California Estimated Tax Payments

You can also request a payment plan online.

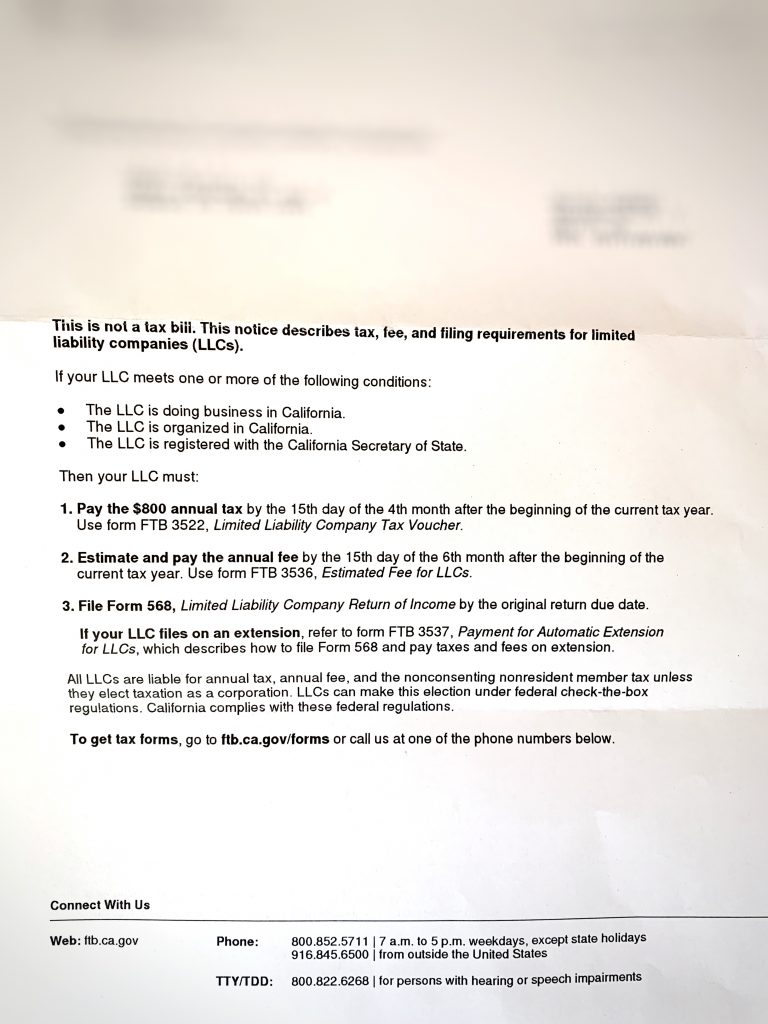

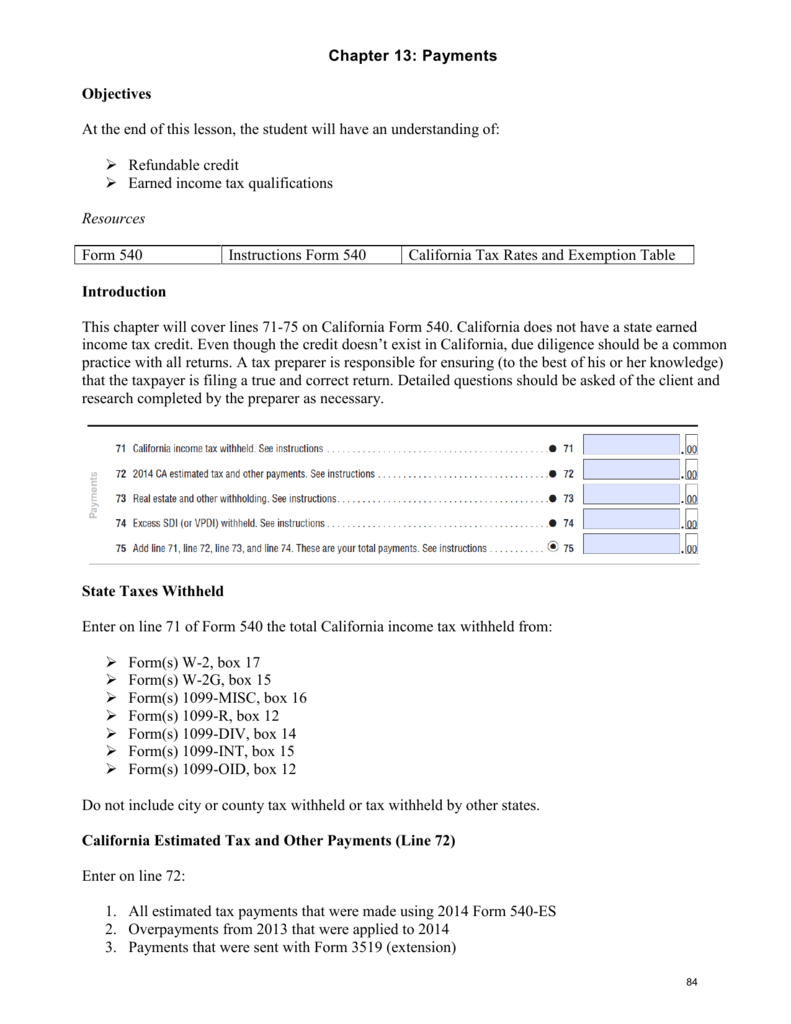

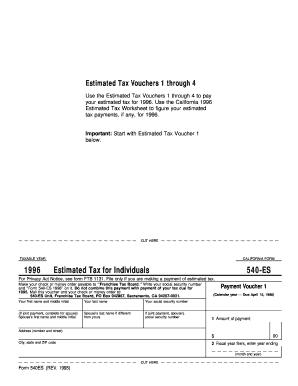

