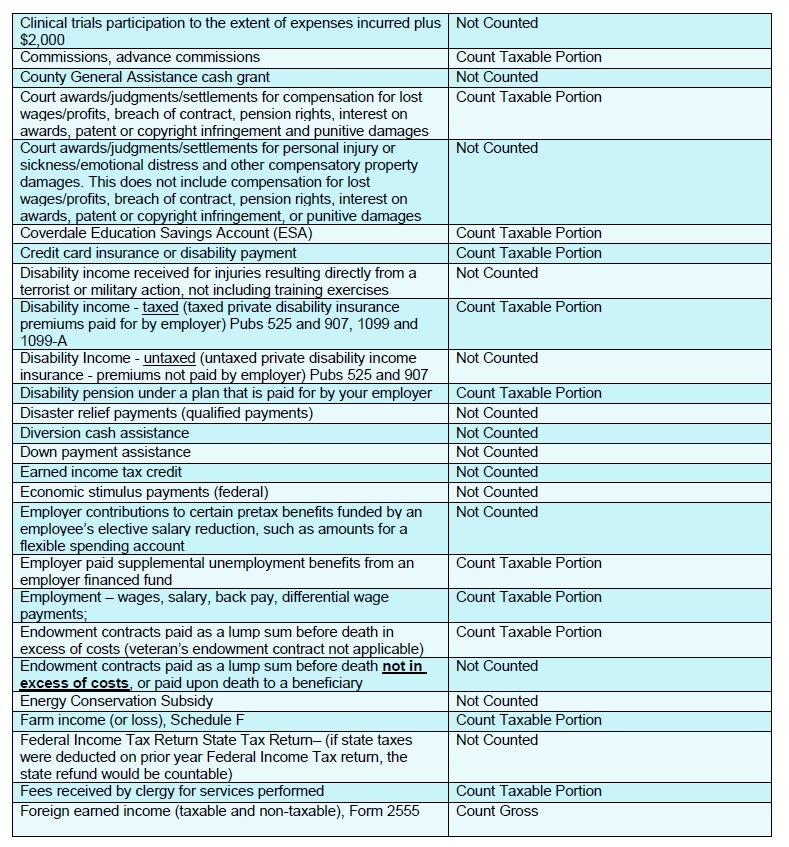

Or offsets of statelocal income taxes count taxable portion count taxable portion line 11 alimony received count taxable portion count taxable portion. The employer statement must. No per the california state economic development department if you leave work because of a disability and receive disability benefits those benefits are not reportable for tax purposes.

