Premium Assistance Covered California

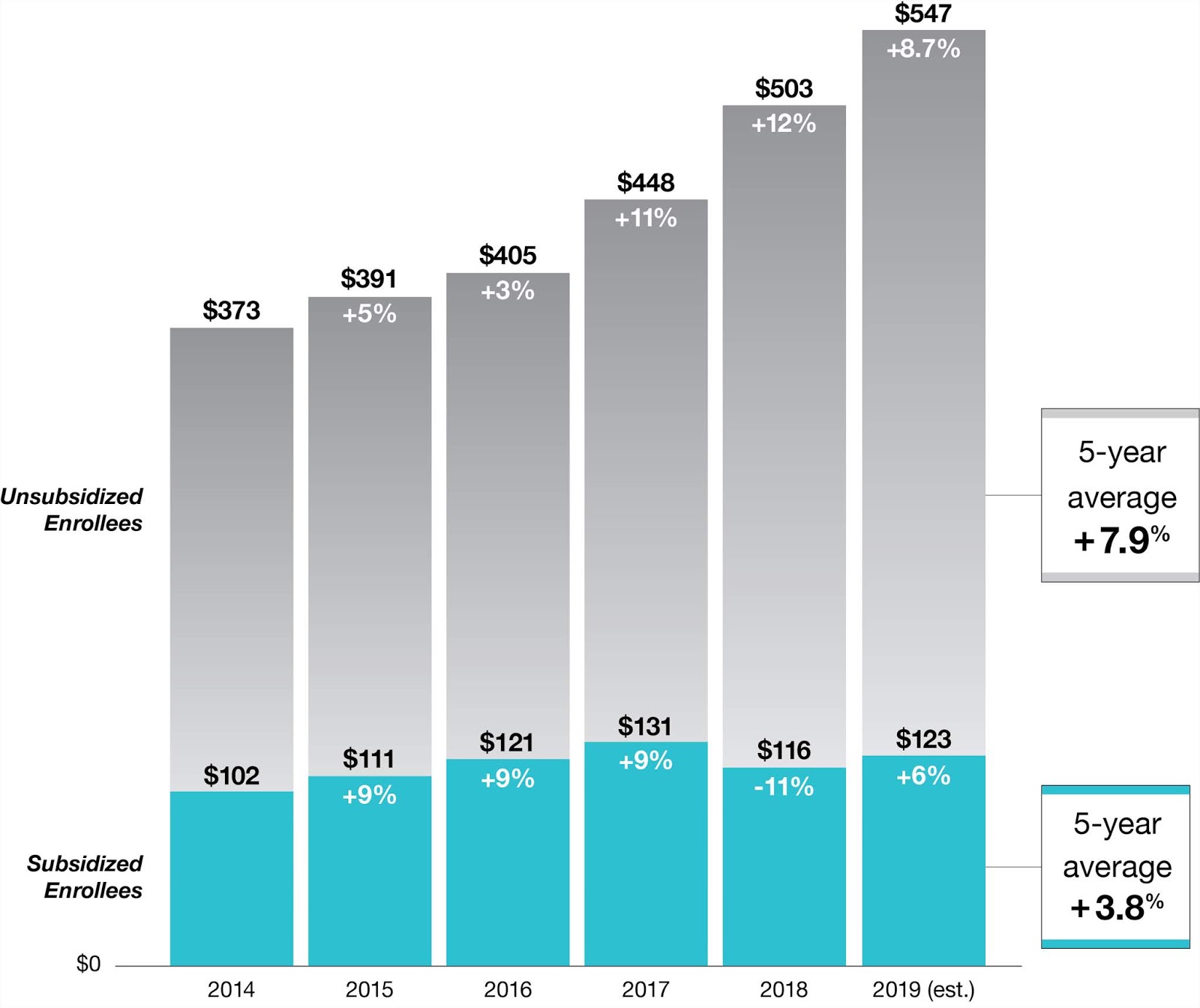

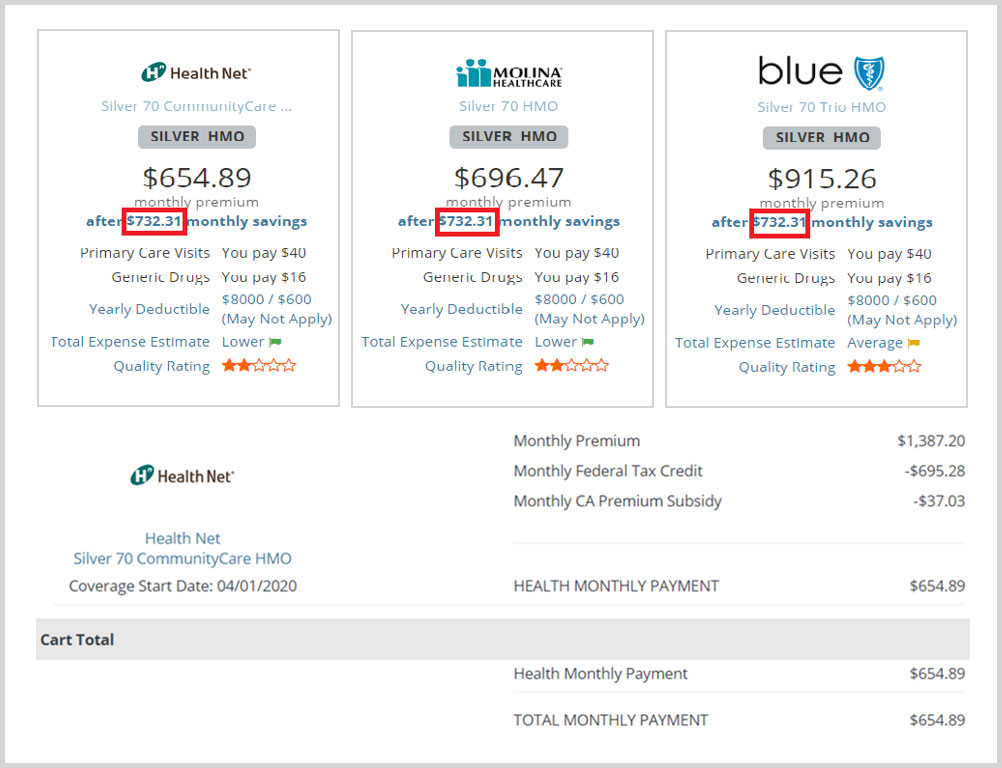

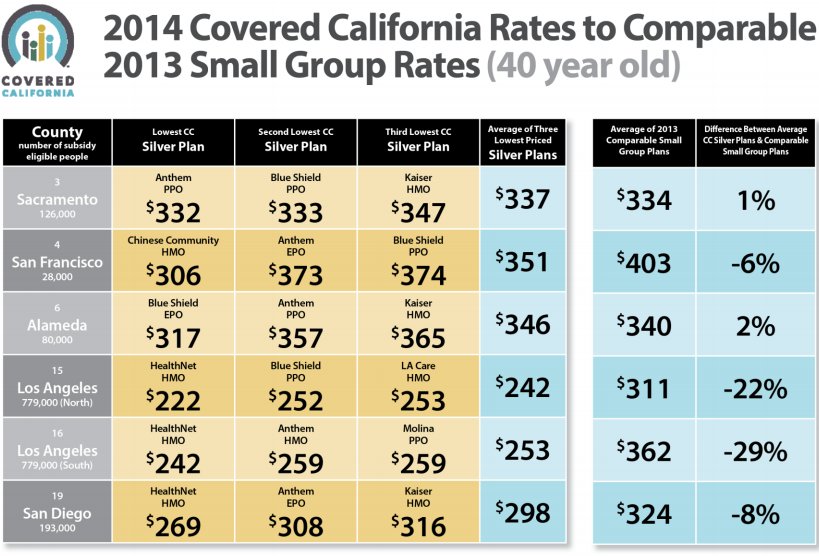

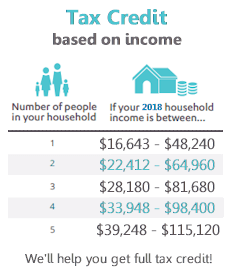