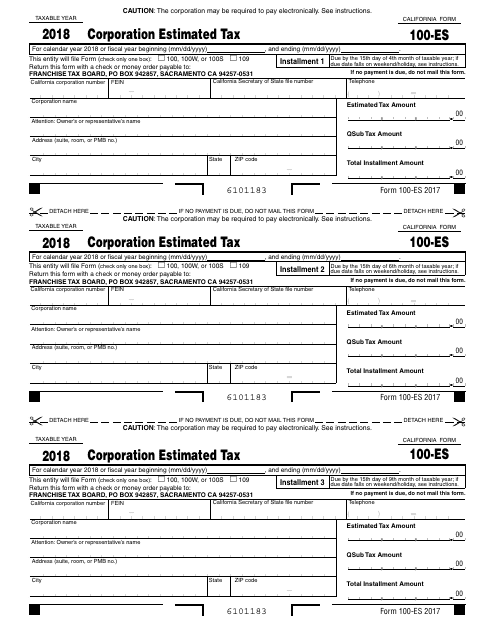

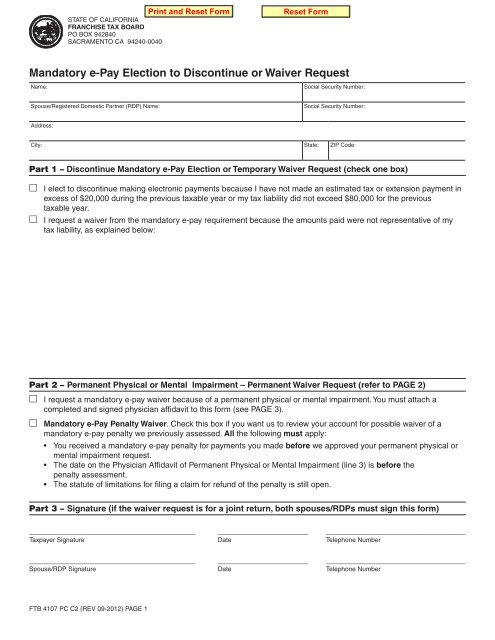

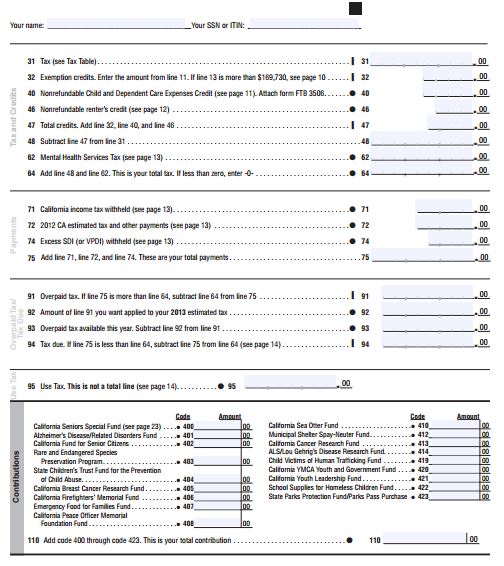

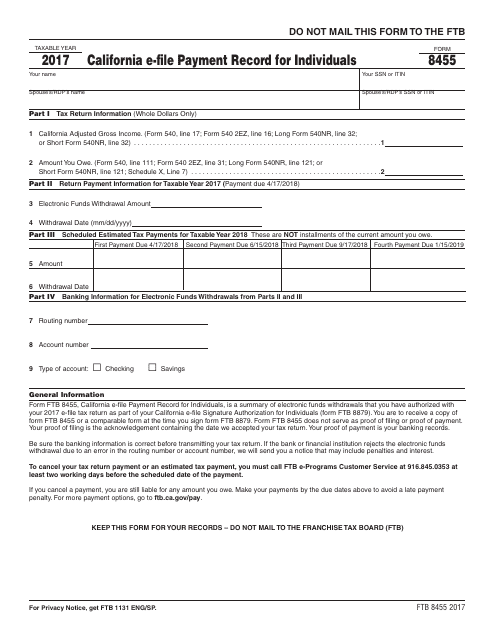

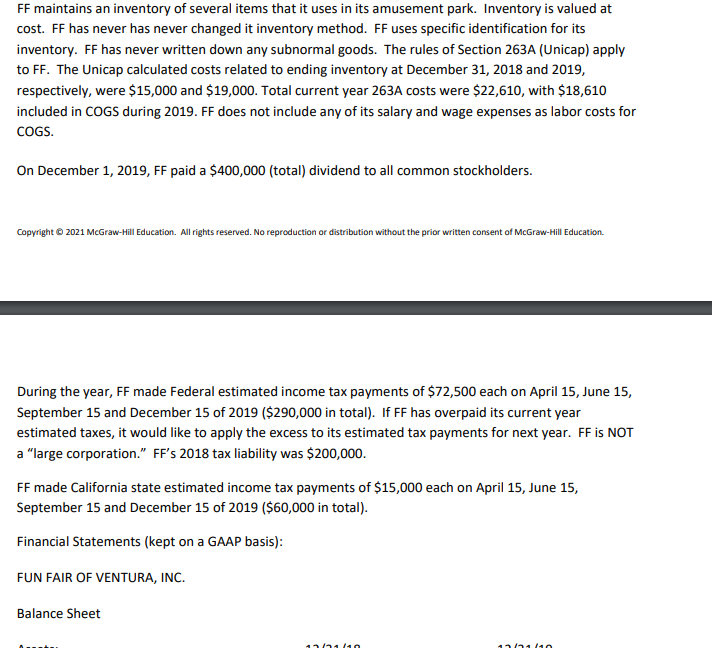

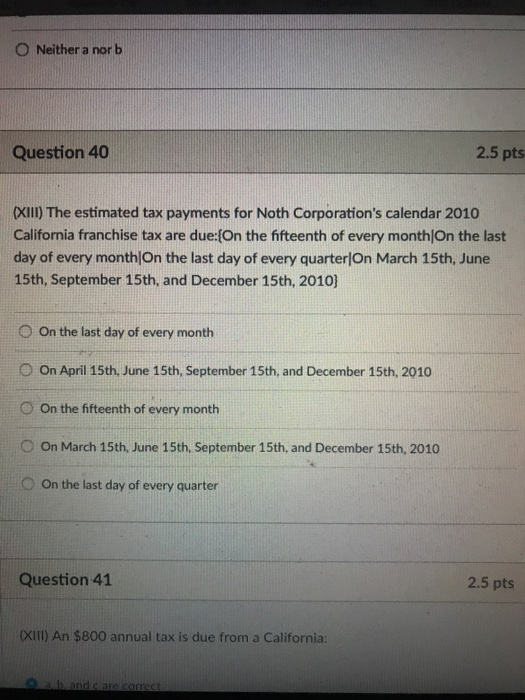