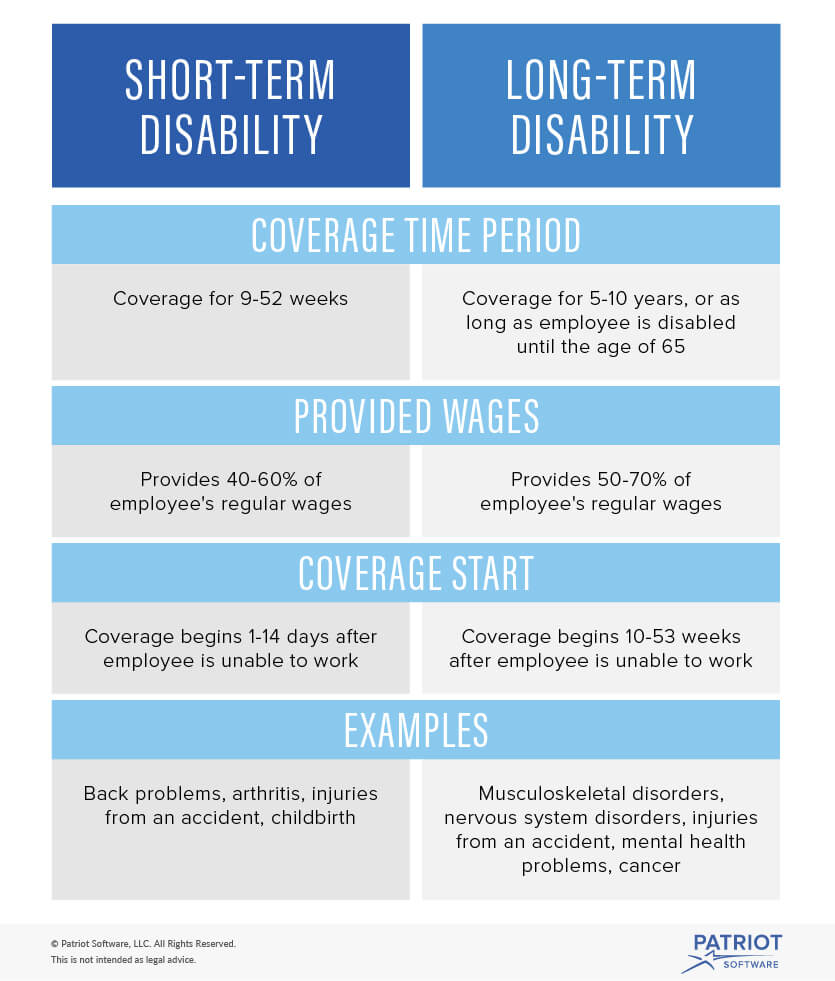

Be no older than 45 days from the date received by covered california. Workers covered by sdi have two benefits available to them. You may be eligible for di if you are unable to work due to non work related illness or injury pregnancy or.