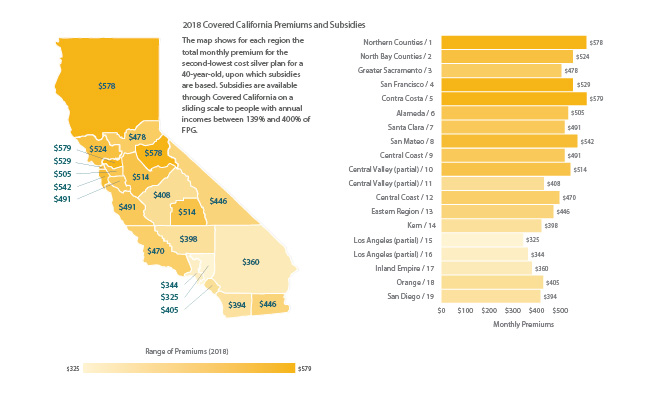

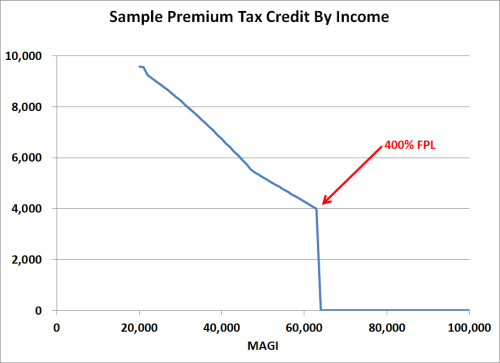

The aptc is calculated according to income family size and rating region based on the cost of the second lowest silver plan available to a consumer.