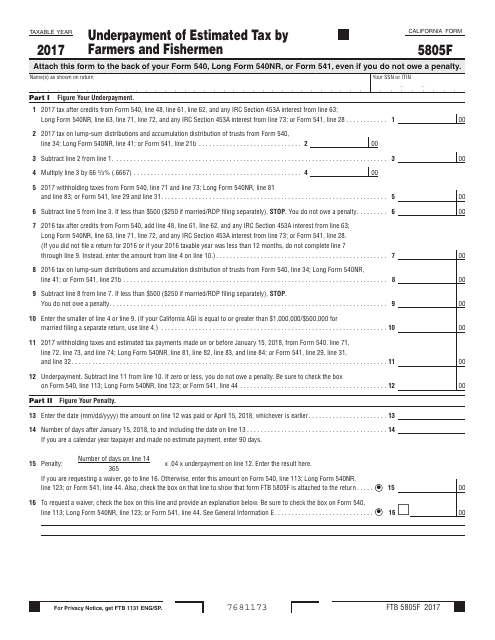

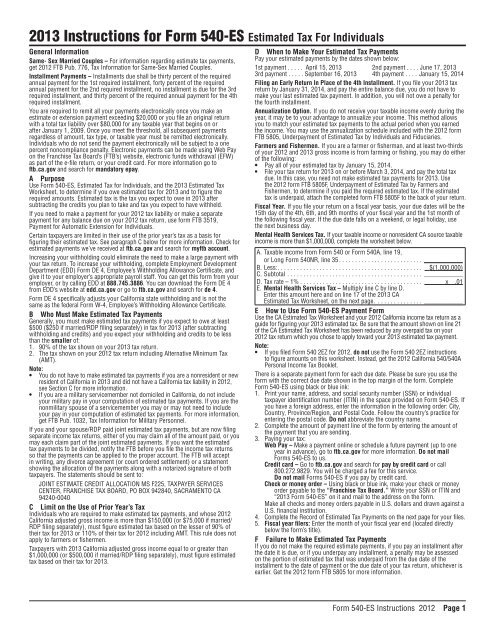

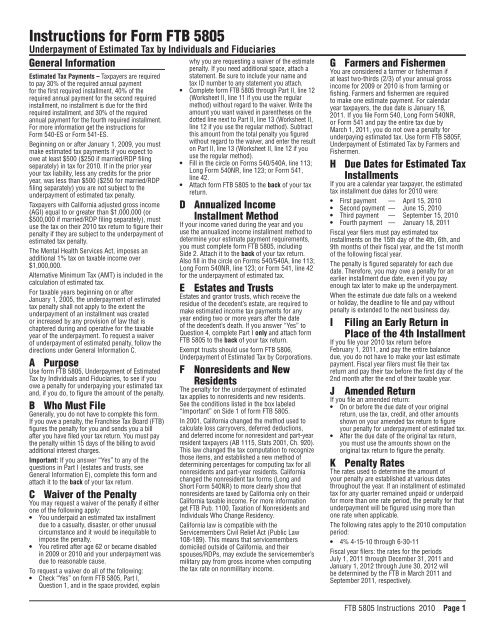

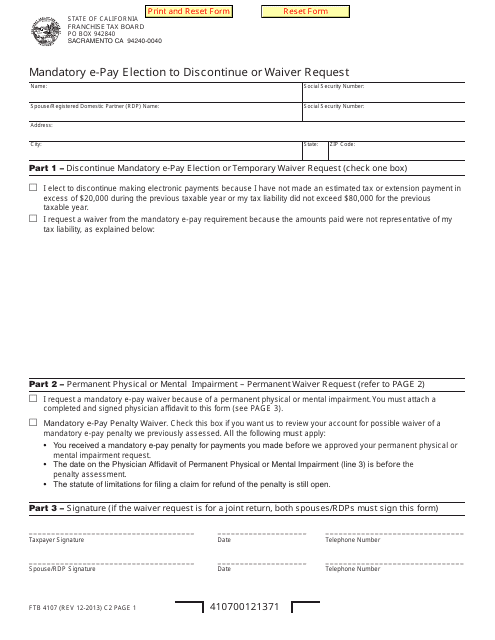

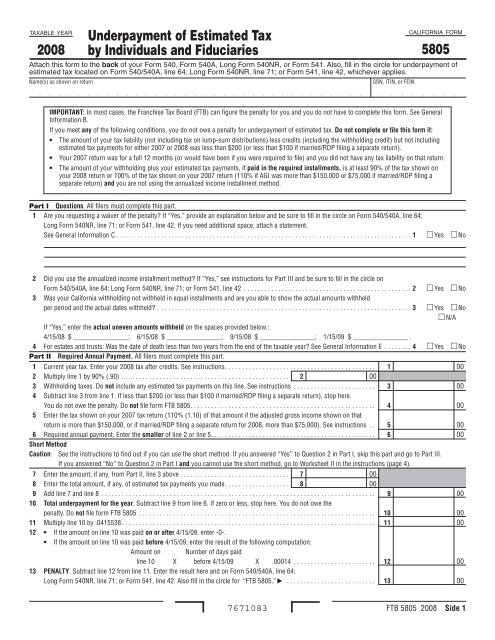

California estimated tax payments. How to pay online to make your payment online. This rule does not apply to farmers or fishermen. If you expect to owe over a certain amount you must make estimated tax payments throughout the year.