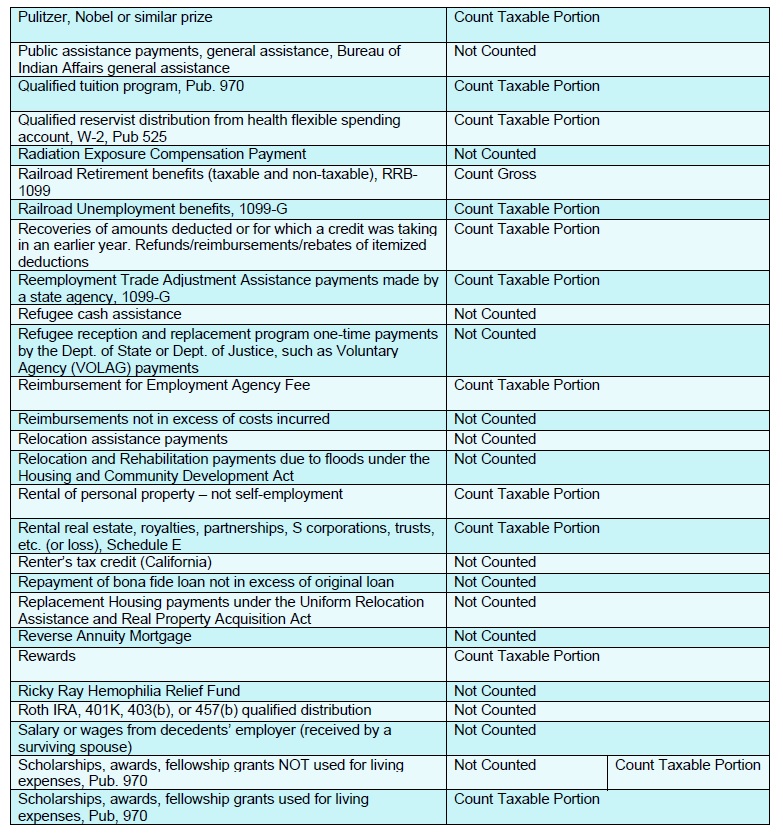

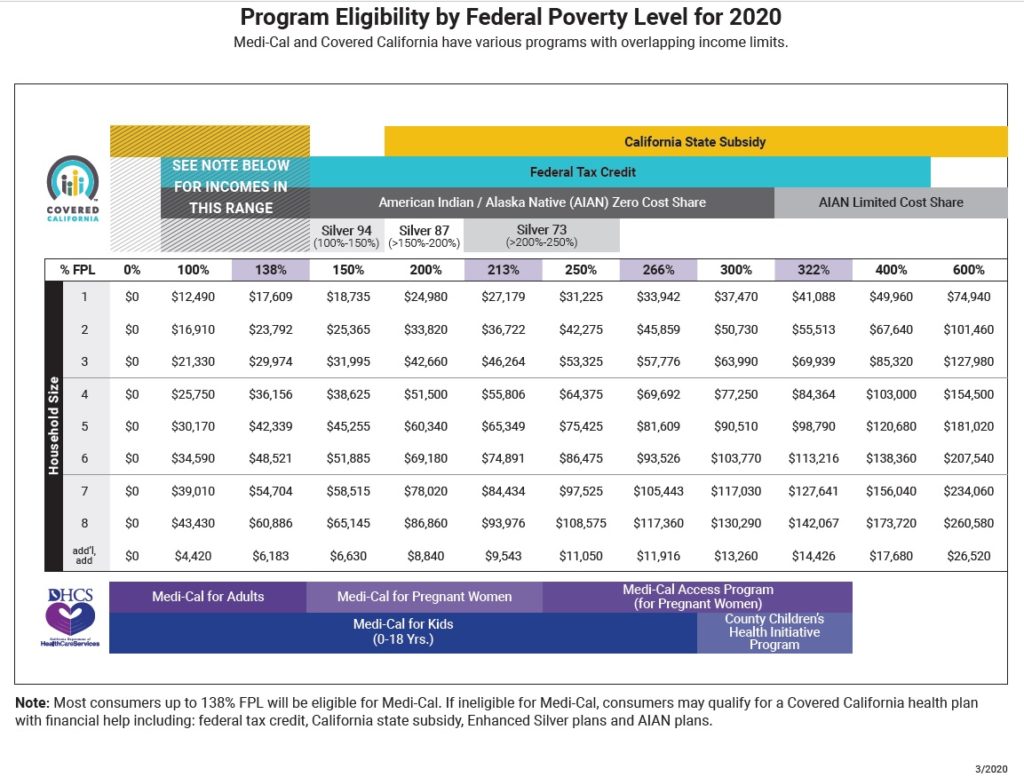

All unemployment benefits including the extra 600 per week puc payment are included in your taxable gross income and magi for purposes of eligibility for financial help available through covered california. Sdi payments are not taxable except for those recipients who cant receive unemployment benefits due to their disability so they receive sdi instead. The edd website includes a chart of weekly sdi benefit amounts based on the amount of money you made in the highest quarter of your base period.