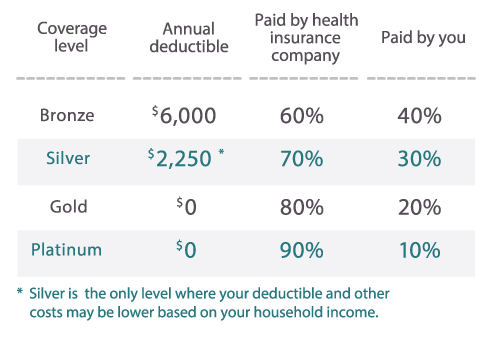

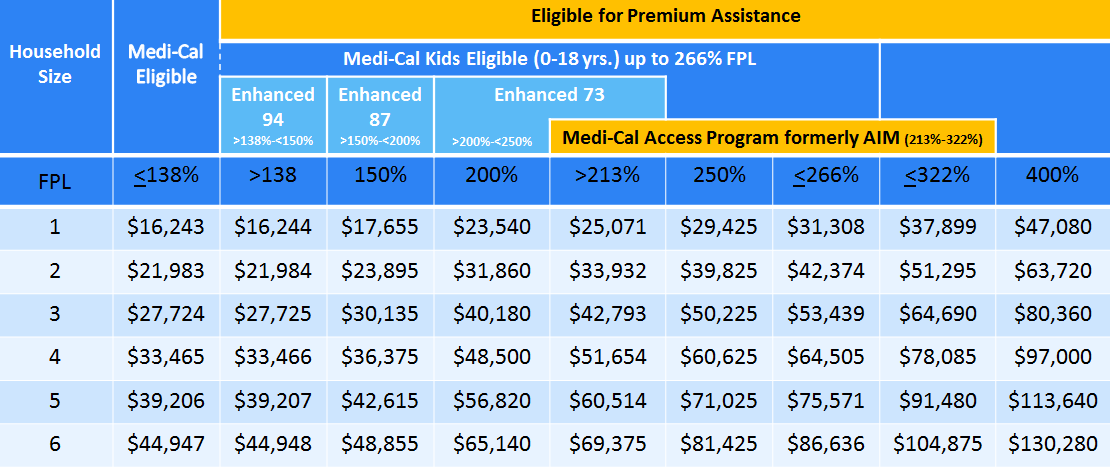

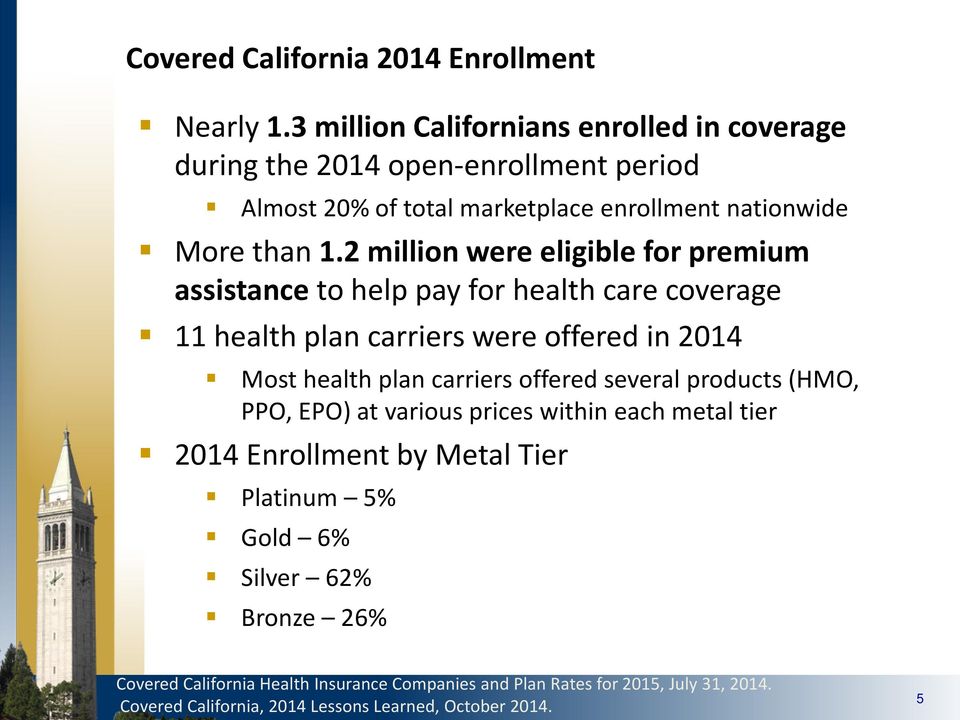

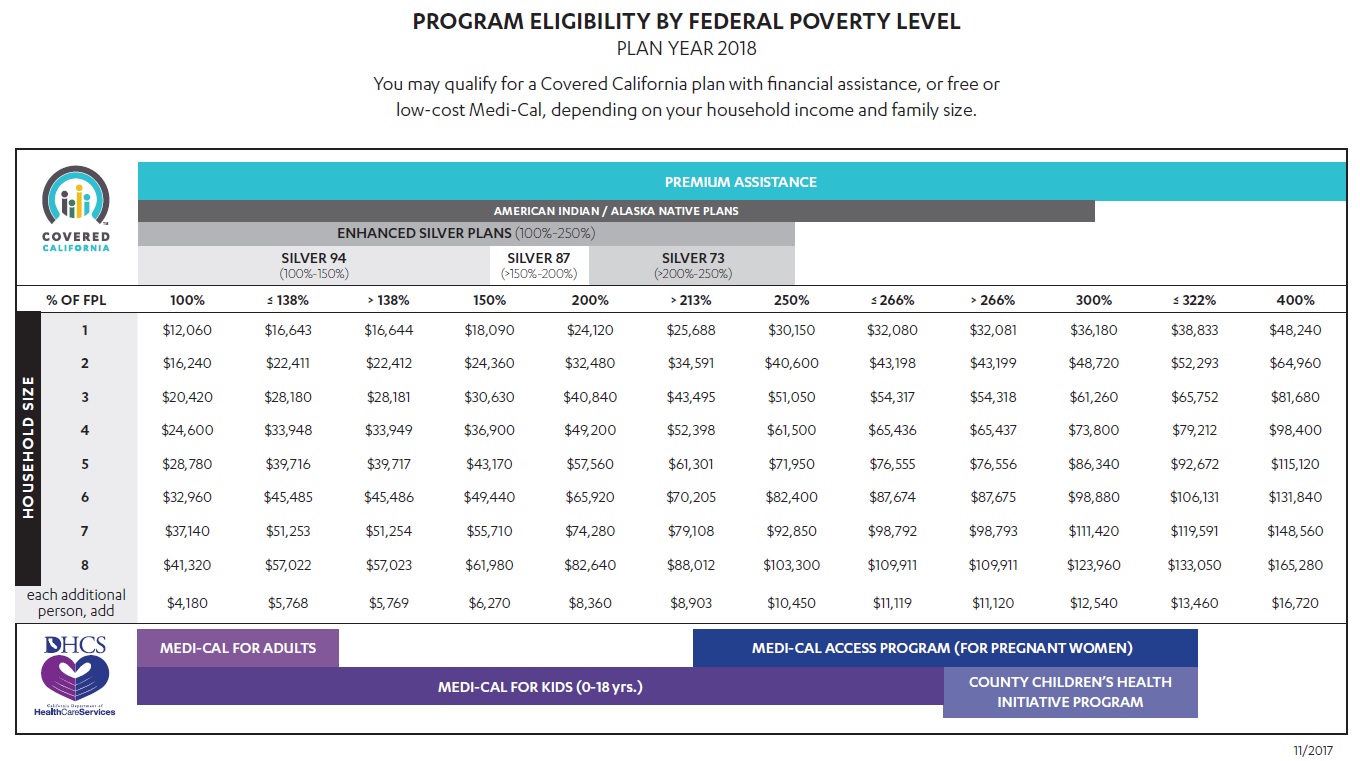

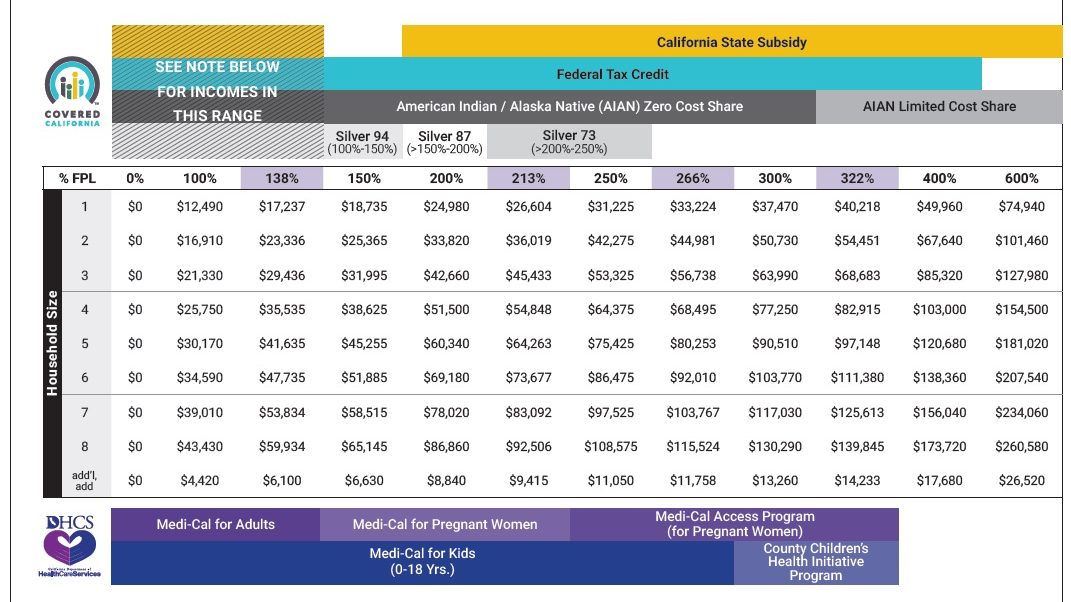

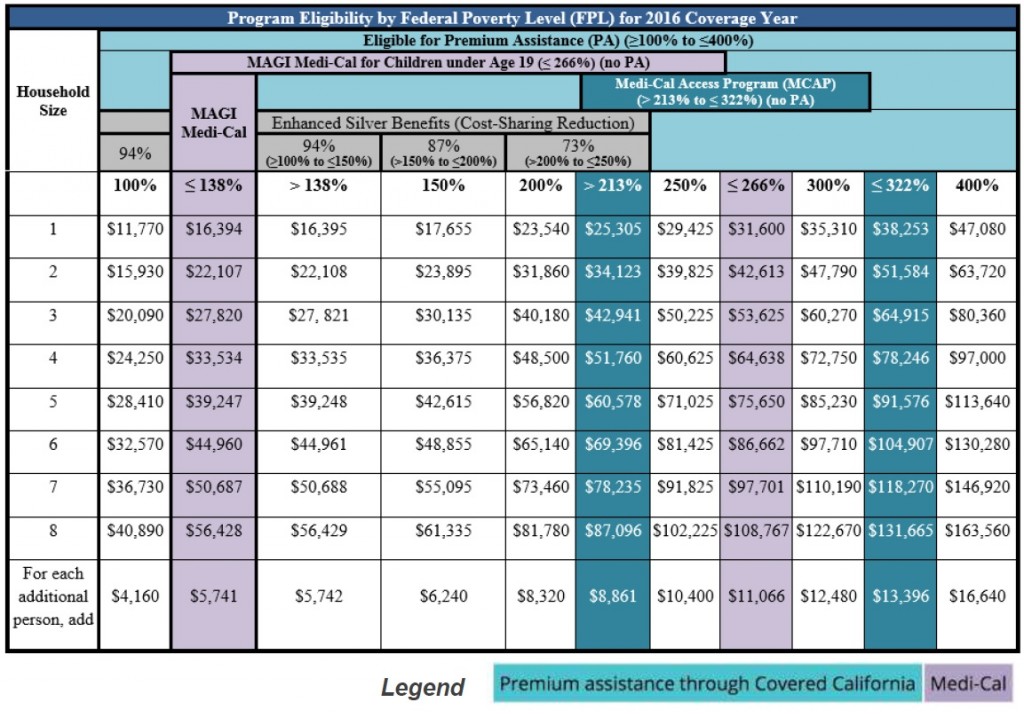