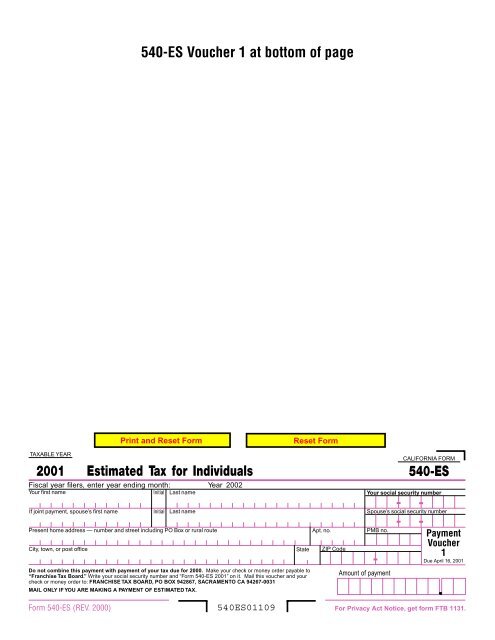

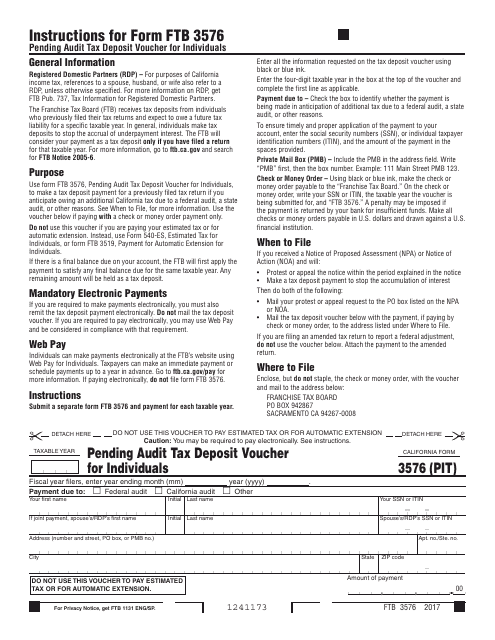

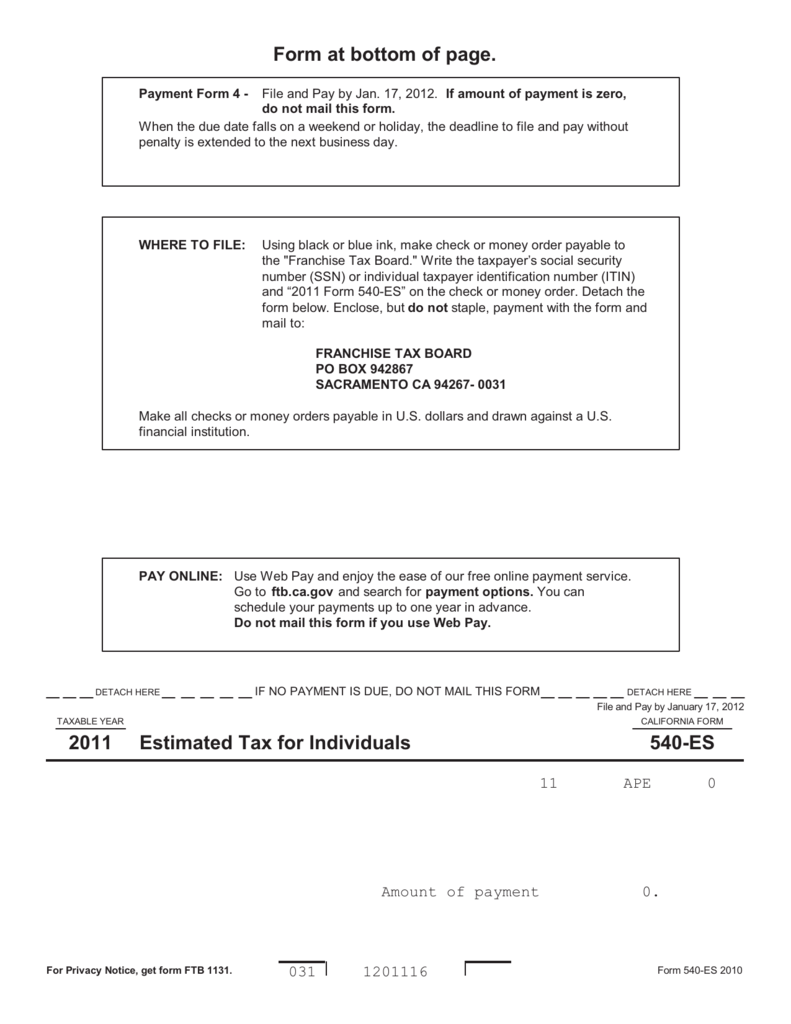

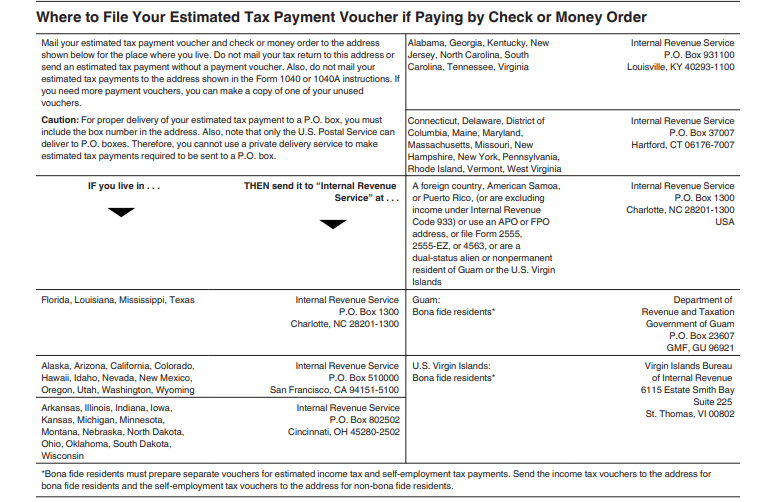

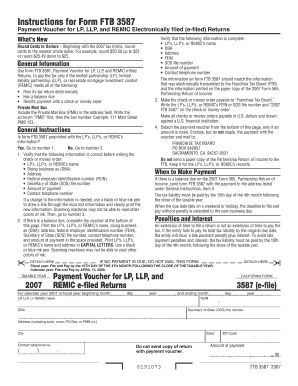

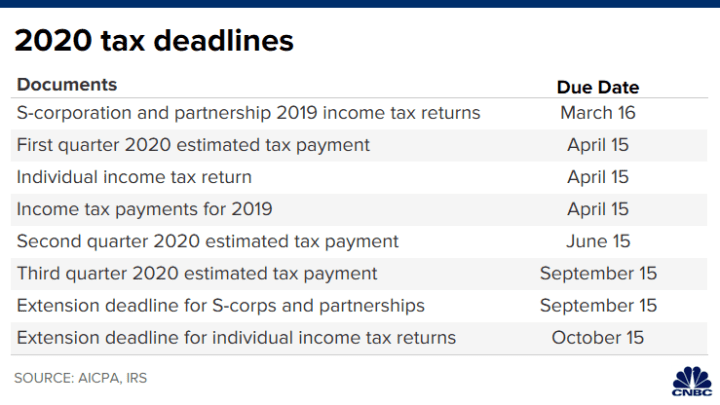

April 15 2020 2nd payment. Mail franchise tax board po box 942867 sacramento ca 94267 0008. Use estimated tax for individuals form 540 es vouchers to pay your estimated tax by mail.

