How Much Does California Earthquake Insurance Cost

Get your free california earthquake insurance estimate how much does earthquake insurance cost.

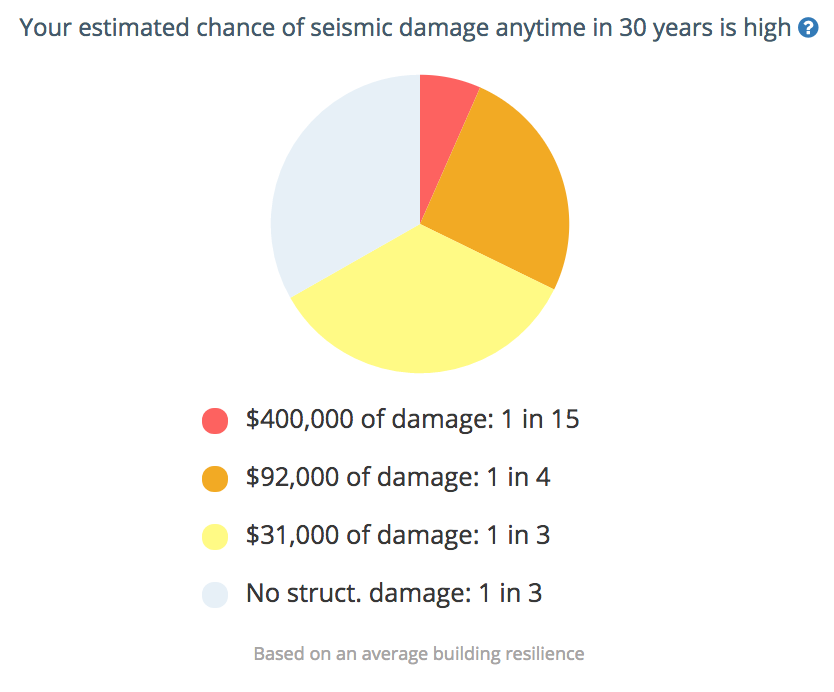

How much does california earthquake insurance cost. If you experience technical issues using the calculator please. Use the cea premium calculator for a free cea california residential earthquake insurance premium estimate. Homeowners in states like alaska california oregon and washington have an average earthquake insurance cost of 800 a year while the average cost in most states is 100 to 300 annually.