Premium assistance covered california. Covered california offers three types of financial help. For a single adult 138 fpl is 17237 and for a family of four it is 35535 on the covered california 2020 fpl for 2020 income table. Theyre also called the advanced premium tax credit aptc.

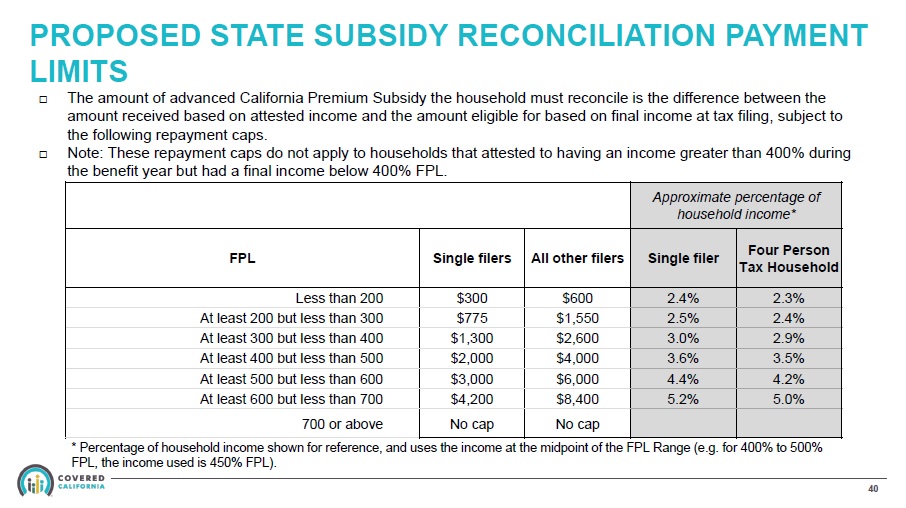

If covered california does not have accurate income information when calculating your premium assistance you may receive too little during the year and you will receive a tax credit. Minimum coverage plans through covered california cover three doctor visits or urgent care visits including outpatient mental healthsubstance use visits with no out of pocket costs and free preventive benefits. Covered california premium assistance who is eligible for premium assistance.