The undersigned certify that as of june 22 2019 the internet website of the franchise tax board is designed developed and maintained to be in compliance with california government code sections 7405 and 11135 and the web content accessibility guidelines 21 or a subsequent version june 22 2019 published by the web accessibility. The undersigned certify that as of june 22 2019 the internet website of the franchise tax board is designed developed and maintained to be in compliance with california government code sections 7405 and 11135 and the web content accessibility guidelines 21 or a subsequent version june 22 2019 published by the web accessibility. June 15 2020 3rd payment.

Individuals who are required to make estimated tax payments and whose 2019 california adjusted gross income is more than 150000 or 75000 if marriedrdp filing separately must figure estimated tax based on the lesser of 90 of their tax for 2020 or 110 of their tax for 2019 including amt. These individuals can take credit only for the estimated tax payments that he or she made. You can check your balance or view payment options through your account online.

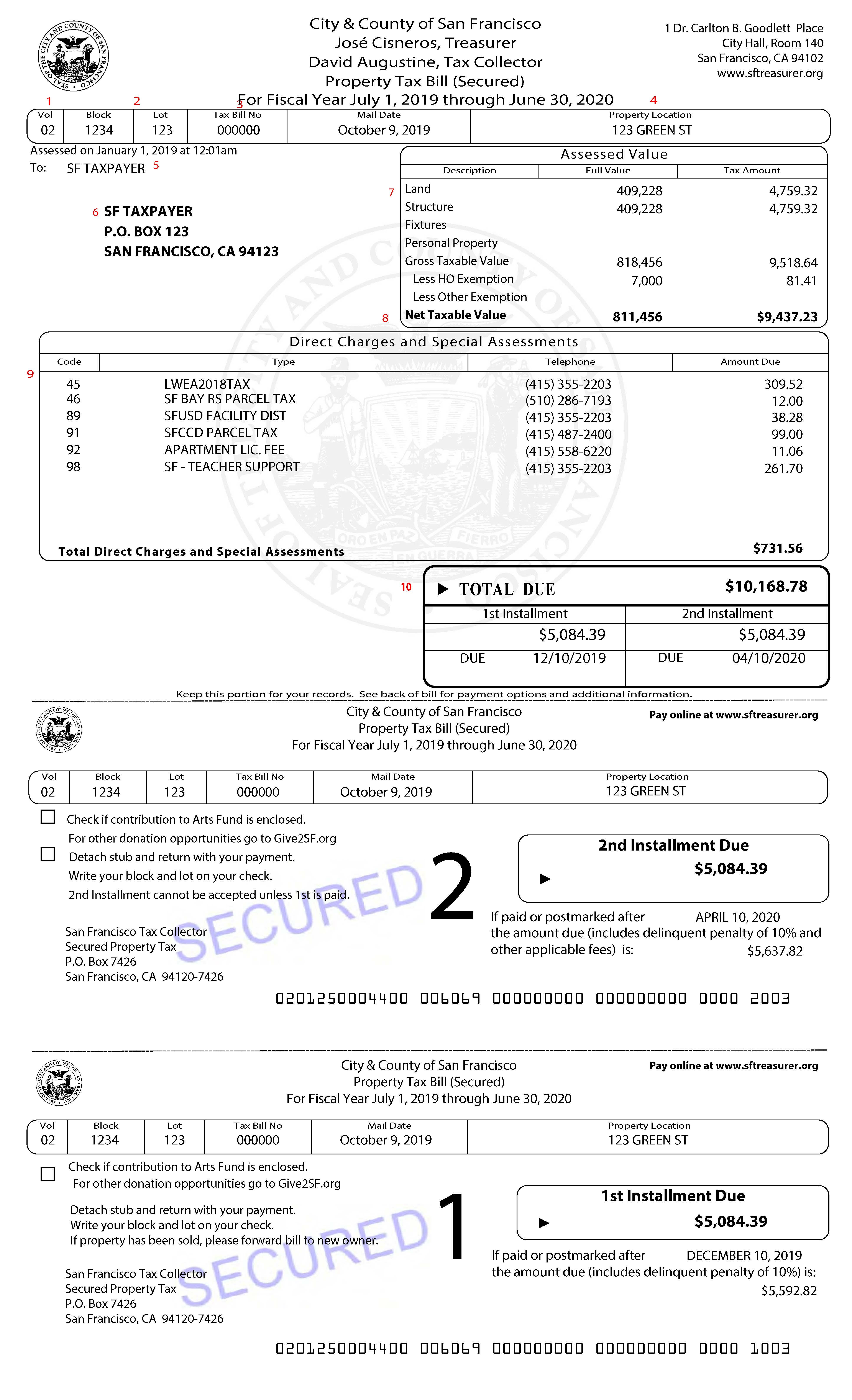

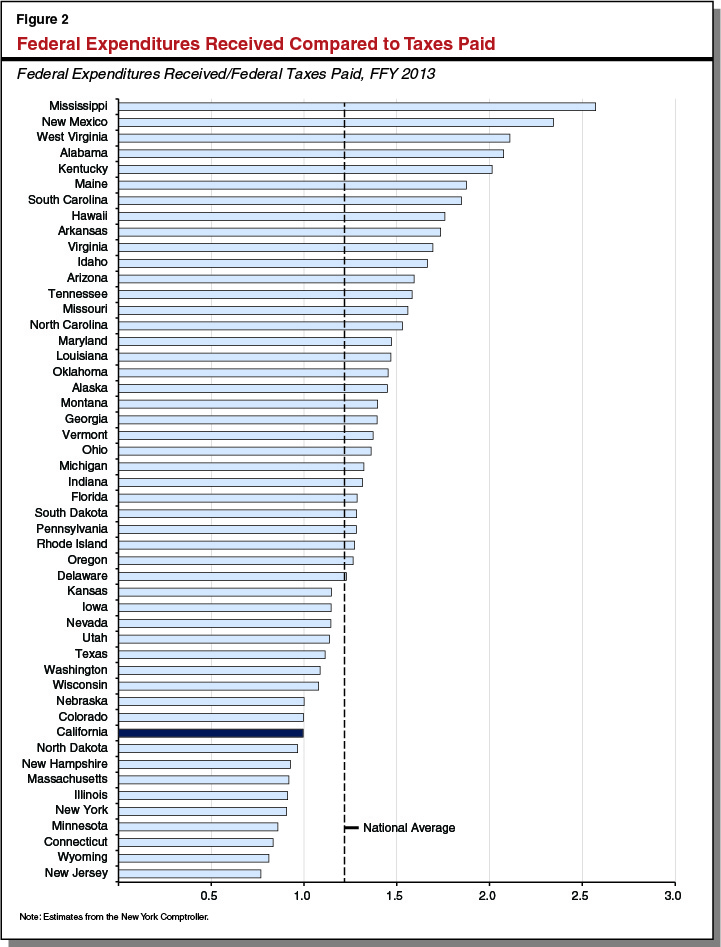

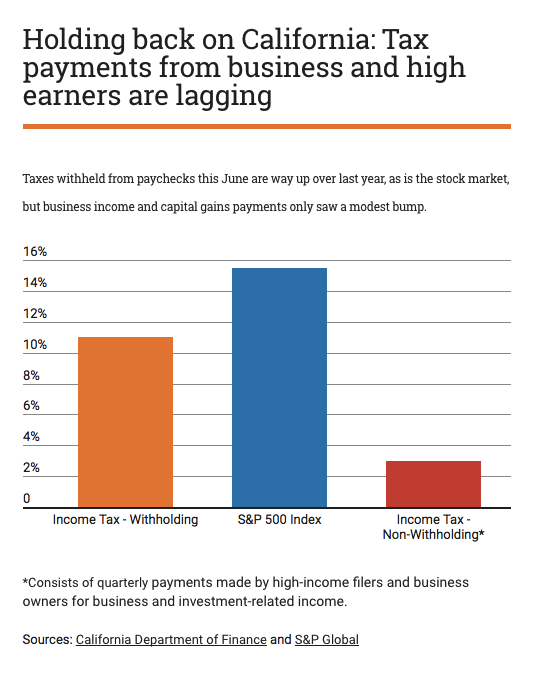

Visit our payment options. Make joint estimated tax payments. That means that regardless of where you are in the state you will pay an additional 725 of the purchase price of any taxable good.

Californias base sales tax is 725 highest in the country.

/i-received-a-1099-misc-form-what-do-i-do-with-it-35d7e9d37e8949de8c556777494dde39.png)

/state-income-tax-deduction-3192840_FINAL_v2-e43549dd9f264eab947794daf86ae338.png)

/GettyImages-1169954518-4b5ed12b6c33425c919c2c27f12c1ae2.jpg)

/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png)