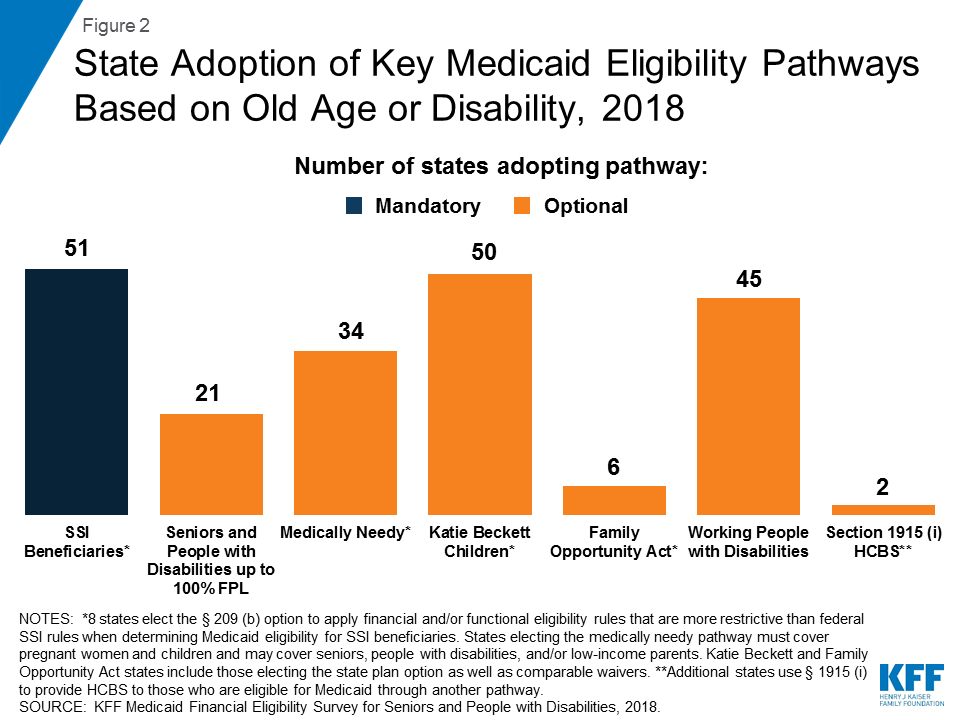

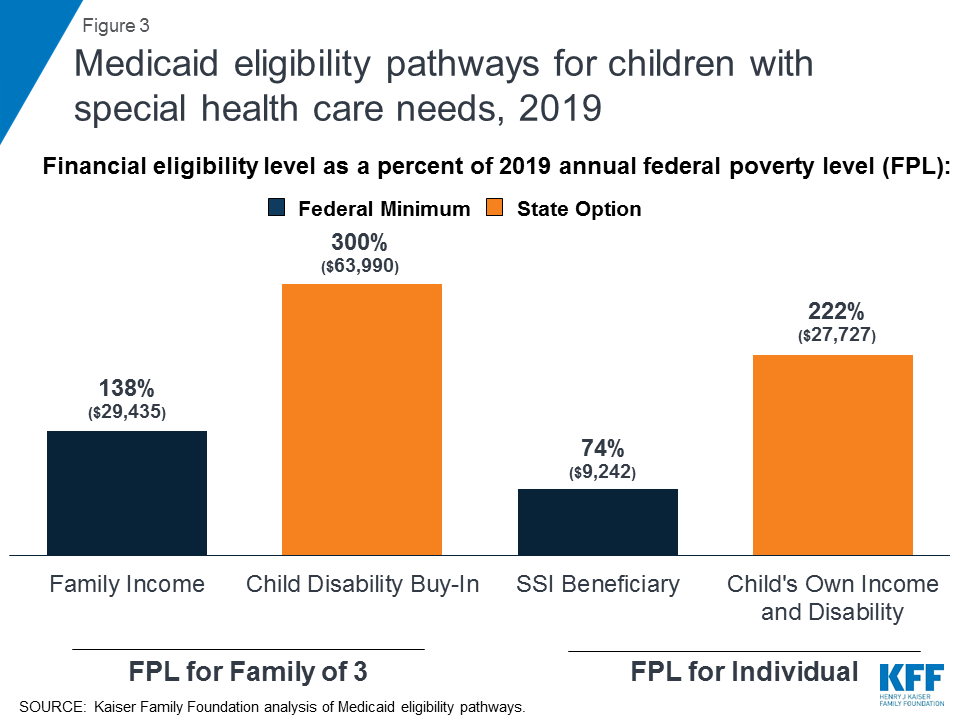

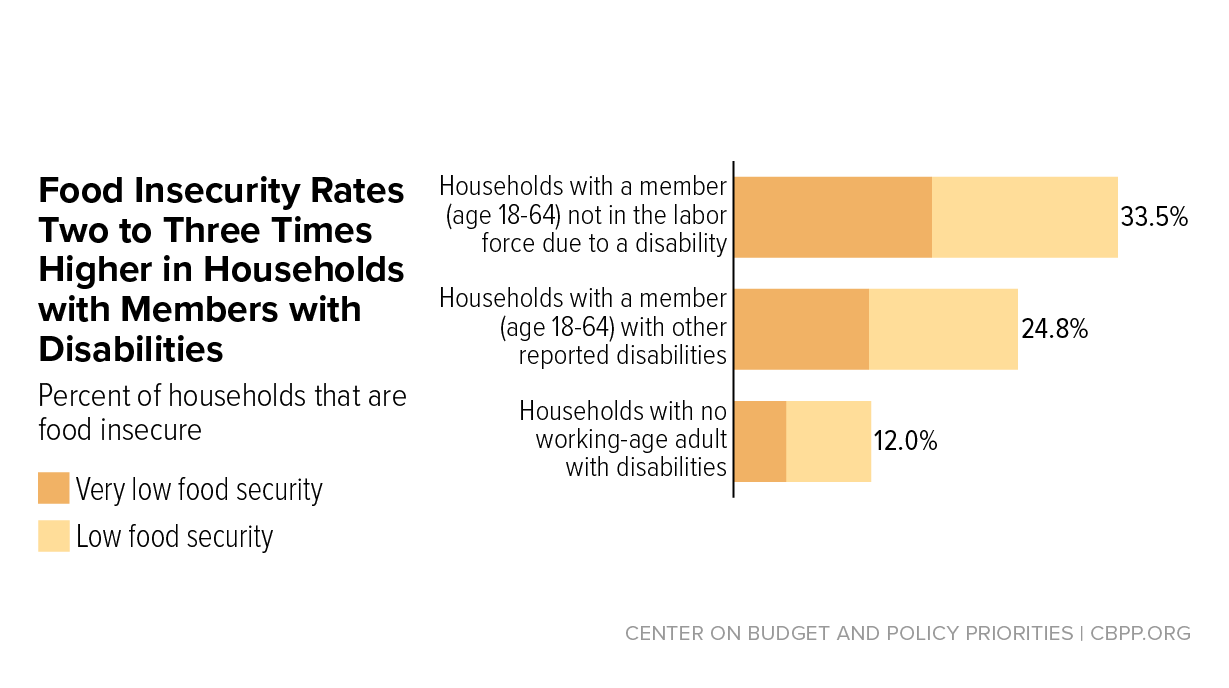

Covered california will let you know which. Social security disability income social security disability income ssdi is considered income. State disability insurance disability insurance and paid family leave benefits.

Are california disability payments considered income. Covered california will accept a clear legible copy from the allowable document proof list from the following categories which you can click on for more details. Supplement security income ssi is not part of magi.

Disability insurance di and paid family leave pfl. Proof of income proof of citizenship or lawful presence proof of california residency and proof of minimum essential coverage. Countable sources of income covered california outreach and sales division july 7 2017 page 1 of 6.

Be signed by the employer. It must contain the persons first and last name income amount year and employer name if applicable. The california state disability insurance sdi program provides short term disability insurance di and paid family leave pfl wage replacement benefits to eligible workers who need time off work.

/short-term-disability-basics-1177839_V2-5bbd0f8146e0fb0051d0c4cf.png)