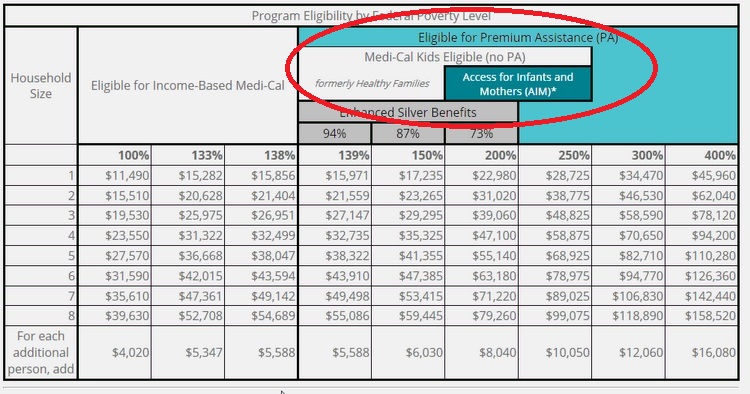

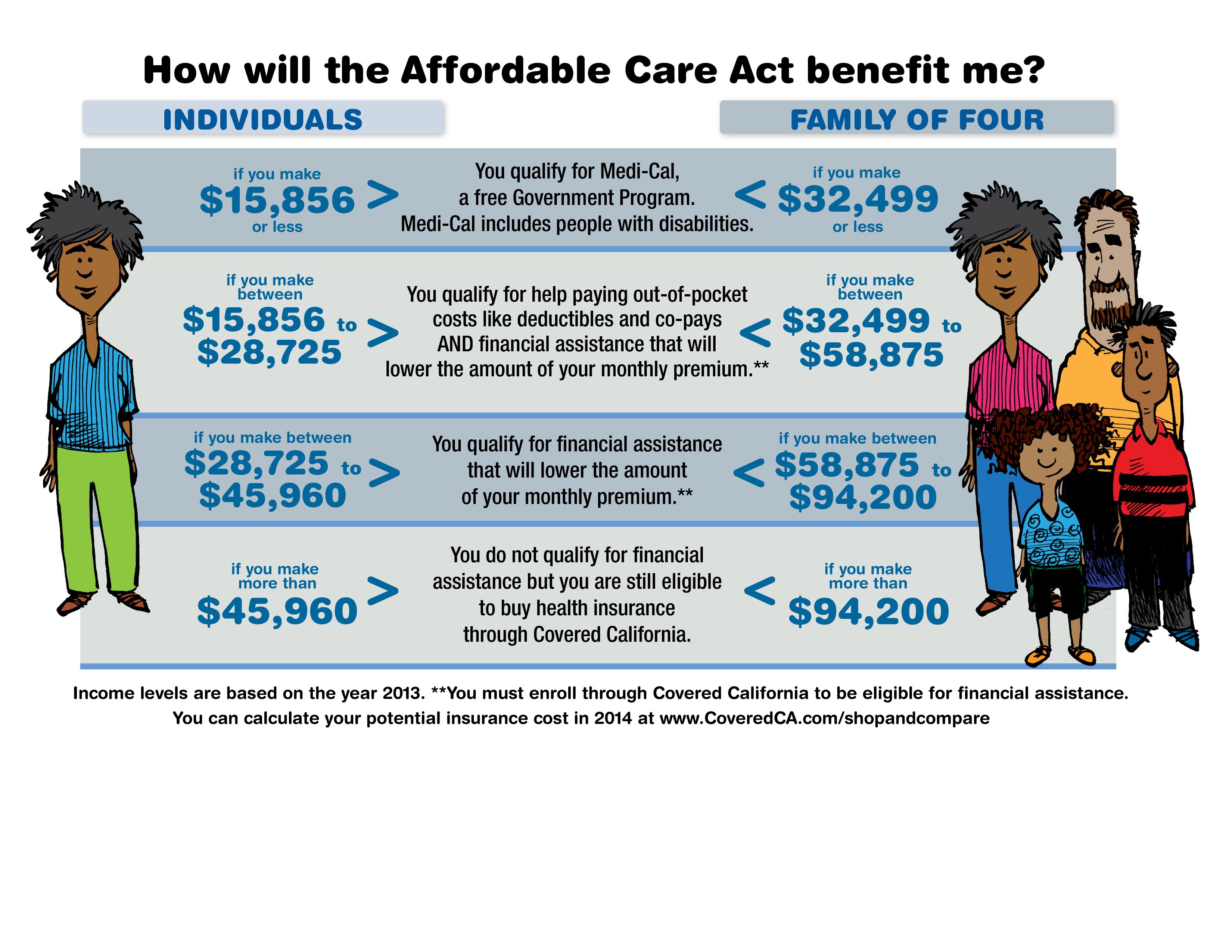

An eligible individual is a taxpayer whose household income modified adjusted gross income magi is between 138 percent and 600 percent of the federal poverty level fpl. In this post i will first focus on the state subsidy for those who dont qualify for the federal premium tax credit today when their income is above 400 fpl. Those who have minimum coverage plans do not qualify to receive premium assistance.