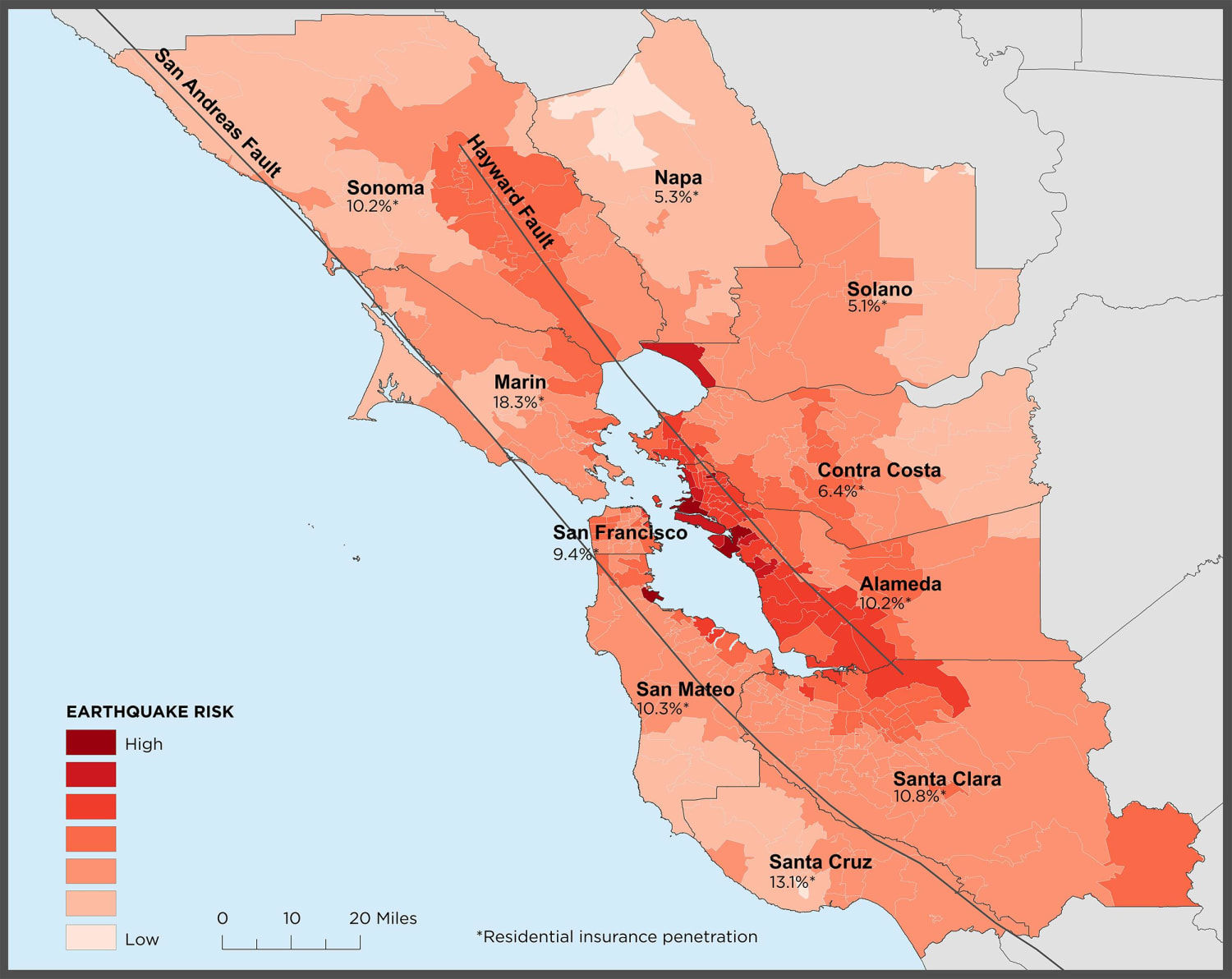

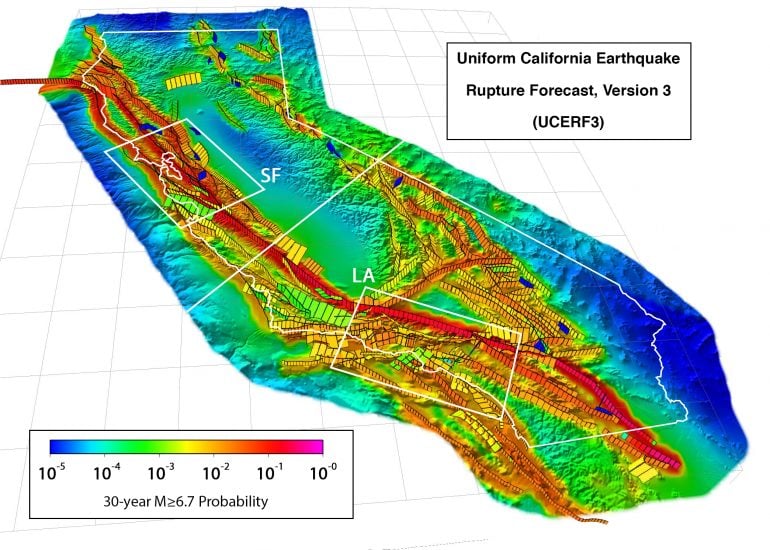

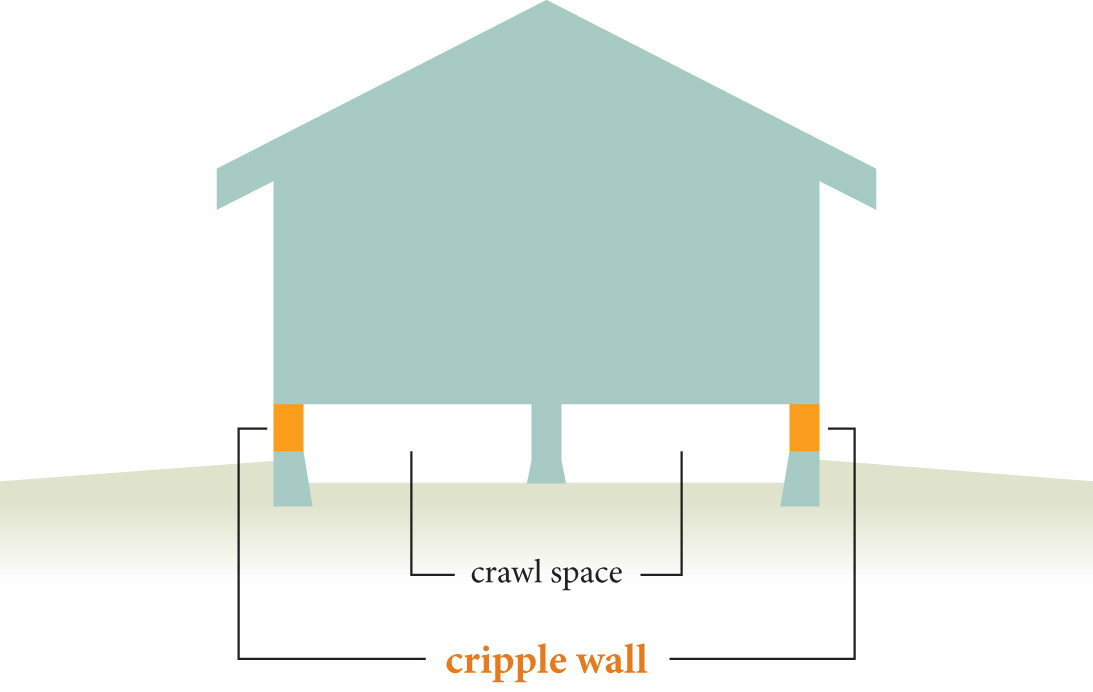

How much is earthquake insurance. In california costs vary widely depending on the construction of the building how old it is how close it is to seismically active areas and the stability of the soil in the area. The average policy costs approximately 850 per year.

If you live in california which has frequent earthquakes the california earthquake authority has resources to help you determine how much earthquake insurance costs. With a two story home in. Your total premium will depend on various factors including the age and location of your home.

The california earthquake authority has a simple calculator you can use to get a fairly accurate quote. Aaa earthquake insurance is available to renters and homeowners in california. How much does earthquake insurance cost vary by insurer.