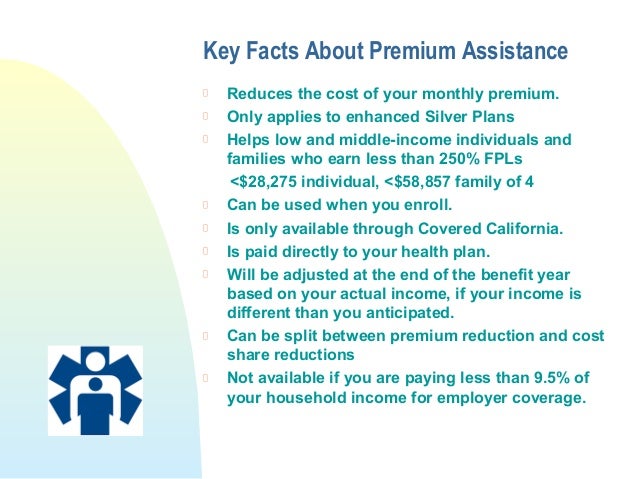

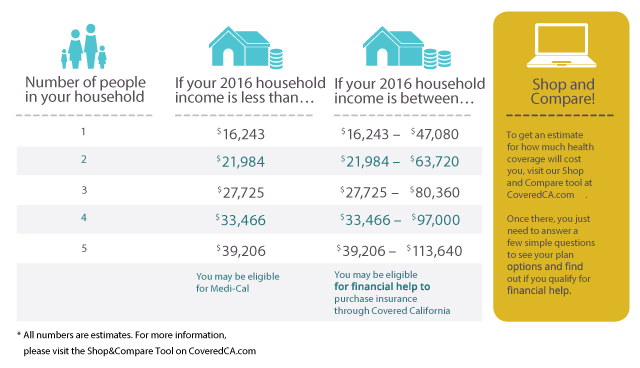

Is there a deadline to enroll in medi cal. Premium assistance to help reduce the cost of health care is available to individuals and families who enroll in a covered california health insurance plan and meet certain income requirements. Can i decline medi cal and enroll in a covered california health plan and receive the federal premium assistance.

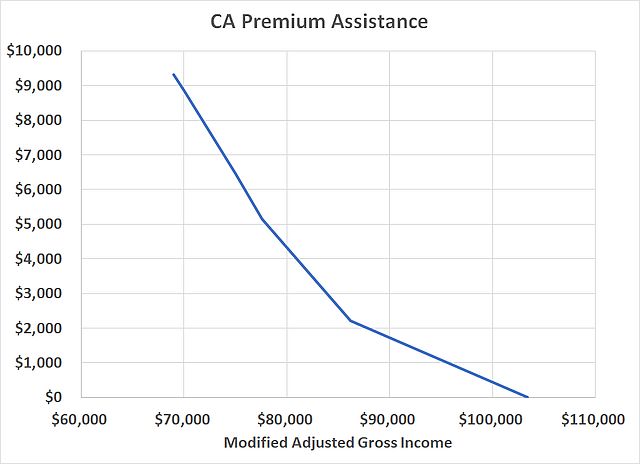

Click here to check your eligibility for premium assistance. California state premium assistance the california law also offers small additional premium subsidies on top of the federal premium tax credit for incomes between 200 fpl and 400 fpl. These reduce the cost of your monthly premium.

In california adults who have an income below 138 of the fpl are eligible for magi medi cal. Premium limits for consumers based on income. Even though premium assistance is a tax credit it is available to eligible consumers whether or not they have filed taxes for the previous year.

If someones medi cal coverage is cancelled due to increased income or decreased household size does that person qualify for special enrollment into covered california. You will need that form when you file your taxes. The state subsidy reduces the cost of your monthly premium.

From the covered california income table for 2020 100 of the fpl for an individual is 12490.