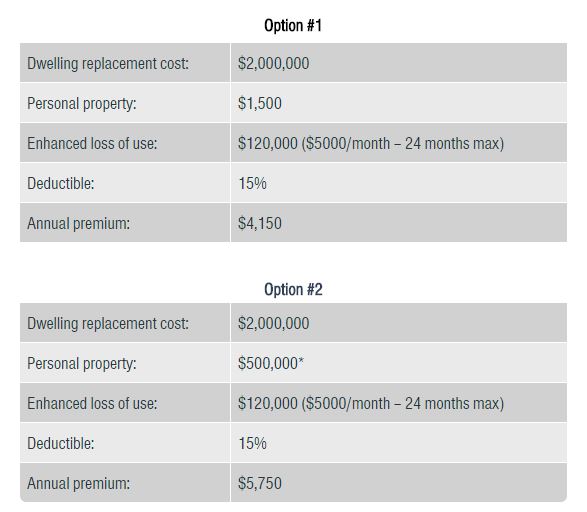

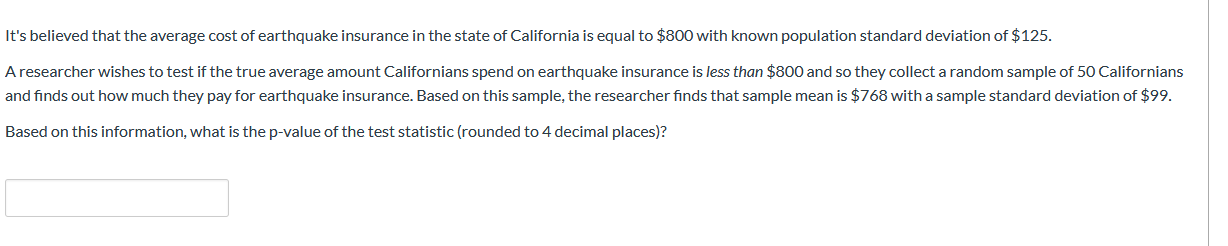

Cea condo unit policies provide up to 100000 for your share fo certain assessments if your association imposes an assessment for covered damage caused by an earthquake. In a state such as california where earthquakes are quite common the average bill can vary from 450 to 3500 a year depending on the size of your home the structure and company you choose. Keep in mind that insuring a single family house in california can cost more between 1248 to 2744 annually for 500000 of coverage.

The average cost statewide is 500 but it can be more than 3000 a year. How much does earthquake insurance cost. To purchase a cea policy you must contact a participating residential insurersee our faqs page for commonly asked questions.

/EarthQuakInsurance_2645855_Final_2-766403111a0d4c21bdfa1b5709a0e0b3.png)

/GettyImages-847369112-59f3d699519de200116dc96c.jpg)

.png)